Genuine Parts Company (GPC) has one of the most impressive dividend growth histories in the market. With 62 years of dividend growth, Genuine Parts has the fourth longest dividend growth streak of any U.S. company. Because of this impressive dividend track record, Genuine Parts qualifies as a Dividend King.

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Dividend Kings are those companies that have managed to increase their dividend for at least 50 consecutive years. You can see the full list of all 25 Dividend Kings here.

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Genuine Parts is probably one of the least followed Dividend Kings out there. However, Genuine Parts’ business, dividend history, yield and valuation make it a buy for dividend growth investors.

Business Overview

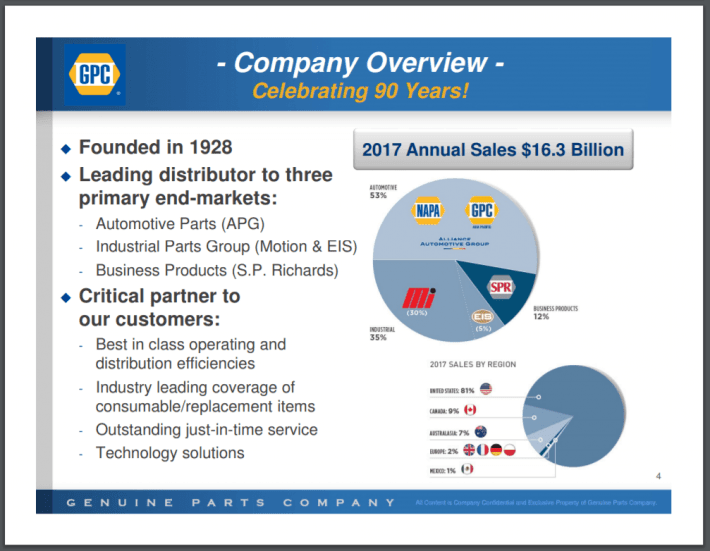

Carlyle Fraser created the Genuine Parts Company that we know today when he purchased Motor Parts Depot for $40,000 in 1928. He gave the company the name it has today. What started as a fairly modest investment 90 years ago has become a publicly owned company with a market cap of almost $13 billion.

These days, Genuine Parts is a leading distributor of automotive and industrial replacement parts.

Source: 2017 Investor Presentation

Genuine Parts employees almost 48,000 people and does business in ten countries. Genuine Parts sells products in the U.S., Mexico, Canada, Australia, the United Kingdom and others.

Genuine Parts consists of four different product segments. The Automotive Group contains the brand name NAPA. NAPA has more than 17,000 AutoCare Centers in the U.S. and another 1,600 in Canada.

The Industrial division sells replacement parts and materials to more than 300,000 customers in a variety of industries in North America. These industries include food and beverage, forest products, pulp and paper, automotive and oil and gas.

Genuine Parts’ Business Product division sells office goods to independently owned office products dealers, supply stores, military bases and food distributors in the U.S. and Canada.

The Electrical/Electronic segment sells materials to equipment manufacturers and industrial firms.

Even though Genuine Parts has been in business for ninety years, the company doesn’t rest on its previous success. Genuine Parts has been very active in buying other companies in order to help grow the business. The company’s recent purchase of Alliance Automotive Group is an example of this.

Source: 2017 Investor Presentation

Announced last September, Genuine Parts spent $2 billion to acquire this European supplier of replacement parts, tools and workshop equipment. The purchase of this company allows Genuine Parts to have access to three of Europe’s largest countries, helping to improve sales and earnings. This effect has already taken place in the company’s most recent earnings report.

Growth Prospects

Genuine Parts reported fourth quarter and full year 2017 earnings on 2/20/2018. Adjusting for a charge due to tax reform, the company delivered earnings per share of $1.19 in the quarter. This beat analysts’ estimates by $0.14. Genuine Parts grew revenue 11.4% year over year to $4.21 billion. This also topped estimates, coming in $160 million above expectations.

Genuine Parts adjusted earnings per share was $4.71 for 2017. Sales totaled a new record $16.3 billion for the year, which was 6.3% above 2016’s figure.

Genuine Parts recent purchase of Alliance Automotive Group contributed almost 7% to sales and $0.07 in earnings. Genuine Parts expects that this acquisition will add $1.7 billion in sales per year. Clearly, this deal will have even more of a positive impact on Genuine Parts going forward.

The largest pieces of the company performed very well during the quarter. Automotive sales grew 16.7% to $2.33 billion. Industrial sales climbed 7.4% to $1.24 billion. Electrical/Electronics had sales of more than $192 million in Q4, a 9% increase from the previous year. Business products was the lone division to decline during the quarter, with sales dropping 2.2% to $465.57 million.

Topping earnings and sales numbers is not unusual for Genuine Parts. The company has seen its earnings increase in 74 of the 90 years Genuine Parts has operated. Sales have increased in 85 of those same 90 years.

This sales growth has been solid over the past six years.

Source: 2017 Investor Presentation

In all but five of the last 26 quarters, Genuine Parts has seen an increase in sales. Twice sales were flat and three times sales were down year over year. Even those declines were small amounts, with each being of the 1% or 2% variety. Genuine Parts has seen record sales in six out of the last 10 years while the company has posted record earnings seven times during the past decade. Remember, this includes the company’s performance during the Great Recession.

