RILA GLOBAL CONSULTING, a boutique social analytics consultancy based in New York City, launched a new market study on 15 global neobanking providers today.

Q2 2020 hedge fund letters, conferences and more

The research, conducted in partnership with Ten Bear Group covers the top 15 neo-banking leaders globally and includes detailed performance analysis, consumer trends, audience segmentation, and more. The data in the study reflects consumer behavior, usage, and consumption of neobanking apps between December 2019 and June 2020, covering trends before, during, and after COVID-19.

The study reveals that the Coronavirus pandemic has substantially increased neobanks’ penetration and consumption with YoY conversation growth of 7%. Consumers were highly critical of providers, citing security, convenience, fees transparency, and flexibility as of utmost importance to them. Customer service was a big detractor across all neo providers, leaving room for improvement. As many consumers used social media as the main method to reach Customer Support, long response times on Twitter and phone were also rated as the top barriers.

Kate Drew, Manager, Fintech Solutions, and Research at Grant Thornton added about this research study that “US banking giants are less hobbled digitally than their counterparts abroad, and consumers in the country tend to favor incentive-packed credit cards for spending, taking some of the punch out of the money management tools that have made many neobanks so popular. To win in this market, these upstarts are really going to have to think carefully about where they can play well and what features they need to get US consumers onboard, even if it means abandoning strategies that brought them great success at home”

New Neobanking Consumer Intelligence Report

Findings overview

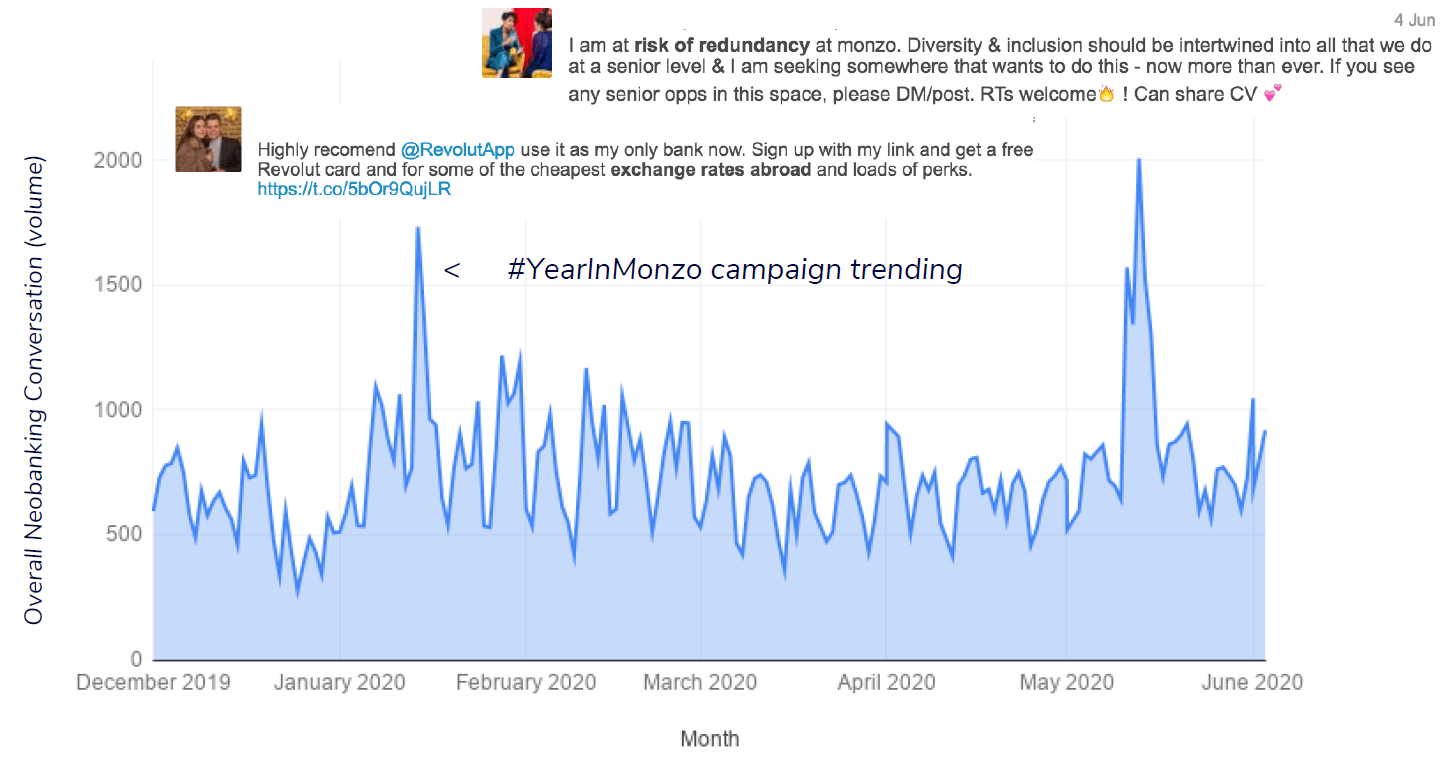

While multiple providers garnered significant global mentions between December 2019 and June 2020, Monzo dominated the neobanking conversation across all media.

A large portion of the volume came from:

- consumers who experienced an issue with their account

- customer service-related

- discussions around Revolut as top choice for crypto trade.

"Customers are using social platforms to discuss, complain, support and recommend their banking providers more than ever. It is critical that banks listen, understand and act on this vital source of customer intelligence to ensure that their products remain relevant and respond to changing demands." - Daniel Meere, Managing Director, Axis Corporate, U.K.

In January, the trending hashtag #YearInMonzo gathered multiple mentions for the brand, proving for a smart engagement strategy with customers. Revolut's sign up link campaign generated peaks in of interest in February, driving brand mentions around cheap exchange rates abroad. Monzo also saw a spike in May, when Tweets from staff members who were threatened with redundancy went viral.

COVID-19 proved beneficial to neobanks

As the pandemic reached various global markets, no notable spikes in conversation were seen across the various providers, however customers reached out to their bank:

- seeking specific assistance and relief around the virus

- to get their account unlocked

- users advising others to stay away from cash as some claimed cash carries the virus

The conversation adopted a stable shape upon Coronavirus news stabilization. Upon further examination of the data RILA/TBG noticed that news sites reach had a frequency of 5x and lost momentum after every following article published on the Coronavirus topic. While neobanking news made up for less than 4% of the conversation during the time frame, clear trends around customer disengagement on this topic can be observed.

Will those shape the future of banking?

The full report can be downloaded on RILA's website using this link.