MoxReport’s Richard Pearson is long Pulse Biosciences Inc (PLSE) as a contrarian long.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

- Pulse is scheduled to discuss “Operational Highlights” on a conference call at 4:30 pm today (Tuesday May 8th). In the past I have highlighted such calls which companies used to create very sharp price spikes. There are some obvious new developments emerging at Pulse.

- Over the past year, critical developments with Pulse have now unfolded exactly opposite to what was required in the short theses. These developments now provide very strong support and clues for the near term LONG

- Billionaire Bob Duggan has nearly doubled his position and now owns 35% of Pulse. Duggan continued to buy even as the share price rose to over $28.00 (nearly 40% above current levels).

- Many are unaware that three of the four newly appointed Pulse board members actually came from Duggan’s Pharmacyclics. That background information was included in in the text but not in the table Pulse’s proxy statement. Pharmacyclics was the company which Duggan turned around from a tiny $15 million market cap and sold to AbbVie for $20 BILLION just a few years later. These newly appointed Pulse directors are his

- As Duggan’s lieutenants were installed at Pulse, other directors associated with MDB Capital then stepped down from Pulse’s board. This now frees MDB parties to sell without restrictions. These parties are now massively incentivized to see a near term spike in Pulse. MDB founder Chris Marlett owns 4.8% of Pulse. Certainly large enough to care, yet just small enough to be able to sell (on a spike) without requiring any

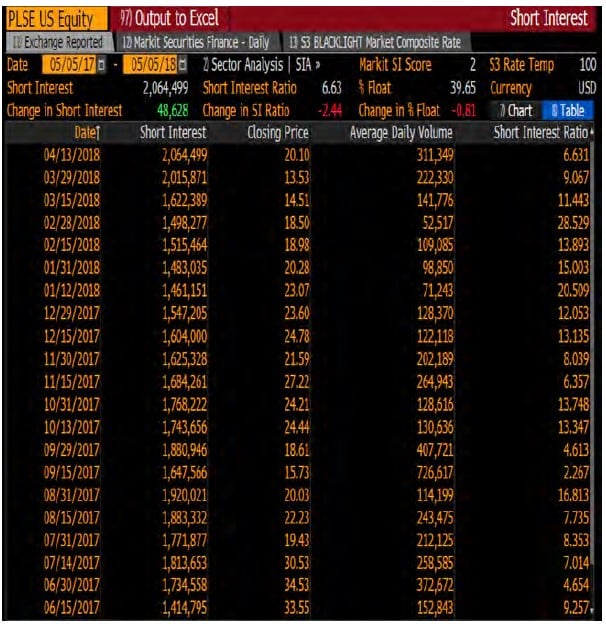

- Short interest has quietly spiked to the highest level in Pulse’s history, now amounting to 2.1 million shares. Fully 40% of the free float is sold short. Following a recent short report, short interest may actually be even

- Remember: Troubled fundamentals do not always equate to an attractive short trade. With Pulse, I have nothing positive to say about: the fundamentals, the technology or the parties involved. Yet I can see that the stock will soon head sharply higher. Similar to Energous (WATT), near-term triple-digit price spikes are in no way dependent upon near-term commercialization of the

- There are multiple strategic avenues which Duggan could announce now or in the near future. These include alternate FDA approval paths as well as new asset injections. Any of these should be expected to have a significant impact on the share price, which would then be sharply magnified by the 40% short interest and low

- Such announcements could happen sooner, later, or never. But starting today there is a series of possible dates on which we could potentially see this happen. Regardless of one’s view of a long position in Pulse, a short position is now downright

LONG $PLSE - Here's why Pulse (PLSE) is headed sharply higher

Rules for contrarian long ideas - read this

Every time I publish a contrarian long idea, I receive howling complaints from out-of-breath academics-cum- researchers who shriek that I am shamelessly pumping some deeply troubled company just to ignite a fleeting short squeeze.

Yet anyone who bothers to actually read beyond the title of my reports will immediately observe my adherence to the following rules:

Rule #1 - I do not pretend to see merit in bad products or dubious individuals. I go out of my way to prominently identify specific problems (i.e. the short thesis). Such flaws are what make the trade a “contrarian” long. The basis of my contrarian long reports is always related to technical factors or financial engineering and it only applies when various parties with a significant long interest have an identifiable means of influencing the share price.

Rule #2 – High short interest alone is NOT SUFFICIENT to merit a contrarian long. Contrarian long ideas are not just fleeting short squeeze plays. These long ideas need to have sources of hidden support which will surprise investors and push the share price higher. Short interest is still very important because it can often significantly amplify a small move into a big move. High short interest in stocks like LFIN, HMNY, WINS was not what caused them to rise in the first place. These stocks needed technical factors or financial engineering. But the short interest undeniably amplified the spike into the stratosphere.

Rule #3 – My theses are of finite duration and are based on specific catalysts and expected timeframes. Clearly not all of my ideas work out as hoped. Once the expected date passes, the catalyst will have either happened or not. Either way, the thesis then becomes outdated and largely moot. As late as November 7th, 2016, I was pretty sure Hillary Clinton would win the US presidential election. Within 24 hours, my thesis was proven wrong and became moot. I adjusted my actions and outlook accordingly. Likewise, within just weeks of my long thesis on Overstock.com (OSTK), abrupt escalation by the SEC against all things crypto neutered my thesis completely. This would be obvious to anyone who read past the title.

