Mittleman Investment Management’s commentary for the first quarter ended March 31, 2021.

Q1 2021 hedge fund letters, conferences and more

Chief Investment Officer Commentary

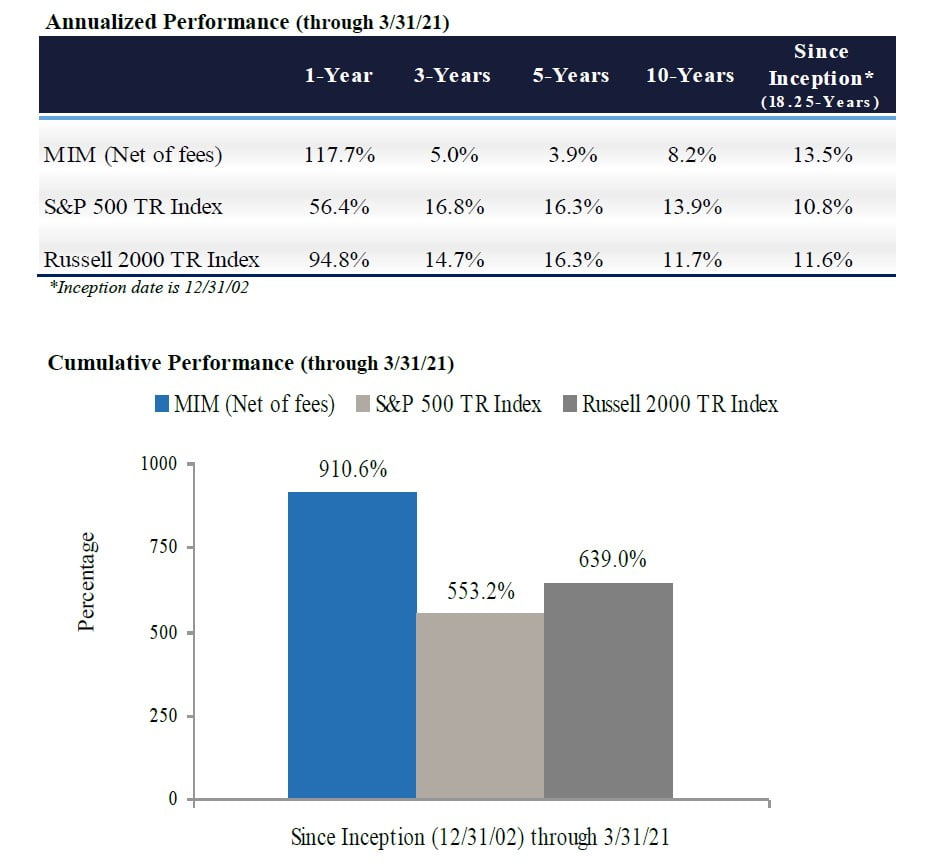

Mittleman Investment Management’s composite gained 25.9% net of fees in the first quarter of 2021, versus gains of 6.2% in the S&P 500 Total Return Index and 12.7% in the Russell 2000 Total Return Index. Longer-term results for our composite through 12/31/20 appear below. Composite performance ranked in the top 1% of PSN’s global equity universe* since inception (12/31/2002) as of 3/31/2021:

The worm has continued to turn for formerly downtrodden value-oriented investment strategies like ours, as we extended a welcomed spurt of out-performance that began with our 42.9% gain in November 2020, leading to a 32.1% gain in Q4 2020, and a 25.9% gain in Q1 2021. As highlighted in our Year End 2020 Investment Review, November 2020 was our best month ever (over 18 years of verified track record), and comparably strong months like that in our prior history have almost always presaged significant further gains over the ensuing year. And while it’s encouraging to see that beginning to play out here again, we recognize that having performed so poorly during a protracted slump, our out-performance in the rebound is somewhat to be expected, if not required. So, while pleased to see the “value will out” maxim regaining some credibility, we remain humbly aware that much work needs to be done. Rest assured, we are doing that work.

Contributors/Detractors

The top three contributors to our Q1 2021 performance were AMC Entertainment (NYSE:AMC): $2.12 to our average exit price of $13.91 (+556%), Aimia (TSE:AIM): US$3.24 to $4.11 (+27%), and Cineplex (TSE:CGX): US$7.26 to $9.47 (+30%).

The three most impactful detractors from Q1 2021 performance were new entrant AMA Group (ASX:AMA): US$0.51* to $0.42 (-18%), Greatview Aseptic (HKG:0468): $0.58 to $0.50 (-14%), and ABS CBN (JSE:ABSP): $0.26 to $0.21 (-19%). *(our AMA AU avg. cost per share in Q1).

