This article on Mozido was originally posted on June 28 2016, on February 27th 2019 the DOJ announced a criminal indictment against the founder. We are proud of our work and want to point out that we love the WSJ and Forbes but we beat them both on this story by at least a few months, I believe we were the first to report on these matters. We were threatened by lawyers for speaking the truth (as happens too often), so we appreciate all the support on this and other stories. We started on this story after recieving an anonymous tip in the summer of 2016, so again we appreciate all tips provided in a manner compliant with the law.

See the original article below. We have removed the paywall so everyone can read it.

Also see more on Turner investments “connection”

…………………………

“Tech Firm Mozido Listed in DoJ, SEC Subpoena”

by Mark Melin

14:59 06/28/2016

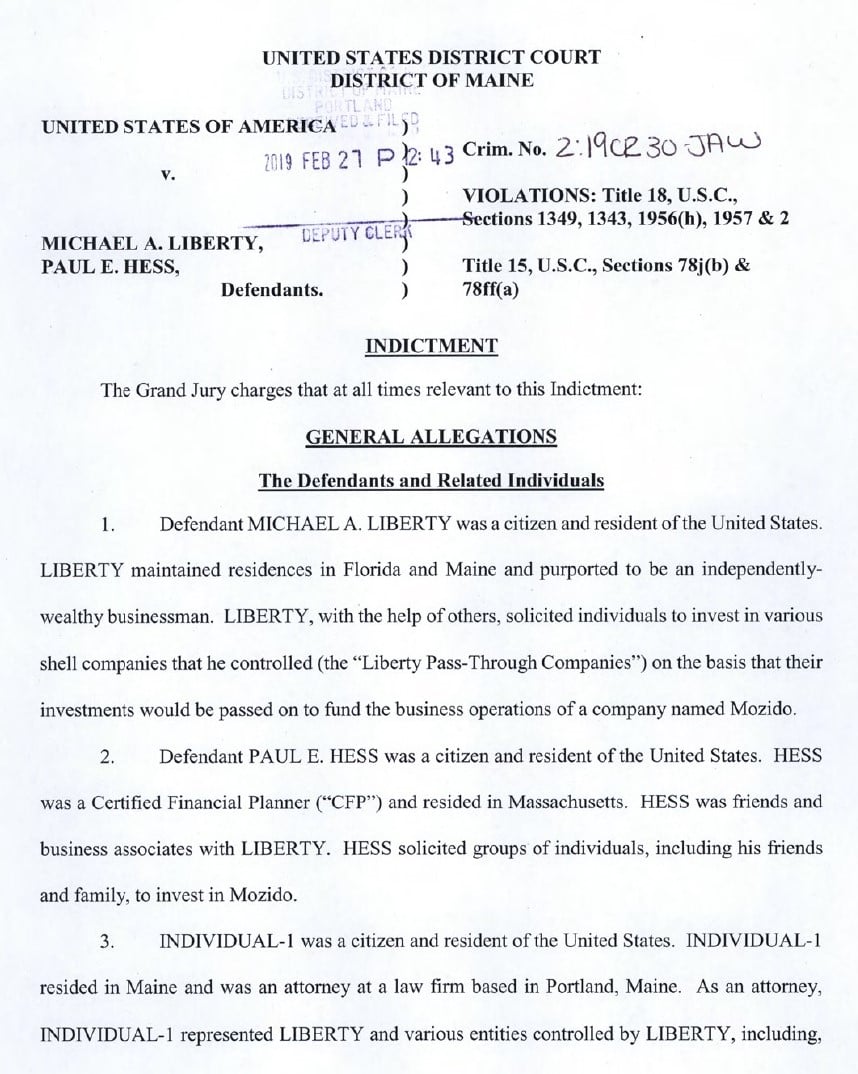

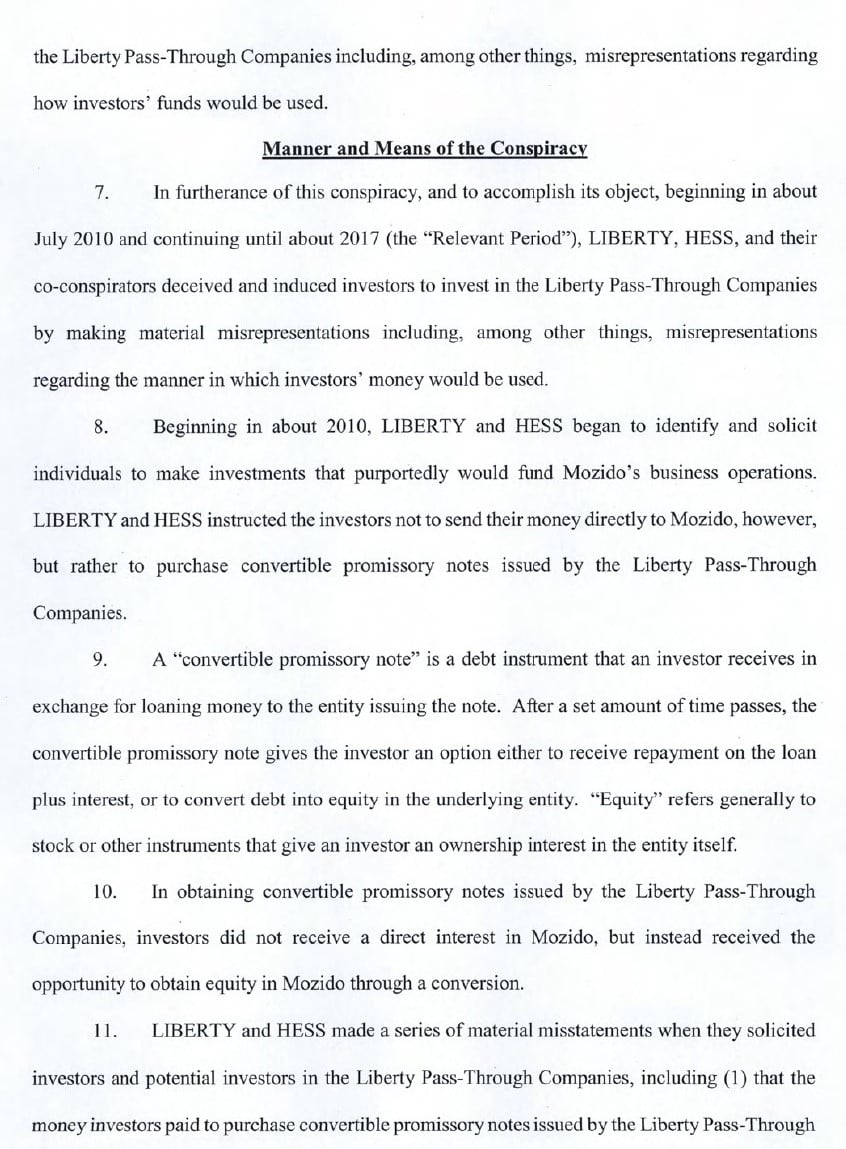

Two individuals were charged in an indictment filed today for their alleged roles in a multi-million-dollar scheme involving purported investments in a start-up financial technology company.

ValueWalk reported back in 2016 on Mozido Inc., being mentioned in both US Department of Justice and Securities and Exchange Commission subpoenas.

