Eletromidia (BVMF:ELMD3) is Brazil’s largest Out-Of-Home (OOH) advertiser. The company has a monopoly in the space, commanding ~84% of the country’s digital advertising inventory and 45% of total ad inventory.

Q1 2021 hedge fund letters, conferences and more

Digital OOH advertising will grow disproportionately higher than its static competition over the next few years. This will allow ELMD3 to capture unfair market share gains, above-average revenue growth, and large profits.

Brazil is the seventh-largest advertising market globally and the largest in Latin America, with total advertising revenues of $12.3 billion at the end of 2020. As Brazil’s largest OOH advertiser, its inventory serves customers in a predictable, non-invasive medium like outdoor furniture, elevator doors, and airport terminals.

Our Variant Perception: OOH Advertising is transforming from a static billboard model to a digital-first “panels” business. ELMD3 is the clear leader in this digital transformation. For example, 68% of the company’s inventory is digital, compared to only 3% from its nearest competitor.

This digital advantage makes ELMD3 the obvious choice to provide better data, better insights and allow seamless ad customization that its static-based competitors can’t match. Finally, customers love working with ELMD3, as shown by the company’s 100% contract renewal rate since 2013 and 9YR average contract relationship.

A New-Wave ‘Roaring 20’s’ means even more socialization, interaction, and congregation around public places. Places where ELMD3 has ample ad inventory to sell to customers.

The company’s projected to hit ~R$ 680M in revenue by 2022 with 30% run-rate EBITDA margins. By 2025, we see a path towards R$ 1B in revenue and R$ 290M in EBITDA. In other words, you can buy ELMD3 for <10x our estimate of 2025E EBITDA. The current stock price implies a potential 58% upside, assuming an average ~15x exit EBITDA multiple.

OOH Advertising In a Post-COVID World

COVID-19 crushed OOH advertising spending, with sales falling ~23% in Brazil last year. In effect, OOH was the worst-positioned advertising medium imaginable given the COVID-19 restrictions.

There are three specifics reasons for the abnormal decline:

- Demand: Local businesses account for ~60% of OOH sales

- Supply: Foot traffic collapsed (and in some cases went to zero) in the highest-density OOH advertising spots (public transport, airports, etc.)

- Vertical Exposure: 3/5ths of OOH top ad spenders were most affected by COVID (Entertainment/Movies, Retail, and Tourism)

This year should look significantly different than 2021. People are vaccinated. There’s massive pent-up demand for traveling, shopping in-person, and experience “normal” life again.

MAGNA, a global media data company, predicts a substantial 11% growth rebound in 2021 OOH ad spending. These pent-up demands directly benefit ELMD3’s available inventory, making the company the go-to OOH advertising solution in Brazil.

ELMD3: The Default OOH Advertising Solution

ELMD3 satisfies two of the most pressing questions for customers purchasing OOH advertising: Reach and Location. They attract a daily audience of 22M+ Brazilians (reach) through five main channels (locations):

- Transport: 6M people

- Elevators: 5M people

- Shopping malls: 3M people

- On the streets: 7M people

- Airports: 80K people

The company owns 55.4K panels to service its 22M+ daily audience. 44% of its panels go to Transportation, 37% in Elevators, and 15% placed in airports. Remember, our assumption is that ELMD3 is the clear industry leader in Brazil to service OOH advertising customers. The company’s next closest competitor owns ~40% of ELMD3’s inventory or 22K panels.

While ELMD3 clearly wins in sheer size (number of panels), the most important figure is the company’s digital panels as a percentage of total panels. As we mentioned earlier, 68% of ELMD3’s panels are digital. In addition, the company outlines four reasons why digital boards make for better advertisement platforms (from Preliminary IPO, emphasis mine):

- Allow greater use of creativity in campaigns, generating greater impact on the audience with the use of moving images

- Serve ads through videos that cannot be interrupted

- Greater flexibility and dynamism of campaigns due to the efficient distribution of content to digital screens through our operations center at our headquarters

- Analysis of campaign data.

ELMD3 has 22.6x as many digital screens as a percentage of its total inventory compared to its competitors.

Ask yourself, which OOH advertiser would you choose? It’s a no-brainer. You’d select ELMD3.

Some of the world’s largest tech companies would agree, including Twitter, Airbnb, Apple, Spotify, Uber, Netflix, and Amazon.

