To many people, life insurance sounds like an expensive and unnecessary cost. Or they may even think it is necessary and want to get life insurance someday, but they’re putting it off until they have more money. While purchasing a policy amount of 7–10 times your income seems really hefty, life insurance policies are often much more affordable than people estimate. In fact, people tend to assume life insurance costs 3 times more than it actually does. In order to dispel some of that misinformation, we’ve put together a breakdown of what life insurance costs really look like and what life insurance companies consider when you buy a policy.

Let’s start with the actual costs. While life insurance costs are going to change based on the individual, TermLife2Go has reviewed some average costs and compared them to other monthly purchases we might be making.

Q2 hedge fund letters, conference, scoops etc

- A 30-year-old could get a $250,000 term life insurance policy for about $160 in annual premiums or $13.33 per month—that’s the same as their HBO subscription.

- A 20-year-old man could get a $250,000, 10-year term life insurance policy for the price of his monthly Spotify subscription (about $10/month).

- A 40-year-old woman could get $1 million of 20-year term life coverage for the cost of 12 Grande Starbucks lattes (about $45/month).

- A 30-year-old woman could get $250,000 of permanent coverage from a universal life policy for the price of six cocktails (about $75/month).

- And a 50-year-old man might get a $500,000 whole life policy for 1/7 the cost of an average Super Bowl ticket (about $800/month).

As you can see, for most people life insurance premiums are relatively close to other monthly subscriptions that we pay for all the time. And knowing that you can afford the price of life insurance means that the peace of a financially protected family is in reach.

Now that we have put the cost of life insurance into perspective, let’s talk about what exactly life insurance companies look at when they are creating your life insurance policy. One thing that makes research about life insurance difficult is that life insurance companies need a lot of information about you in order to give you a good estimate. But often people don’t want to give up that kind of information. So to help you with this conundrum, let’s go over the top three things insurance companies look at when creating a policy for you.

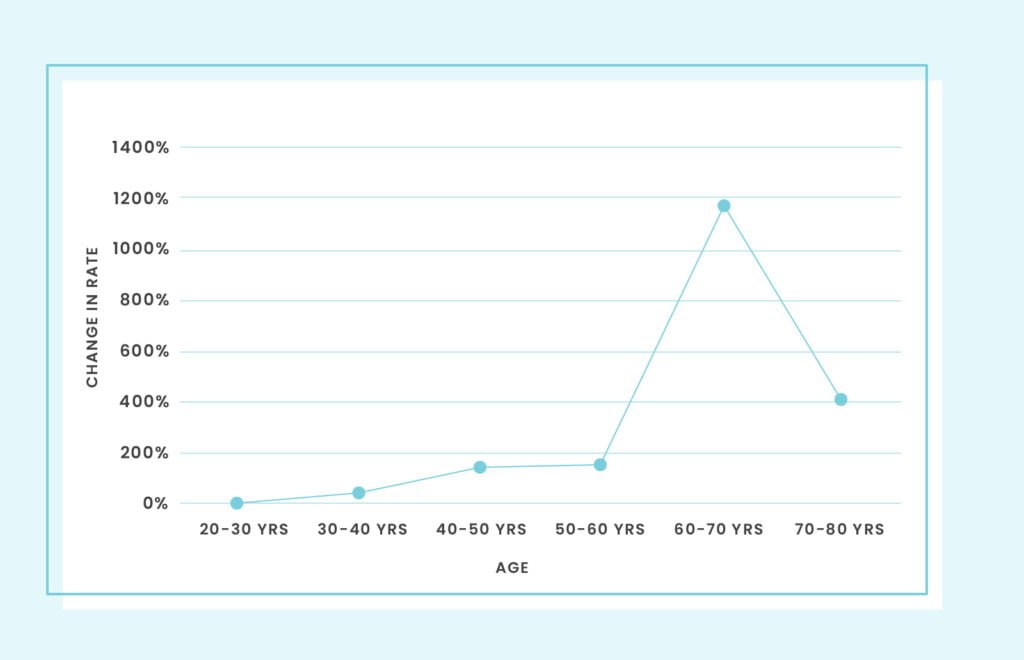

Life Insurance Costs By Age

The first thing that insurance companies will look at is your age. In general, the younger you are, the lower your rates will be. This is why it is so important to get a life insurance policy when you’re younger as the price will only rise as you get older.