Tech Firm Mozido Listed in DoJ, SEC Subpoena

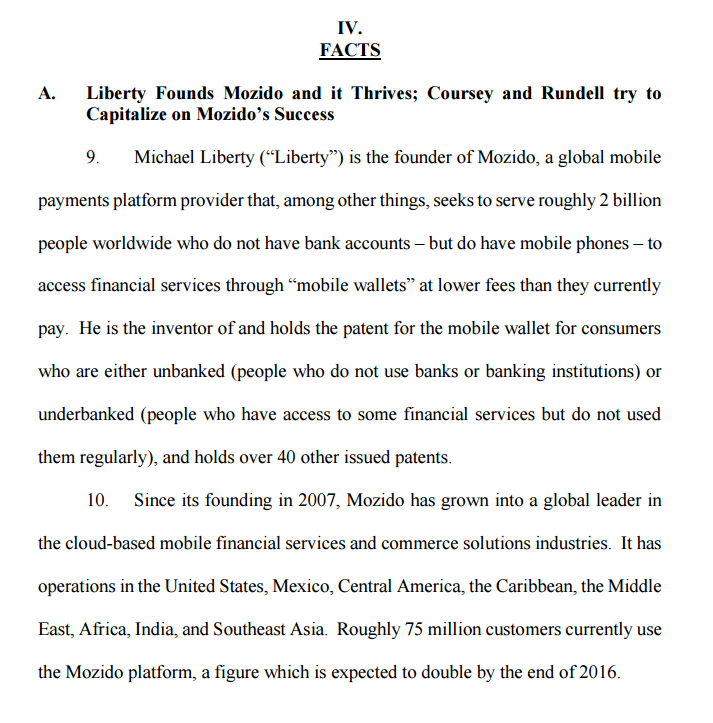

A major early stage technology firm, Mozido Inc., is prominently mentioned in both US Department of Justice and Securities and Exchange Commission subpoenas, ValueWalk has learned. Mozido provides many low-income clients without a bank account the ability to pay for consumer items using their cell phone.

The subpoenas point to a long-running history of legal disputes, one of which is with an influential corporate executive and Republican campaign contributor. The nature and exact details of both the DoJ and SEC investigations has not been made public outside what has been revealed in open civil court proceedings involving Mozido and its founder, Michael Liberty.

Well-known corporate executive and Republican donor Phillip Geier at odds with Mozido and its chairman and founder Michael Liberty

The subpoenas, revealed in New York Supreme Court proceedings, were served to Phillip Geier, a well-known corporate executive and political contributor. They asked for documents and records relating to Mozido, an Austin, TX-based company that allows consumers to pay for items using their mobile phone. Geier had alleged in a separate case that Mozido failed to live up to promises related to investment options.

Geier, a Florida resident and former CEO of Interpublic Group, a large advertising conglomerate, alleged through his lawyer that he was the victim of a fraudulent investment scheme. Geier is a major donor to Republican causes and former advisor to presidential candidate John Kasich, served as a director on some 20 corporate boards and was on the board of Mozido, LLC for approximately 13 months in 2012 and 2013. Geier never served as a board member of Mozido Inc., the subsequent iteration of the company that is mentioned in court documents at the center of the transfer of assets that is alleged to have disadvantaged Geier and other investors. In testimony Geier is alleged to have called Liberty a “crook” and claimed “the SEC was going to come after” Liberty and Mozido.

The source of the animus is an investment arrangement gone bad and what appears a dispute over assets being transfered from one company, with separate investors, to another group of investors.

In a Delaware case, Geier alleged that when he went to exercise a 1% option to purchase stock in the company after having served on the board for a year, he discovered the intellectual assets of the company had been transferred from Mozido LLC to Mozido Inc., a separate company, with the goal to insulate new investors from claims by early investors in the company, allegations in court documents claimed.

In a Florida lawsuit, allegations were made by Geier Holdings, Geier’s investment subsidiary, that an improper asset transfer took place. The defendants in that lawsuit maintain they were released as part of the November 2013 settlement. Mozido has a pending motion to dismiss Geier’s Delaware suit and a legal resolution has not been ruled upon.

“The allegations of the Geier lawsuit are emphatically denied, and are being vigorously defended by Mozido and Mr. Liberty in the lawsuits that Mr. Geier has commenced,” Dean Pamphilis, a lawyer for Kasowitz Benson Torres & Friedman representing Mozido, explained to ValueWalk.

Geier’s allegations revealed in court documents also mention Robert Turner, a newer investor and chairman of Turner Investments, who was appointed Executive Chairman of Mozido Inc. nearly two years ago. While Turner is not the subject of a lawsuit and his lawyers claim he has not been questioned by the DoJ or SEC, in court documents Geier alleges Turner was involved in denying him his investment when he went to convert the options. The latest investigation news comes as a lawyer representing both Turner and Mozido, Marc Kasowitz, a partner at for Kasowitz Benson Torres & Friedman, claims that Turner Investments is “doing fine” and remains operational.

