Hayden Capital commentary for the first quarter ended March 31, 2022.

Dear Partners and Friends,

The last six months have been extremely painful – by far, the worst period since we started Hayden. There’s a lot to worry about – the highest inflation rates in decades, an aggressive US central bank that’s rapidly increasing interest rates, and Russia’s invasion of Ukraine shaping geopolitical dynamics for the next decade.

Q1 2022 hedge fund letters, conferences and more

This macro uncertainty, combined with rapidly rising interest rate expectations have had a dramatic impact on the market valuations of our portfolio companies, along with the rest of the ecommerce, fintech, gaming, consumer internet and emerging markets sectors we operate in more broadly.

To illustrate the carnage out there, the Hang Seng Tech index (which tracks the largest technology companies listed in Hong Kong) is down -65% since its peak last year. Ecommerce stocks (as measured by the ProShares Online Retail ETF) are down -62%, and Fintech stocks (as measured by the Global X FinTech ETF) are down -56%. Looking at the NASDAQ, over 50% of the index companies are now down more than -50% from their highs. Even Amazon, a blue-chip of the tech universe is down over -40% from its highs last year.

This isn’t a normal draw-down in our sector. The markets are already trading similarly to what we saw in 2001 and 2008… the amount of fear that’s out there is chilling.

As another example of the craziness out there, you can even find growing, profitable companies, trading below net cash (see HUYA at a negative -$800M valuation, although there are plenty of other examples) in the Chinese Internet sector. You don’t see these types of extreme situations in healthy markets.

I thought the below graphic from my friend Freda at Altimeter illustrated the situation well. As of April 22, the median internet stock was down ~-40% YTD alone.

In addition, the American Association of Individual Investors (AAII) survey indicates ~60% of investors believe the stock market will fall in the next six months – levels not seen since March 2009 in the depths of the financial crisis.

Note, these statistics don’t mean that the markets will turn around quickly. But I mention it, as it does tell us where we are today, and state of the market’s mood.

When the markets are full of pessimism, usually that’s a buy signal for long term investors. But there’s certainly the possibility of even more pain in the short term, so the question becomes “when” to buy and how to tell the difference between stocks that will be permanently value impaired in this downturn, versus those whose fundamental trajectories are unaffected and their share prices should rebound quickly after sentiment improves.

Personally, I’ve been surprised by the speed and magnitude of the draw-down, especially considering many of the companies in our universe are even trading below their valuations prior to Covid.

This is in contrast to their fundamentals, which have only gotten stronger and have grown 2 - 3x from their levels two years ago. The pandemic helped provide “free” customer acquisition as customers were stuck at home and looked for new online alternatives (see our Q1 2020 letter, where I talked about this dynamic in the early days of Covid; LINK).

The recent share price round-trip would make sense if these customers were returning back to their old habits – but that isn’t happening. In fact, these customers have proven to be sticky, and the companies themselves are expecting to grow by 20 - 40% annually on top of their “Covid gains”, despite Covid restrictions ending.

It’s been a difficult period, and the markets are trading more on macro-factors than company fundamentals these days. It’s impossible to call a bottom in the short-term, especially as daily moves are seemingly dictated by narratives. And as long as there’s negative headlines and Fed officials keep increasing their hawkish tones, the markets and our portfolio will continue to be extremely volatile in the short-term. In the near-term, stock prices can trade anywhere – it simply depends on at what price the last marginal seller is willing to part ways with their shares.

But if we look out a few years from now, I believe we’ll look back to this time period and recognize just how cheap these companies were trading at, and how much certain companies’ valuations had over-shot to the downside. In markets like these where it seems most investors have a hard time looking out more than 3 weeks, those who have the ability to look out even 3 years will likely be rewarded.

