Prescience Point Capital Management raise their price target on Groupon Inc (NASDAQ:GRPN).

Q4 2021 hedge fund letters, conferences and more

Raising Our Price Target To >$88 Following Recent News That Shows Groupon’s ~5% Stake In SumUp Is Likely Worth More Than Its Entire Market Cap

The recent news of SumUp seeking to raise capital at a $22.5B valuation validates our original thesis and significantly increases the upside for Groupon (“GRPN” or the “Company”). This is the first ever public data point discussing SumUp’s valuation and GRPN’s windfall could be greater than $1B, which exceeds its entire current market value. We expect this news to set off a series of catalysts that will propel GRPN shares significantly higher in short order.

Summary Highlights:

- Based on recent news that SumUp is seeking to raise capital at a $22.5Bn valuation, Groupon’s ~5% stake in SumUp could be worth >$1Bn, which is more than Groupon’s entire current market capitalization and is almost 4.2x higher than our original base case estimate

- Based on our revised valuation for Groupon’s SumUp stake, we are raising our price target for Groupon shares to >$88/share, 225% higher than the current share price • We believe the recent news of SumUp’s proposed funding round will set off a series of catalysts that will result in a rapid increase in Groupon shares. These catalysts include 1) public confirmation by Groupon of its ownership percentage in SumUp, 2) increased price targets from sell side analysts, 3) incremental investments from value and arbitrage funds and 4) covering by crowded short sellers

- We urge Groupon to publicly disclose its ownership percentage in SumUp and update the market on a path toward stake monetization and plans for the proceeds (e.g., special dividend, share buyback, etc.).

Groupon's Stake In SumUp

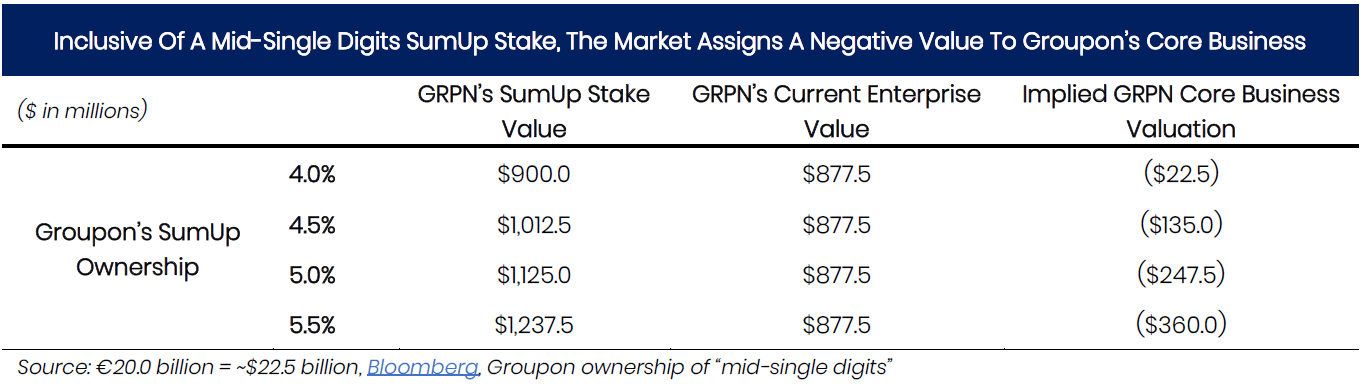

On 01/26/2022, Bloomberg broke news that SumUp is seeking to raise new money that would value the mobile payments company at ~$22.5 billion. In our initial report, we estimated that Groupon owned ~5% of SumUp. Independently, a large shareholder recently informed us that former Groupon CEO Mr. Aaron Cooper confirmed to them last year that Groupon’s SumUp ownership stake was in the “mid-single-digits.”

Based on an estimated ownership of 5% and the proposed $22.5 billion valuation, we calculate that Groupon’s stake could be worth >$1 billion. In other words, the market is currently assigning negative value to Groupon’s core business which is amidst a major turnaround, flush with cash, and poised for growth with a new ambitious CEO.

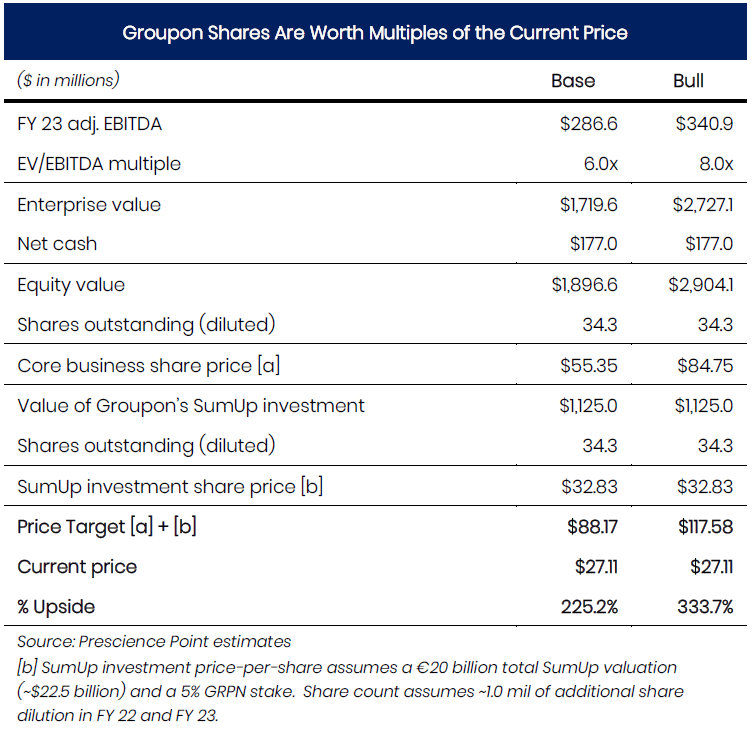

Based on the new SumUp information, we are significantly raising our estimates for Groupon’s fair market value. We value Groupon’s core business at 6.0x (above current levels, but well below the historical average) our FY 23 adj. EBITDA of $286.6 million, or $55.35/share + the SumUp stake at $1,125.0 million, or $32.83/share, resulting in a base case price target of $88.17. A more bullish case, assuming FY 23 adj. EBITDA of $340.9 million and an 8.0x multiple (in-line with historical levels) + $32.83/share for SumUp, results in a bull case price target of $117.58.

Read the full report here by Prescience Point Capital Management