As noted in our Year End 2020 Investment Review (published on 2/1/21), we exited our position in AMC at around $14 during the last week of January. That price exceeded our then $10 estimate of fair value, as the stock went parabolic with the Gamestonk/Reddit/WallStreetBets frenzy that captivated the media, market and general population in January. As long-term shareholders, we were pleased that AMC’s CEO, Adam Aron, did not take the easy way out during AMC’s darkest days when the vast majority of the investment community were writing the company’s obituary. He showed loyalty to shareholders despite being in the zone of insolvency (where fiduciary duty to shareholders extends to creditors as well).

We continue to believe the movie exhibition industry will bounce back sharply, but we much prefer the risk/reward in Cineplex going forward. Cineplex has been expertly managed by its President & CEO Ellis Jacob for more than 20 years, with Gord Nelson, CFO, by his side for 16 years. The company generated a total return CAGR of 14.5% vs. 7.9% for the TSX from IPO on 11/25/03 through 12/31/19 (before the COVID-19 collapse), much of that achieved via cash dividends averaging C$91M (C$1.44 per share) over the past 11 years. Cineplex had agreed to a buyout by Cineworld PLC (CINE LN) for C$34 per share in cash (10x EBITDA) announced on 12/16/19, which was then repudiated (wrongfully, it seems) by the buyer on 6/12/20. We think that lawsuit will be settled by Cineworld and that a revised buyout will occur at around C$23 per share (10x EBITDA on new fully diluted share count 92.21M) which is our fair value estimate (+93% from the 3/31/21 stock price). Settling in that manner would gain Cineworld (which already owns Regal in the U.S.) what they originally desired (before they lost the ability to pay) which was dominance of the North American theater business achieved on accretive terms. The alternative to a revised buy-out is likely to be a judgement or settlement of hundreds of millions of dollars for which Cineworld would receive no cash flow in return. Cineworld has yet to state any claim that would seem to justify their breach of the definitive agreement. Once Cineworld has healed enough to afford it, we expect a revised deal.

Aimia Inc.’s 48.9%-owned Kognitiv in March entered into a sale transaction and partnership agreement with IRI, whereby IRI acquired Intelligent Shopper Solutions for undisclosed terms, and IRI and ISS will explore opportunities for IRI’s retailer clients to leverage Kognitiv’s unique Platform-as-a-Service. Also in March, Aimia announced that it entered a binding Memorandum of Understanding with AirAsia to sell its 20% equity stake in AirAsia’s loyalty company BIGLIFE for a consideration of C$31.4 million (US$25.0 million) to be satisfied by 85.86 million new publicly traded ordinary shares of AirAsia (AAGB.MK), representing an approximate equity stake of 2.2% of AirAsia’s existing issued shares. The BIGLIFE transaction is subject to AirAsia’s shareholders’ approval, which is expected to occur before the end of May 2021. As the team at Aimia works to maximize the value of the company’s legacy holdings, it continues to seek and find highly appealing new investment opportunities globally, focused on establishing controlling stakes in proven free cash flow generators. With over C$170M in cash and securities, no debt, shareholder equity of C$431M, and C$714M in tax assets, Aimia is ready for deals. Presentation: https://www.aimia.com/wp-content/uploads/2021/04/AIMIA-investor-presentation-Q4-2020-vF.pdf