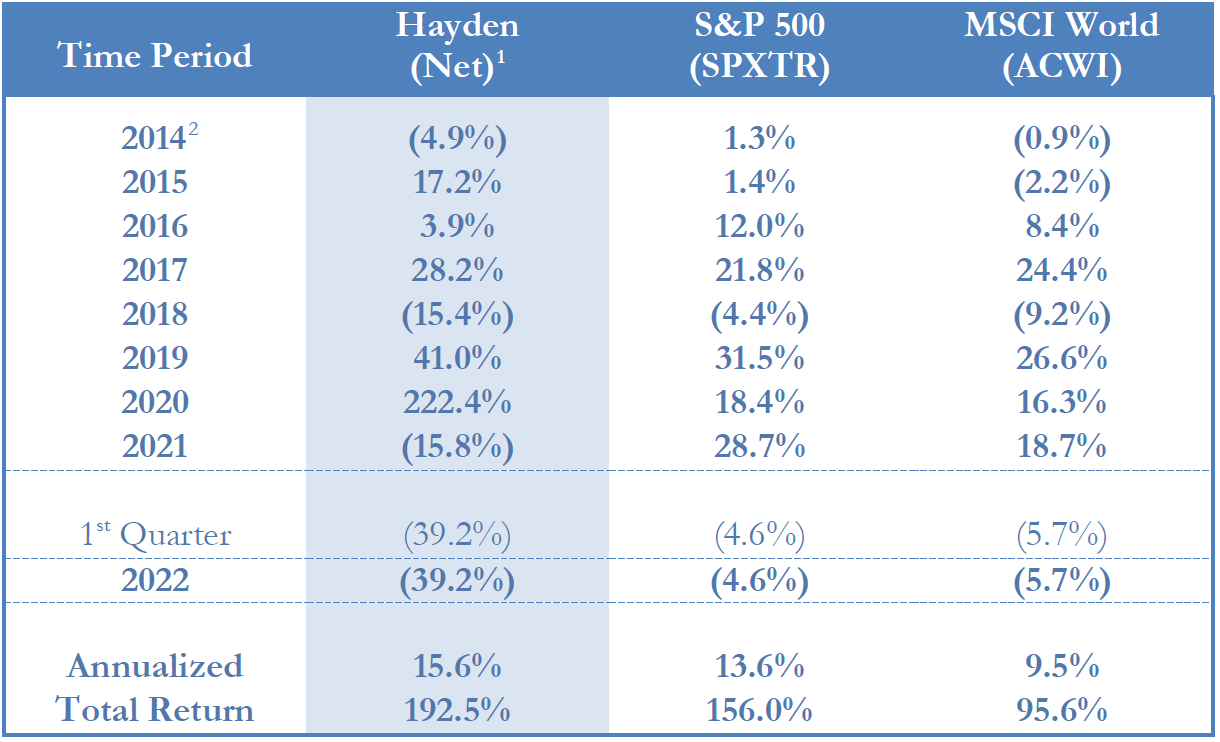

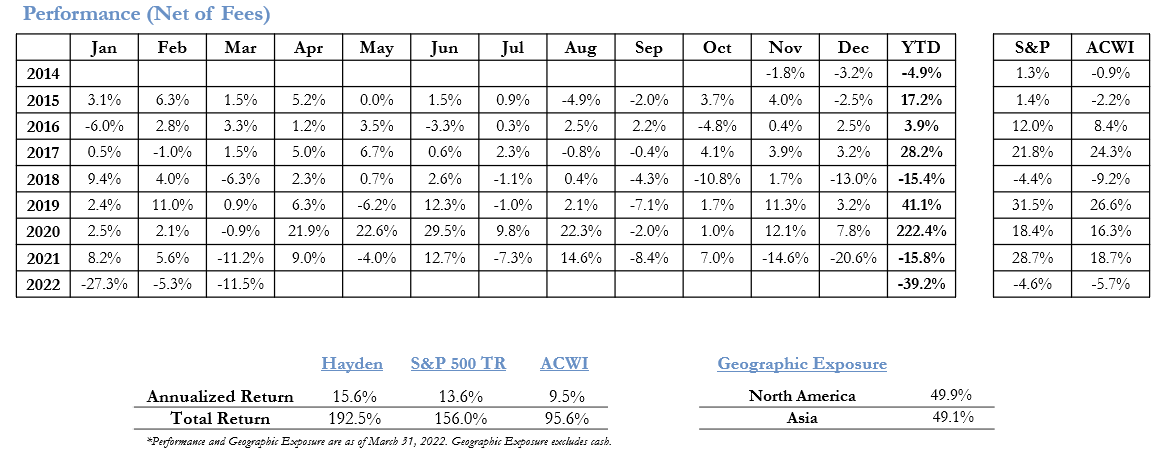

During the first quarter of 2021, our portfolio declined by -39.2%. This compares to the S&P 500’s -4.6% and the MSCI World’s -5.7% first quarter return. We have generated a +15.6% annualized return for our partners, since our portfolio’s inception.

Meanwhile, our portfolio ended the year with ~49% of our assets invested in Asia and ~50% in North America, with the remainder in cash. Our Australian position was acquired in Q1 2022.

Anatomy of a Bear Market

Over the past few years, I’ve described the areas we hunt for our investments and how that fits in our portfolio construction process (see our Q1 2019, Q2 2020, and Q3 2020 letters for reference).

Historically, we’ve focused on the early-stage of the S-curve. These companies are younger in their business model development, likely still a few years before they are able to generate profits and thus need external capital to reinvest into (by our calculations) high return on capital business opportunities, which given the high incremental margins will take them to profitability within a few years. Considering their nascent stage, the market tends to perceive these businesses as having a wide range of outcomes, and our alpha has historically come from being able to determine more accurately where the business trajectory might lie within this range.

Essentially, we get paid to take business model risk. As the business model proves itself to be capable of profitability, the market tends to ascribe a higher valuation to these business models than at our initial purchase due to this higher certainty / predictability. This allows us to realize valuation expansion, on top of an exponentially growing earnings stream. Once our companies are self-sustainable, our goal is to then allow our capital to compound alongside them, so long as the future reinvestment opportunities within the business remain attractive (i.e. high IRRs).

However in markets like today, this strategy is going to be extremely volatile. The reason for this, is that similar to fixed income markets where investors require higher returns in compensation for committing their capital for longer durations and higher volatility (30 year debt is more expensive than 1 year debt), I believe the equity markets exhibit a similar dynamic.