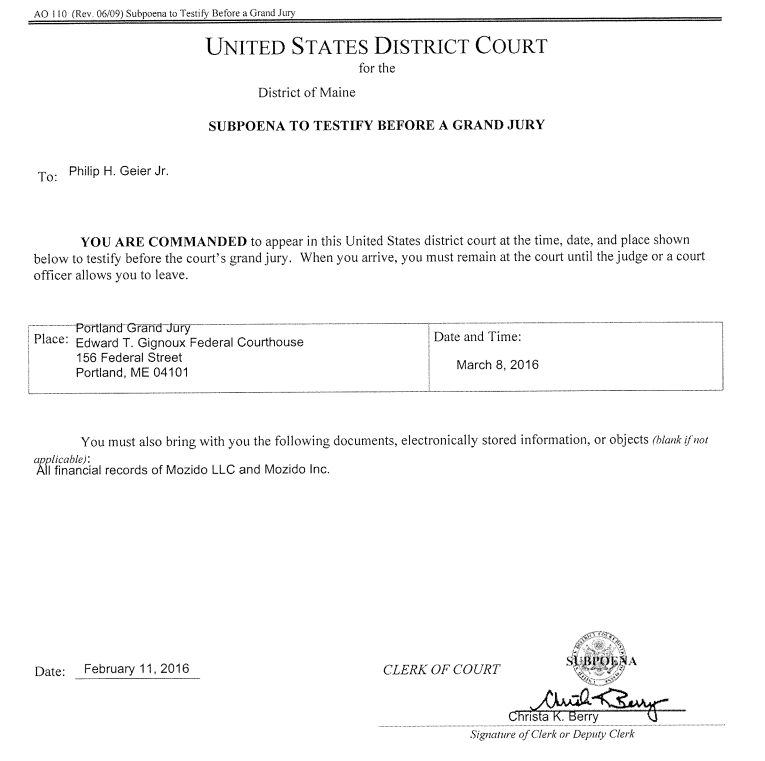

Former Mizido LLC board member and influential corporate board member Phillip Geier alleges fraud

In February Geier was issued subpoenas from both the US Department of Justice and Securities and Exchange Commission. The DoJ Subpoena states that it is “relate[d] to the investigation of a federal felony offense,” and requests “financial records of Mozido LLC and Mozido Inc.” On February 23, 2016, the SEC issued a subpoena to Geier seeking documents concerning the finances of Liberty and his affiliated entities as well as Mozido and its affiliated entities, including the “transfer of assets between or among Liberty and various related parties” and their lawyers’ escrow accounts. The SEC Subpoena also seeks documents reflecting communications between Geier regarding the Mozido entities and Liberty, as well as all court and arbitration pleadings, filings and transcripts.

Based on the subpoenas, the DoJ investigation is being conducted by a US Attorney in Maine and the SEC investigation is being conducted out of Boston. Lawyers for Mozido say the two matters are unrelated and Mozido has been advised that it is not a subject or target of the DoJ investigation in Maine. It is unknown if other jurisdictions are investigating this or other related matters.

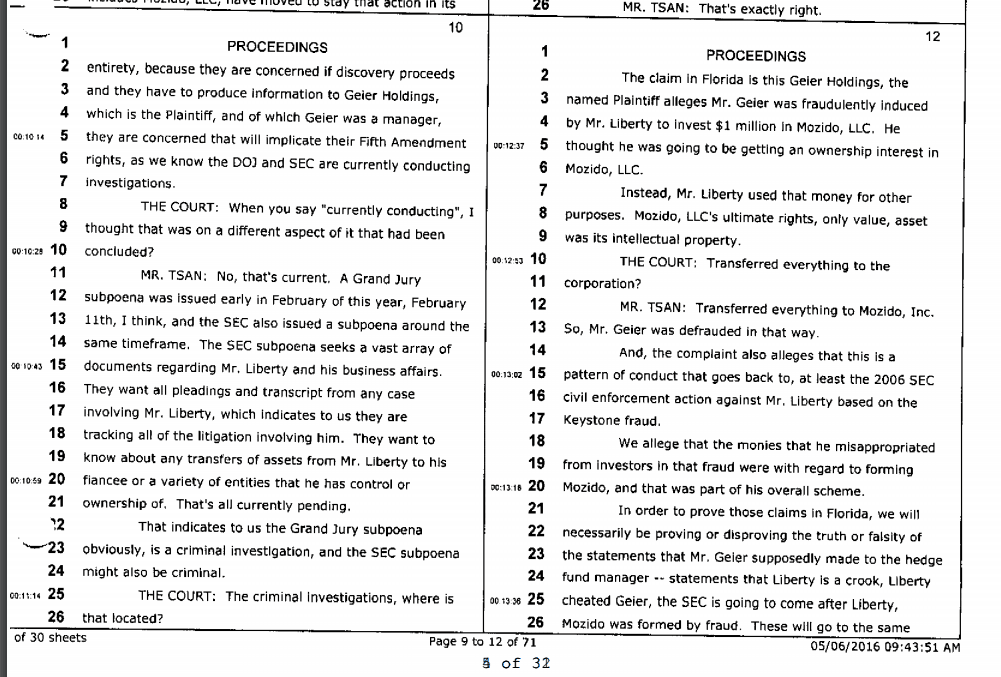

Court documents (Figure 1) show Geier believed he had invested $1 million in Mozido but in reality that’s not where the money went, Geier’s lawyer, Clifford Tsan of Bond Schoeneck & King, alleged in New York Supreme Court:

