The latest issue of ‘The Globe‘, Eurizon monthly publication describing the Company’s investment view. In this issue, a focus is dedicated to “the narrow soft-landing path”.

Scenario

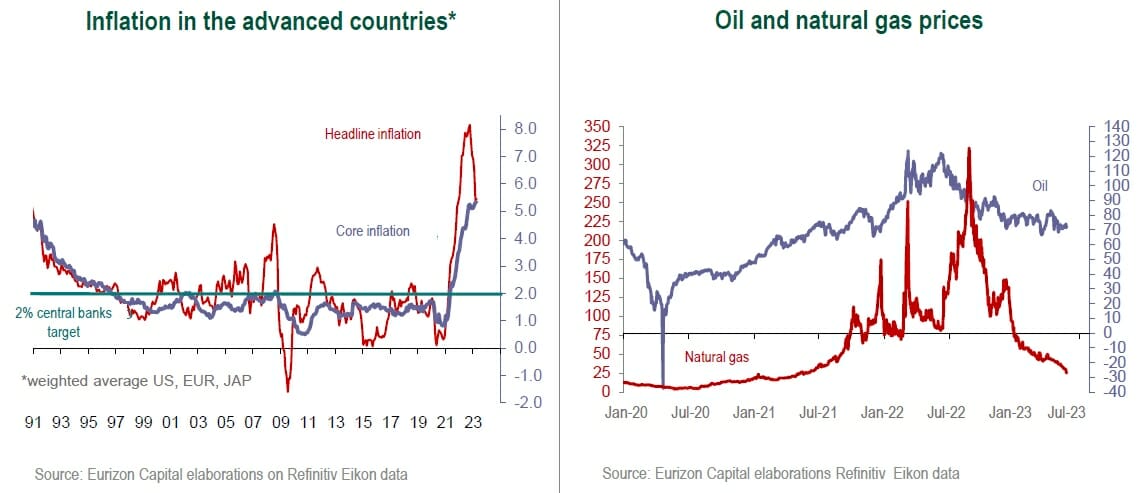

The macro picture is characterised by a sluggish decline of inflation and a slowdown of economic growth, that remains positive nonetheless.

The drop of inflation mostly reflects the reduction of energy prices, whereas core component price increases are still higher than in the pre Covid period. Economic activity, on the other hand, is slowing but still sufficiently strong to keep the labour market in expansionary territory.

In the eyes of the central banks, the downward trajectory of inflation is reassuring, although the slow pace of the decline and the resilience of economic growth suggest a still cautious approach to rates.