Our companies tend to be long duration (most of their profits, and thus basis for their valuations, lie further out in the future). Therefore any change in the interest rate or market environment tends to affect the market’s perceived valuation of these businesses to a greater degree, than more “stable” / more predictable companies.

For example, US government long-term bonds have already declined by over -30% since their peak, which is even greater than in 2008 – 10. If essentially risk-free US government bonds are trading at these extremes, it’s only logical that the stock prices of our businesses, which are not only long-duration, but also have business risk as well, will decline even more.

In addition, real yields (as measured by TIPS) have increased by the quickest pace since the financial crisis of 2008. While the absolute level is still relatively low by historical standards, it’s the pace of change that matters most for financial markets. Markets tend to be able to digest yield increases if it’s done in a methodical and steady manner. However sudden changes in the yield cause turmoil and volatility, and panic to reposition investor portfolios, which is what we’re seeing today.

Long-Duration Bonds Drawdown

As of April 18, 2022 (LINK)

Most Rapid Increase in Real Yields Since 2008

As of May 7, 2022 (LINK)

Businesses are the Most Pessimistic in Decades

During pessimistic and fearful markets like today, the market tends to discount the expected future trajectory of these businesses to highly conservative (and often overly pessimistic) levels. This means that not only do our businesses get negatively impacted by entire market valuations shifting downwards due to rising interest rates, but also that the “equity yield curve” steepens too.

On top of these two already negative factors, investors then value these businesses at the bottom end of the potential range of outcomes, in an effort to be conservative in an uncertain environment. These three factors combined, result in a large negative impact on the valuations the market places on our businesses today. However as the macro environment stabilizes and investors are able to analyze the future clear-eyed again, these factors tend to revert just as violently upwards as they did to the downside.

