Maximising Shareholders’ Value For The Longer Term, Germany’s blue-chip index, regulatory landscape and pay for performance study

Q2 2020 hedge fund letters, conferences and more

COVID-19 and Its Impact On The German DAX index

Reflecting on this year’s proxy season, CGLytics is releasing its first annual DAX proxy review, providing key takeaways from proxy season 2020 and analysing the state of the German DAX index in times of the COVID-19 crisis. Learning from key issues of the season, as presented in this report, ensures corporations will be prepared to confidently engage with investors.

The Coronavirus has affected global markets in the last few months and is likely to leave the economy in a state of uncertainty for the near future. Companies in various industries and markets have experienced changes in supply and demand. Some industries being affected negatively, while others have benefited from the consumer shift.

German companies have been striving to protect the health of its employees and shareholders by closing production sites, enforcing working from home and organising virtual meetings of shareholders. Second quarter results for 2020 show that some companies are coping well with the crisis and remain profitable (an example being Deutsche Post AG), while others (such as Daimler AG) show significant drops in profit.

The German government has introduced numerous updates to legislation, including corporate governance regulations and guidelines, in order to help minimise the impact of the pandemic. Most notably, virtual Annual General Meetings are allowed until the end of 2020, contrary to prior legislation. In addition, the government proposed a bailout package of €156 billion to support the society and self- employed citizens, €600 billion rescue fund available for loans, guarantees and equity stakes in companies, and €500 billion available to boost companies’ liquidity1.

At the end of June, shareholders of Deutsche Lufthansa AG voted in favour of the stabilisation package of up to €9 billion provided from the government to help the company recover from the crisis.

Looking at the constituents of the German DAX index, several common responses to the COVID-19 pandemic with regards to corporate governance can be seen. Many companies have rescheduled the Annual General Meeting of shareholders for later months or held it as a virtual event. In order to respond to a rapidly changing economic situation companies have been announcing changes in forecasts or withdrawals of the outlooks for the 2020 financial year.

Other companies, such as Bayerische Motoren Werke AG, have updated their outlook to show the expected negative impact of the Coronavirus. The German DAX index has also witnessed a significant number of cancellations of share buy-backs as a means of liquidity and capital retention.

The pandemic has brought about pay cuts for executives in order to decrease costs. Within the DAX, eight companies have issued some form of pay cut for their Chief Executive Officers and the Management Board members. Of these, seven companies issued cuts on the base salaries ranging from 10% to 100%.

Most reductions were introduced as temporary measures, varying from a one-month fixed pay cut for the Management Board of Deutsche Bank Aktiengesellschaft to nine-months 20% fixed pay cut in case of Beiersdorf Aktiengesellschaft and Daimler AG. Adidas AG also announced 100% reduction in the variable bonus for the Executive Board members for the

entire year2.

Five companies further announced fee reductions for the members of the Supervisory Board, varying from a 15% cut for the six-month period (as in the case of Covestro AG) to a 50% reduction for undisclosed duration (for Adidas AG). The companies that disclosed actions regarding the reduction of the Supervisory Boards’ remuneration are operating predominately in the Consumer Discretionary and Materials sectors. These sectors showed general decline across the world as the demand for non-essential goods dropped during the crisis.

Seven of the 30 index constituents introduced changes to dividend payments caused by the pandemic. Deutsche Lufthansa AG’s shareholders voted in favour of the cancellation of dividend payments for 2019 as the company is going through the bailout processes. Volkswagen AG and Adidas AG announced postponement of dividend pay-outs (Adidas was influenced by the conditions of the syndicated loan the company received from the State Development Bank). Furthermore, three companies proposed the reduction of dividends to their shareholders - a motion that was supported at their respective Annual General Meetings. Overall, the impact of the pandemic is expected to continue to affect companies on German and other markets.

