The latest issue of ‘The Globe‘, Eurizon monthly publication describing the Company’s investment view. In this issue, a focus is dedicated to “still hawkish tones from central banks”.

Scenario

Inflation has kept falling in the past month, but the central banks have remained hawkish, especially in words. The resilience of economic growth is a useful ally for the Fed and the ECB, that are prepared to overshoot with their restriction to make sure inflation is definitively placated.

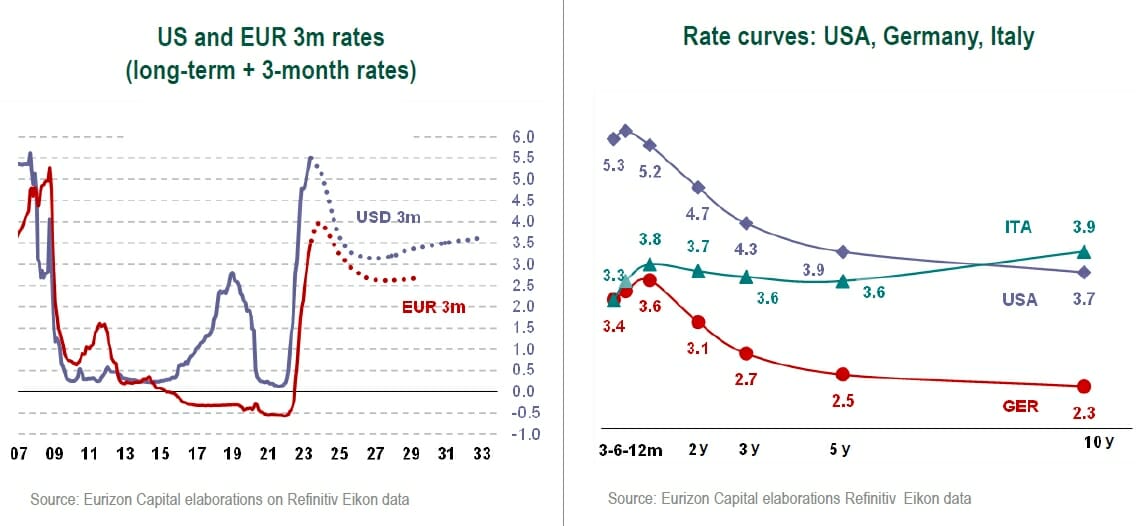

The Fed has made it known it intends to hike rates again after pausing in June, but the market has only partly embraced this outcome and is attaching a high probability to the possibility of the Fed’s hike cycle having now ended. On the ECB front, the market is fully pricing in two further rate hikes, but then expects rates to stay put from the autumn onwards. Based on monetary market expectations, in 2024 interest rates will drop.

This scenario will have to be validated by inflation data, as the core components will have to replicate the disinflation already displayed by energy prices. Labour market data will also be in the spotlight, and a weakening could reignite fears of a hard landing of the economy.

China is not commanding much attention in the present phase, confirmed to be back on the recovery after the scrapping of the “Zero Covid” policy, but without the excesses seen following reopenings in the US and in the Eurozone. Russia’s war on Ukraine is also on the backburner for the markets, even after the coup attempt, as the impact on oil and gas prices has decreased for some time.

Macro Economy

- Inflation on the decline, but still above central bank targets; economic growth is slowing, but is proving resilient despite the monetary restriction.

- The Fed could hike rates again after pausing in June, but Fed Funds futures reflect only partial belief in this possibility; as regards the ECB, the market is pricing in two final increases.

