Technology names rallied yesterday after Meta Platforms Inc (NASDAQ:META)’s results showed it beat its forecasted estimates despite a slowing economy, with a surge of 13.9% after the release, even with the economic slowdown and high inflation.

Technology companies like Microsoft Corp (NASDAQ:MSFT) and Alphabet Inc (NASDAQ:GOOGL), which reported results earlier this week, gained more than 3%, and Intel, which beat expectations, is set to open up 6% higher.

Earnings season has propped up the sector after 2022’s dismal performance. Currently, tech is one of the leading sectors in the S&P 500, with its S&P 500 Information Technology index up 20.70% YTD, trailing the Nasdaq 100’s 21.15%.

This tells us that investors may be willing to take on risks in the market as the technology sector is most closely associated with “risk,” The market is betting on Tech companies that have been resilient despite the current economic conditions.

Benefits of Investing in Tech

One of the best qualities of tech stocks is their potential for high growth. These companies are often involved in cutting-edge industries, such as artificial intelligence, cloud computing, and biotech. These industries have huge growth potential due to disruptive technologies being introduced.

Disruption

Tech stocks have been at the forefront of disrupting traditional industries. Companies like Uber and Airbnb have completely reshaped the transportation and hospitality industries, respectively. Investing in the right stocks can put any investor at the forefront of another game-changing technology.

Potential for High Returns

While there are no guarantees in the stock market, investing in companies with high growth potential will offer higher returns. However, investors should still be wary of the risk, as the higher the return, the higher the risk.

Risk Factors in Tech

Tech has always been constantly evolving with new gadgets and technology being invented. This has been the most alluring yet riskiest aspect associated with this sector. The constant development and adoption at a breakneck pace of new technology can leave any company in the dust if they could not keep up with the ever-evolving market needs.

High Valuations

Another factor with associated tech stocks’ risk is their high valuations. Some stocks with high growth potential can trade at high earnings multiples, creating unrealistic expectations for future growth and profitability. High valuations can make it difficult for a company to meet market expectations and may lead to further issues with the company in the long run.

Intense competition

Tech is highly competitive, with new companies trying to gain and maintain market share, it becomes a very cutthroat business wherein if a company cannot compete may find itself either brought out or failing. Furthermore, intense competition can also drive up costs as companies must invest heavily in research and development to stay ahead of their competitors.

Economic Conditions

Economic downturns or recessions can also affect tech stocks as consumer spending declines and the demand for technology products and services decreases. In addition, with the tech industry’s heavy reliance on global supply chains, any disruption during economic uncertainty can heavily affect the industry.

Strong Buy Tech Stocks Expected to Release Earnings

With the market looking for resilient tech companies that have beaten expectations, let’s look at some companies that will release their earnings with above-average recommendations.

