Boyar Value Group commentary for the first quarter ended March 2021.

“Don’t mistake activity for achievement.” – John Wooden

Q1 2021 hedge fund letters, conferences and more

If Hollywood made a movie based on the events that drove financial markets during 1Q 2021, most viewers would find the plotline too farfetched. (Then again, the same could probably be said for most of 2020’s major headlines!) The year started out with the Georgia senate runoff races securing Democratic control of Congress (via the Vice President’s Senate tiebreaking authority), paving the way for more fiscal stimulus than would have occurred with divided government. Then, on January 6, protesters in support of then-President Donald Trump stormed the Capitol as Congress met to confirm President-elect Joe Biden’s election victory. The protests turned violent, causing lawmakers to shelter in place. Ultimately more than 140 people were injured, and 5 people died, including a police officer. And all this occurred within the first seven days of the year!

Then the Reddit/WallStreetBets crowd burst on the scene, with nonprofessional investors informally banding together to buy stocks that in many cases were heavily shorted (presumably by hedge funds), causing a “short squeeze” in certain stocks, most notably mall-based video game retailer GameStop. At one point during January, GameStop shares had advanced 1,741% for the year! This short squeeze destroyed some hedge funds and left former star hedge fund manager Gabe Plotkin of Melvin Capital nursing a 53% loss for January, causing him to seek a capital injection from his former boss, Steven Cohen, and Citadel Securities’ Ken Griffin.

Toward the end of the quarter we saw one of the largest financial implosions since Long-Term Capital Management when Archegos, the family office of Bill Hwang (a protégé of hedge fund legend Julian Robertson), was annihilated by massive margin calls on a select number of levered bets in companies such as ViacomCBS. Word on the street is that Mr. Hwang lost $20 billion in 2 days.

Trying to mitigate their own losses, Hwang’s brokers liquidated his substantial positions via a series of block trades, causing stocks such as ViacomCBS to lose half their value over just a few days. JP Morgan estimates losses of more than $10 billion for the prime brokerages that loaned money to Mr. Hwang’s firm.

What’s especially fascinating about this episode is that Archegos was able to amass massive stakes in companies effectively bypassing SEC regulations requiring it to report these positions, thanks to its use of a financial product called a “total return swap.” Even more amazing is that banks such as Credit Suisse, Nomura Holdings, Goldman Sachs, and Morgan Stanley would extend so much leverage to a single firm without doing more due diligence on the firm’s total leverage—or that they were willing to do business with Archegos in the first place considering Mr. Hwang’s checkered past. (His former firm, Tiger Asia Management, pleaded guilty in 2012 to inside trading and paid more than $60 million in penalties.)

Amid these crazy headlines, stocks continued to climb. By far the best-performing sectors for Q1 were energy, which advanced 30.9%, and financials, which rallied 16.0%. However, thanks to the S&P 500’s low weighting of energy shares (only 2.8% of the index) and relatively modest weighting of financial shares (11.3%), the S&P 500 managed only a modest gain of 6.2%. According to JP Morgan, since the market bottomed in March 2020, the S&P 500 has advanced 80.7% (as of March 31, 2021)—leaving us “only” 19% above its February 2020 peak.