As long as the companies do not need access to the capital markets, are self-sustainable (generating profits) or have plenty of cash to get them to profitability soon, these companies’ stock prices tend to rebound quickly after the macro environment calms down.

Multiple Negative Factors = Long-Duration Asset Prices are Most Impacted

A couple historical case studies of these, are Amazon.com, Inc. (NASDAQ:AMZN) and Mercadolibre Inc (NASDAQ:MELI) during the past two major market drawdowns (in 2001 and 2008, respectively)3. Both of these companies were in similar stages of their business lifecycles during these periods, as our companies today. They were young companies at less than 10 years old, growing in the high double digits annually, and were just starting to make a mark on their industry with single digit market shares of their addressable markets.

Amazon (AMZN) Stock Chart

July 1999 – December 2003

For example, Amazon reached a peak by the end of 1999, at a valuation of over $30BN. Considering that the company only generated $1.64BN in revenues that year (growth of 169% y/y), this equated to a valuation of 18x Price / Sales at the peak.

More notably though, was that Amazon was a pure 1P retailer at the time, meaning that they owned the inventory that they sold. Long-term margin assumptions under this business model were low, at just ~5% expected operating margins (365x implied structural operating profits).

By the time the stock bottomed in September 2001, shares were trading for ~0.7x P/S or 14x structural operating profits.

During those years, Amazon worked to reduce its operating losses and dialed back its growth investments as a result. In 2000, Amazon grew revenues by 68% y/y and reduced its cash burn from -26% operating margins to -6% by the end of the year. In its year-end 2000 earnings release, Amazon indicated that it targeted profitability by the end of 2001.

While the stock continued to decline throughout the first 9 months of 2001, the company reiterated on its 3Q 2001 earnings that it would achieve its profitability target within the next quarter. They had to dial back growth from its previous ~68% y/y in 2000 to just ~13% y/y growth in 2001, in order to cut costs and achieve this.

However, with investors focused on profitability, this period marked the turning point for the stock price, with a bottom ~$6 per share (equating to the aforementioned ~0.7x P/S or ~14x structural operating profits). Notably, based on this, the stock was able to bottom a full year before the NASDAQ index found a bottom in September 2002.

Over the next few of years, Amazon’s fundamentals remained strong, with sales growing ~26% y/y in 2002 and proving to investors that the company could be profitable in such an environment. By 2003, the company was generating $5.2BN in sales and reported its first full year of profits.

Within a little over a year of bottoming, by the end of 2002, the share price had recovered 240% to ~$21 per share (equating to 1.8x P/S). By the end of 2003, the stock had recovered to a 4x P/S multiple or $21BN valuation. This equated to a ~8.5x return on the stock price in just a little over two years.