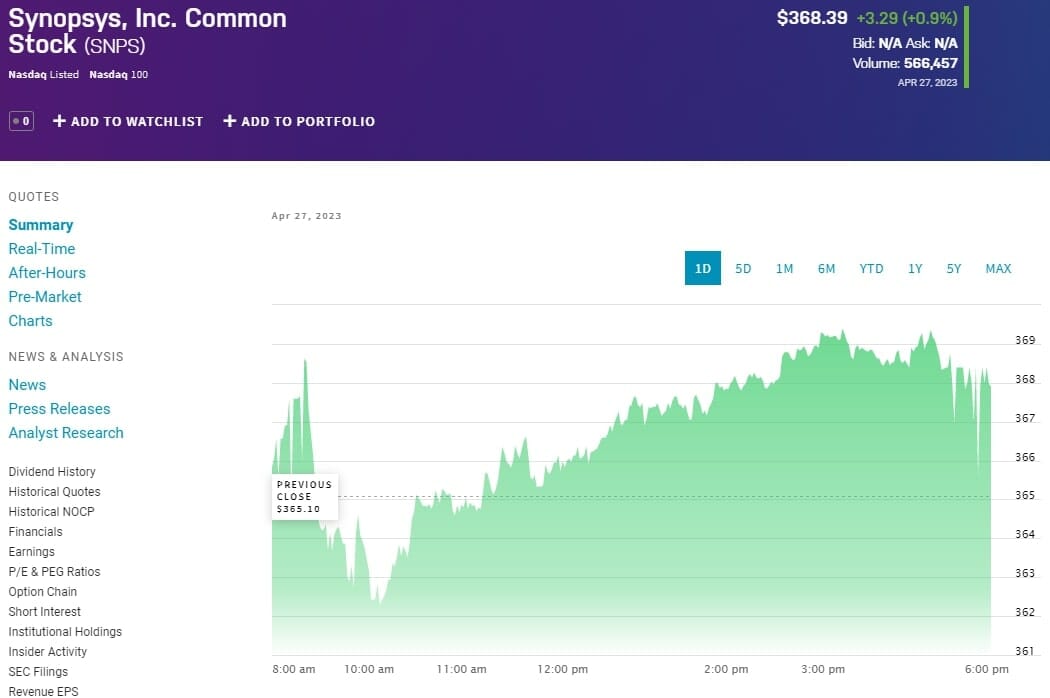

Synopsys, Inc. (SNPS)

Expected Earnings Release: Week of May 15

Synopsys Inc (NASDAQ:SNPS) is a products and services provider across the silicon-to-software spectrum. The Company operates through two segments:

- Semiconductor & System Design – includes advanced silicon design, verification products and services, software integrity, and semiconductor intellectual property portfolio.

- Software Integrity – includes a portfolio of products and services that intelligently address software risks across their customer portfolio.

Analyst Rating

Analysts rate SNPS as a strong buy from 15 analysts with a mean target of $431.25 and a high target of $450.00, an upside of 22.15%.

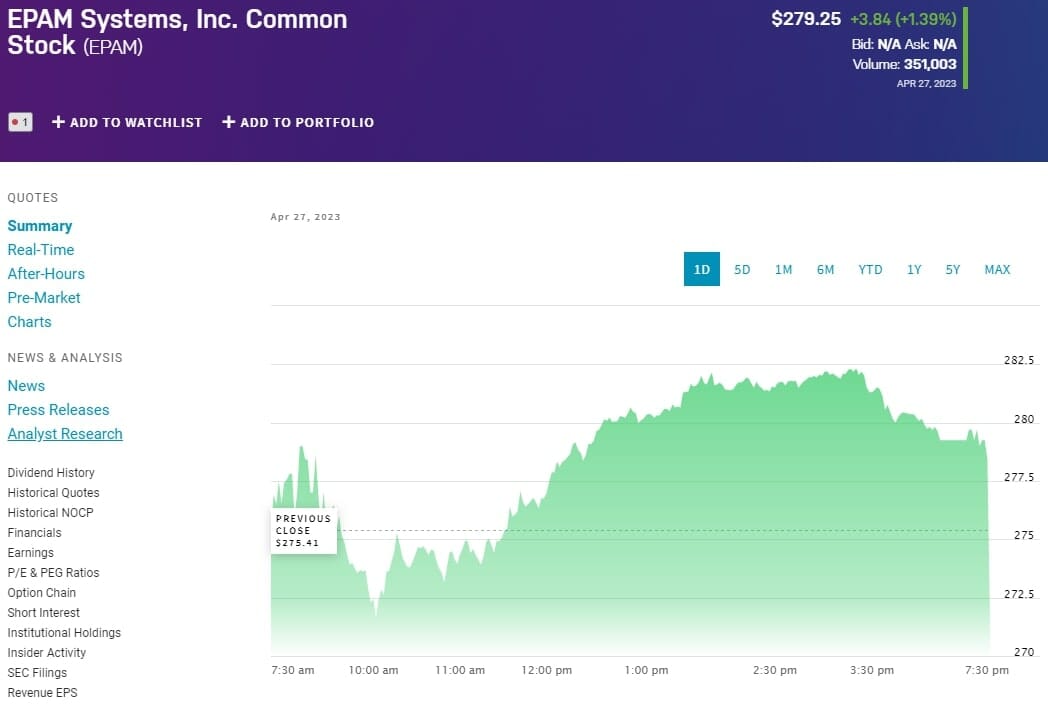

Epam Systems (EPAM)

Analyst Rating: Strong Buy

Expected Earnings Release: Week of May 15

EPAM Systems Inc (NYSE:EPAM) is a digital transformation services and product engineering company that provides services globally through:

- Digital platform engineering

- Software development services

The company maintains a group of testing and quality assurance professionals specializing in various technology platforms and industry verticals. The group provides its clients with application testing, quality assurance, and consultation services.