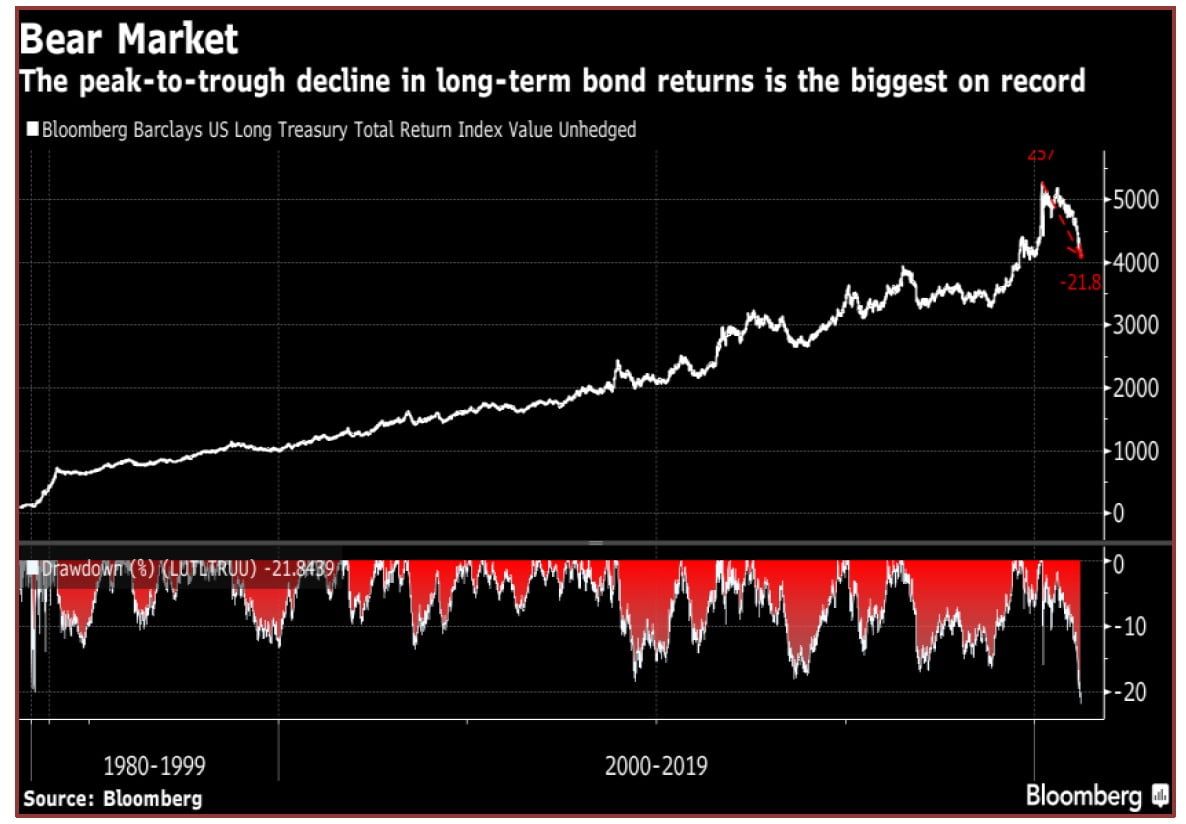

During the quarter, the Treasury bull market that began in 1981 appears to have ended. The Bloomberg Barclays U.S. Long Treasury Total return index, which tracks bonds maturing in 10 years or more, plunged 22% since its March 2020 peak. Amazingly, according to an article that appeared in Bloomberg on March 19, 2021, this index advanced by 4,562% between September 1981 and March 2020 without ever experiencing a peak-to-trough loss of 20%). As Alexandrea Scaggs reported in Barron’s, the Treasury market posted its worst quarterly performance in more than 40 years. According to ICE Indices, the Treasury market lost 4.6%, but investors in longer-dated government bonds, such as the iShares 20+ Year Treasury Bond Index, lost 14%—an especially stinging loss for those who viewed these investments as “safe.” Incredibly, with a yield of only ~1.6% for the 20+ Year index, it would take almost 9 years of interest to make up for the recent quarter’s loss (should rates remain unchanged).

Public Market Valuations

By almost every traditional valuation measurement, the stock market (as measured by the S&P 500) is expensive compared with its 25-year average. But unlike during most of the past 25 years, interest rates are notably low. So although the market was selling at 21.9x forward earnings by the end of 1Q 2021—expensive even compared with historical market tops (in October 2007 the S&P 500 reached a forward PE of 15.7x before the index tumbled 57%)—the 10-year Treasury currently yields ~1.55%, compared with 4.7% in 2007. As we’ve noted in previous letters, historically low interest rates could continue to fuel stocks above historical norms.

We’ve previously observed that the S&P 500 is being driven by a handful of mega-cap stocks (because the index is weighted by market capitalization, companies with a higher market capitalization have a greater impact on its performance), but things haven’t always been this lopsided. JP Morgan reports that as of March 31, the top 10 companies in the market-cap-weighted S&P 500 accounted for 27.4% of the index (versus just ~17% back in 1996) and boasted an average forward multiple of 30.1x (versus an average of 19.5x since 1996). The other stocks in the index currently sell at 19.6x, also well above their average valuation of 15.6x since 1996 but significantly less so than the top ten companies.