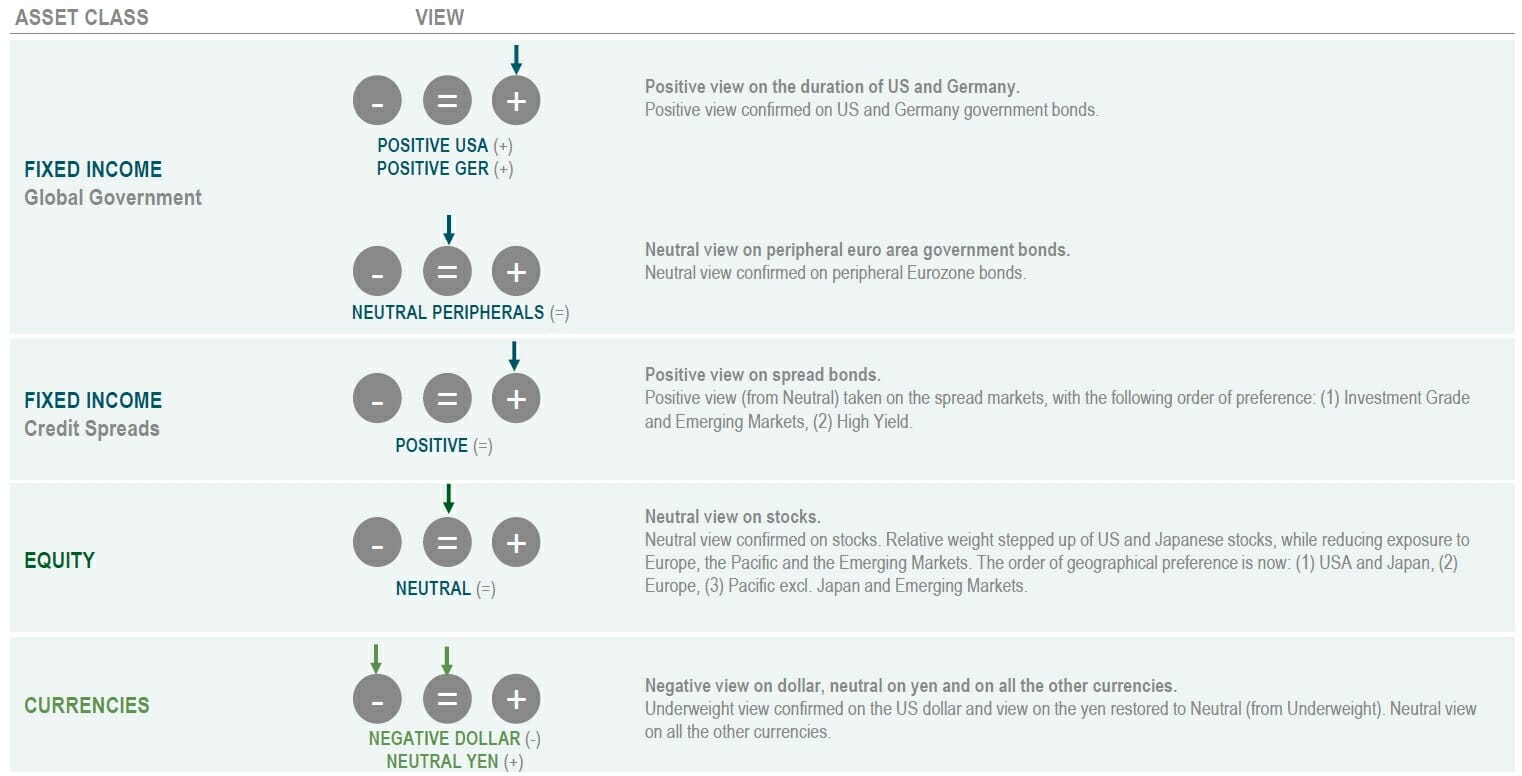

Asset Allocation

- The combination of high yields to maturity on the short medium segments of the curve, and expectations for the macro slowdown to continue, make the core bond markets appealing.

- Risk assets offer appealing valuations, but could be confirmed volatile in waiting for the central banks to complete the monetary restriction process.

