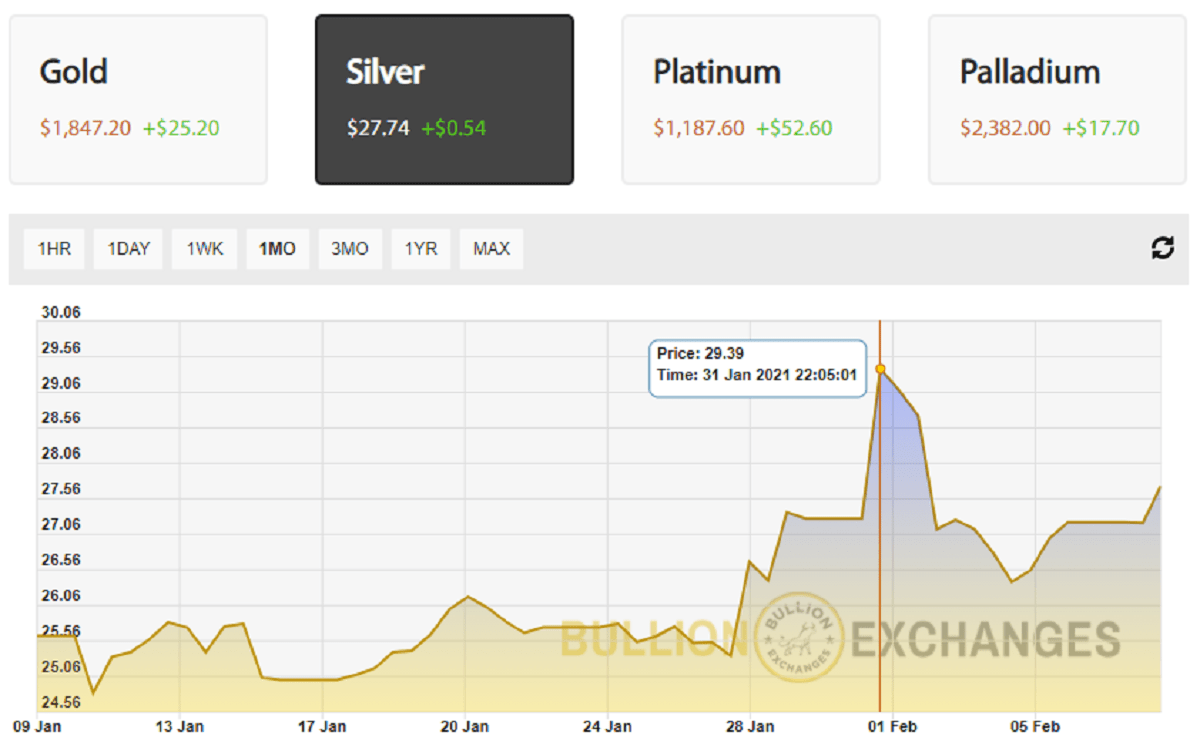

Last week we discussed what Reddit’s WallStreetBets were up to and where they might turn next. At first, many thought it would be the silver price because of previous discussions happening on the subforum. However, the CME Group increased its maintenance margins on Comex 5000 Silver Futures by about 18%, spiking the silver price. It fell the next day, proving that Reddit had little to nothing to do with this. Although the GameStop short squeeze seems to have blown over, retail investors continue to “hold the line.” This is certainly partly owing to Robinhood and other brokers limiting the trade on GME last week. They have since been issued a class-action lawsuit. Because GameStop shares fell more than 50% last Tuesday many are drawing comparisons to the Dot Com Bubble burst of 2000. But what exactly happened back then might not repeat in this case.

Q4 2020 hedge fund letters, conferences and more

In fact, this massive social investing in GameStop, AMC, Nokia, and Blackberry might actually change everything.

What Was the Dot Com Bubble Burst?