But we aren’t index investors: we aren’t “buying the market.” Yes, there are significant near-term risks, but we believe that investors who take a valuation-focused approach over the next 3-5 years will be rewarded. What’s more, we don’t expect index investors to reap similar gains. We’ve said it in previous letters, and legendary investor (and The World According to Boyar podcast guest) Leon Cooperman said it, too, during a November 2020 CNBC interview: “Whenever you bought into the S&P 500 when it sold at 22 times earnings or more, your 5-year return that followed was near zero.” Not only do we believe that Mr. Cooperman’s observation will prove correct once more, but we also believe that plenty of stocks either outside the major indices or index components selling at reasonable valuations should offer patient long-term investors more than satisfactory future returns. Passive equity investing has generally been the most lucrative way of investing money over the past decade, but we believe, in line with recent results, that active investors who take a valuation-focused approach should be able to invest profitably for the foreseeable future.

Speculation Abounds

Speculation ran rampant during 1Q 2021 and has continued into 2Q. Whether in cryptocurrencies, with Bitcoin more than doubling in value in 1Q and continuing its ascent into 2Q; in nonfungible tokens, or NFTs (with an NFT by the artist known as Beeple selling for $69 million at Christie’s, the third-highest auction price achieved by a living artist, after Jeff Koons and David Hockney); or in more traditional asset classes, such as high-yield credit and equities, excessive risk taking has generally been rewarded with spectacular returns recently. As Bill Blain of Shard Capital noted via Randall Forsyth’s column in Barron’s,

“The desperation of investors to garner any real returns is simply driving greater and greater complexity as the investment banks and other bad actors seek to profit from the insatiable demand for returns. Their apparent success and the plethora of implausibly successful investments (from [electric vehicle] makers, virtual art, [special-purpose acquisition companies], and whatever-nexts) has sucked in more and more marks—because everyone wants returns.”

As a result, we’ve seen heightened animal spirits in, among other places, the M&A market. Fueled by low interest rates as well as renewed signs of corporate confidence in doing deals, M&A had its biggest quarter since 1980, according to data from Refinitiv that appeared in a Financial Times article by Kaye Wiggins on April 1, 2021. Traditional M&A-type deals accounted for most of the transactions, such as in General Electric’s sale of its aircraft leasing business to AerCap for $30 billion or Canadian Pacific’s ~$29 billion takeover of Kansas City Southern (Canadian National Railway recently made a higher bid, setting off a possible bidding war). Private equity was also a large participant in the action, with one notable deal involving Apollo Global Management’s purchase of life insurance company Athene Holdings. All told, the value of private equity deals globally rose 116% from the same time last year.