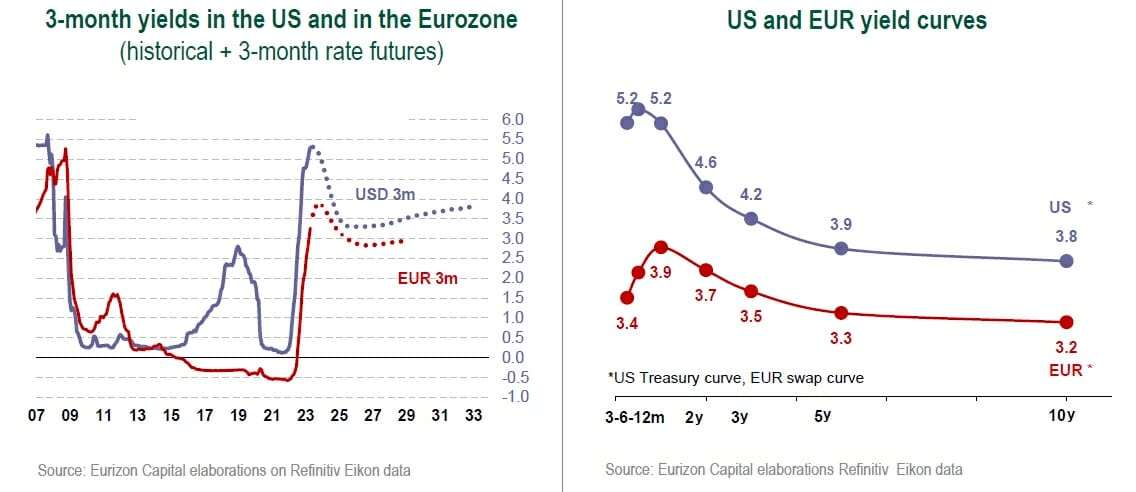

Consensus on the monetary market is mid way between the Fed staying on hold for the rest of the year or proceeding with one final 25 basis points hike between June and July. As regards the ECB, the monetary market is pricing in two 25 basis points hikes, one in June and one in July, after which the ECB will stay on hold. These expectations are consistent with a soft landing scenario for economic growth, to be verified in light of forthcoming data on inflation and economic growth.

China is not commanding much attention at present, confirmed to be back on the recovery after the scrapping of the “Zero Covid” policy, but without the excesses seen in the US and in the Eurozone. Russia’s war on Ukraine is also on the backburner , as the impact on oil and gas prices has decreased for some time.

Macro Economy

- Economic growth slowing, but still positive, with inflation on the decline but still well above the central bank target rates

- Monetary market futures are pricing in a completed monetary restriction cycle on the Fed’s part, with the ECB following by th e e nd of July.

