Every successful fund manager has developed a set of strategies which helps them identify wise investments, and Oakmark Portfolio Manager William Nygren of Harris Associates is no different. At the 2019 Ben Graham Conference, Nygren explained one key factor he uses to identify value stocks. His strategy has certainly worked for him, given that Oakmark has nearly doubled the S&P 500’s return over the last 25 years. He also said every Oakmark has outperformed versus its benchmark since inception in 1991.

Identifying value

In his presentation, Nygren said value is a function of price and quality, and they use three main tenets in their decisions. They buy businesses at a significant discount to what their estimate of intrinsic value is. They also look for companies they believe will grow their per-share value over time, and they seek companies with management teams that think and act like owners.

Q2 hedge fund letters, conference, scoops etc

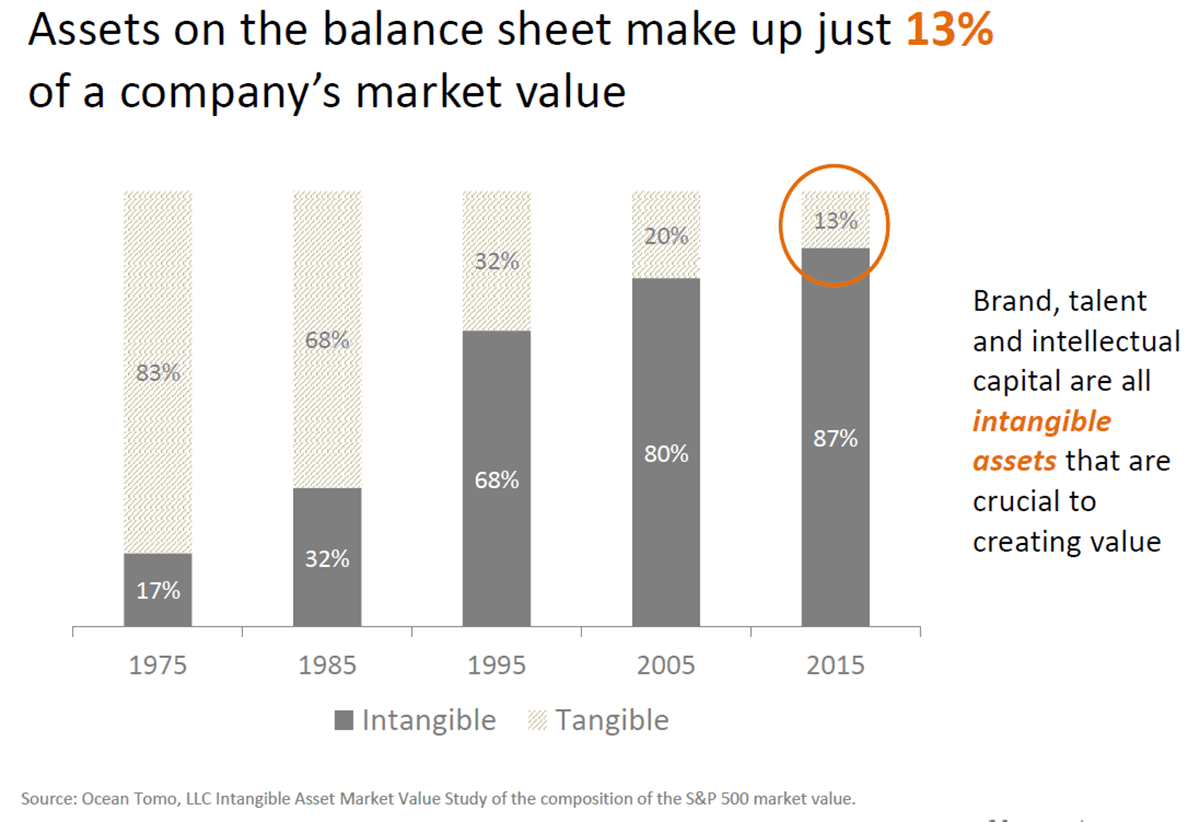

He also talked about company balance sheets and explained why they place less importance on balance sheets these days. Instead, they focus more on "intangible assets" like brand, talent and "intellectual capital," all of which he says are important when it comes to creating value. Nygren now estimates that balance sheet assets contribute only about 13% of a company's market value. This represents a significant decline over the last several decades.

Book value is now less important

Nygren also believes the tie between the book value and economic value of a company has broken. He estimates the correlation between stock price and tangible book value for the 500 biggest U.S. companies at 71% in 1975. However, as of 2018, he believes this correlation has plunged to 14%. Thus, knowing a company's book value provides very few clues about what its stock price should be.

He also said that returns from screening in this manner have diminished. The price to book value mean reversion has even underperformed significantly since 2010.

Intangible assets to become more and more important

The Oakmark team expects intangible assets to grow even further in importance rather than start diminishing. Additionally, they believe limiting investments to stocks with low price-to-book values will probably disappoint.

In order to determine a company's value, Nygren adjusts its earnings to reflect their estimations of the company's intangible values. This means they not only invest in traditional value stocks but also growth stocks. Even though Oakmark is a value manager, it holds stocks in every mid- and large-cap factor style box. Among the holdings Nygren mentioned are Citi and Ally Financial under value, TE Connectivity and News Corp under core, and Netflix and CBRE Group under growth.

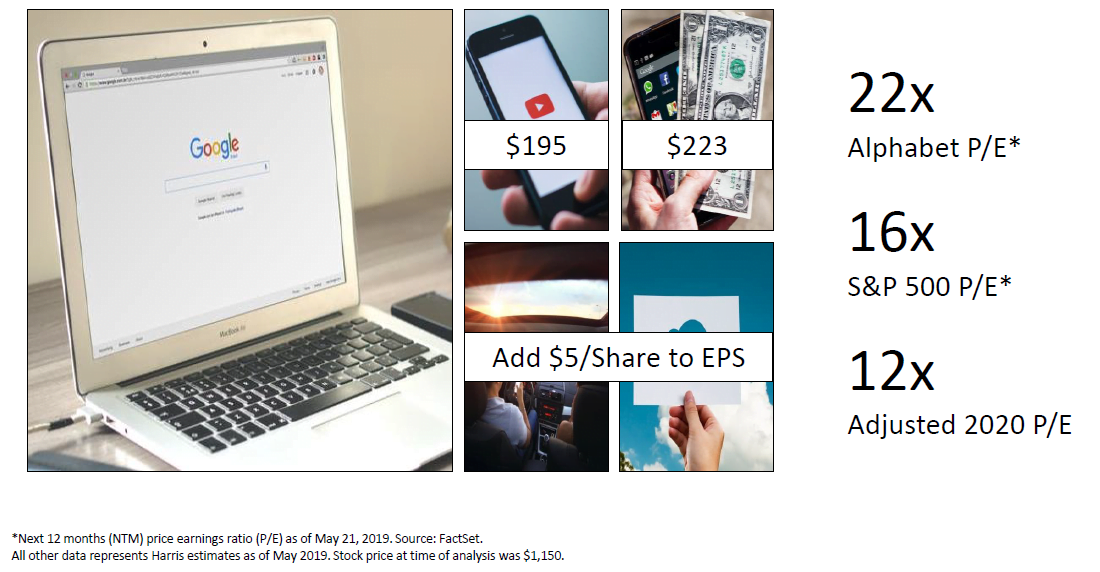

He used Alphabet as an example of including intangibles in adjusted earnings numbers. He said using the P/E ratio misses some parts of the company's value.

This article first appeared on ValueWalk Premium