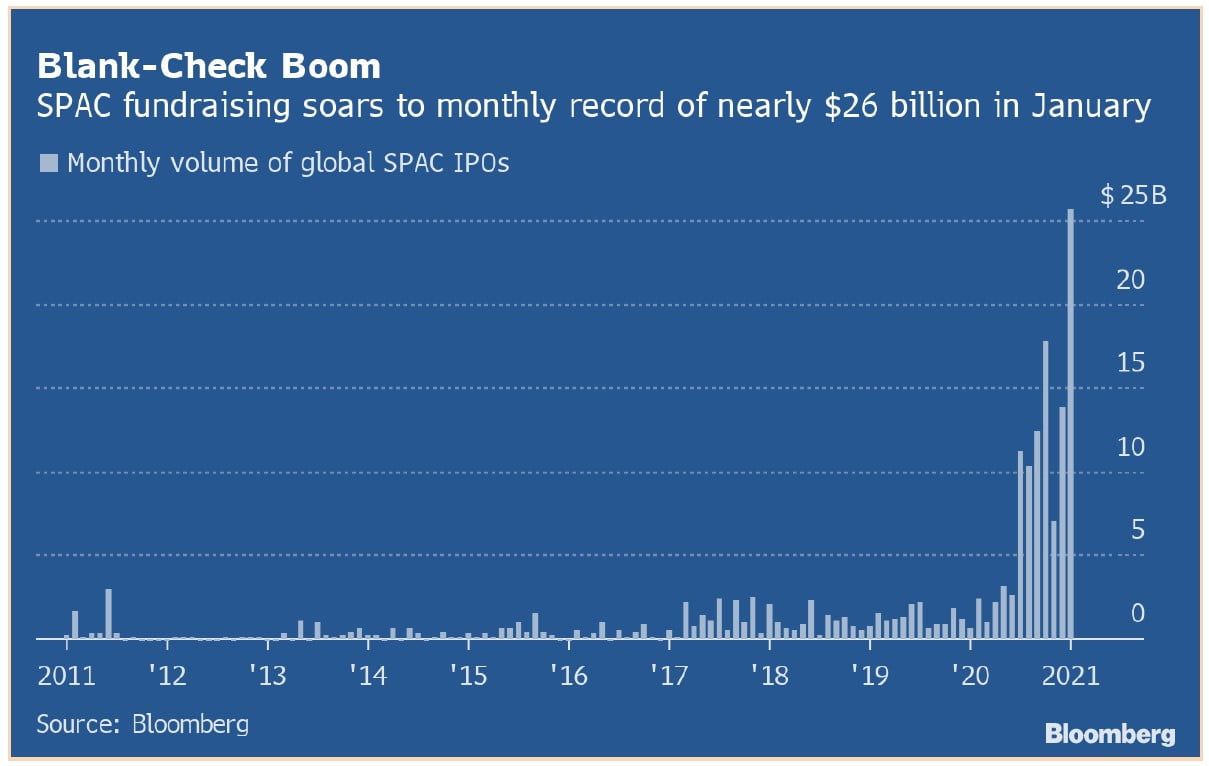

And then there are special-purpose acquisition companies, or “SPACS.” These funds, which raise money on the public markets with the intent of finding a company to purchase, typically must find an investment within 2 years or else give all funds back to investors—and they’ve become all the rage on Wall Street, accounting for $172 billion worth of the completed deals. Interestingly, even though SPACs raised ~$100 billion through mid-April (already topping last year’s record of $83 billion), “SPACmania” seems to be subsiding on Wall Street in recent weeks. (According to an article published in the Wall Street Journal on April 16, through March roughly 5 SPACs were taken public each day in 2021, but over the past 14 days, only 12 SPACs have gone public.) Perhaps this slowdown reflects potential regulatory changes on the horizon—or maybe just SPACs’ recent poor public market performance, with an ETF that tracks SPACs down more than 25% from its February peak. Regulators have begun questioning the optimistic financial outlooks provided by certain businesses that have merged with SPACs. (SPACs have proliferated on Wall Street in part because the regulations surrounding them are much less onerous than those governing traditional IPOs. We believe that this lack of regulation, as well as the incentive structure that surrounds investors bringing SPACs to market, have made SPACs a potentially dangerous investment.)