Asset Allocation

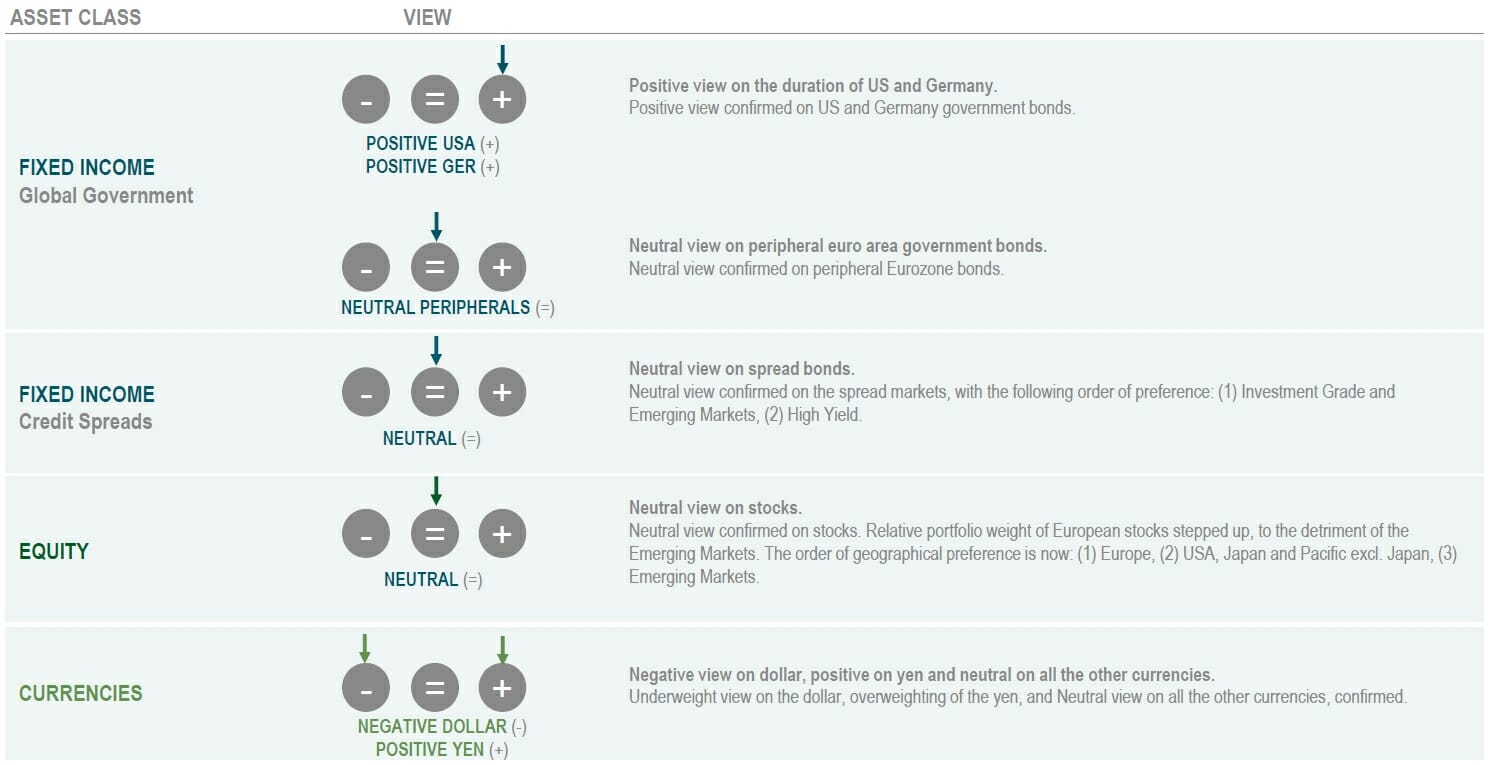

- The slowdown of the economy, easing inflation, and the forthcoming conclusion of the monetary restriction make the core bond markets appealing.

- Risk assets offer appealing valuations, but could be confirmed volatile in waiting to assess the scope of the macro slowdown.

Fixed Income

- Overweighting view confirmed on USA and German government bonds, that offer appealing yield to maturity and can provide protection in case of a macro slowdown.

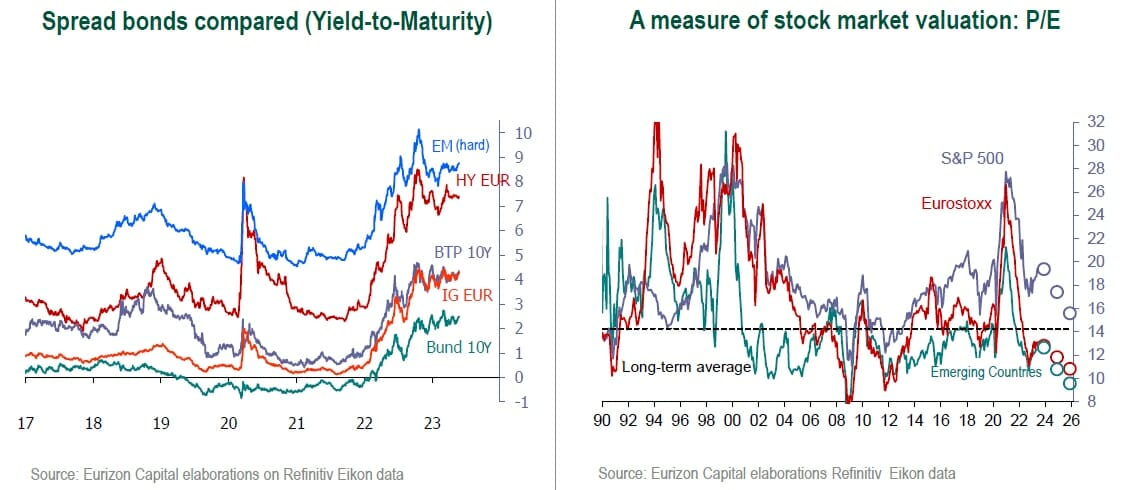

- Preference confirmed among spread bonds for Investment Grade and Emerging Market bonds, as opposed to lingering uncertainties in the High Yield segment. Neutral position on Italian government bonds.

Equity

- Stock market valuations are at historically appealing levels, but the risk of a sharper than expected macro slowdown could generate volatility.