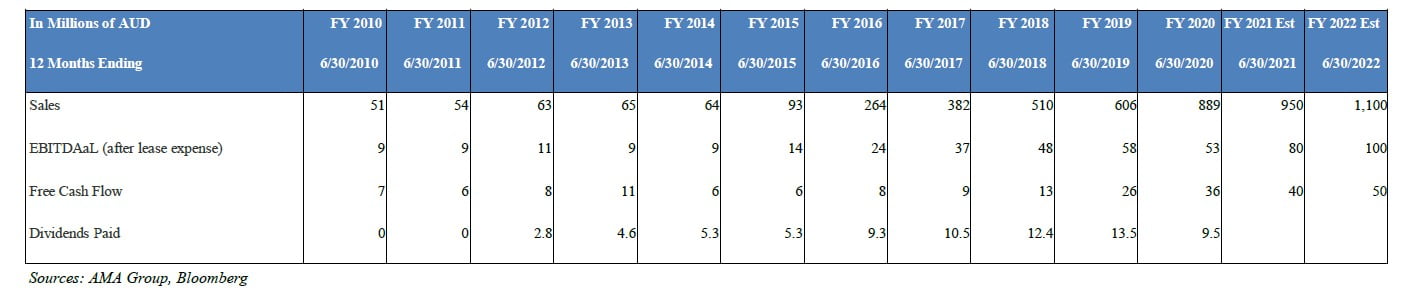

AMA Group Ltd. is the largest vehicle panel repair business in Australia and New Zealand. With trailing 12-month sales of A$926M, it represents nearly 13% to 15% market share of the industry’s total revenues at their estimate of A$6B to A$7B annually. AMA is a roll-up, consolidating a fragmented industry, and it appears to be following the template of Boyd Group Services (BYD CN, C$213), a Canadian company that has been very successful rolling up that industry in Canada and the U.S., generating a 42% CAGR total return for its shareholders over the 10 years ending 12/31/2020. AMA also performed well as the table below shows how its sales, EBITDA, FCF, and dividends have grown over the past 10 years.

Organic growth is slow, as miles driven is the main factor for the number of collisions, but we believe that will rebound strongly from COVID-19 as more people drive to take long overdue vacations and to commute to work. Collision avoidance technology is a long-term headwind, but has had only a minor effect thus far, offset by more technology in each automobile yielding more expensive bills per repair. 90% of AMA’s revenues are paid by auto insurance companies, its maintenance cap-ex is low, and free cash flow conversion is high. Large players like AMA benefit from scale in that they can better afford new equipment needed to service higher tech content in cars and secure better terms from suppliers (like AMA’s 10-year deal with BASF for paint) and payers (insurers recently agreed to pay AMA more for more complex repairs). The industry remains highly fragmented, so buying smaller operators (unwilling to spend on new equipment for more complex repairs, roughly A$100,000 investment per shop) at 3.5x EBITDA where that EBITDA becomes worth 10x as part of the larger entity is a path to continued growth that they have yet to fully exploit.

On 1/31/21 AMA announced the termination of its CEO, Andrew Hopkins (Exec. Director since 2015 when his former firm was acquired), claiming he charged excessive unapproved expenses, seeks A$1M. They named director Carl Bizon as CEO. AMA stock fell on the news and we started buying shares in the days that followed. Our purchases have continued such that Mittleman Brothers is the 3rd largest shareholder as of the date of this letter with just over a 7.1% stake in AMA.

Our A$1.15 fair value estimate of AMA is derived as follows: A$1.15 = 10x EBITDAaL (est. for FY2022) of A$100M = A$1B minus net debt of A$150M (as of 12/31/20) = A$850M equity / 742M shares. Equity value = 17x FCF est. of A$50M. While public comps are limited, with the aforementioned Boyd Group in Canada being the closest comparable and trading at 13x EBITDA est. for 2022, there are some auto retailers in Australia like Eagers Auto (APE AU, A$16.80) which is valued at 15x EBITDA est. for 2022 despite having substantially lower EBITDA margin vs. AMA, and we’ve seen auto retailers buying body shops in other countries so that’s relevant. There is also Driven Brands Holdings (DRVN $25.42) in the U.S. which is not a pure play (they own car washes and other auto service businesses, not just collision repair) and enjoys a much higher EBITDA margin because its largely a franchised operation (maybe something AMA can consider) so it does have a much higher EBITDA multiple of 20x, so less comparable to AMA today, but something to aspire to, maybe.

We discussed Greatview Aseptic at length in our Year End Investment Review, so I won’t rehash those items here as there were no notable new developments beyond a slightly weaker than expected year-end result announced on 3/30/21, which brought consensus estimates down slightly, but did not change our view of fair value at all. We added to the position in Q1 on weakness in the stock price. With nearly a 7% dividend yield (fully covered by FCF, and net cash balance sheet) and over 40% upside to fair value by our conservative appraisal, for a growing specialty packaging business with a 19% EBITDA margin and relentless FCF generation, trading at less than 6x EBITDA, with heavy insider ownership, it really has outstanding total return potential. Also, savvy Southeast Asia investor, Jardine Matheson ($47B mkt cap), bought just over 28% of Greatview Aseptic at just over HKD $5.00, a 29% premium to the HKD $3.87 price at which it closed on 3/31/21, less than 4 years ago in June 2017. Sales and EBITDA were USD $346M and $80M in 2017, and $441M and $90M in 2020. Cash dividends paid out were USD$41M in 2017, $46M in 2018, $47M in 2019, and $47M in 2020. That’s USD$181M in cumulative cash dividends over the past 4 years, which is over 27% of current market cap. of US$660M. Recently released 2020 annual report definitely worth a read: https://greatviewpack.com/investor-relations/annual-interim-reports/