Health

Your health will be the second-largest influence on your life insurance policy rates. Every insurer has their own class system that they use to rate your health, so if you feel that your health has been rated lower than it is, you can shop around and see how other companies rate your health. Some known health factors that most life insurance take into consideration include smoking and drug use. In some cases, you can also look at no-exam policies, that are typically more expensive but don’t require a medical exam.

Life Insurance Costs Based On Type And Term

The next item that will impact your life insurance prices is the type of policy you choose. There are three main types of life insurance that you can choose from:

- Term Life Insurance covers you for a certain period of time, commonly 10, 20, or 30 years.

- Universal Life Insurance covers you until a certain age, such as 95, 105, or 121.

- Whole Life Insurance covers you until you die, provided you continue to pay the premiums.

Generally, the shorter the term, the lower the cost. However, everyone has different needs, so be sure to look at your own life circumstances before you decide which policy to buy.

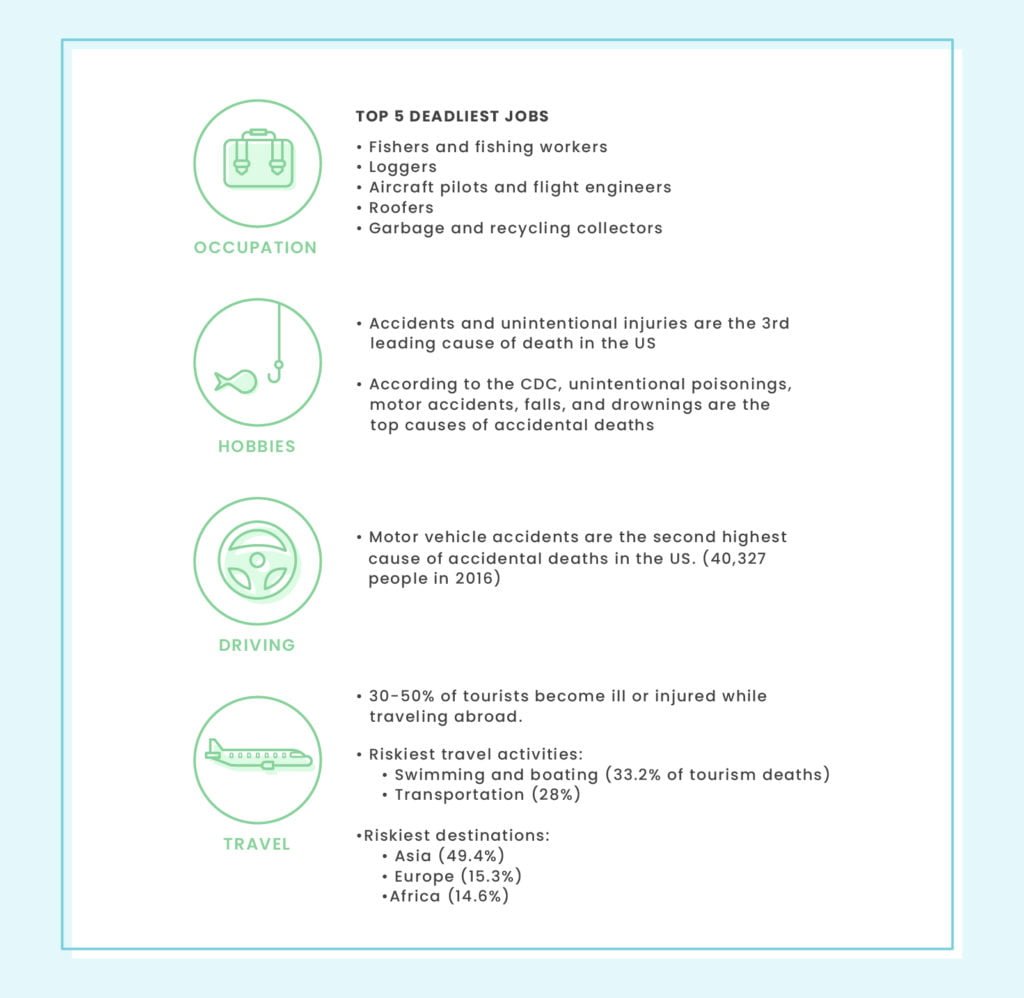

There are a few other factors that play a role in your life insurance premiums, such as your desired payout amount, your gender, and even your occupation. With all of these different factors playing a role in your coverage, it’s important to do your research and talk to experts who can help you make the right decision.