**

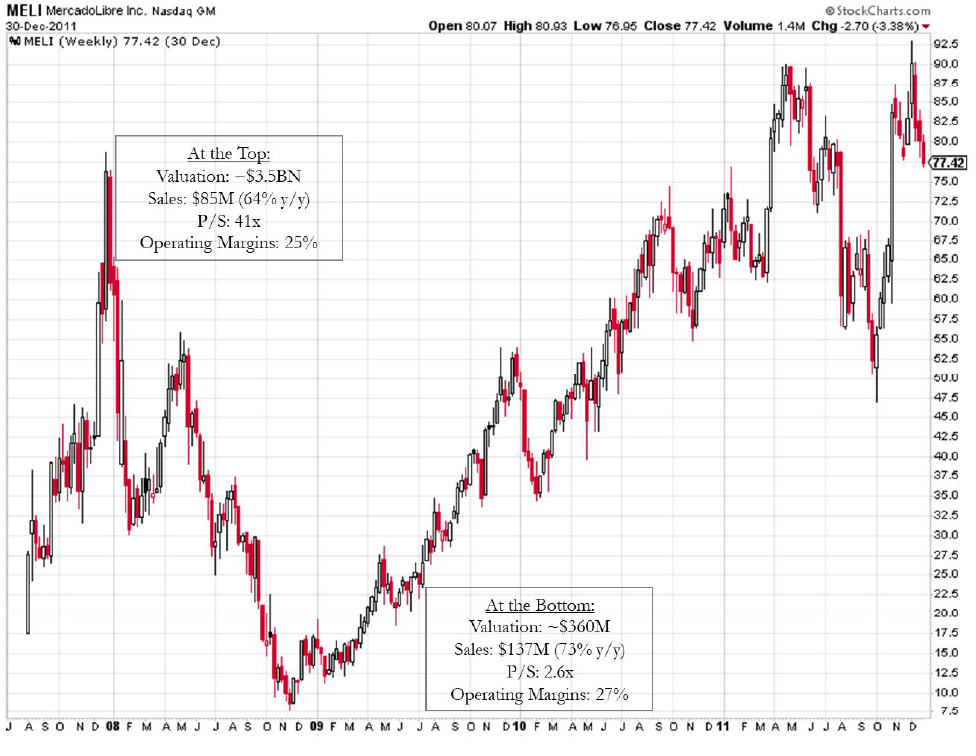

Mercado Libre, the leading ecommerce company in Latin America, is another example of this dynamic. Mercado had just IPO’d in August 2007, and the stock immediately shot up in the following months. At its peak in December 2007, the company was valued at ~$3.5BN despite only generating revenues of $85M that year (~41x Price / Sales) and growing top-line at 64% y/y.

But contrary to the Amazon situation, Mercado was highly profitable from the time of its IPO. Operating margins were ~25%, and gross margins were ~85%. Despite its highly profitable business model though, its shares declined from these high valuations throughout the 2008 financial crisis.

Mercado Libre (MELI) Stock Chart

August 2007 – December 2011

The share price reached ~$8 in November 2008, equating to a ~$360M valuation. Revenues increased to $137M in 2008 (61% y/y growth), and operating profit grew by a similar amount (73% y/y growth, 27% operating margins) to $37.5M. This equated to ~2.6x Price / Sales and ~10x operating profit at the bottom. The company kept executing and its fundamental trajectories remained intact, despite the dour market sentiment.

Notably, the share price didn’t stay at those levels long and doubled soon afterwards. By the end of 2008, it had reached $17 per share as the market sentiment for many growth companies turned towards the end of the year (and ~4 months before the broader indexes turned).

The company grew more slowly coming out of the recession, growing revenues 26% y/y & 25% y/y in 2009 and 2010, while operating profits grew 49% y/y and 33% y/y, respectively.

The share price quickly rebounded over the next year, and reached $50 by the end of 2009 (a 525% return from the bottom, and 194% return from the end of 2008). This equated to a valuation of 9x Price / Sales, and 27x operating profits.

By 2011, revenues had grown to $299M (38% y/y growth) with operating margins of 33%. The stock traded at 12x P/S or ~37x operating profits, and the price had rebounded ~10x from the bottom within a span of 3 years.

By contrast, we can look at Cisco Systems Inc (NASDAQ:CSCO) during the 1999 – 2002 years, as an example of a company that failed to recover after the bear market ended.

Cisco (CSCO) Stock Chart

July 1999 – December 2004

During the height of the tech bubble, Cisco’s stock peaked at ~$80 in March 2000, reaching up to a $500BN+ valuation (~26x Price / Sales, with ~17% operating margins or 156x operating profits). However, by the time it bottomed in September 2002, shares were trading at just ~$8.60 per share (~3.2x Price / Sales, ~21x operating profits). A little over a year later, the share price had doubled to ~$20, but then continued to trade around those levels in a range for the next 10 years.

So why were Amazon and Mercado Libre able to recover so quickly from their large draw-downs, while Cisco’s stock price remained anemic?