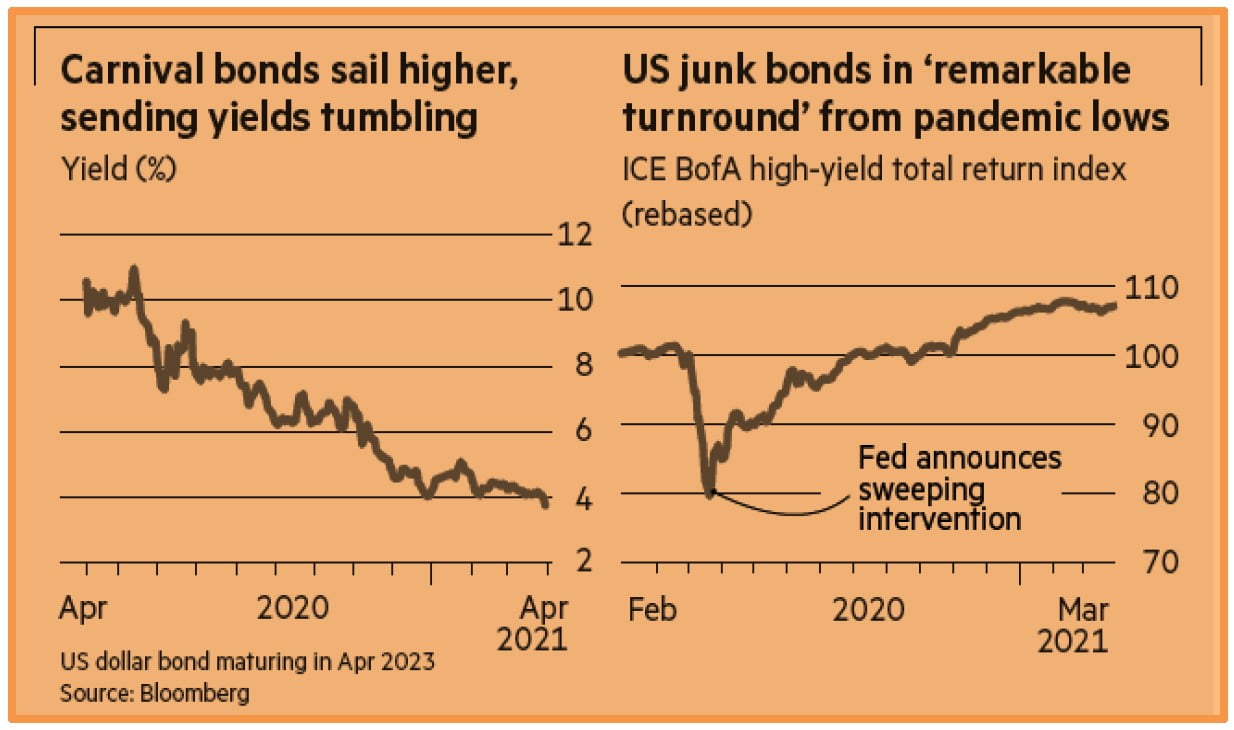

We see the high-yield debt market as especially frothy. Last year, beleaguered cruise operator Carnival Cruise used its ships as collateral to borrow $4 billion at 11.5% interest just to stay afloat—pun very much intended. Despite burning through $600 million per month, with no sign of a significant return to cruises on the horizon, these bonds have gained so much in value that they now yield a measly 4%—a level that we believe falls far short of justifying the very real risks investors take when investing in these bonds.

In the Financial Times, Joe Rennison reported that U.S. high-yield bonds have returned more than 23% from March of last year to the recent quarter end. According to Deutsche Bank, this was one of the only times the rolling 12-month return for the high-yield market has passed 20% (along with the global financial crisis and the dot-com crash). Investors’ quest for yield has become so frenzied that 79% of the $1.5 trillion U.S. high-yield market trades above 100 cents on the dollar, according to ICE Data Services.