Analyst Rating

EPAM is rated a “Strong Buy” by 16 analysts with a mean estimate of $407.00 and high estimates of $460.00, an upside of 64.73%.

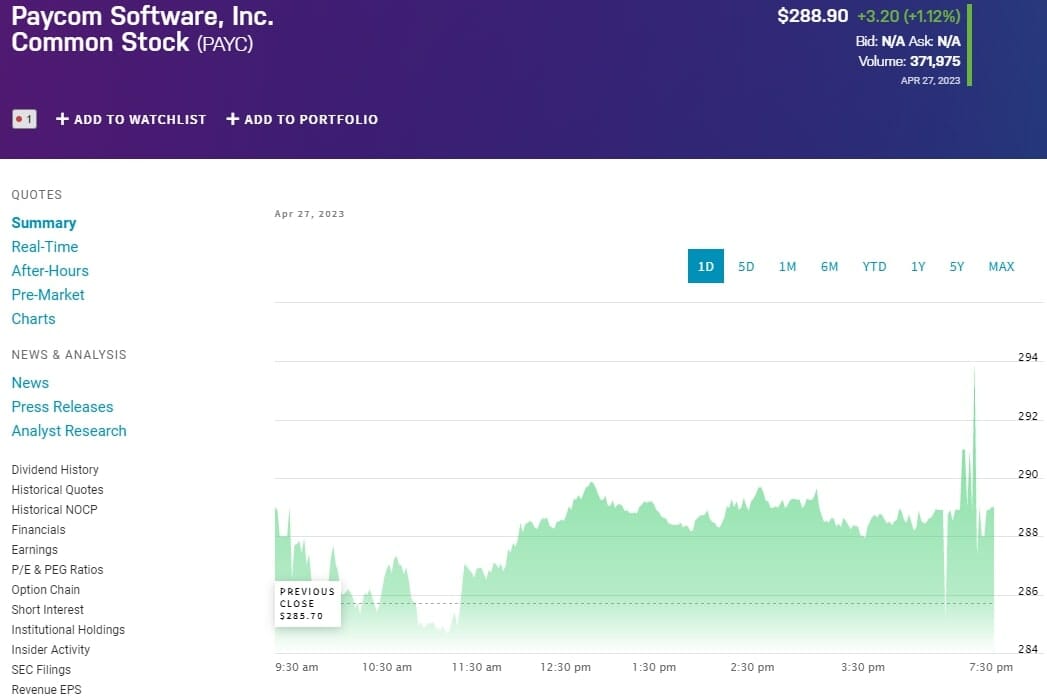

Paycom Software (PAYC)

Expected Earnings Release: Week of May 3

Paycom Software Inc (NYSE:PAYC) is a cloud-based human capital management (HCM) solution provider delivered as software-as-a-service (SaaS). The Company offers functionality and data analytics solutions that require virtually no customization and is based on a core system of record maintained in a single database.

This caters to HCM functions like talent acquisition, time and labor management, payroll, talent management, and human resources (HR) management applications. The company sells its solution directly through its sales force based in offices across the United States.

Analyst Rating

PAYC is rated as a “Strong Buy” by 16 analysts, with a mean estimate of $386.00 and a high estimate of $450.00, an upside of 55.76%.

Final Thoughts

Investing in tech stocks can give investors high portfolio growth and return potential. With rapid technological changes, such as the current AI craze, investors making the right bets can ride the market shift. However, investors should always be aware of potential risks and the market environment as tech is a highly volatile industry and should only risk capital within their investment philosophy.