NEW YORK (S&P Global Ratings) March 22, 2021–The global economic recovery is gaining steam–powered by accommodative fiscal and monetary policy stances and accelerating vaccinations. And the recent rise in U.S. Treasury yields, and its spillover into corporate bond yields, indicates greater confidence in a sustained recovery, including a normalization in market functioning and risk pricing. However, the exit path from a very unusual cycle has the potential to be uncertain and volatile for credit markets, and recent discussions have focused on the risk of rising inflation.

Q4 2020 hedge fund letters, conferences and more

Fears that overaggressive fiscal policies could stoke a return of too high inflation have pushed bond yields higher and led central banks to clarify their (for now, dovish) reaction functions. In our view, these discussions confuse the risk of global reflation fueled by a solid recovery, which is broadly positive, with the risk of a disorderly rise in inflation and yields, which is broadly negative. These fears are most pronounced in the U.S. but could spread as the recovery gains traction.

We think inflation fears are overblown and that orderly reflation, around a return to sustainable growth, is a healthy development for both macro and credit development, said S&P Global Ratings today in its article "Orderly Global Reflation Will Support The Recovery From COVID-19."

Risks relate to a rapid and volatile reset in risk premium or durably elevated inflation--which would hurt, in particular, corporate entities at the lower end of the rating scale and in some emerging markets.

Orderly Global Reflation Will Support The Recovery From COVID-19

As vaccines are rolled out at an increasing pace, activity rebounds, and the light at the end of the COVID-19 crisis tunnel becomes brighter, thoughts have turned to the shape and speed of the recovery. Recently, discussions have focused on the risk of rapidly rising inflation.

