Preparing for a Market Shift as Volatility Returns: Institutional Investors Focus on Alternative Investments, ESG and Risk Management, Natixis Survey Finds

- 78% of institutions anticipated the increased volatility now shaking the markets

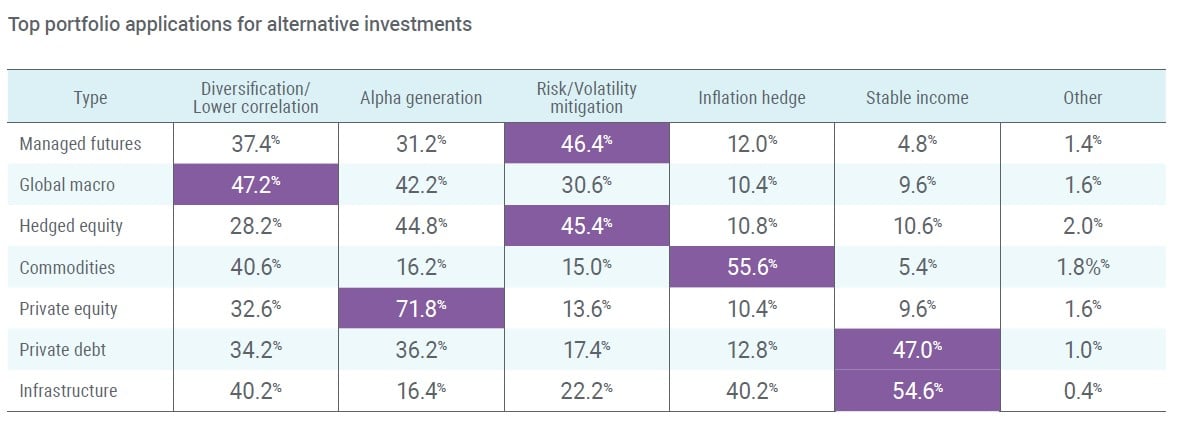

- Institutions apply alternative investments to a wide range of portfolio objectives: private equity for alpha generation, managed futures for volatility mitigation, infrastructure for stable income

- Environmental, social and governance (ESG) investing playing a greater role in institutional investors’ strategies

- Institutions see the benefits of rising interest rates outweighing the costs

BOSTON, Feb. 22, 2018 – Volatility finally roared back to abnormally tame markets, but most institutional investors were already bracing for impact; their efforts to diversify and build durable portfolios may now pay off, according to new survey findings released by Natixis Investment Managers. Seventy-eight percent of institutional investors expected stock market volatility to spike in 2018, and they are making opportunistic allocations to active management and alternative investments in order to help meet average long-term return assumptions of 7.2% this year.

Natixis’ Center for Investor Insight surveyed 500 institutional investors around the world to gain insight about how they are balancing long-term objectives with short-term opportunities and pressures. Seven in 10 investors agreed that the addition of alternatives is important for diversifying portfolio risk. Yet they see a number of alternative strategies playing distinct roles in their portfolios.

When asked to match the most appropriate alternative strategies with specific portfolio objectives, institutional investors indicated the following:

- Diversification: Institutional investors most commonly cite global macro strategies (47%), commodities (41%) and infrastructure (40%) investments as best for diversification.

- Fixed-income replacement: Top choices for providing a source of stable income as interest rates rise and the 30-year bond bull market ends include infrastructure (55%) and private debt (47%).

- Volatility management: Institutions cite managed futures (46%) and hedged equity (45%) as best suited to manage volatility risk.

- Alpha generation: Traditional markets have generated attractive returns, but institutions see opportunity to outperform. Seven in 10 (72%) cite private equity as their top choice among alternatives for generating alpha. They also see hedged equity (45%) as useful in meeting this objective.

- Inflation hedge: Institutions view commodities (56%) and real estate (46%) as best for inflation hedging strategies.