Why can Genuine Parts continue to deliver strong earnings and sales numbers? The answer is that the company is taking advantage of the fact that people want to keep their cars running for a very long time.

Competitive Advantages & Recession Performance

Instead of buying new automobiles as the old ones age, consumers are willing to put money into their vehicles to prolong their lives. The average age of a vehicle on the road in the U.S. is 11.7 years. And the older the vehicle, the more it costs to keep it running.

Source: 2017 Investor Presentation

As you can see from the company’s investor presentation, costs of auto repairs go up over the life of a vehicle. With seven out of every ten vehicles on the road older than six years of age, consumers have to spend more than $800 a year to repair them. That is a lot of dollars up for grabs for replacement parts suppliers.

In addition, the global market for auto repair is very large and fragmented.

Source: 2017 Investor Presentation

In the geographies that Genuine Parts competes, the total automotive aftermarket is more than $200 billion. Genuine Parts controls roughly 7.5% of this total market.

The market for replacement parts is growing in every country that Genuine Parts operates. That means that there are still more revenues for the company to capture around the globe. Recall that Genuine Parts is very good at growing sales and investors can expect that the company will continue to take market share. The purchase of Alliance Automotive Group, for example, should allow the company to gain more share in Europe over time.

With sales and earnings growing almost every year, Genuine Parts can return a lot of capital to shareholders. While the company did buy back almost two million shares of its own stock in 2017, perhaps the most important way Genuine Parts can return capital is through its dividend.

Source: 2017 Investor Presentation

With more than six decades of dividend growth, shareholders can pretty much rest assured that Genuine Parts will increase its dividend every year. Listed below are the company’s growth rates over the short, medium and long term.

Genuine Parts has given shareholders mid-single digit dividend growth over the past 3, 5 and 10 year periods of time. The most recent raise occurred on 2/20/2018 and resulted in a 6.7% dividend increase. This is higher than the average raise for the previous decade. At the current annualized dividend of $2.88, shares currently yield 3.33%.

The best part is that the company has a payout ratio of about 61%. This affords the company more room to grow the dividend in the future.

Let’s examine the company’s earnings performance during and after the Great Recession:

- 2007 earnings-per-share of $2.98

- 2008 earnings-per-share of $2.92 (2.0% decline)

- 2009 earnings-per-share of $2.50 (14% decline)

- 2010 earnings-per-share of $3.00 (20% increase)

Genuine Parts saw a slight earnings decline in 2008 and a more significant decline in 2009. Most companies did see earnings decline in 2009, so this isn’t surprising. While people want to keep their automobiles running, consumers probably held back on buying anything above and beyond what they needed during this time.

Coming out of the recession, Genuine Parts saw strong earnings in each of the next two years. In fact, the company has grown earnings every year since 2009 save for a slight drop in 2016.

So, what type of returns can investors expect going forward?

Valuation & Expected Returns

At the midpoint of the company’s 2018 earnings guidance, $5.675, Genuine Parts shares have a forward price-to-earnings multiple of 15.2. In the past 10 years, the stock has had an average price-to-earnings ratio of 17.0. A price-to-earnings ratio of 17 is a reasonable estimate of fair value for this high-quality company.

As a result, Genuine Parts is valued at a discount of approximately 12% to our estimate of fair value.

Source: ValueLine

Over the past ten years, Genuine Parts has grown earnings per share at a 5.71% clip. The only years that EPS dipped versus the previous year was 2008, 2009 and 2016. That is solid earnings growth even with a recession thrown in there.

In 2017, Genuine Parts repurchased 1.9 million of its own shares. The company also has an authorization to buyback another 17.4 million with no set end date. Let’s assume that Genuine Parts repurchases another 1.9 million shares in 2018. That equates to 1.3% of the stock’s current market cap. It wouldn’t be out of the question for the company to buy back even more stock if the price remains where it is at.

Shares are also yielding above 3%.

Even though the price to earnings multiple is well below the company’s average, let’s assume that it won’t expand from here. In this scenario, investors can expect earnings per share growth, buybacks and dividends to make up the stock’s total return.

- Earnings per share growth of 5%-6%

- Share buyback of 1%

- Dividend yield of 3%

Based on just these figures, investors can reasonably expect Genuine Parts to have a total return of 9%-10% going forward. And this is before the multiple expands. If the P/E grows to align more with its average multiple, then the total returns will likely exceed 10% annually.

Final Thoughts

With the average age of vehicles on the road growing, customers are going to need replacement parts to keep them running. With well-known brands in North America, Europe and Asia-Pacific, Genuine Parts has an opportunity to expand its market share even further.

Very few companies can touch Genuine Parts’ history of dividend growth. The company continues to reward shareholders with mid-single digit dividend growth that is powered by solid earnings growth. Genuine Parts has a juicy dividend and the authorization to buy back a large amount of its own stock. To top it off, Genuine Parts’ shares trade below the stock’s historical P/E and the S&P 500 index on both a trailing and forward basis.

Market dominance, history of dividend growth and valuation make Genuine Parts a buy.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Nate Parsh, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.