The claim in Florida is this Geier Holdings, the named Plaintiff alleges Mr. Geier was fraudulently induced by Mr. Liberty to invest $1 million in Mozido, LLC. He thought he was going to be getting an ownership interest in Mozido, LLC. Instead, Mr. Liberty used that money for other purposes.

Mozido sees the situation differently. They said in the Florida action, it is Geier Holdings and not Philip Geier that invested $1 million in Family Mobile and not Mozido. Neither Mozido or Family Mobile have any ownership interest in one another and the exact legal relationship has yet to be determined in court.

Mozido raised $80 million in a Series A round in 2013 followed by a $185 million Series B round in 2014, the company web site states.

Mozido founder Liberty involved in previous court battle that is raised in Geier case

In its case, Geier’s lawyers are attempting to show a trending pattern of behavior, particularly as it relates to the founder and his administration of stock options.

They point out the SEC had previously alleged Keystone Venture Management Holdings Inc. allowed Michael A. Liberty, then 45 and a resident of Gray, Maine, to divert investment assets to himself and to associates. Over $9 million were alleged to have been misappropriated from the venture capital fund. The SEC agreed to a negotiated settlement in the 2006 case and Liberty agreed to pay $600,000 to resolve the situation.

“These defendants then concealed the misappropriation of funds by creating false and misleading financial statements that reflected the diverted assets as legitimate investments even though they knew or were reckless in not knowing that those funds had been diverted to Liberty and others associated with him,” the SEC complaint alleges. “These false and misleading financial statements were then disseminated to existing and prospective limited partners of the Fund.”

Those defending Mozido point out these are unproven allegations concerning a civil lawsuit initiated by the SEC over a decade ago against many defendants of which Liberty was one. The civil suit concerned events that occurred 20 years ago and was settled by Michael Liberty, without any admission of liability on his part.

It is not guilt or innocence that is at issue with Geier, who is alleging in court the lawsuit was not properly disclosed to him at the time of the investment. This case remains open.

Mozido counter punches, says Geier defamed them with investors, called Liberty a “crook” and said Mozido “was formed by a fraud”

Mozido, for its part, filed a suit against Geier alleging he damaged and defamed the organization.

“Mr. Geier had a conversation with an unidentified hedge fund manager. In that conversation, Mr. Geier allegedly said that Mr. Liberty is a crook, the SEC is going to come after Mr. Liberty, Mozido was formed by a fraud,” Tsan told the court, encapsulating charges made by Liberty and Mozido.

In court documents, LIberty and Mozido say Geier, used his board member status and “inside knowledge as a director of Mozido” to defame Liberty. The documents said a “smear campaign” involved “making disparaging and defamatory statements concerning Plaintiffs to the manager of a prominent New York City based hedge fund” that had invested in Mozido. Tiger Management founder Julian Robertson was mentioned in the court documents as having such conversations. When reached through his publicist, Fraser P. Seitel, Robertson did not provide comment.

Other investors in Mozido include MasterCard, Wellington Management, Sheikh Nahyan, who heads the Ministry of Culture in the United Arab Emirates, and TomorrowVentures, the early-stage investor venture capital fund co-founded by Google billionaire Eric Schmidt.

Turner involved in numerous disputes, but Turner Investments continues to move forward

Turner’s involvement appears to be of an investment facilitator and bearer of bad news.

In court documents in the suit in Delaware against Mozido, LLC and Mozido, Inc, Geier alleges he “wrote to Robert E. Turner, the Chairman of Mozido, LLC and formally demanded to exercise his right to purchase the optioned units and requested a copy of the Company’s option plan and agreement. Defendants refused to permit Geier to exercise his Option and refused to deliver to him the Company’s option documents.”

Neither Turner nor Turner Investments are defendants any other action brought by Philip Geier, or Geier Holdings. As previously reported in ValueWalk, Robert Turner and the firm he founded, Turner Investments, is involved in multiple disputes with employees and the firm’s assets under management have fallen sharply, but the company moves forward.