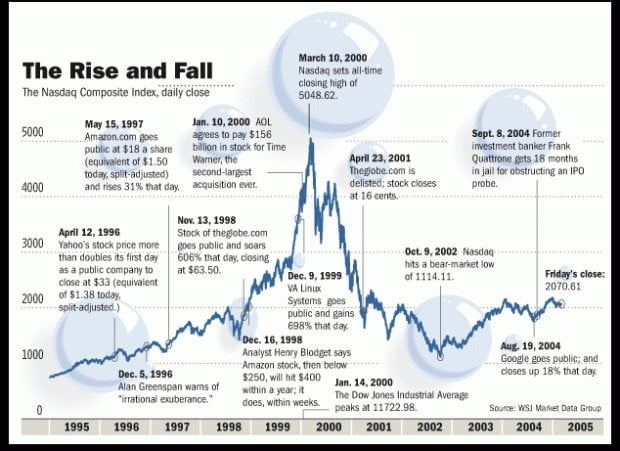

The Dot Com Bubble refers to the rapid rise of US tech stock equity valuations supported by investors going “all-in” on internet-based companies. Since the 90s were a time of rapid technological growth, commercializing the internet was naturally a new horizon. Over exuberant investors hopped on the bandwagon, rapidly expanding capital growth in the US at an unprecedented rate. That being said, the stock market did not surge until 1995 in support of the dot com business.

The Dot Com Bubble resulted from a combo of speculative and fad-based investing, not too dissimilar from what is happening today. Back then, people invested based on overconfidence in the market and speculation. They were also fueled by anxiety to invest in anything that ended in “.com,” anticipating a major profit from the internet wave.

However, the value of equity markets grew way too quickly back then. The Nasdaq rose five-fold between 1995 - 2000. The dot com bubble burst after a peak of 5,048.62 on March 10, 2000, to 1,139.90 on Oct 4, 2002. It took until April of 2015 for the Nasdaq to return to this peak. Back then, many dot coms failed to turn a profit. On top of that, most companies overspent on marketing instead of their product or service, delivering promises they could not fulfill. But the real turning point was when leading tech companies, like Dell and Cisco, placed major sell orders on their stocks in March of 2000.

Source: Twitter

This caused panic selling and after a few weeks, the stock market lost 10% of its value. Many lost money as companies folded after their stocks dried up. Investors left the market. Very few companies remained when the dust settled, but those who remained included Amazon, eBay, and Priceline.

What Happened to the GameStop Stock?

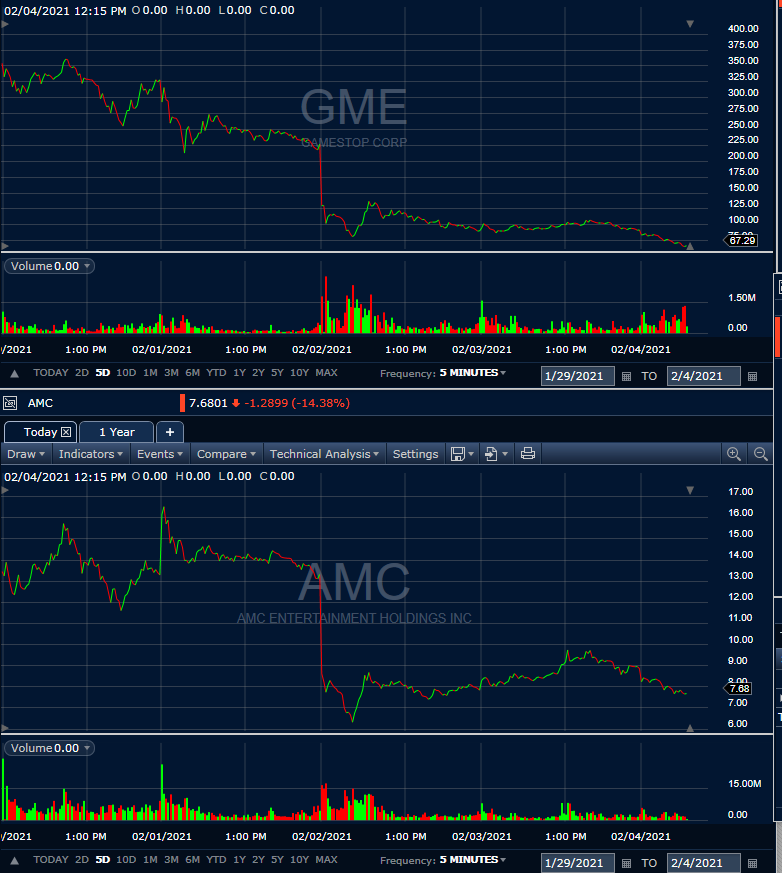

The GameStop stock is crashing as of this writing. Although it hit a high over $450, it remained in the red last week, sinking below $100, and then under $50 by last Thursday afternoon. Today, it is just above $65. Similarly, AMC is also in the red, trading at most of $19.90 last week only to drop to about $6 this Monday morning. There is major support on r/WallStreetBets for the argument that this fall is completely artificial. Their reasoning is mostly how the charts for AMC and GME “are almost identical.” As a result, even despite the plummet, people are still holding their stocks and plan to keep them, no matter what. Here are the charts they referenced:

Why did people buy GameStop stock in the first place? It might be as simple as they were tired of slowly investing and seeing little return. Many people wanted to gamble, while others wanted to ruin hedge funds.

