Livermore Partners update for the month ended January 31, 2021.

Q4 2021 hedge fund letters, conferences and more

To Partners,

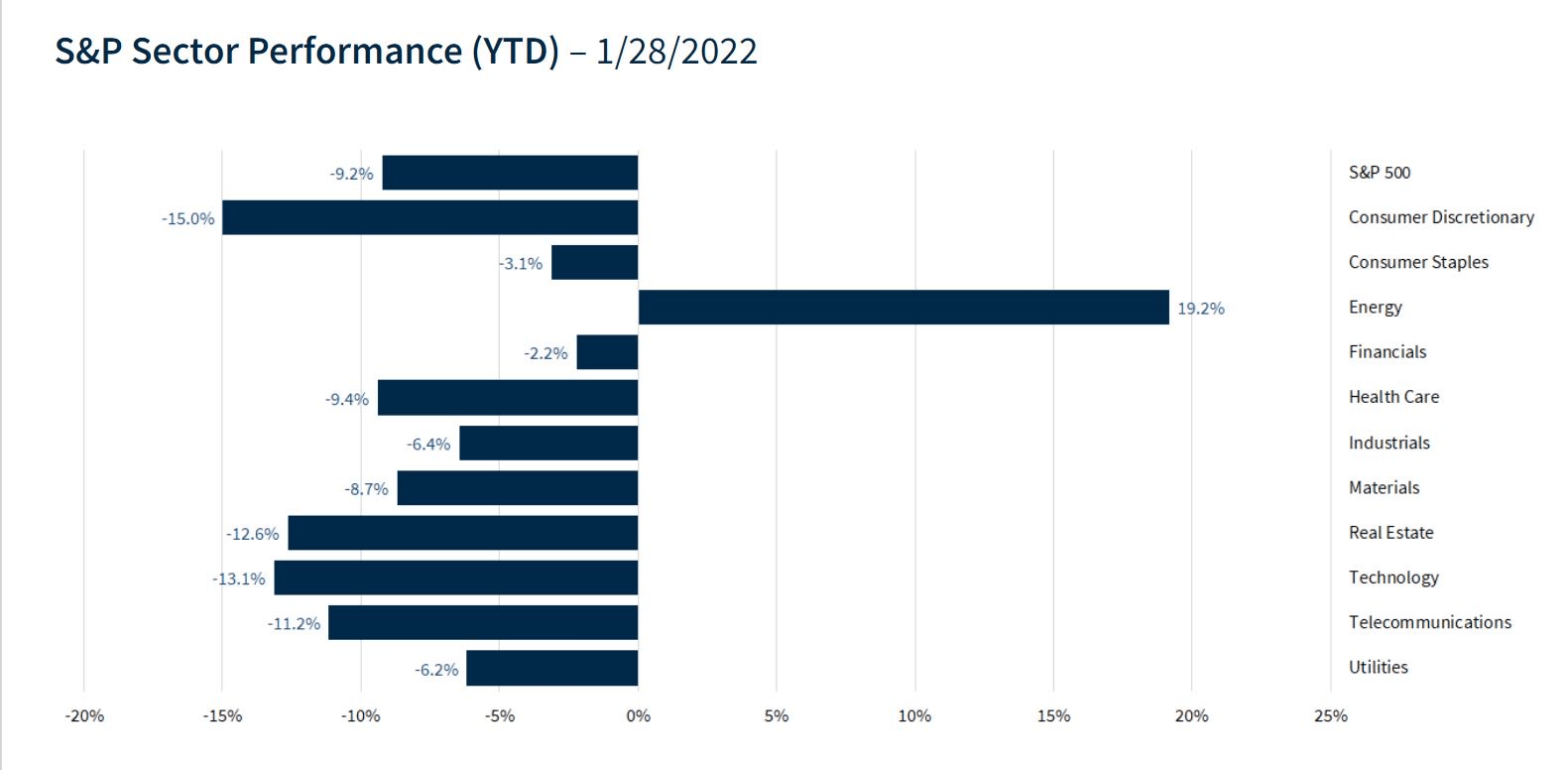

January was a rough month for the markets. It seemed that all of a sudden, value mattered. Macro forces concerning Russia came to the forefront and a behind the curve FED started to rumble. Suggesting finally, it maybe time to remove the punch bowl of QE. Couple that with mixed earnings guidance from several high-flying companies (still trading at lofty multiples) and all together you have an S&P Index down over 5% to start the year.

As most of you are aware, our core hedge fund positions center around value and opportunist special situations. With energy (see diagram below) the key theme and driver of our value plays( Jadestone, Vista Oil, Energean). And with that said, I am happy to present our Livermore Strategic Opportunities Fund, LP closed January up over 6%. This outperformance has continued as we start February. Given markets have attempted to rebound as volatility subsides.

In order to position for the possibility of further market weakening, we have used this rally to re-implement select short positions as hedges. Using the same 3 Generals as last year. ARK Innovation ETF (NYMARKET:ARKK), Tesla Inc (NASDAQ:TSLA), and Meta Platforms Inc (NASDAQ:FB). Although today, these positions are more nominal than they were in Q4. Still, we felt the recent snapback in tech was a selling opportunity and as of this evening, we discovered it was the correct call. With Facebook getting crushed in after market trading given a cut in guidance and weak operating numbers.

Therefore, the fund is continuing its strong momentum and adding to what was a solid 2021 performance.

Let's hope this trend has some running room to spare...

All my best,

David Neuhauser

CIO

Livermore Partners