As markets brace for uncertainty, investors expect hedge funds to offer positive returns while reducing portfolio risk

Strong Optimism From Hedge Funds

NEW YORK – July 12, 2022: New research from leading quant technology provider SigTech reveals strong optimism from hedge funds for increased investor inflows.

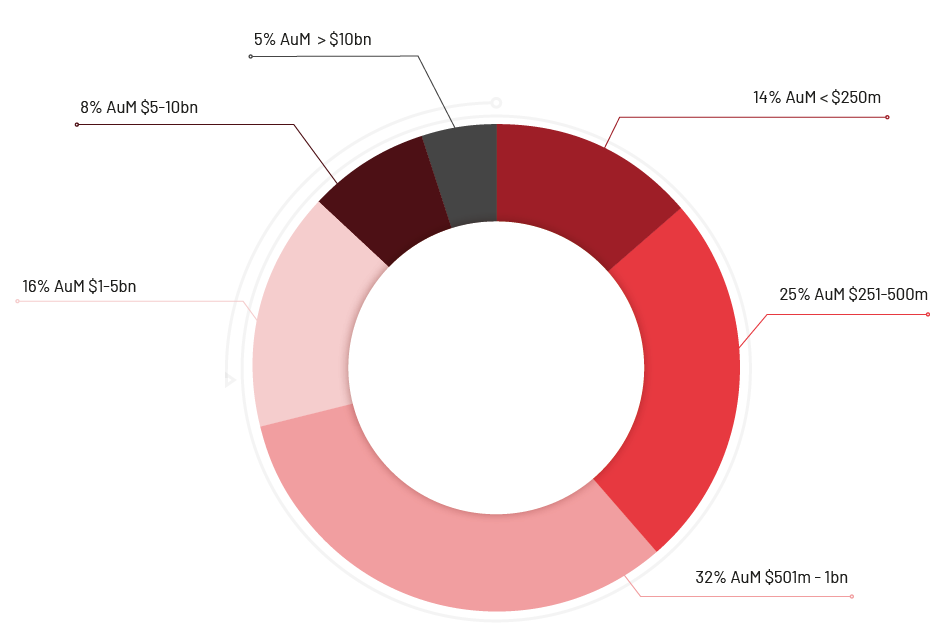

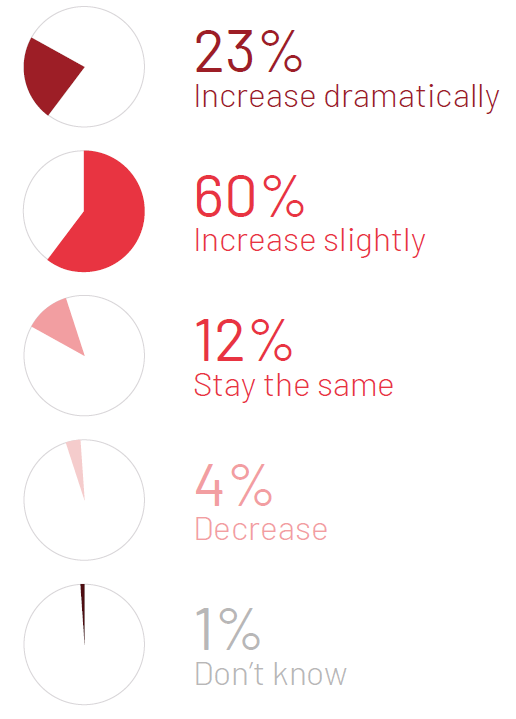

SigTech conducted a global survey of hedge funds with $194 billion in assets under management collectively. 83% of respondents expect institutional investors to increase their allocation to hedge fund strategies over the next two years, with nearly one in four (23%) expecting a dramatic increase.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The primary reason identified for institutional investors increasing allocation to hedge funds over the next five years was the expectation that they can generate absolute returns in any market environment. The research further found investors believe hedge fund strategies play an important role in mitigating certain risks and improving overall portfolio diversification.

A key factor in attracting flows from institutional investors is the level of transparency of the investment process employed by a hedge fund. 90% of survey respondents identified this as an important issue.

Commenting on the report, Daniel Leveau, Vice President, Investor Solutions at SigTech, said: “Our research shows a high degree of optimism amongst hedge funds for growing their assets under management. Advances in technology enable greater in-depth analysis of data and ever more sophisticated investment strategies. This represents a huge opportunity for hedge funds to unlock the true value of financial data.”

“However,” Leveau added, “with this comes greater demands from institutional investors for more transparency around strategies and investment processes.”