“The sudden return of market volatility is a healthy reminder that it’s important to take a consistent approach to portfolio diversification,” said David Giunta, CEO for the US and Canada at Natixis Investment Managers. “Institutional investors are increasingly turning to active managers and alternatives for the tools and flexibility to diversify their portfolios and mitigate risk.”

Three-quarters (76%) of institutional investors think the current market favors active managers. And while alternative investments can present a range of portfolio risks, 74% say the potential returns of illiquid investments are worth the risk. That said, two-thirds report that solvency and liquidity requirements have created a strong bias for shorter time horizons and highly liquid assets, and hidden risks lurking within the dynamic macroeconomic and regulatory market make it even more challenging for institutions to balance short-term opportunities and long-term objectives.

ESG Investing Takes on Broader Importance

Natixis found that institutional investors are increasingly integrating environmental, social and governance (ESG) factors into investment analysis to help manage risk and enhance return potential. Whereas a year ago, the top reason institutional investors were integrating ESG was to comply with their firm’s mandate or investment policy,[1] their top reason for implementing ESG strategies now is to proactively align investment strategy with organizational values (47%). Three in 10 (29%) include ESG to generate higher risk-adjusted returns over the long term. The survey also found:

- 59% say there is alpha to be found in ESG investing.

- 56% believe ESG investing mitigates risks (e.g. loss of assets due to lawsuits, social discord or environmental harm).

- 61% agree incorporating ESG into investment strategy will become a standard practice within the next five years.

“Institutional investors have borne witness to the impact of environmental, social and governance events at numerous companies in recent years and watched as stock values declined right along with corporate reputations,” said Dave Goodsell, Executive Director of Natixis’ Center for Investor Insight. “Our survey shows ESG analysis is playing a greater role in institutional strategy, with more institutions finding that this approach can help navigate a path to potential profits.”

However, there is an opportunity to educate institutional investors who say that ESG still needs clearer definition, as only a small number of respondents (14%) see the full potential of ESG today.

Renewed Focus on Risk Management

Underscoring the broad range of risks presented in today’s uncertain markets, including interest rates, volatility and geopolitics, the survey found that 63% of institutions say it’s a challenge for their organization to gain a consolidated view of risks across their portfolio. Incorporating ESG strategies and increasing efforts around liability management are two measures that are playing an important role in institutional plans. In seeking to better control portfolio risk:

- 84% of institutional investors believe that diversification is an effective strategy.

- 81% find that risk budgeting is an effective tool.

- 46% say integration of material ESG factors is useful in controlling portfolio risk.

Chief among the long-term risk concerns for institutional investors is managing longevity risk, as indicated by 78% of corporate pension plans, 76% of public pension plans and 85% of insurance firms. As such, ongoing improvements in life expectancy enhance the challenge of funding longer retirements, especially during a prolonged low-rate environment. According to the study, prospects for continued interest rate increases are a positive for many institutions, as such increases would help to reduce the present value of their liabilities, but would also reduce present value of bond holdings. To strike an optimal balance, institutions cite managing duration as their top strategy for navigating a rising rate environment.

Upward Trend in Outsourcing CIO Functions

As institutional investors pursue more innovative investing strategies, a growing number are turning to outsourcing. Forty-four percent of institutional investors outsource at least some portion of their investment management function. Among those who do, they outsource management for approximately 41% of their portfolio. Their primary reason for doing so, according to 49% of institutions, is to access specialist capabilities.

During the next 12 months, nearly one in five (17%) institutions is considering outsourcing investment decision making, a rise from 13% in 2016 or 30% more.

Investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. This release does not constitute investment advice and should not be construed as a recommendation for investment action. The views and opinions expressed may change based on market and other conditions.

Alternative investments involve unique risks that may be different than those associated with traditional investments, including illiquidity and the potential for amplified losses or gains. Investors should fully understand the risks associated with any investment prior to investing.

Volatility management techniques may result in periods of loss and underperformance, may limit the Fund's ability to participate in rising markets and may increase transaction costs.