Our original thesis for ABS CBN was that a blatantly political cancellation of the most popular TV broadcaster in the country would prove too unpopular politically to attempt, but that is unfortunately what happened last year (on July 22, 2020). Our plan B was that the populace would not tolerate being unable to see their favorite shows for very long, and we continue to believe that to be so. Thus, our estimates assume a return to normal operations in 2022 or 2023 at the latest. The next Presidential election in the Philippines is on May 9, 2022 and Duterte cannot be re-elected. Despite having been wrong about the broadcast franchise renewal, we did note last year that “…even if it were to transpire [the cancellation of the broadcast license], ABS-CBN could run their programming on a competing broadcaster’s channels, for a fee of course that would impair profits immensely, but such an outcome is already more than in the share price.” That is happening, so they are getting their programming out there with block-time deals on TV-5 and another channel. ABS-CBN is a dominant collection of media properties, with decades of track record. In such a fast-growing country, it should not be trading in the open market for less than 4x normalized EBITDA today, when similar companies in slower growing developed markets trade for around 7x to 10x EBITDA and more. Once the political punishment abates, we believe the stock should triple with plenty of upside beyond that to our estimate of true fair value. We have been adding to our position in ABS CBN.

Our other new position in Q1 (in addition to AMA Group) is Viatris (VTRS), which is the old stock of the generic drug manufacturer Mylan Labs after it merged with Pfizers’s Upjohn unit late last year, via a tax-efficient Reverse Morris Trust. VTRS’s current market capitalization of ~$17B is less than 6x its estimated FCF of $3B (before restructuring costs) estimated for 2022, and the current enterprise value of $40B is only 6.4x EBITDA of $6.25B. Consider that Mylan Labs stock (MYL, predecessor to VTRS) was nearly $67/share on a $40B buy-out offer from Teva in 2015. Mylan rejected that seemingly very reasonable bid. In merging with Pfizer’s spin-off of Upjohn, Viatris became an equal (in sales, about $17B for each company) to the largest player in generic pharmaceuticals globally, Teva, Mylan’s former suitor. Viatris is an orphan, but its pedigree is tarnished (the reputation of Mylan’s management in rejecting the Teva bid, and other mistakes, still lingers), even though the new CEO and CFO come from Pfizer, the Chairman and President from Mylan remain. Also, ETFs that owned Pfizer had to sell the VTRS shares that they received, which added considerable forced selling.

The stock dropped sharply after the company offered guidance on their first Investor Day on March 1, 2021 that was lower than expectations, and our estimates above reflect those revised inputs. Our fair value estimate of $30 per share for VTRS is based on EV/EBITDA multiple of 9x est. 2022 EBITDA of $6.25B and market cap / FCF of 12x est. $3B free cash flow.