Stock Market Leadership/Signs of Hope for Value-Oriented Investors

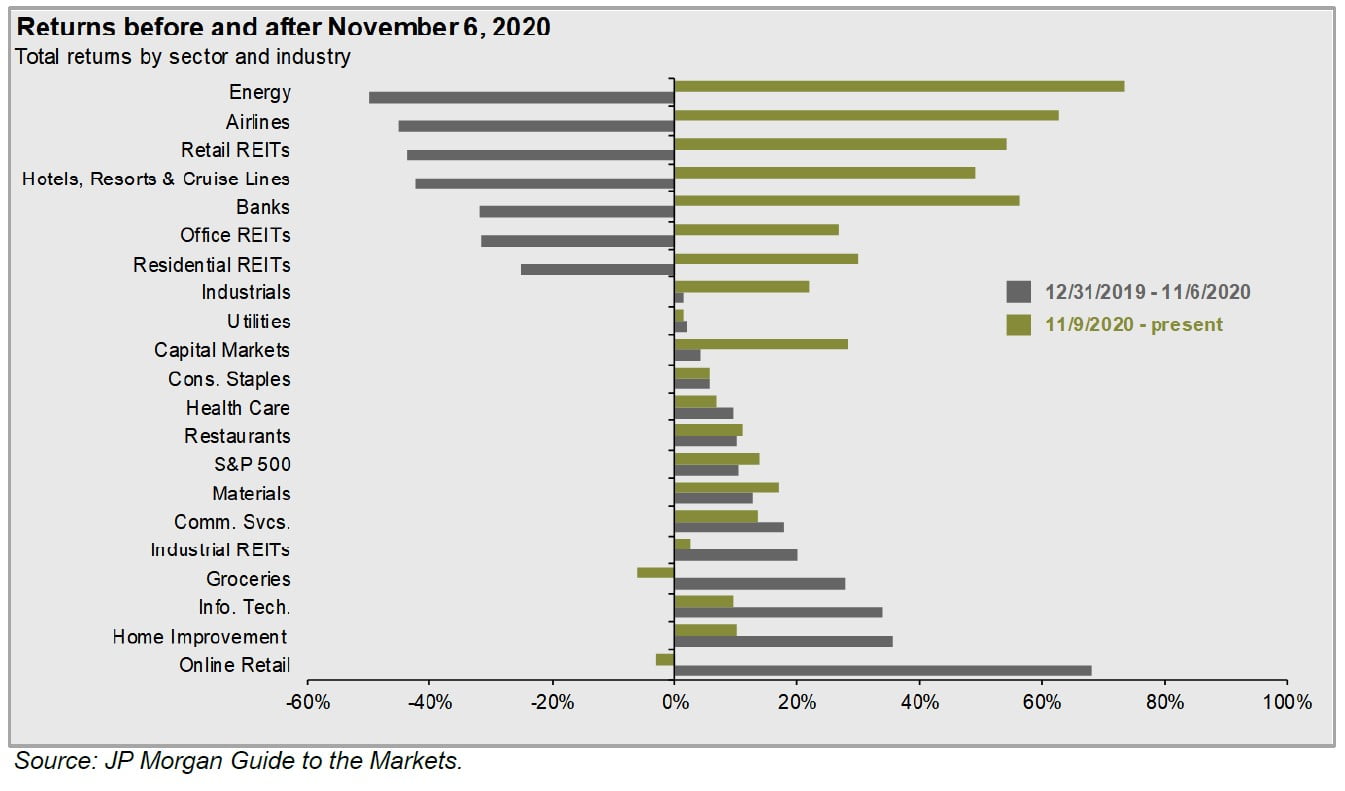

It’s incredible how dramatically stock market leadership can change—just see the following chart. On November 6, 2020 (the last business day before Pfizer announced that its vaccine candidate was more than 90% efficacious against COVID-19), online retail, home improvement stocks, and information technology stocks were the clear winners of 2020. After the announcement, however, these former leaders’ returns were much more muted, with laggards such as energy, airlines, and retail REITs producing spectacular gains from early November.

This change in leadership could help signal a prolonged turn into more sensible value-oriented investments. In our last quarterly letter, as value was beginning its reemergence from a decades-long hibernation, we wrote,

Now that the major indices are far from cheap and many of the current leaders are selling at valuations that seem unsustainable, value-oriented shares might be ready to emerge from their hibernation . . . the catalyst for value’s reemergence is anyone’s guess. Perhaps a sustained rotation into value has already happened (value has outperformed since the election of Joe Biden and the announcement of multiple successful vaccine trials) or maybe we’re waiting on something else (rising interest rates, perhaps?), but either way, we believe that after years of underperforming their growth peers, value-oriented shares will once again shine as they did in 2000.

Despite some recent setbacks, value has continued its ascent. Recently JPMorgan Chase & Company chief global markets strategist Marko Kolanovic suggested that value-oriented shares could be in for a sustained rally, saying that “[w]e might be at a more significant turning point rather than just historically what were blips that reverted back to the growth investing style” and that “[w]e think this recovery can last longer and be more profound and have more of an impact on investor styles and flows than people appreciate.” Historically, value stocks have typically outperformed growth as recessionary periods end and the economy begins to recover, which seemingly is where we are in the current economic environment.

No one’s suggesting that we’ll see a straight line up, but as the economy reopens, with massive fiscal stimulus making its way from consumers’ bank accounts to the real economy and interest rates continuing to rise, we expect value-oriented shares to continue their ascent.

