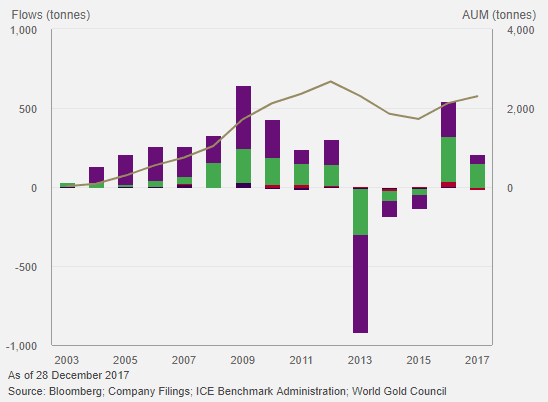

Our monthly analysis of gold-backed ETFs and similar products, provides detailed information and insight on global trends of gold investment demand through ETFs.

[REITs]2017 themes

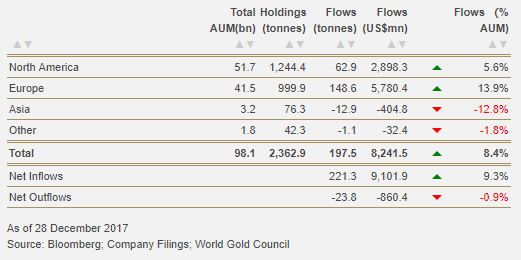

- European funds captured 75% of global inflows in 2017, adding 148.6t of gold (US$5.8bn, 14% AUM) to their holdings

- German-listed ETFs accounted for 35% of global net inflows in 2017

- In the US, iShares Gold Trust and SPDR® Gold Shares collectively accumulated 62.6t or 28% of global net inflows

- On a percentage basis, currency-hedged gold-backed ETFs had some of the strongest growth during 2017

- Asian-listed funds accounted for 54% of global net outflows

2017 top 5 individual funds by US dollar flows

- Xetra-Gold accumulated US$2.3bn

- iShares Gold Trust added US$2bn

- Source Physical Gold ETC added US$1.1bn

- SPDR® Gold Shares accumulated US$923mn

- iShares Physical Gold ETC added US$721.5mn

December 2017 trends

- In December, global gold-backed ETFs increased their holdings by 5.3t (US$101mn, 10bp AUM), to 2,363t

- Global net inflows were spread across Europe, North America and Asia

- In Europe, Xetra-Gold added 4.7t (US$141mn, 2% AUM). Source Physical Gold ETC led global outflows losing 3.6t (US$135mn, 3% AUM)

- In North America, iShares Gold Trust added 2.1t (US$88mn, 88bp AUM). SPDR® Gold Shares had outflows of 2t (US$67mn, 19bp AUM)

- Huaan Yifu Gold ETF in China, led Asian inflows 0.6t (US$24mn, 3%)

Article via Gold.org