Rule #4 – I don’t “pump” anything. It is easy to see that after I publish, I mostly refrain from putting out ongoing comment for a significant period of time. I let the market digest my findings and allow others to respond without interference. Over the past seven years, I have put forth a mere 400 or so tweets. This isn’t by accident. For example, starting November 16th, Restoration Hardware (RH) soared by more than 35%, starting on the exact day I had predicted. After November, I did not write or tweet about RH again until early April. RH now sits at around $100.

Rule #5 – The best way to go broke is to let researchers make trading calls. Any time we see a stock with a very high short interest, there is typically is a near-infinite supply of negative information which is easily discoverable for those who care to spend the time. The more time one spends the more one will uncover. Forever. But remember the maxim that “time management is a crucial part of fund management”.

Academic oriented short researchers can become unhinged when I suggest that a stock price may rise even though it has (gasp!) fundamental problems which are easily visible. Yet in the real world we see such spikes happen quite frequently. For obvious reasons, such researchers will unswervingly express a) absolute conviction about b) a very large decline which will happen c) in the very near future. For those of us more focused on economics over philosophy, it is critical to apply a very strong filter when considering the views of such researchers. When their clients suffer losses, these researchers will quickly suggest the urgent need for even more billable research hours to dig up even more dirt from the bottomless quarry. But with technical trades and financial engineering, the general result is that no amount of additional garbage sifting will yield a positive result on the trading side.

Pulse - the long thesis vs. the short thesis

A sharp rise in Pulse’s share price does NOT require any near term commercialization of the product.

Maneuvering by insiders, including Bob Duggan, shows that they are now sharply escalating their focus on Pulse.

Critical elements of the short thesis have all gone in the exact opposite direction of what required for the short thesis. These same elements now strongly support a LONG position.

These developments have quite plainly boosted the case for a sharp rise in the share price. They also sharply increase the likelihood of a sudden strategic announcement by Pulse.

Pulse Biosciences describes itself as a clinical stage “electroceutical” company pursuing commercial applications for its Nano-Pulse Stimulation (“NPS”) technology, potentially including immuno-oncology and dermatology. Pulse has no revenues to date. Pulse came public in an IPO by MDB Capital in 2014. In early 2017, billionaire Scientologist Bob Duggan acquired an initial 15% of Pulse. The announcement quickly sent the sock up by as much as 600% to just under $40. Throughout 2017, Duggan continued purchasing additional shares of Pulse, even as the share price rose as high as $28.00. In the past three quarters Duggan has nearly doubled his subsequent stake and now owns 35% of the outstanding shares.

Yes, yes, yes. I am well aware of the dismal track record of MDB deals in terms of achieving any long term commercial success. I also have nothing positive to say about Pulse’s would-be product or the various parties involved with the company. But I am also equally aware of the short-term performance of MDB deals in terms of share price, particularly when certain specific elements are present.

REGARDLESS of one’s view on the product or the parties involved, recent developments should make it quite clear what is about to happen with the share price at Pulse. I can understand why some might refrain from going long on Pulse. But it is unclear to me why anyone would deliberately choose to remain short through this period.

The first (and most obvious) catalyst date for Pulse comes today (Tuesday) after the close. There will be more additional catalysts going forward. There are multiple scenarios involving alternative FDA approvals, new asset injections or tie-in’s with other Duggan entities. All of these should be very easy to envision immediately.

For those who are skeptical of “electro-ceuticals”, try lowering your expectations. Ask yourself instead: what are the odds of an explosive press release. Pulse has neither earnings nor revenues such that “earnings calls” are a misnomer. Instead these calls will be focused on “operational highlights”. This is exactly the type of call which Restoration Hardware (RH) used to surprise investors on November 16th, 2017, sending the stock up by more than 35% to new all time highs.

Here is a link to my report on RH which predicted that exact move on that exact day.

MoxReports: Long $RH – $RH Will Spike Much, Much Higher Very, Very Soon

And here is a link to the press release from Pulse announcing to call discussing “operational highlights” call at 4:30 pm today.

“PULSE BIOSCIENCES TO REPORT FIRST QUARTER 2018 FINANCIAL RESULTS AND OPERATIONAL HIGHLIGHTS”

Key arguments for short thesis now support LONG position

The key elements of the short thesis have ALL gone in the exact opposite direction of what was required for a successful short trade.

Various short articles have already made clear their case against Pulse’s technology, its fundamentals and the various parties behind it. But none of those elements were explicit reasons for the share price itself to decline.

The bear thesis against the share price has been predicated on three specific catalysts. None of these elements came to pass. And in fact each of them has now gone in the exact opposite direction of what was required for the short thesis to be successful. Each of these new developments now becomes a strong component of the LONG thesis.

Separate note: the only visible regulatory issue I see for Pulse is an SEC subpoena over possible trading by certain individuals. I see zero chance that this has any material impact on the share price of the company.

In contrast to stocks like WINS and LFIN, I also see no other activity with Pulse which would indicate any likelihood of issues with securities regulators.

See the full PDF below.