Fixed Income

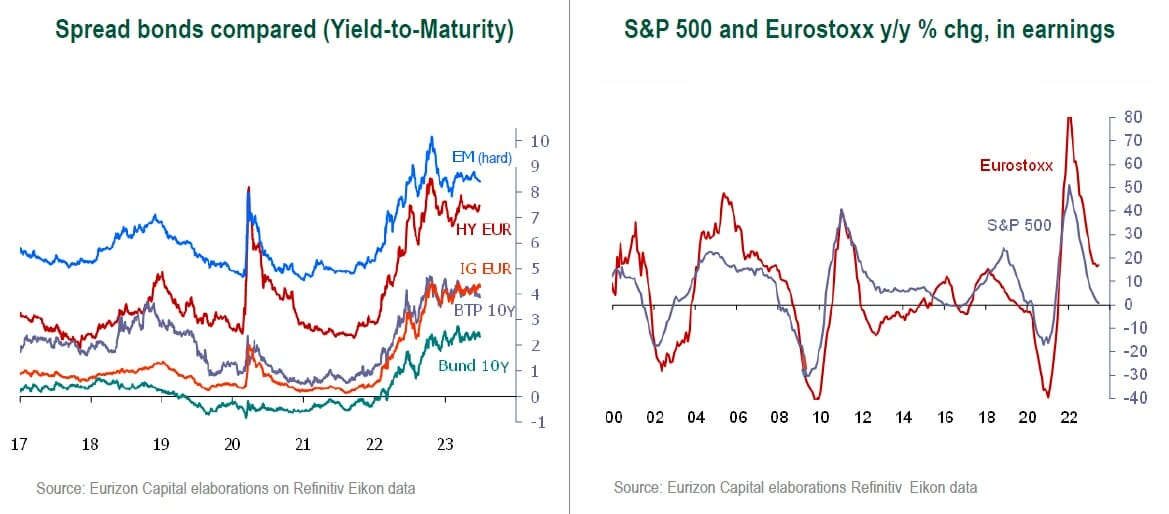

- Overweighting view confirmed on USA and German government bonds, that offer appealing yield to maturity and can provide protection in case of a macro slowdown.

- Preference confirmed among spread bonds for Investment Grade and Emerging Market bonds, as opposed to still Neutral views on High Yields and Italian government bonds.

Equity

- Stock market valuations are at historically appealing levels, but the risk of a sharper than expected macro slowdown may be a source of volatility.

- By geographical region, our relative preference goes to the USA and Japan.

Currencies

- The lagged inflation cycle in the Eurozone compared to the US may result in the ECB’s monetary restriction proving longer than the Fed’s, supporting the euro against the dollar.

Investment View

The baseline scenario features a sluggish decline of inflation and a slowdown of economic growth, still positive nonetheless. Resilient economic growth is prompting a still hawkish policy approach, at least verbally, by the central banks, although according to the basel ine scenario monetary restriction is heading towards completion. Positive view on US and German government bonds, as well as on spread bonds, as opposed a still Neutral view on stocks, that could be confirmed volatile in waiting for monetary restriction to end.