CEO Compensation Reduction amidst COVID-19

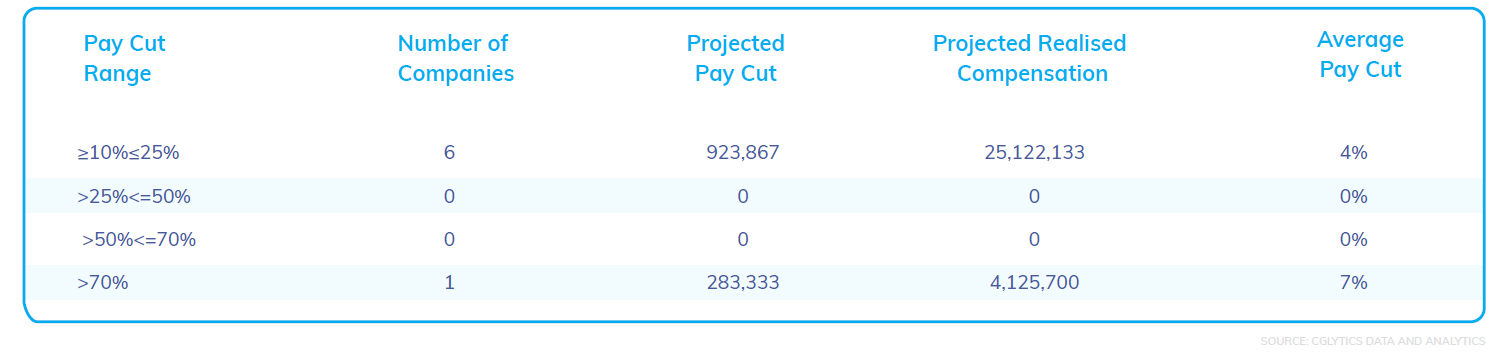

Among the seven companies that disclosed pay cuts to their CEO’s base salaries, six reported a pay cut between 10% and 25%. The projected pay cut represents an average of approximately 4% of their projected realised compensation for 2020.

Deutsche Bank Aktiengesellschaft reported that their CEO will forfeit one-months’ full salary. From our analysis, this is expected to represent 7% of the total realised compensation for their CEO.

Pay Cuts May Merely Be Immaterial

Despite the appeal of executive pay cuts, they make up a small portion of what CEOs will receive in 2020. The pay cuts as announced by these companies are meant as a show of support and solidarity with their employees. However, with CEOs’ base salaries forming a small chunk of the composition of CEO pay, we find that their intention though nobled oes not represent enough skin in the game.

Furthermore, the majority of the DAX constituents announced losses in the first and second quarters of 2020. The Consumer Discretionary sector was severely hit by the crisis. All of the representatives of the Automobiles and Components industry in the index have declared losses, had to temporarily close factories and have experienced drops in demand from the global markets. Bayerische Motoren Werke AG, Daimler AG and Volkswagen AG announced plans to lay off employees due to the losses and cost reduction initiatives.

Other industries have experienced similar issues. Materials sector’s companies in the index all showed unsatisfactory results in the first quarter, and HeidelbergCement AG announced the introduction of shortened working hours for its employees.

As global air travel was hit by the lockdown, Deutsche Lufthansa AG and MTU Aero Engines AG both declared losses and layoff intentions. Most of the Financial industry companies were affected by the crisis, and Deutsche Bank Aktiengesellschaft has decided to resume job cuts as part of its cost reduction program.

A few companies, on the contrary, showed strong performance since the beginning of the pandemic due to raising demand for their business. Among them are Industrial sector representative Deutsche Post AG; Communication Services company Deutsche Telekom AG; E.ON SE and RWE Aktiengesellschaft representing Utilities; and Health Care sector companies Fresenius Medical Care AG & Co. KGAA and Fresenius SE & Co. KGaA. As the global demand shifted towards online shipping, virtual communications and the urgent need for specialised health care products, these companies showed upwards trends in their performance.

Read the full report here.