Low Penetration Rates & Digital OOH Growth

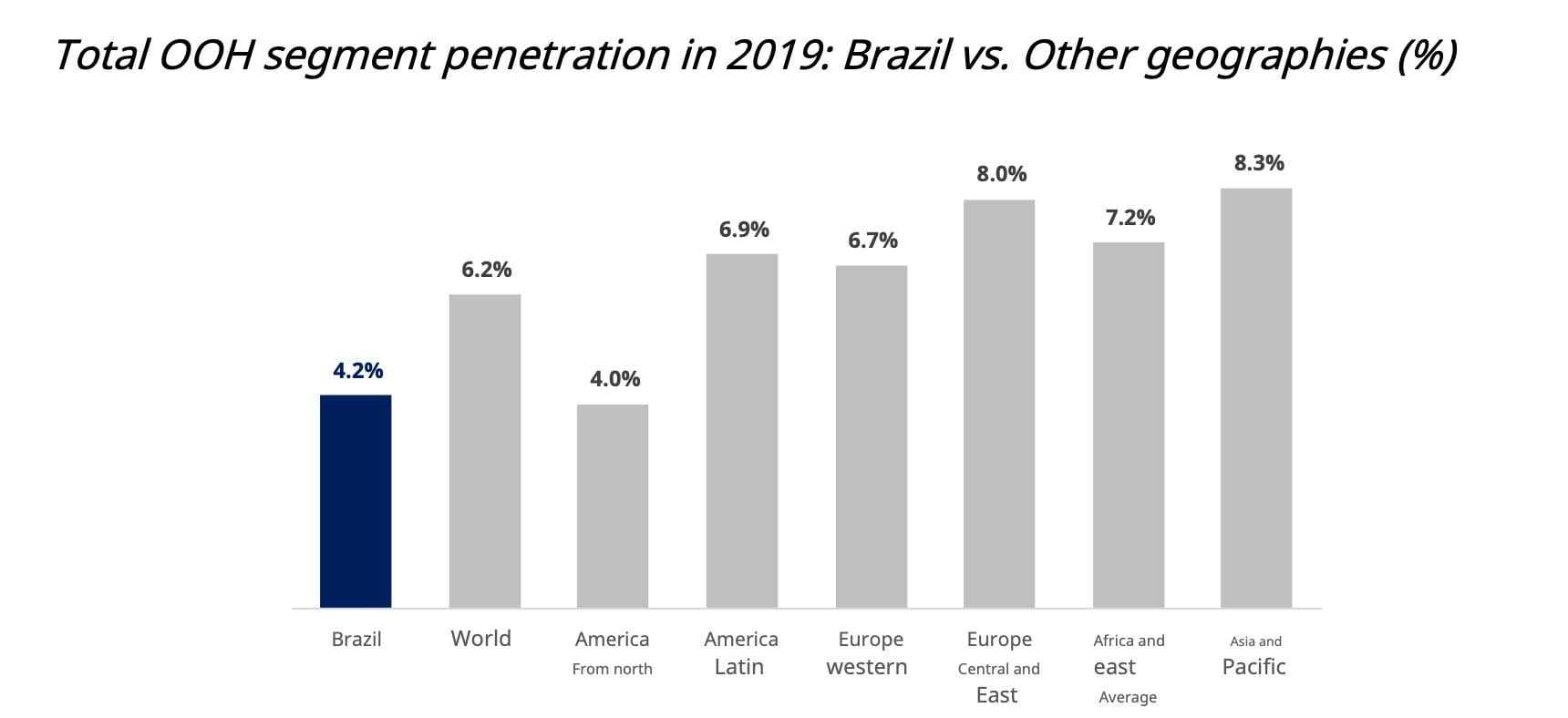

OOH is one of the smallest advertising segments in Brazil, generating ~4.2% of its ad revenue from the category. However, other regions command much higher OOH penetration rates. For example, Asia and Central/Eastern Europe generate 8%+ from their OOH segments.

The average OOH penetration rate in Latin American countries is 6.9%. As the largest advertising market in Latin America, Brazil’s OOH segment is perfectly positioned to capture significant revenue growth as advertisers make the switch to digital panels. ELMD3 is the best-positioned company to capture that penetration rate increase.

Digital is the future in OOH advertising, and we’re seeing that trend manifest in the growth data. For example, between 2013-2019, digital OOH advertising revenue grew at a 15.8% CAGR — doubling traditional OOH’s 7.5% growth rate. Currently, Digital represents ~40% of Brazil’s ~R$ 2B OOH market.

Between 2020-2024, Magna estimates that Digital OOH will grow at an 11.1% CAGR compared to traditional OOH’s 2.9% growth. These growth rates have massive implications for Brazil’s OOH industry.