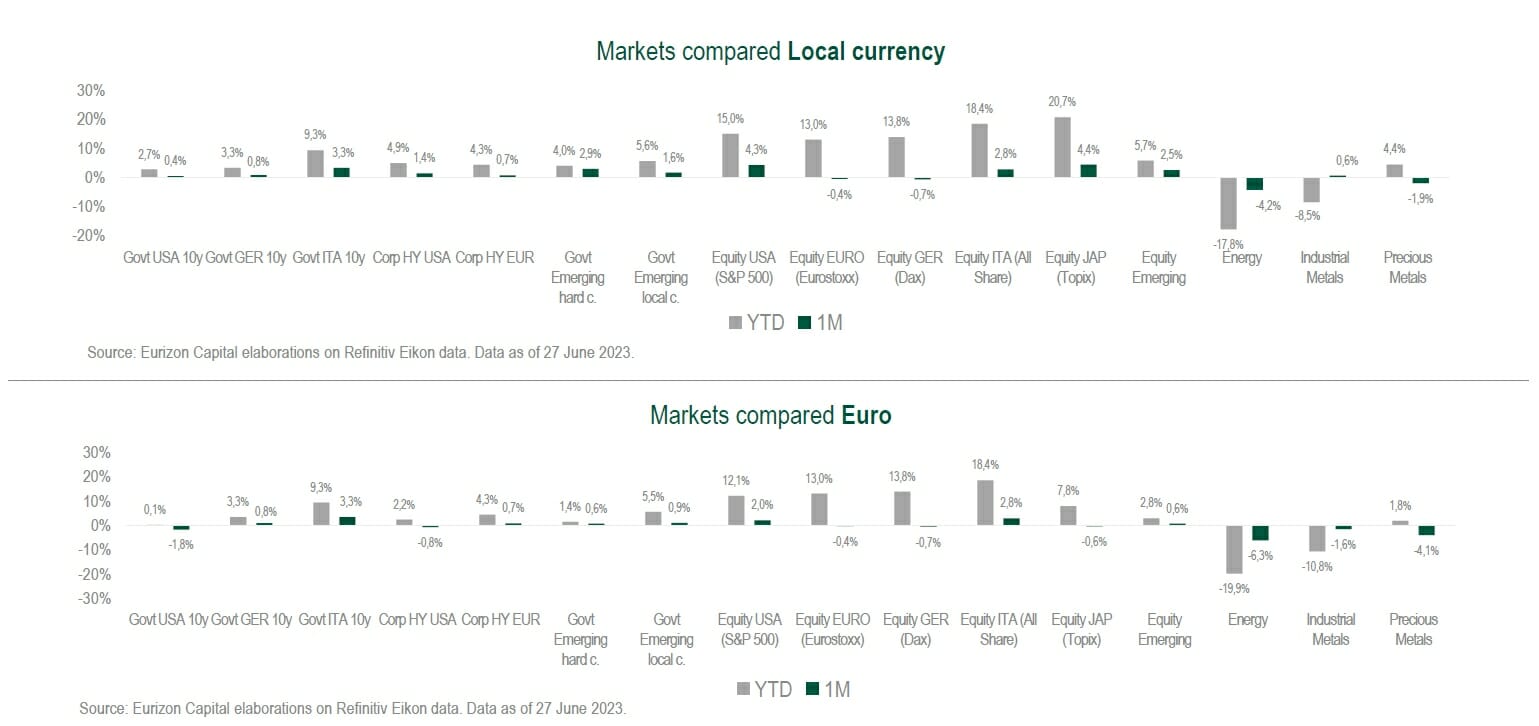

Asset Classes Compared

Government bond rates rose back up on the shorter end of the maturity curves in June, as opposed to little changed longer maturities. The inversion of the US and German curves is again extreme, as was the case already in mid March. Risk assets performed positively, with tighter spreads both in the Eurozone and for the credit and emerging components. Stock markets up. Dollar on the decline, back to 1.10 a gainst the euro.