Sergey Savastiouk, CEO of Tickeron, said that many people will lose money and their confidence in Wall Street and the stock market. As a result, he thinks fewer people will participate in the market. “What’s going on with GameStop and AMC is like driving without a license,” he explained.

Richard Smith, CEO of the Foundation for the Study of Cycles, compared last week’s GameStop stock trade to the dot com bubble burst. He drew this comparison to show what could potentially happen as small investors get too excited about investing. His main takeaway is that not paying attention to fundamentals is a big problem.

What this means is that although the AMC and GameStop stocks may have increased in value, it was not because they produced high revenue or profits. They are also not paying large dividends or creating jobs for the economy. The only reason for the increase in its price is because there was a high demand for the stocks. Once the demand died down, the stocks’ values began to slump.

How is Today Different?

What makes today truly different from back then is average investors can trade much more efficiently and cost-effectively. This is thanks to no-fee brokerage firms like Robinhood, whose service pushed all other major brokers to also drop their fees. At the push of a button, people can easily trade today, and even own fractional shares instead of one major share. This makes investing far more accessible to more people. It also means that people can “instantly” get out of the market just as easily as they can enter it.

Recently, Mark Cuban commented, “As long as we’re allowing companies to trade stocks in milliseconds, how can we expect this to be an investors market? Until you change that, you can’t change what’s happening with WallStreetBets.”

The Dot Com Bubble burst revolved around the fact that too many companies could not deliver on promises they made. Today, despite how AMC and GameStop stocks are falling, there is widespread support for investors to hold it at all costs. Spite and the anticipation of the stocks climbing back up seem to fuel their motivation to keep their shares.

Back in the 90s, people were looking to get rich fast. However, today, many people today are not looking to profit off this short squeeze. They have different motivations, and many do not seem to care if they lose money on Occupy Wall Street 2.0.

How Does GME Change the Future of Investing?

The internet is a useful tool that connects people internationally. But, instant access via Twitter and Reddit to investing and forums centered around the subject comes with a price. The fear of missing out, aka FOMO, weighs far more heavily and instantaneously on the average investor now. Gust Kepler, founder and CEO of BlackBoxStocks pointed out:

"This trend will not end anytime soon. There are some investors who play in the individual stock arena just the one time. But there is a fear of missing out. That may not sound much different from the late 1990s with day traders, but now social media augments the ability for groups of investors to band together and share information in real time."

Back in the 90s, people could not communicate as quickly as they can now. This new form of social investing, as the CEO of Invstr Kerhim Derhalli said, “...is not going away. This is a powerful commercial trend and we are just at the beginning of it. People have more information and more power.” Derhalli also said that as younger investors move into the markets more and more, the market will need to change. They invest in companies and brands they know and like.

"Younger retail investors are in touch with changes taking place. They understand consumer trends because they are the ones making and creating them. There are some Millennials making a lot of money and there are hedge funds pissed off that retail investors have joined the game and are beating them at it."

What Comes Next for Investors?

Retail investors have proven that when somewhat organized, they can push hedge funds around. Going forward, they might rally on other stocks and commodities that they believe can push higher. Inflation also inspires many to get in the market sooner rather than later, while others turn to alternative investments. Now, Reddit and Twitter act as the new Raging Bull and Yahoo Finance. This is where major conversations are actually happening about investing, and joining in is all too easy.

Mark Cuban, who recently publicly interacted with the subforum, indicated that if Reddit were to repeat this process they would need to go through a broker that has a balance sheet over trillions of dollars long. That way, their trading will not be as easily limited. He appears to appreciate what retail investors are doing together, characterizing this as a great equalizer on Wall Street.

Does this mean the targeted short squeeze repeat? It just might. Will the silver price be the next place they attack? It is not certain at this time. However, it appears that the investing market is shifting its focus back to Bitcoin this week. The gold price and silver price were up this Monday morning upon news of Tesla investing in Bitcoin. The major company also now allows investment through cryptocurrency as well as gold bullion and gold ETFs.