Interest Rates & Inflation

A major fear for both investors and corporations alike is that inflationary pressure could boost interest rates meaningfully, putting the brakes on a sustained economic recovery. The Fed has repeatedly said that it will not be raising rates for quite some time, with Fed Chair Jerome Powell going so far as to say, “We’re not even thinking about thinking about raising rates.”

However, some parts of corporate America don’t seem to have gotten the memo. U.S. firms are currently willing to pay millions of dollars in penalties to refinance existing debt so that they can lock in today’s historically low rates, as Lisa Lee noted in Bloomberg on March 22. Companies like Hilton, Avis, and MSCI are selling new bonds to buy back existing notes and are paying a “call premium” (essentially a penalty for paying a loan back early) to do so. According to the article, these fees would be lower or even zero if the companies would wait anywhere from a few months to a year before refinancing. Clearly, however, these companies disagree with Chairman Powell about where rates are headed.

Signs of inflation abound—the question is whether inflation can be kept at manageable levels to avoid impeding economic growth. The Consumer Price Index, or “CPI” (which reflects the price of goods and services and is often used as a barometer for inflation), increased by .4% in February and by .6% in March—the most since 2012. Excluding food and energy from the measure, the CPI increased by .3%—the most in 7 months—according to Reade Pickert of Bloomberg News.

Anyone who does construction—or who fills their car at the pump, for that matter—has seen inflation at work firsthand. The price of lumber has increased by over 170% since the start of the pandemic, and gas prices have risen 27% in 2021 alone. Consumers will begin seeing inflation at the supermarket as well. Procter and Gamble, which makes goods ranging from diapers to detergent, recently announced that it will start charging more for its goods, citing rising raw material and transportation costs. P&G is far from the only firm passing along increased costs to consumers: JM Smucker and Company recently raised prices for its Jif peanut butter brand, citing higher shipping costs and other inflationary pressures, and may do the same with its pet snacks.

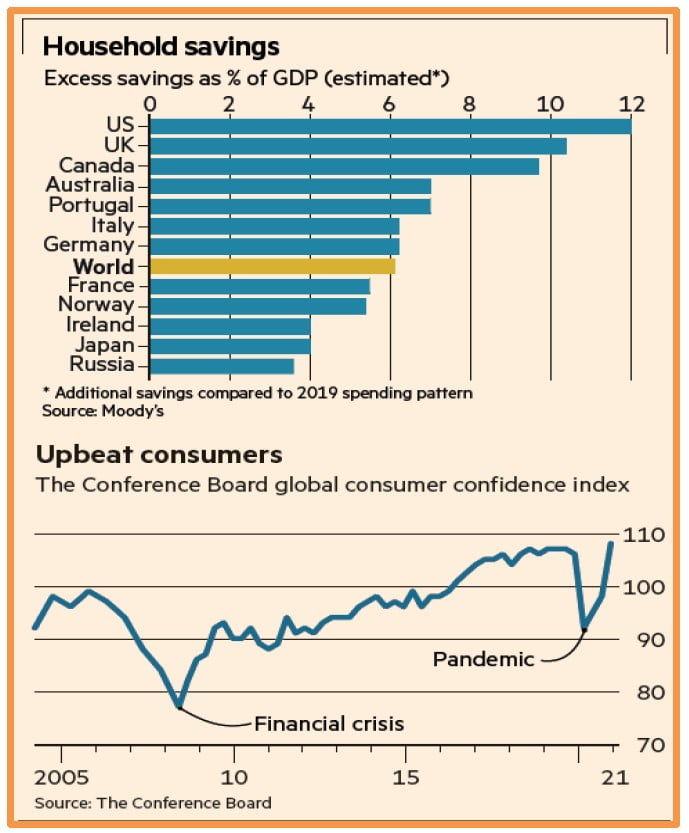

The Fed is in an extraordinarily difficult position. It has done everything in its power to keep interest rates artificially low during the pandemic, hoping to keep the economy running and credit markets flowing—avoiding devastating economic consequences. But with the recent rounds of government stimulus going directly into consumers’ pockets, coupled with increased savings (according to the Financial Times, in the U.S. alone, households have piled up more than $2 trillion in extra savings during the pandemic), we could be on the verge of a dramatic increase in consumer spending. According to Mark Zandi, chief economist at Moody’s Analytics, “[t]he combination of an unleashing of significant pent-up demand and overflowing excess savings will drive a surge in consumer spending across the globe as countries approach herd immunity and open up.” This surge in spending will cause prices to increase, and at some point the Fed will have the difficult job of figuring out how much and when to increase interest rates so that it can keep inflation under control without derailing the economic recovery—a tall task indeed.