Currencies

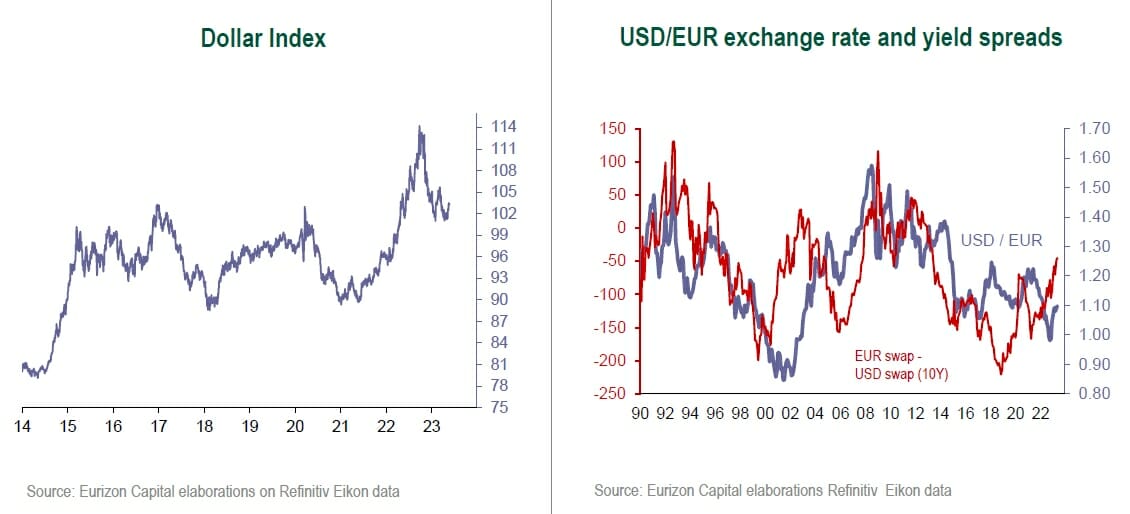

- The lagged inflation cycle in the Eurozone compared to the US may result in the ECB’s monetary restriction proving longer tha n t he Fed’s, supporting the euro against the dollar.

- Scenario uncertainties and the change at the helm of the Bank of Japan could be supportive factors for the yen.

Investment View

The baseline scenario points to slowing economic growth and declining inflation, albeit still higher than central bank target ra tes. In light of the present picture, we confirm our Overweight view on US and German government bonds, and our Neutral stance on stocks and sprea d b onds, that could continue to prove volatile in waiting to assess the scope of the macro slowdown.