“Turner Investments is operationally sound and continues to do well,” Kosowitz told ValueWalk. Kasowitz has been described by CNBC as the “toughest lawyer on Wall Street” and Bloomberg Financial News called him the “uberlitigator.”

Mozido and Liberty involved in similar options-related legal mater

It wasn’t just Geier who has had option-related issues with Mozido and Liberty, but his lawyers allege a material pattern of behavior was at play.

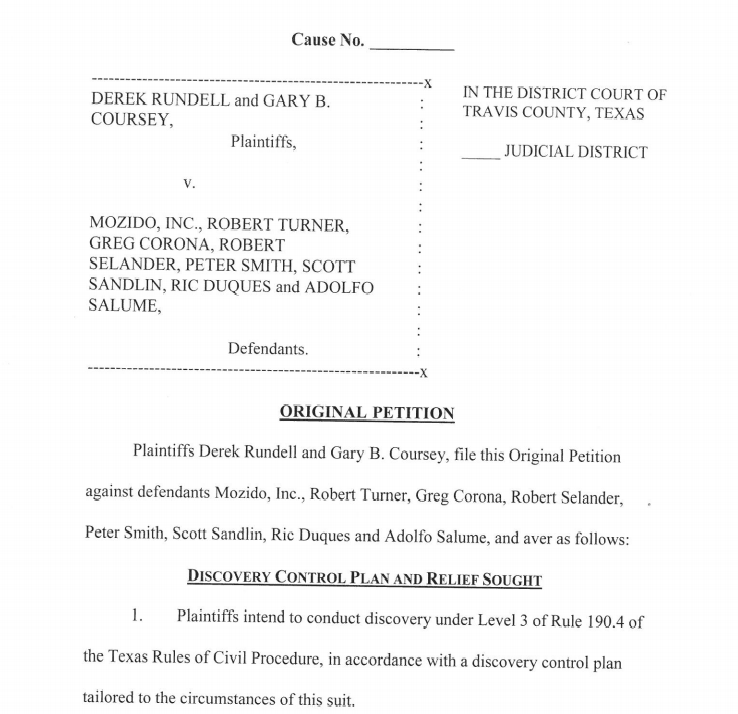

Separate court documents drafted on behalf of Derek Rundell and Gary B. Coursey, one-time consultants for Mozido, alleged that Mozido and Liberty failed to live up to contractual obligations and asked for over $1 million in compensation. The unsigned and unfiled legal document was attached to briefing in the New York Supreme Court case to show the dissemination of alleged false and defamatory statements concerning Mozido and Mr. Liberty.

The case is similar in some respects to Geier’s claim that Mozido did not properly execute its stock options contract on one hand and includes a defamation charge on the other end.

In the draft document in New York Supreme Court, Rundell and Coursey said they were “induced” by Mozido, Liberty and Turner, “promised options to acquire Mozido equity equivalent in value to 2.5% of Mozido’s predecessor and principal shareholder, Mozido, LLC” as well as pay consulting fees. They claim the defendants “reneged” on this obligation. “Today, Mozido is valued at over $5.5 billion. The 2.5% promised to Rundell and Coursey is worth over $80 million,” Rundell and Coursey claimed in the document.

The unsigned complaint was never filed by Coursey and Rundell and they did not sue any of the individuals identified in that draft but rather pursued arbitration. Mozido obtained a temporary restraining order from Judge Cohen in the Northern District of Georgia to stop the arbitration proceeding because Mozido did not agree to arbitrate with Coursey and Rundell. The issue has yet to be decided.

Analysis: Those involved in processing financial transactions are typically held to a high regulatory standard

As society moves into the realm of digital money, with ample evidence that cyber-crime, hacking and even theft from within a company are problems that will never go away, the question becomes what standard should those in charge of financial services organizations be held?

In a word where digital assets in the most secure account structures in the world can simply disappear, are those in control of financial organizations the ones that need to be policed the most?

Don’t think digital financial abuse can happen without being noticed?

Take a look at MF Global. Those customers who thought there accounts were secure woke up to see their savings and investments disappear with the click of a mouse. Their money had simply “vanished,” they were told, and they shouldn’t expect any more than 60% returned if they were lucky was the initial official communication.