Theme Of The Month: Still Hawkish Tones From Central Banks

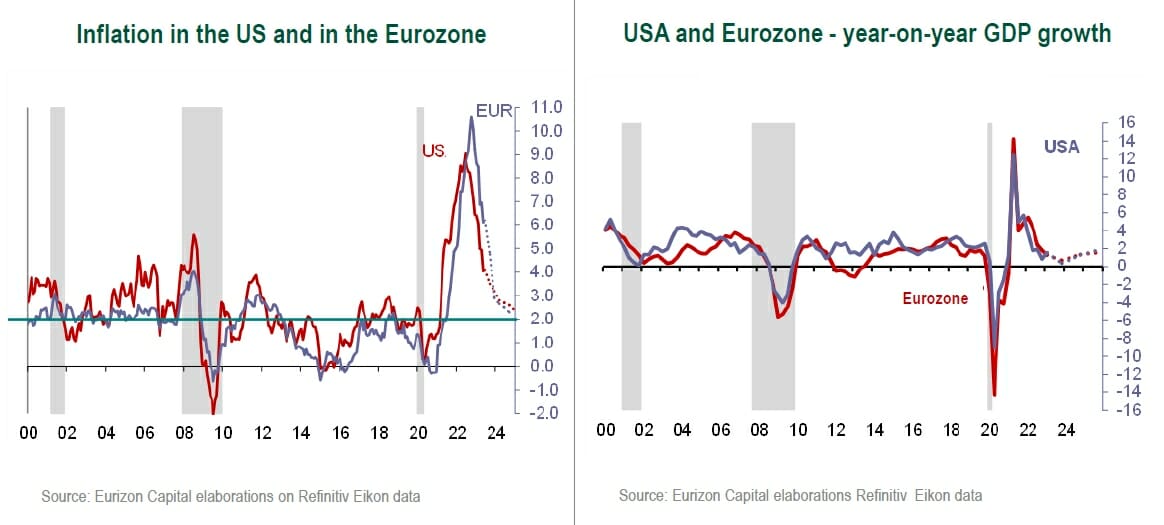

Inflation fell further in May, based on the latest available data, and is now at 4.0% y/y in the US and at 6.1% in the Eurozone. The decline is by no means negligible, considering that inflation had peaked at 9.1% in the US and at 10.6% in the euro area. However, a decline is not enough to consider the inflation flare up as overcome , especially when considering that much of the drop is explained by the normalisation of energy prices, while the core components are still rising too strongly.

In any case, the market remains convinced that inflation is now assuredly heading for 2%. Consensus estimates point to a decline of inflation over the next year and a half, to around 2% in both the US and in the Eurozone at the end of 2024.

For what concerns economic growth, the aggregate estimates drawn up by forecasters outline as the baseline scenario a continuation of the orderly slowdown, to close to zero at the end of 2023, subsequently achieving a low but stable cruising speed in 2024 and 2025.

While the gradual decline of both inflation and growth is an ideal combination , the spotlight remains on core inflation data , that will have to replicate the disinflation already displayed by energy, and on labour market statistics , a weakening of which would heighten focus on the risk of a hard landing.

For the time being, the central banks have not been won over by the fall of inflation and continue to use hawkish tones. In essence, however, the Fed did not hike rates in June, after 10 consecutive moves. The ECB implemented a 25 basis points increase, but started slowing the pace of the hike cycle several months earlier.

Going forward, the Fed has indicated it intends to hike rates again twice this year. The markets only believe this outcome in part and, save for particularly strong labour market or inflation data, think the Fed may have already ended its restriction . The ECB has generically declared that it intends to keep tightening monetary conditions. The market has quantified these intentions in two increase by the autumn.

Therefore, we are in the final stages of an accelerated monetary restriction phase, that began over a year ago. In all likeliness, 2024 will be a year in which interest rates decline , both because inflation will be tamed (soft landing scenario), and because the need will arise to contain the macro slowdown (hard landing scenario).

In both cases the bond market , on which short and medium term rates have returned to levels in line with their highs for the year (without beating them), seems interesting. The shape of the US and German curves, ultra inverted, supports the view that the monetary restriction is now coming to an end.

Risk assets have reacted in an orderly manner to the still hawkish tones used by the central banks. In fact, bond spreads have narrowed and the stock markets have risen. This reaction also implies the assumption that the monetary restriction phase is coming to an end, and that the economic cycle will continue.

In the next few months this scenario will have to be validated by inflation and labour market data but may be considered as the baseline scenario in a medium term perspective.

Among corporate bonds, Investment Grades present an appealing risk return profile, with high yields to maturity and spreads that are already pricing in a certain degree of economic slowdown. High Yield bonds, on the other hand, are at higher risk of volatility. Emerging economy bonds hold appeal , as the central banks in the emerging countries have a margin to accommodate a potential slowdown of the economy.

As regards stocks , absolute valuations (price to earnings ratio) and relative valuations (risk premium vs. the benchmark sovereign bond ) are consistent with medium term yields in line with long term averages. However, the potential extension of the monetary restriction phase or, at the opposite, a sharp slowdown of economic growth, could reignite volatility , subdued of late, as expectations are for the soft landing scenario to prevail.