It seems the answer is in their differing growth profiles in the years afterwards. For example, Cisco revenues were $18.9BN in 2000, $22.3BN in 2001, $18.9BN in 2002, $18.9BN in 2003, and $22.0BN in 2004. By contrast, Amazon was able to grow its business by ~120% in the 3 years after the stock bottomed, and Mercado Libre grew by ~118% in the following 3 years.

For Cisco, it wasn’t until 2012 (11 years later) that revenues managed to double (to $46BN) from its original peak. Compare this to Amazon, who during those same 11 years, managed to grow its business 22x.

These are just a few select examples, but investors can go back to the last few market crises to find similar dynamics among other stocks.

This is all to illustrate, that what really matters to whether a stock recovers after a bear market, is 1) whether its fundamentals continue to grow throughout the period, and 2) if the business is able to prove that it can be profitable. If business performance is permanently impaired, you can expect its stock price to as well.

But if the business is able to grow through the bear market / recession or optimally come out of it even stronger, you tend to see the stock price rebound quickly (usually by multiple-fold from the lows) in the 1-2 years after overall market sentiment improves and panic selling subsides.

If we’re confident in the fundamentals of our businesses and the valuations are reasonable, then the stock prices will reflect that in due time.

Given the market dynamics & volatility we’re seeing today, it leads me to think we’re closer to the bottom than otherwise. However, during the bottoming process, these prices during these months can be heart-wrenching and extremely “choppy”. If you examine the volatility in the weeks or months surrounding “the low”, you’ll notice that these stocks regularly exhibit 10 – 40% moves on a weekly (!) basis. In addition, there’s going to be several “false starts” and bear-market rallies, which take an even greater emotional toil than the low prices themselves.

Note, I’m also not necessarily saying that we’re going to see 8 - 10x increases from the bottom over the next few years like Amazon or Mercado. But rather, I’m just illustrating that these stocks can trade extremely wildly once there’s panic in the markets, since they’re early-stage and the market has a hard time pricing them during uncertainty.

Prices during these periods are not dictated by fundamentals (the intrinsic values of Amazon and Mercado didn’t change by 8 - 10x over just a few years) – they’re controlled by whatever price the marginal seller is willing to sell at. There will certainly be companies that don’t make it during this period and will eventually be sold for scraps or go out of business. On the other hand, those companies that can maintain their growth trajectories and prove their ability to be self-sustainable / profitable tend to bounce back quickly.

The issue today, is that the market can’t distinguish between the two, so all companies within this category are being sold off indiscriminately. However, if we look at the valuations of our portfolio companies and other quality companies within our investment universe, we’re already at or below the valuations reached at the depths of the 2001 and 2008 crises4.

And crucially, this is nothing like the 2001 tech bubble. During that time, average valuations multiples were more than double that of where valuations peaked this time around, adjusting for growth and margin profiles held equal. Additionally, the reason that it took many years for tech stock prices to recover afterwards, was that revenues back then were primarily comprised of non-recurring hardware spend.

As the entire technology industry slowed, capex spend slowed as well, which meant that many companies went into negative earnings growth for several years (many companies fell into the Cisco situation, as above). Meanwhile, the technology sector today is largely comprised of digital based or software revenues (i.e. high-margin and / or recurring revenue streams), and their earnings continue to exhibit strong growth.

Because of this, I believe it’s a good time to go hunting as an active investor. History has shown that once these types of markets turn, there’s a high chance of generational returns on the other side.

It’s our job to determine which businesses will continue thriving during this period versus those that will ultimately fade away – using the market’s indiscriminate selling to our advantage. Afterwards, it just requires bravery to go capture these returns.

Portfolio Review

Undisclosed Positions: We’ve had quite a few changes on the early-stage side of our portfolio in the past few months. As discussed above, this portion of the portfolio tends to have a wider-range of outcomes, with both higher potential returns (targeting multiple-times our initial capital) if our thesis plays out, while also higher downside if our thesis fails. These tend to be highly-asymmetric situations, because of this.