There is an old saying that the best way to rob a bank is to become a banker. As we watch the DoJ and SEC inquiry with Geier and the company play out, it should be noted that at one point in history those at the top of financial institutions were given the most scrutiny, held to the highest regulatory standard of conduct.

With a payments company who controls transactions of people without bank accounts — and without powerful lobbyists — one might look at the current DoJ and SEC investigation from the perspective of a vetting process to a certain degree. This is not a stated intent, of course, and in civil charges Mozido and Liberty could very well be proven innocent or Geier might prevail.

The DoJ and SEC subpoenas might not result in charges and could simply be a deep dive into an issue that involves as one subject a company that controls financial transactions of those who are financially vulnerable. The motivations are nuanced and complex and, at this point, the future is unclear.

……….

DOJ press release

Assistant Attorney General Brian A. Benczkowski of the Justice Department’s Criminal Division, U.S. Attorney Halsey B. Frank of the District of Maine, Special Agent in Charge Joseph Bonavolonta of the FBI’s Boston Field Office and Special Agent in Charge Kristina O’Connell of the IRS Criminal Investigation (IRS-CI) in Boston made the announcement.

Q4 hedge fund letters, conference, scoops etc

Michael A. Liberty, 58, of Windermere, Florida, and Paul E. Hess, 63, of Braintree, Massachusetts, were each charged in an indictment filed in the District of Maine with one count of conspiracy to commit wire fraud, four counts of wire fraud and one count of securities fraud. In addition, Liberty was charged with one count of conspiracy to commit money laundering and three counts of money laundering.