Remember, ELMD3 has 37K digital panels (68% of inventory). Its closest competitor has 660 digital screens. In other words, ELMD3 owns more digital panels than the sum of its nearest competitor’s total inventory.

That’s 800bps of growth differential that will unfairly favor ELMD3’s inventory over its competitors. It’s easy to predict which OOH company will come out on top given those growth rates: the one with the most digital inventory.

ELMD3 Growth Levers

There are three main levers the company can use to grow:

- Rise of new Screen-able Items/Furniture

ELMD3 recently signed a contract with TemBici, a bicycle-sharing company, to install 310 screens on its bike stations. You can see a video of the screens and bike stations here. The broader point here is that any new street “furniture” has the potential to increase ELMD3’s installed panel base.

- Organic growth from existing mediums and new infrastructure

The company has significant room for growth within its existing mediums. Here are ELMD3’s current penetration rates as a percentage of total available advertising contracts: Elevators (15%), Newsstands (22%), and Malls (26%).

Another avenue for organic growth lies in new infrastructure builds (I.e., new “furniture”). In addition, the company has a line of sight to a new public and private concessions pipeline for the next 5 years. Most of these projects involve airports and “street segments,” two of ELMD3’s most prominent mediums.

- Inorganic acquisitions and International Expansion

OOH Advertising is a fragmented market. ELMD3 has used such dynamics to acquire five companies over the last few years. In addition, the company’s identified 17 additional acquisition targets: 10 in street segments, 4 in Brazilian airports, and three in elevator and transports.

The company is also looking outside Brazil to expand its Latin American foothold. So far, ELMD3 has identified four countries: Mexico, Chile, Colombia, Peru, and Argentina.

What’s ELMD3 Worth?

Before COVID, ELMD3 grew at a robust 44.6% revenue CAGR while Gross Profit margins declined to more normal industry averages (40%). So let’s ask ourselves two questions:

- Will OOH Advertising become a smaller or larger industry post COVID?

- Will ELMD3 become a larger or smaller player in Brazil’s OOH Advertising market post-COVID?

We can answer “yes” to both questions. First, the Magna data shows a robust post-COVID rebound in OOH Advertising Revenue, especially from the Digital OOH segment.

ELMD3 owns 84% of Brazil’s digital OOH advertising inventory. As a result, most of Brazil’s Digital OOH growth will flow to ELMD3, making them a significantly larger player in the space.

Let’s assume the company grows ~33% per year for the next five years and ends 2025 with 25% EBITDA margins. While 2022-2023 estimates indicate 30-33% EBITDA margins, we’re choosing a more historical average. So in the above scenario, we end 2020 with ~R $1.1B in revenue and R$ 290M in EBITDA.

What would a reasonable buyer pay for this company? There are a few public comps we can use:

- JCDecaux SA (DEC): 36x NTM EV/EBITDA

- Ströer SE & Co. KGaA (SAX): 11x NTM EV/EBITDA

- Lamar Advertising (LAMR): 19x NTM EV/EBITDA

Let’s assume a buyer would pay ~15x EBITDA for ELMD3. There’s a strong argument that 15x is too low given ELMD3’s monopoly on Brazil’s digital panel inventory.

Anyways, 15x 2025 EBITDA gets us ~R$ 4.35B in Enterprise Value. Add back ~R$ 37M in net cash, and you get R$ 4.4B in Shareholder value, or R$ 32/share. That’s a 62% upside from the current stock price.

Risks

There are a few significant risks to the bull thesis. First, the company relies on inorganic acquisition growth. Failure to consolidate the OOH advertising industry could dampen future revenue growth rates.

Second, ELMD3’s gross margin decline is worrisome. We shouldn’t see GM % decline past 30-35% on a run-rate basis, and any drop below should be a red flag.

Finally, customers could decide to stop using OOH advertising and opt for smartphone/mobile-only advertising. However, this seems highly unlikely given the shift towards online privacy, making it harder for companies to target specific customers.

Concluding Thoughts

ELMD3 is the best-positioned company to capture the growth in Brazil’s OOH Advertising market. The company owns 84% of Brazil’s digital ad panels when digital OOH will grow nearly 4x as fast as its static counterpart.

This gives ELMD3 an unfair competitive advantage over any OOH advertising company in the country. Customers will choose the company with the highest digital ad space as it offers greater customization, better metrics, and detailed ROAS figures.

When it comes to Digital OOH advertising in Brazil, there’s no better choice than ELMD3.

Article by , Macro Ops