A survey of industry experts

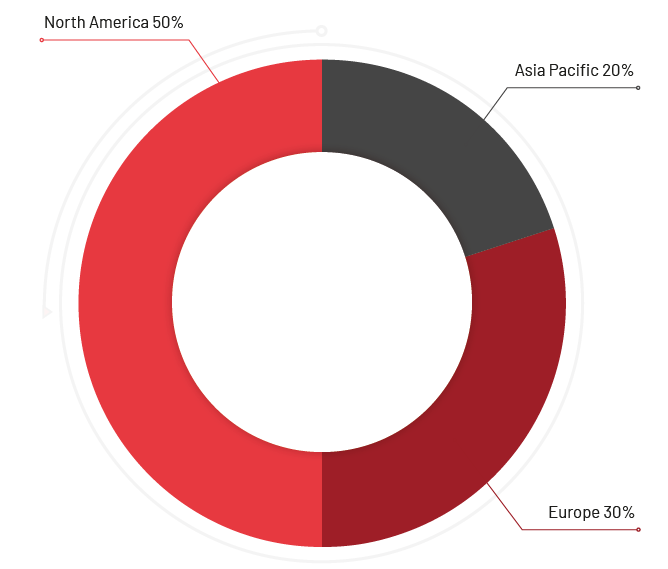

We surveyed 100 leading hedge funds across North America, Europe and the Asia Pacific region collectively overseeing around USD 194 billion in assets under management. The interviews were conducted in Q2 2022.

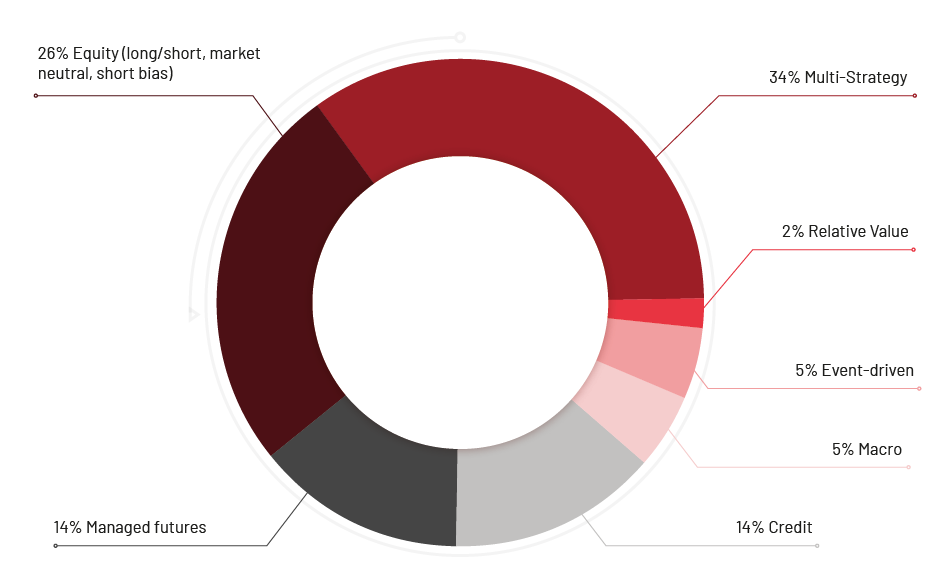

Fund managers from all major hedge fund categories represented

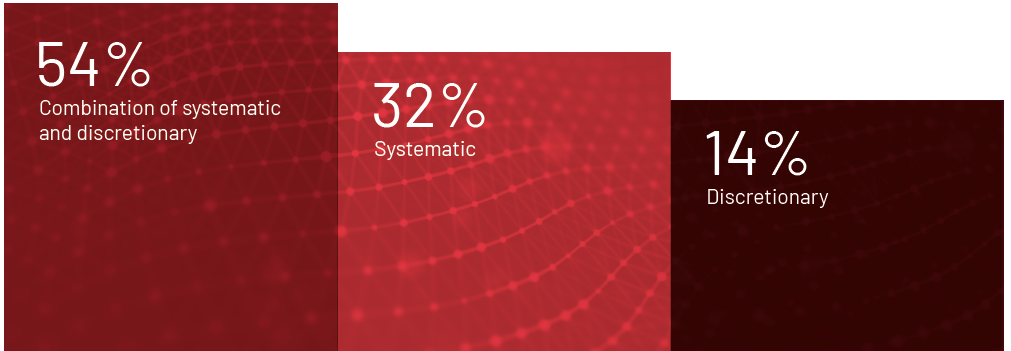

The managers surveyed represent all major hedge fund categories. It is noteworthy that the majority of hedge funds surveyed now apply a combination of systematic and discretionary analysis. This underscores the dominant trend among discretionary funds; the integration of systematic analysis into their investment processes.

How would you describe the investment process of the hedge fund firm you work for?

Over the next two years, how do you see allocation levels to hedge funds in general from institutional investors change?

Increasing Demand For Hedge Funds

Four out of five managers expect institutional investors to increase their allocation to hedge funds over the next two years. This is predominantly due to hedge funds being expected to generate absolute returns, mitigate risk, and improve overall portfolio diversification irrespective of prevailing market conditions.

Read the rest of the report’s findings here: SigTech Hedge Fund Research Report 2022

About SigTec

SigTech offers quant technologies for global investors and data owners. Cloud-hosted and Python-based, SigTech accelerates the data-driven investment process, from research to live trading. The platform integrates an industry leading backtesting engine with clean, validated data across asset classes. SigTech eliminates the expensive upfront costs of infrastructure build-out, giving clients an edge in alpha generation from day one.