Homebuyers are £10k worse off thanks to stamp duty holiday price boom

Jump In House Prices With The Introduction Of The Stamp Duty Holiday

Research by Newcastle-based property developer, StripeHomes, has found that a hot housing market driven by the stamp duty holiday has seen the saving on offer wiped out by house price increases in all but two major cities.

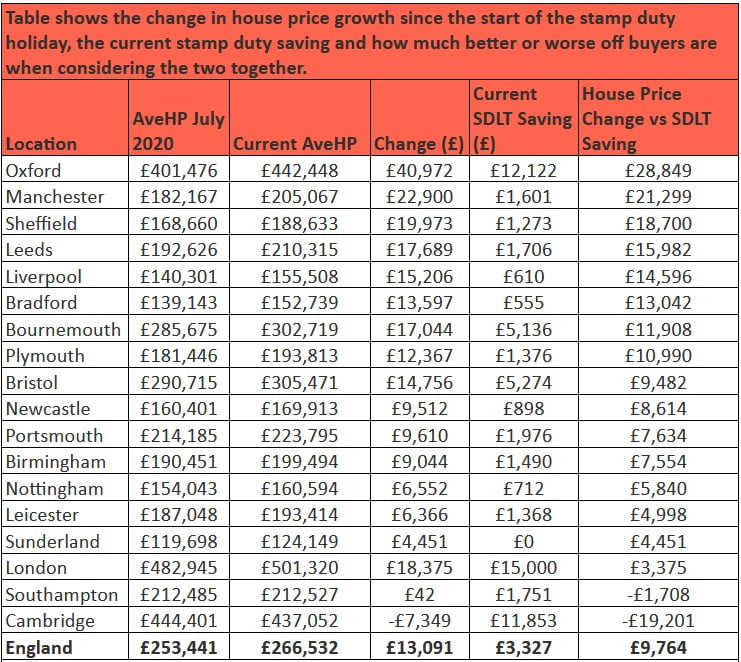

StripeHomes analysed house price growth since the introduction of the stamp duty holiday in July of last year across 18 major cities in England and how this compares with the saving on offer via the tax reprieve.

The research shows that back in July, the average house price in England average £253,441 meaning the stamp duty saved would have equated to £2,672. Today, the average house price across England sits at £266,532, an increase of £13,091.

While homebuyers are still saving £3,327 in stamp duty due to the extended holiday deadline, it means they are paying £9,764 more to get on the ladder when compared to July last year.

Oxford Homebuyers Got Hit The Worst

Oxford homebuyers are even worse off. Since the introduction of the stamp duty holiday, house prices have jumped by £40,972 to £442,448 today. Even with a stamp duty holiday saving of £12,122, homebuyers in the city are still paying £28,849 more on the average purchase.

In Manchester, homebuyers are paying £21,299 more than they were prior to the stamp duty holiday even after taking the current saving into account, while in Sheffield the cost of buying is up £18,700.

Other cities where homebuyers are now worse off by more than £10,000 include Leeds (£15,928), Liverpool (£14,596), Bradford (£13,042), Bournemouth (£11,908) and Plymouth (£10,990).

In fact, the research by StripeHomes shows that buying now is better for homebuyers in just two major cities.

In Southampton, house prices have climbed by just £42 since July of last year meaning homebuyers can still save £1,708 in stamp duty.

In Cambridge, house prices have fallen by £7,349 since the introduction of the stamp duty holiday, meaning with the addition of a £11,853 tax saving, homebuyers are £19,201 better off buying now.

Government Initiatives Push House Prices Further Out Of Reach

Managing Director of StripeHomes, James Forrester, commented:

“Time and time again, we see poorly thought through Government initiatives designed to 'help' homebuyers ironically push house prices further out of reach.

The stamp duty holiday has done just that and while the average homebuyer might feel as though they’ve been given a helping hand with a few thousand pounds saved in tax, it’s nothing but smoke and mirrors by the Government.

The reality is that they’re far worse off due to the heightened levels of house price growth the initiative has caused and with the holiday now running until September for many, we can expect house prices to continue to climb and many more homebuyers to be priced out of homeownership as a result.”

- StripeHomes is as a brand name and is written as a singular word, not as Stripe Homes.

- StripeHomes is a UK property developer focussed on North East student and residential developments with 20 years’ property experience.

- James Forrester has worked within the property industry for 20 years, born and bred in Newcastle, he has extensive knowledge of the local market, as well as the wider North East.

- James is a director of StripeHomes, a company specialising in top-quality new-build developments in the North East.

- As a result, James has an unrivalled knowledge of the sales, lettings and new-build sectors, making him an accomplished, all-round property market commentator.