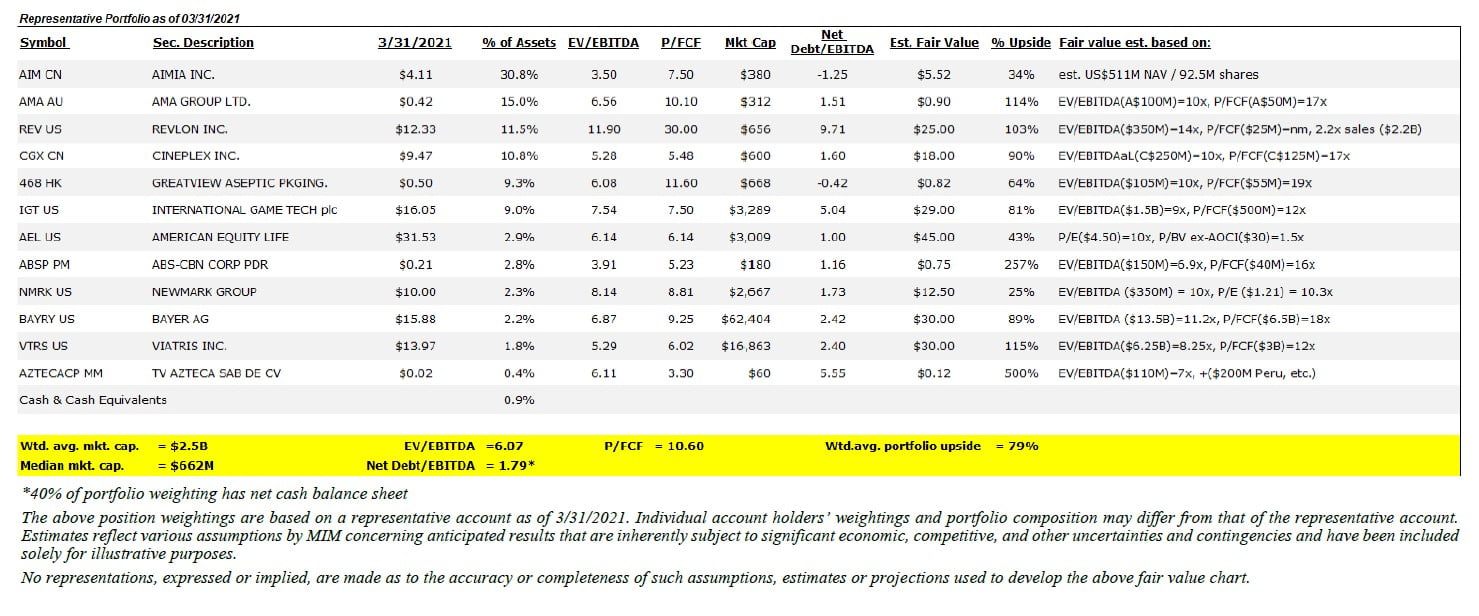

Below is a brief summary of our view of fair value of our portfolio holdings as of 3/31/21:

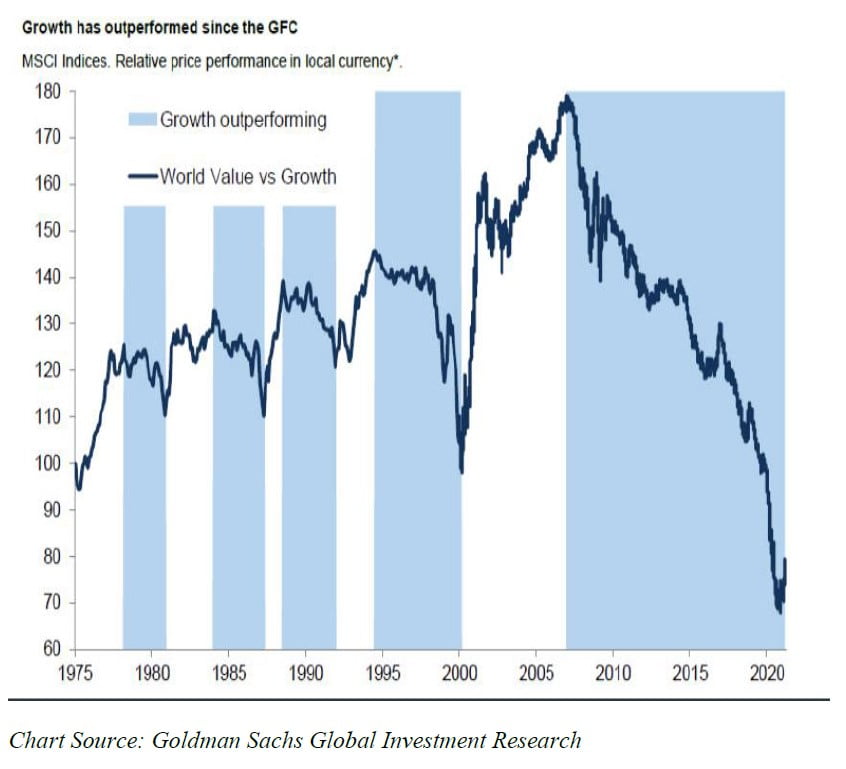

The bifurcation in the market today remains highly reminiscent of the 1999/early 2000 market, where unsustainable over-valuation was pervasive amongst the popular names, while value stocks languished, until the paradigm suddenly reversed. Goldman Sachs produced a powerful illustration of the severity and duration of value’s underperformance relative to growth since the Global Financial Crisis. Although our portfolio outperformed by a wide margin during the first half of the latest period shaded in blue, the length and magnitude of value’s relative drawdown to growth has been unprecedented.

The Secular Underperformance of Value to Growth

The recent improvement in valuation for value-oriented investments like ours has a long way to go to back to some semblance of normal, in our view. I believe our performance over the last 12 months is an early indication of our significantly undervalued holdings attracting the right kind of attention.

Sincerely,

Christopher P. Mittleman

Chief Investment Officer