Compounding the matter are the significant budget deficits that the U.S. has produced recently ($3.1 trillion in fiscal 2020) and will continue to produce in the near future. While the Fed has been purchasing $80 billion in Treasury bonds (and $40 in agency mortgage-backed securities) monthly to provide liquidity to the markets and hold down interest rates, the tapering and ultimately the end of these purchases will also serve to increase interest rates by removing a large purchaser from the market at a time when U.S. borrowings are continuing to surge due to budget deficits. Obviously, the combination of increasing inflation and large government borrowings concurrently will probably not result in just a gentle rise in interest rates.

The Importance of Taking a Long-Term View

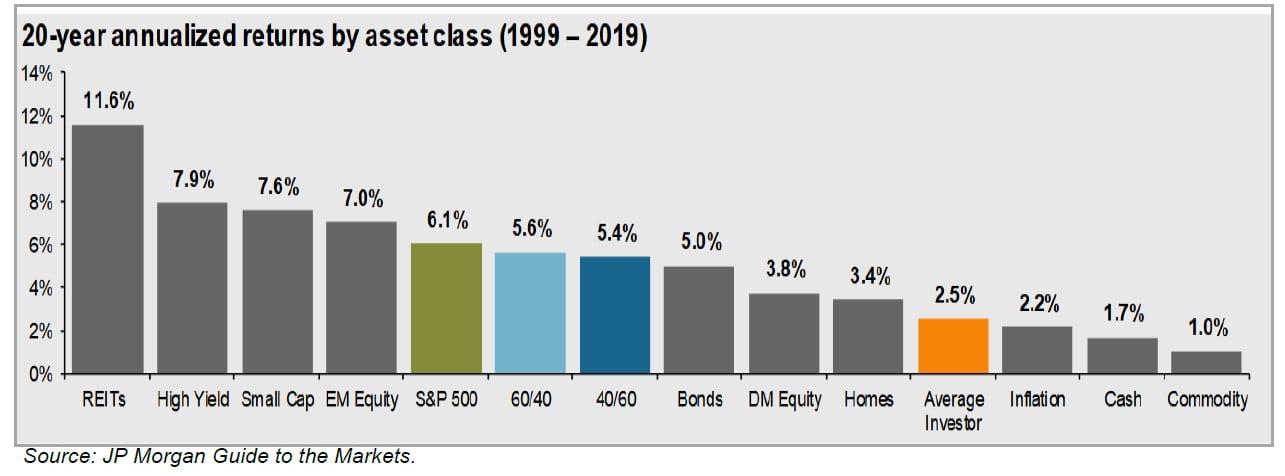

We’ve said so before, but it’s important enough to say again: one of individual investors’ best ways of helping their chance of success is to take a long-term view. According to Dalbar, over the past 20 years the S&P 500 has advanced 6.1%, yet the average investor has gained a mere 2.5% (barely beating the 2.2% inflation over the period). Why this underperformance? Partly because investors let their emotions get the best of them and chase the latest investment fad—or sell when they should be buying.

By contrast, taking a multiyear view tilts the odds of success in investors’ favor. Since 1950, the range of stock market returns measured by the S&P 500 (using data supplied by JP Morgan) in any given year has been from +47% to -39%. For any given 5-year period, however, that range is +28% to -3%—and for any given 20-year period, it is +17% to +6%. In short, since 1950, there has never been a 20-year period when investors did not make at least 6% per year in the stock market. Although past performance is certainly no guarantee of future returns, history shows that the longer the time frame you give yourself, the better your chances of earning a satisfactory return.

As always, we’re available to answer any questions you might have. If you’d like to discuss these issues further, please reach out to us at [email protected] or 212-995-8300.

Best Regards,

Mark A. Boyar

Jonathan I. Boyar