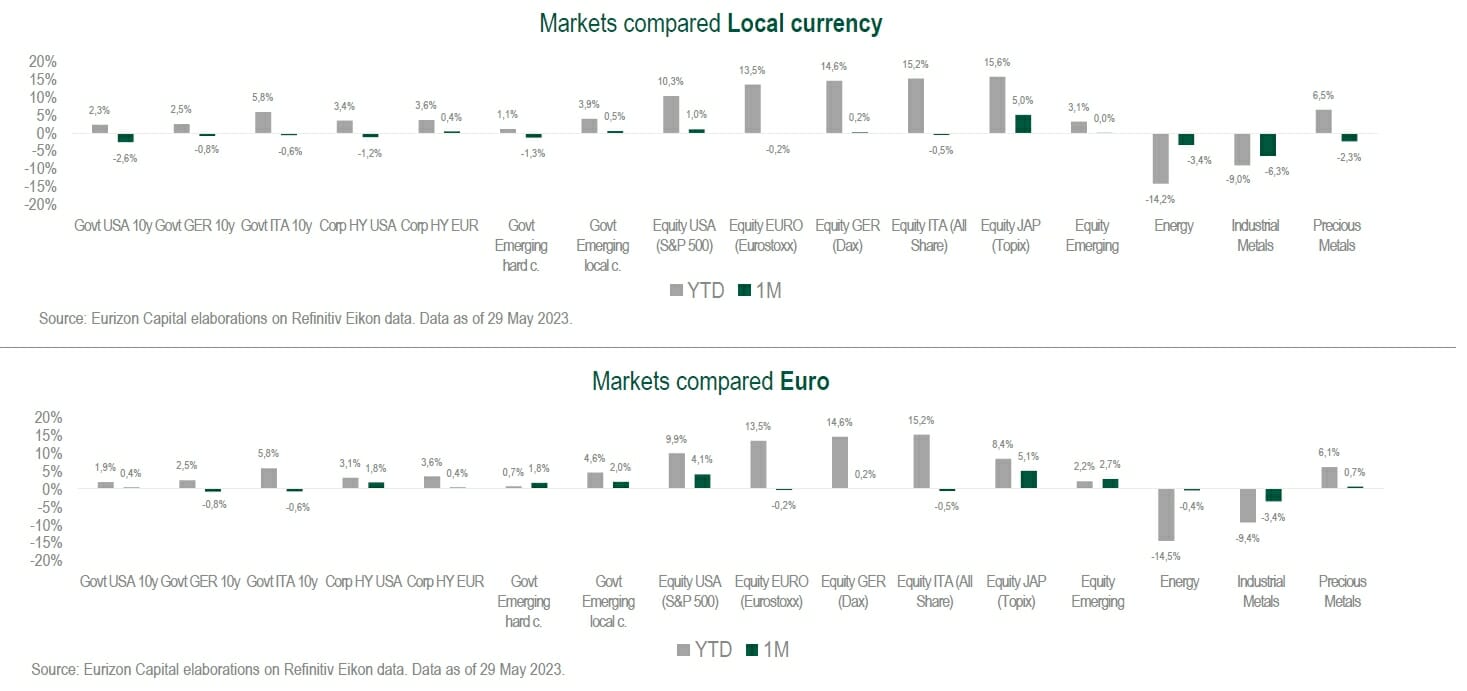

Asset Classes Compared

Government rates rose back up in May, especially in the US on the shorter end of the maturity curve. Yield to maturity levels re main below the highs marked at the beginning of March in any case across maturities, and the US and German curves remain inverted. Eurozone and credit market spreads were little changed. Positive balance for the stock markets, close to their highs for the year. Dollar strengt hen ing, up to 1.07 against the euro.

Theme Of The Month: The Narrow Soft-Landing Path

Inflation is still the main variable in the spotlight for the macro scenario.

Price growth has evidently changed direction: inflation was at 10.6% in the Eurozone in October and is now at 7.0%; it was 9.1% in the US in June last year, and was at 4.9% in April 2023, the latest available reading. However, the normalisation process cannot be considered complete, as inflation is still well above the 2% mark, considered ideal by the central banks, and because the decline is almost exclusively due to the drop of commodity prices, while the core components remain under pressure.

The likeliest scenario is that the moderation of prices at the source, and energy prices in particular, will gradually dampen the other components. However, the disinflation process takes time, especially because economic activity is still expanding, and this allows the sectors that have incurred price increases in the past year to keep transferring them downstream.

The main element of reassurance is the fact that inflation at the source, i.e. on commodities, has eased for several months now. Proof is provided by the price of oil, that has been between 70 and 80 dollar per barrel for several months, and by low and still declining natural gas prices.

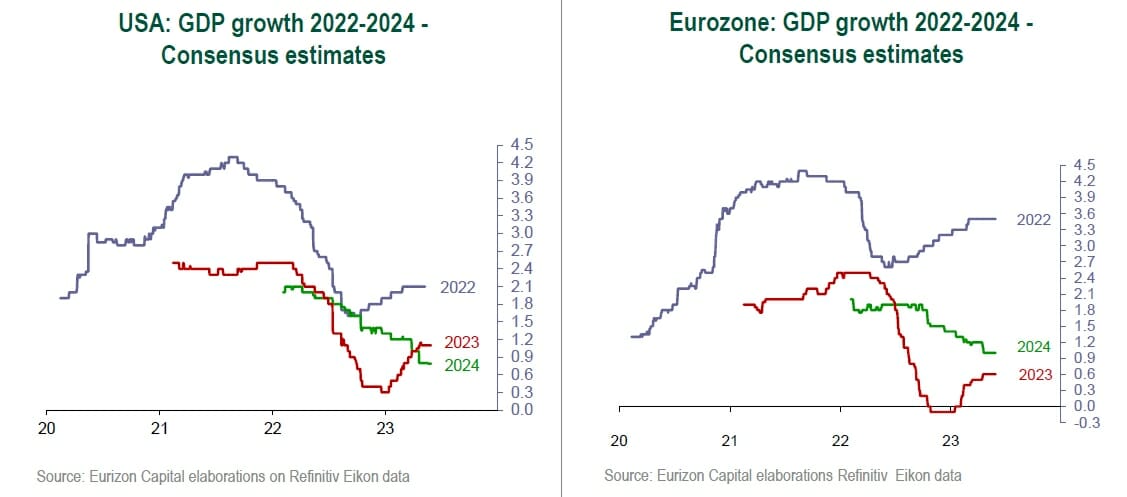

The luckily, or unfortunately, economic growth is standing up egregiously to the sharp monetary restriction implemented over the past year.