Sustainable investing focuses on investments in companies that relate to certain sustainable development themes and demonstrate adherence to environmental, social and governance (ESG) practices, therefore the Fund’s universe of investments may be reduced. It may sell a security when it could be disadvantageous to do so or forgo opportunities in certain companies, industries, sectors or countries. This could have a negative impact on performance depending on whether such investments are in or out of favor.

Diversification does not guarantee a profit or protect against a loss.

Alpha: A measure of the difference between a portfolio's actual returns and its expected performance, given its level of systematic market risk. A positive alpha indicates outperformance and negative alpha indicates underperformance relative to the portfolio's level of systematic risk.

Methodology

For the sixth consecutive year, Natixis surveyed 500 institutional investors, including managers of corporate and public pension funds, foundations, endowments, insurance funds and sovereign wealth funds in North America, Latin America, the United Kingdom, Continental Europe, Asia and the Middle East. Data was gathered in September and October 2017 by the research firm CoreData. The findings are published in a new whitepaper, “When. Not if.” For more information, visit im.natixis.com/us/research/institutional-investor-survey-results-2017.

About the Natixis Center for Investor Insight

As part of the Natixis Investment Institute, the Center for Investor Insight is dedicated to the analysis and reporting of issues and trends important to investors, financial professionals, money managers, employers, governments and policymakers globally. The Center and its team of independent and affiliated researchers track major developments across the markets, economy, and investing spectrum to understand the attitudes and perceptions influencing the decisions of individual investors, financial professionals, and institutional decision makers. The Center’s annual research program began in 2010, and now offers insights into the perceptions and motivations of over 59,000 investors from 31 countries around the globe.

About Natixis Investment Managers

Natixis Investment Managers serves financial professionals with more insightful ways to construct portfolios. Powered by the expertise of 26 specialized investment managers globally, we apply Active ThinkingSM to deliver proactive solutions that help clients pursue better outcomes in all markets. Natixis ranks among the world’s largest asset management firms2 ($997.8 billion AUM3).

Headquartered in Paris and Boston, Natixis Investment Managers is a subsidiary of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Investment Managers’ affiliated investment management firms and distribution and service groups include Active Index Advisors®;4 AEW; AlphaSimplex Group; Axeltis; Darius Capital Partners; DNCA Investments;5 Dorval Asset Management;6 Gateway Investment Advisers; H2O Asset Management;6 Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Managed Portfolio Advisors®;4 McDonnell Investment Management; Mirova;7 Natixis Asset Management; Ossiam; Seeyond;8 Vaughan Nelson Investment Management; Vega Investment Managers; and Natixis Private Equity Division, which includes Seventure Partners, Naxicap Partners, Alliance Entreprendre, Euro Private Equity, Caspian Private Equity and Eagle Asia Partners. Not all offerings available in all jurisdictions. For additional information, please visit the company’s website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers includes all of the investment management and distribution entities affiliated with Natixis Distribution, L.P. and Natixis Investment Managers S.A.

2 Cerulli Quantitative Update: Global Markets 2017 ranked Natixis Investment Managers (formerly Natixis Global Asset Management) as the 15th largest asset manager in the world based on assets under management as of December 31, 2016.

3 Net asset value as of December 31, 2017. Assets under management (“AUM”), as reported, may include notional assets, assets serviced, gross assets and other types of non-regulatory AUM.

4 A division of Natixis Advisors, L.P.

5 A brand of DNCA Finance.

6 A subsidiary of Natixis Asset Management.

7 A subsidiary of Natixis Asset Management. Operated in the U.S. through Natixis Asset Management U.S., LLC.

8 A brand of Natixis Asset Management. Operated in the U.S. through Natixis Asset Management U.S., LLC.

# # #

[1] Natixis Investment Managers 2016 Global Survey of Institutional Investors. Survey of 500 institutional investors in October and November 2016.