But given the nascent stage of some of the businesses and thus inherent business model risk, they need to be sized smaller. Also because of the early-stage nature, the rapidly changing dynamics of their businesses, and just the fact that the odds of us being wrong on these investments is higher (but compensated by the higher returns, if we’re correct), we’ve tended to refrain from talking about them publicly (partners are always free to reach out, to discuss offline though).

Additionally, this portion of the portfolio provides strategic benefits to the “core” portfolio, as it allows us to be closer to these companies. Given their rapidly evolving businesses, it forces us to keep closer tabs on their evolution and quickly recognize their inflection points.

By doing so, we can also “flex up” these positions in a more expedient manner at that time, given the research groundwork that we had prepared beforehand. Lastly, it provides healthy competition for the capital within the portfolio, since a high velocity of new ideas is the best way for us to keep the portfolio “fit”.

Partners will notice that we trimmed or sold some holdings within this segment of the portfolio in the past few months.

**

In addition, we added two new software companies to the portfolio.

Historically, I have avoided software investments given a combination of high valuations, along with requiring a different research process than our core competency of consumer internet businesses. We’ve conducted quite a few deep-dives on the space over the years, but never felt like we had a durable edge versus other investors, especially given the high valuations.

However, with software valuations coming down rapidly in the past few months, I believe we’ve identified two companies that fit squarely within our circles of competence, and at very attractive valuations. Software is too large a component of the technology universe to ignore, so it’s time to build out our research muscles in this space and wade in.

For example, one of them has overlap with a core sector competency of ours – mobile gaming. Mobile gaming (and especially casual games) is extremely hit driven, which has made it tough to invest in the space over a longer holding period.

But our new position has a commanding position within the most critical piece of the mobile game value chain. Despite this dominant position, the company is actively consolidating the industry to create an even stronger competitive advantage and growing their SAAS business at 100%+ y/y rates at ~30% EBITDA margins. The shares have nevertheless traded down to a ~11x EV / EBITDA in this market sell-off (share are down -75% from their highs, and over -60% from their IPO price). I believe this is an extremely attractive valuation, and may discuss it publicly in due time.

**

Lastly, we also made an investment into a Chinese ADR this quarter. This is a company that we owned 2 years ago, but had exited early, since during the course of our research, I realized that the economics on the new projects the company was investing in weren’t as attractive as its core business, and thus expected its unlevered ROICs to decline over time.

These issues still remain. However with the stock now trading over -50% below where we originally sold the shares (despite doubling its earnings over that time frame), these issues (and more) are now priced in. The company generates attractive margins (~50% EBITDA margins), is growing 20-30% y/y, and is one of the most stable assets and cash flows in China tech. I expect that the company will be largely insulated even if the China tech regulation pressures continue and / or the Chinese economic issues persist, given the critical service that it provides its customers.

Given this backdrop, I thought the shares were too cheap to pass up, and worthy of reinstating a position. It seems that most of the share price impact has been from negative flows – i.e. US-based funds exiting their Chinese investments due to today’s macro uncertainties (whether it’s sanctions, US ADR de-listings, China’s slowing economy / Covid lock-downs, etc.). We’re comfortable with all of these issues and believe the company is even insulated from them. In fact, the shares are already dual-listed in Hong Kong as well, so a potential ADR de-listing should have minor long term impact.

Due to the aforementioned issues though, this likely won’t be a long-term hold for us. But when others are essentially forced selling for non-company related worries, we’re happy to be on the other side scooping up shares.

The share price could continue to be volatile in the short-term, due to market flows. But if the company continues to execute along its current growth path, we should see earnings double over the next 3 years (and the stock price along with it). If the macro worries around China subside by then, I’d expect a multiple re-rating as well back to its historical levels, and a 3-4x return from current prices in that scenario.

**

At a portfolio level, the current funding environment means that it will be tough for businesses that still require external capital to get them to scale and achieve profitability. The cost of funding and the bar to do so, is going up. As such, we have thoroughly reviewed the portfolio, and reduced / exited investments that are still reliant upon the capital markets.

