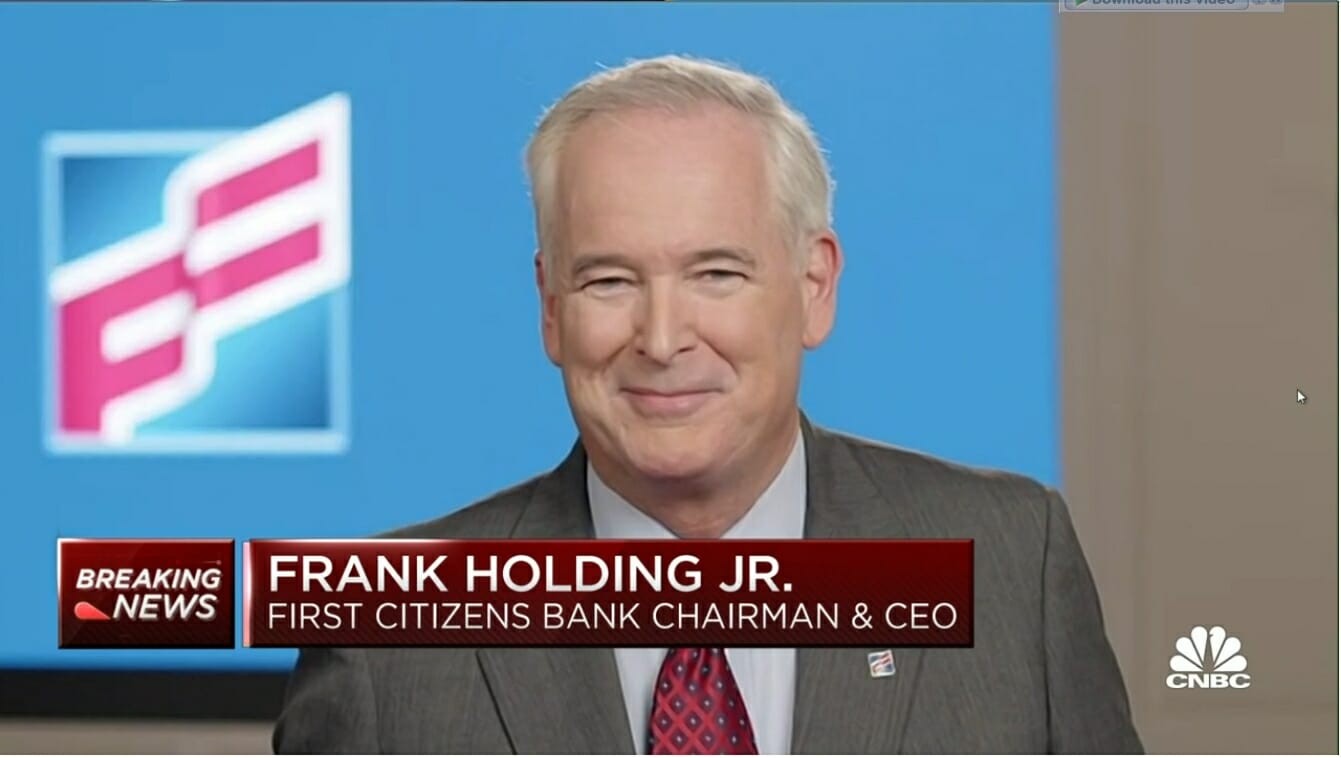

Following are excerpts from the unofficial transcript of a CNBC interview with First Citizens Bank (NASDAQ:FCNCA) Chairman & CEO Frank Holding Jr. on CNBC’s “Squawk Box” (M-F 6AM – 9AM ET) today, Monday, March 27th about agreeing to buy assets of Silicon Valley Bank.

First Citizens Bank CEO On Silicon Valley Bank Asset Purchasing

Q4 2022 hedge fund letters, conferences and more

Holding On Depositors

FRANK HOLDING: This is a remarkable transaction in partnership with the FDIC that should instill confidence in our deposit system and it’s also a great example of where regulators and banks come together to protect depositors.

Holding On Bid Process

HOLDING: We’ve been through this before. We go through a competitive process, bid process and we like to think that our competitive bid was not just the function of the quality of bid we put and the competitiveness of it but also the strength and stability and soundness and expertise that we bring to the transition which we think adds stability to our industry.

Holding On First Citizens Bank’s Core And Silicon Valley Bank

HOLDING: At our core, we are a conservative relationship bank and what we see at Silicon Valley is a real passionate commitment around their customer service and will find much more in common here than not.

Silicon Valley Bank brings to us, overlaps our strengths in private banking, wealth management, and small banking, small business banking. What we look forward to learning and listening is their market expertise in serving the tech and venture market and we will be adding a lot of associates in that, with that capability.

Holding On Liquidity

HOLDING: We have ample liquidity and capital in this market place and we are working with the FDIC and we both agree we have the strength and stability to handle this transaction and we look forward to adding a lot of clients today and we’re meeting a lot of new associates.