“Luckily” as no-one loves a recession. “Unfortunately” as with a slightly more pronounced slowdown of economic activity the inflation flare-up would already be over, with all the positive fallout this would have implied on the conduct of central banks. The soft-landing path is a narrow one, flanked by a hot economy on the one side, and the risk of a recession (hard landing) on the other.

However, data released over the past few months suggest that a soft landing is possible. For the US as well as for the Eurozone, growth estimates for 2023 have been systematically revised upwards since the beginning of the year, from the zero mark they had reached at the end of 2022.

However, a certain degree of uncertainty between a soft- and hard-landing outcome will linger for some. After the banking sector turbulences in mid-March, in the US the credit squeeze is adding its effects to the monetary restriction, while in the Eurozone the ECB has not yet closed its hike cycle. In these conditions, the risk of a sharp slowdown is not ruled out from forecasts, but only pushed back. Until the central banks announce that the fight against inflation has been won.

Monetary policy expectations reflect this still evolving context. The central banks consider the fight against inflation to be at an advanced stage, but not yet complete.

For what concerns the US, where fed funds rates are already above 5%, consensus estimates are mid-way between pricing in a Fed on hold for the rest of the year, and one final 25-basispoints rate increase in June or July. Future contracts point to a decline of rates to 3% in 2024, a normalisation that would be in order if inflation is under control by them. For the ECB, expectations point to two 25 basis points increases, followed by a hiatus for a few months, and a 2024, in this case as well, in the name of normalisation.

The shape of the bond rate curves is also consistent with this interpretation. Short- and medium-term rates have reached levels at which the monetary market prices in the end of the restriction, in the 5% area in the US, and in the 4% area in the Eurozone. Longer-term rates, at lower levels than short-term rates, are pricing in a normalisation of the monetary market rates in 2024, once inflation will have been defeated.

From the investor’s perspective, the short and medium ends of the bond curves are interesting to cash in, with relatively low volatility, abundantly positive yield-to-maturity levels. The long ends hold strong downside potential (capital gains) in the event of a hard landing of the economy.

Risk assets combine appealing valuations with a still uncertain macro context, that may rekindle volatility.

Among corporate bonds, Investment Grades offer an appealing risk-return profile with historically high yield-to-maturity levels and spreads that are already pricing in a certain degree of economic slowdown. High Yield bonds would be at greater risk of volatility in case of an adverse macro scenario materialising. Among spread bonds, appeal is found in those issued by the emerging economies, where the central banks hiked rates aggressively before the Fed and the ECB and now have room for accommodation in the event of a sharp slowdown of the economy.

For what concerns stocks, absolute valuations (price/earnings ratio) and relative valuations (risk premium versus the government benchmark) seem appealing in historical terms and consistent with medium-term returns in line with long-term averages. A potential extension of the monetary restriction or, by contrast, a sharp slowdown of the economy, may rekindle volatility, dampened of late by expectations for a soft-landing scenario to prevail.

The hot economy, i.e. the fast and inflationfuelling exit from the Covid-induced recession, supported the dollar, that strengthened both in 2021 and in 2022. There were two reasons behind the upswing: among the central banks of the advanced countries, the Fed was the one that led the way on interest rates; secondly, the uncertainty generated by the inflation flare-up enhanced the dollar’s role as a shelter currency.

As soon as the hot economy showed signs of abating, at the end of 2022, the dollar lost strength, although it has recently stopped declining.

Under our baseline scenario, that contemplates a gradual easing of inflation and an orderly slowdown of the economy, the decline of the dollar should resume, thanks to a lower level of uncertainty. On the other hand, the dollar could prove weaker under the alternative scenario as well, i.e. a hard landing of the economy, under which at some point the Fed could decide to cut rates sooner and more rapidly than the other central banks, also taking advantage of the weak exchange rate to support the national economy.