Among our portfolio today, all of our companies (except for one tracking position) are self-sustainable going forward. Some of the businesses are highly profitable with 30 - 60% margins, growing 20 - 50% y/y, and are actively buying back their shares.

Others are near break-even, but are expected to generate substantial profits in the next 1 - 2 years. In these circumstances, the businesses have more than enough cash on their balance sheet to get them there (often >5 years of runway) without any risk of needing to tap the capital markets. Additionally, we’re getting paid to wait for this inflection in profitability, since during these periods the market tends to be extremely skeptical of any companies where the profits aren’t obvious today.

In markets like these where everything in our fishing pool of investments has declined by substantial amounts, it actually gives us a rare opportunity to upgrade the portfolio. We’re able to exit positions where the thesis is weaker, and reinvest the proceeds into companies with more attractive outlooks but at similar valuations. During these periods, partners should expect to see more portfolio activity than normal, as we use this to our favor.

Conclusion

The recent period has been unpleasant, as we are currently in the middle of a once every ~10 years type of market decline. Judging by the historically large price draw-downs as illustrated above, I understand that I’m essentially asking all our partners to come to the Gates of Hell with us, with the confidence that we’ll come back unscathed over the next few years. It’s going to be scary, and the mark-to-market prices painful to look at.

However as history as shown, as long as these companies 1) don’t go bankrupt, 2) have a profitable business model, and 3) their financials continue to grow throughout this period, the stock prices do eventually return. Mr. Market just needs to get through his depressive panicky phase first.

Logically, our partners might ask if we’re prepared for another leg down in prices, why not just sell the entire portfolio now and have cash at the bottom? Well first, is that in the depths of a bear-market, the swings in price can be massive and you never know which way it will go.

When prices are driven by emotions rather than fundamentals, gauging the market’s near-term direction is a toss of a coin. But the key is to catch the turn in the markets when that finally happens, because stock prices can move 50-100% in just a few weeks. And it’s impossible to know when that’s going to happen, or if the upswing is just another bear market rally.

In addition, it’s key to stay in the game during this period, and keep a hawks-eye watch over our company developments on a real-time basis. This is psychologically much easier when you have positions / capital at risk – especially when there’s little chance of long-term value impairment at these low levels – and can therefore add to them when the time is right.

**

On a completely different note, I was fortunate enough to be interviewed by Columbia University’s Graham and Doddsville newsletter in December of last year (what a difference the last few months has been!). The interview was just published, and I think it does a good job of illustrating how I think about Hayden’s place in our investment industry, and how we think about the investing craft in general. Those interested can read the full interview here:

Link: Graham & Doddsville – Spring 2022

It’s crazy to think that I’ve been reading Graham & Doddsville for the past 15 years, all the way to when I was still in high school. It’s really an honor to be included in this semester’s edition, and thank you for the G&D team for including Hayden.

**

There are few things more important to me, than our partners, our portfolio, and Hayden as a firm. Starting Hayden has been a dream of mine since even those original days of reading Graham & Doddsville during lunch breaks in high school, fifteen years ago.

But we must be prepared for this period of market volatility, which is going to test both our portfolio and the resilience of our partners.

My friend Yen of Aravt Global mentioned to me the other day – “The only way out [of this bear market] is through it”. I think those are wise words, and we should be both mentally and financially ready for the times ahead, and what’s sure to be some wild swings in our portfolio prices.

But while the markets are noisiest, it’s actually the most crucial period to maintain focus and get to work finding the winning companies of the next decade. These low prices won’t last forever. Our existing portfolio companies will also continue to grow and execute upon their business plans during this period, with some taking advantage of this time to emerge even stronger than before.

I’m confident that we’ll get “through it” and eventually things will get better. And once we’re on the other side, there will be a plenty of washed-up “multi-baggers” for us to hunt. I don’t know when that will be – it could be a few months, or a few years. But that day will come, and we need to be ready.

Sincerely,

Fred Liu, CFA

Managing Partner