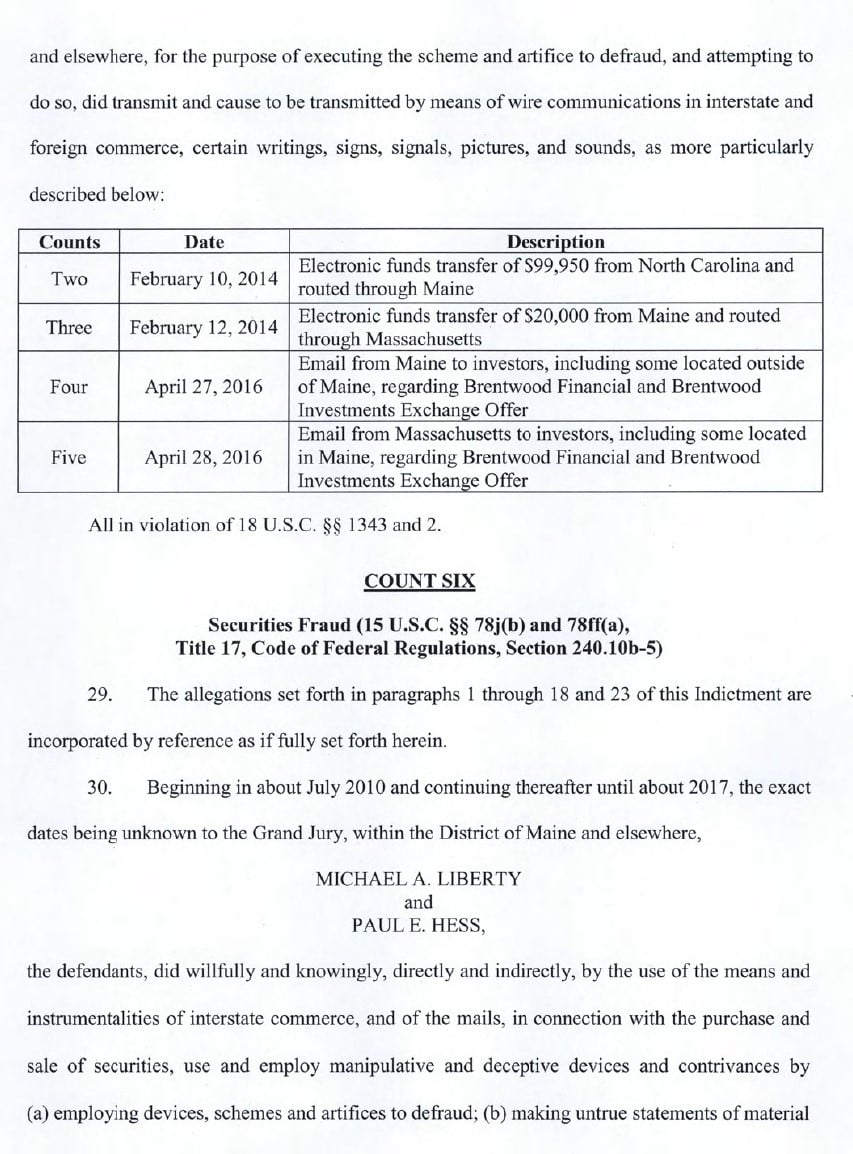

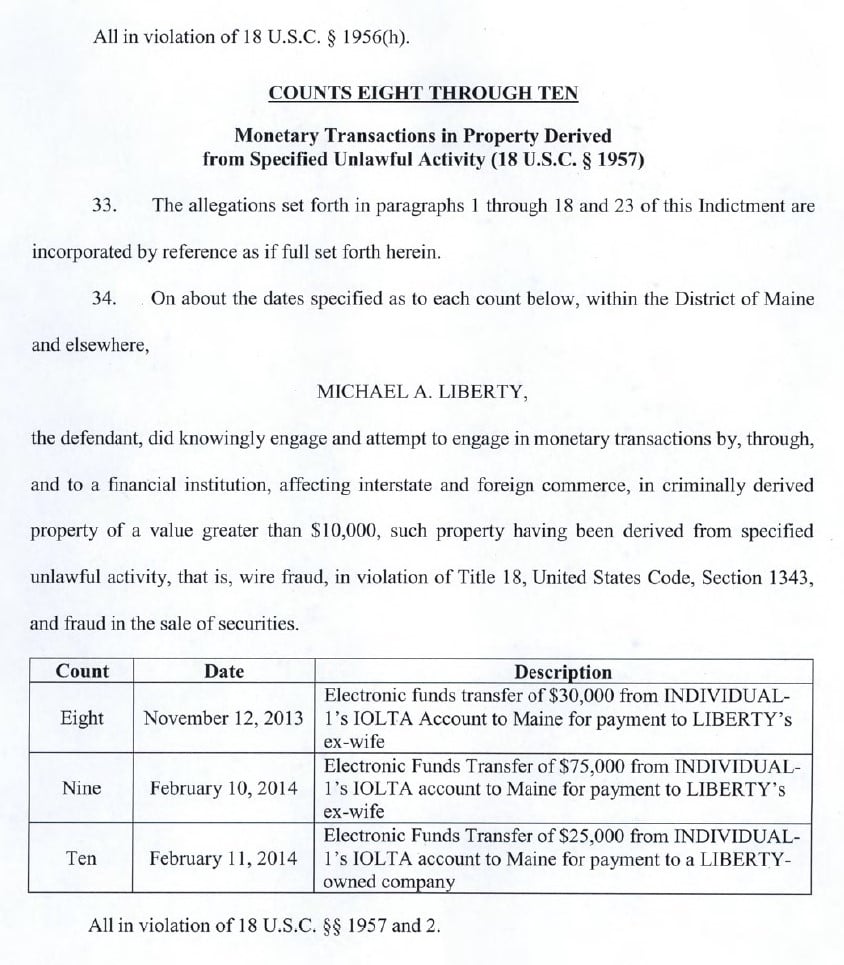

The indictment alleges that, beginning in 2010, Liberty and Hess solicited investments in Mozido, a privately held financial technology start-up company that offered users an ability to make payments using their mobile phones. Liberty and Hess allegedly raised millions of dollars from investors telling them, among other things, that their money would be used to fund Mozido’s business operations and that Hess was not being paid to raise the money. The indictment alleges that a substantial amount of the money did not go to Mozido, that a portion of the money was diverted to pay Liberty’s personal expenses, and that Hess received commissions and other payments in return for the money he raised from investors.

The charges in the indictment are merely allegations, and the defendants are presumed innocent until proven guilty beyond a reasonable doubt in a court of law.

The FBI’s Portland, Maine Resident Agency and IRS-CI are investigating the case. Trial Attorneys Michelle Pascucci and Matthew Sullivan of the Criminal Division’s Fraud Section and Assistant U.S. Attorney Donald Clark of the District of Maine are prosecuting the case.

Individuals who believe they may be a victim in this case should contact the Victim Witness Services Unit of the U.S. Attorney’s Office for the District of Maine at (207) 780-3257 for more information.

See Liberty and Hess Indictment below.