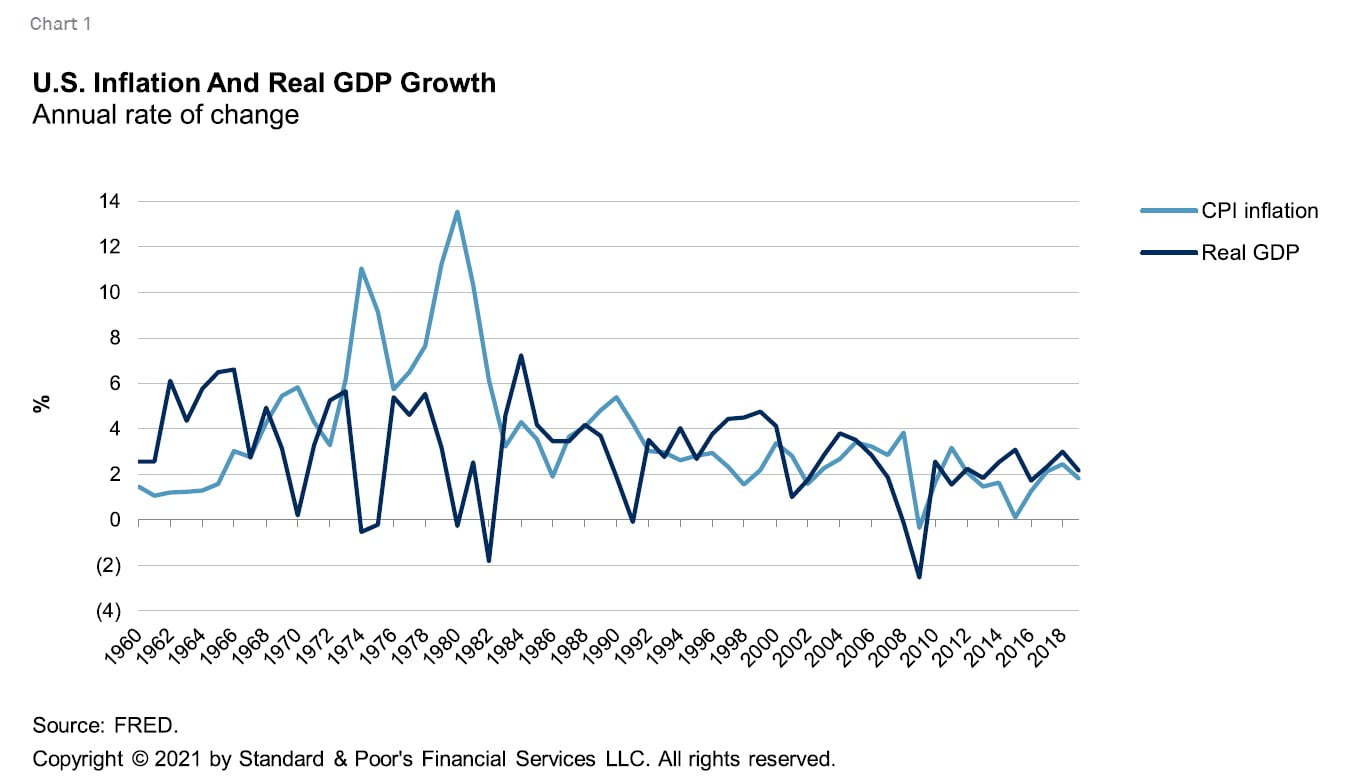

Market fears that overaggressive fiscal policies could stoke a return of too high inflation have pushed bond yields higher and led central banks to clarify their (for now, dovish) reaction functions. In some ways, these discussions harken back to the days when the central bank's job was seen as taking away the punch bowl before the party got started (see appendix for details). In our view, these discussions confuse the risk of global reflation fueled by a solid recovery, which is broadly positive, with the risk of a disorderly rise in inflation and yields, which is broadly negative. These fears are most pronounced in the U.S. but could spread as the recovery gains traction.

Our bottom line is that orderly global reflation is, on balance, a healthy development for macro and credit outcomes. This narrative implies that moderate demand and wage pressures have reemerged after a lost decade and that the interest rate structure has the potential to return to more normal levels. While there will inevitably be some market adjustments as credit is repriced, this will lead to better outcomes.

Too Much Or Too Little Policy Response?

COVID-19 took an awful economic toll as governments imposed harsh restrictions on social mobility. These measures led to unprecedented declines in output and spikes in unemployment and much shorter working hours. Surprisingly to some, governments discovered that they had more fiscal space than thought and spending was accordingly ramped up to protect the hardest hit and to build the foundation for the recovery. And governments have continued to roll out large stimulus plans, in part to guard against the premature tightening that took place after the global financial crisis. Most notably, U.S. President Joe Biden's $1.9 trillion plan was enacted into law in early March 2021.

But how much is too much? Few economists would argue for a hyperaggressive, sustained fiscal stimulus that would run the economy too hot, push medium-term inflation expectations away from 2%, and require the Fed--or any central bank--to slam on the brakes and potentially put the economy back in recession. The flipside is the risk of going too little, driven by the 1970s-fear of stoking any inflation above target. This would keep fiscal policy too cautious and demand too weak, prolonging the period of ultralow rates and the negative effects on macro and credit outcomes.

Turning to the monetary policy response to the recovery, the issue is not whether it would be beneficial for central banks to move off zero. The answer is surely "yes." With the Fed's inflation target of 2% and estimates of the neutral real rate of interest around 0.5%, the neutral fed funds rate would be around 2.50%, consistent with the most recent Fed dot plot (see Related Research). With the Fed at 2.50%, the 10-year Treasury yield would be in the low- to mid-3% range. Interest rates on credit to private-sector firms would be on top of these rates, depending on the spread.

This "neutral" rate structure would have several benefits: give the monetary authorities some ammunition for the next downturn, price credit in a way that would lead unviable firms to exit the market, and rationalize asset prices (see more below).

As we exit the COVID-19 downturn, monetary and fiscal policies would ideally be coordinated. In the case of fiscal policy, a middle path to create demand--and to withdraw it when no longer needed--would include aggressive near-term support that is withdrawn judiciously as private demand recovers, as we argued previously (see our latest outlook, "Global Economic Outlook: Limping Into A Brighter 2021"). This would help to anchor inflation expectations and support macro and financial stability. (For a "semiautonomous discretion" approach to fiscal stimulus, see the recent PIIE paper by Orszag, Rubin, and Stiglitz, link in Related Research.)

Read the full report here by S&P Global Market Intelligence.

This report does not constitute a rating action.

The report is available to subscribers of RatingsDirect at www.capitaliq.com. If you are not a RatingsDirect subscriber, you may purchase a copy of the report by calling (1) 212-438-7280 or sending an e-mail to [email protected]. Ratings information can also be found on S&P Global Ratings' public website by using the Ratings search box located in the left column at www.standardandpoors.com. Members of the media may request a copy of this report by contacting the media representative provided.