Dan Loeb’s letter to Third Point investors for the second quarter ended June 2023, providing an update on his AI-driven positions.

Dear Investor:

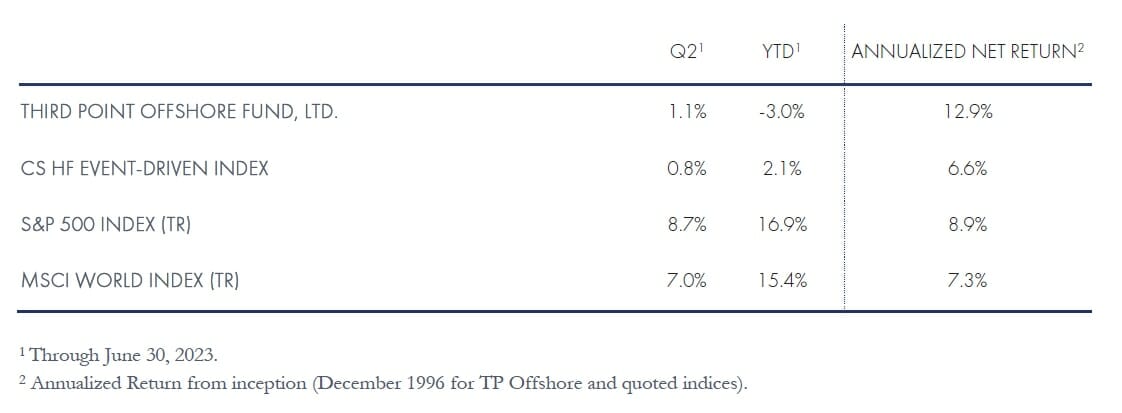

During the Second Quarter, Third Point returned 1.1% in the flagship Offshore Fund.

Q2 2023 hedge fund letters, conferences and more

The top five winners for the quarter were PG&E Corporation (NYSE:PCG), Microsoft Corp (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc (NASDAQ:GOOGL), and Ferguson PLC (NYSE:FERG). The top five losers for the quarter were Alibaba Group Holding Ltd (NYSE:BABA), Danaher Corporation (NYSE: DHR), Catalent Inc (NYSE:CTLT), International Flavors & Fragrances Inc (NYSE:IFF), and a private position.

Equity Updates: AI-Driven Positions

Third Point has been investing in AI-enabled business models since our 2016 Series B venture investment in Upstart, which ultimately became the firm’s most lucrative investment. We have watched AI evolve and believe the technology has matured to the point that it is driving a transformational technology platform shift similar to those seen roughly once per decade: the personal computer in the 1980s, internet in the 1990s, mobile in the 2000s, and cloud in the 2010s.

AI is creating interesting investment opportunities across the information technology “stack”, and we have increased our exposure to companies throughout the software and semiconductor value chains that should benefit from mass adoption of Large Language Models (or “LLMs”), one of the foundational technologies underlying generative AI.

Within application software, LLMs have potential to accelerate revenue growth and reduce operating expenses for many publicly traded software companies. While LLM-enabled products are in their infancy, exciting early use cases are emerging across several major application categories including productivity software, content creation software, customer relationship management software, and enterprise resource planning software.

Companies will monetize this by offering higher-priced AI-enabled versions of existing products, resulting in accelerating ARPU and faster revenue growth, as Microsoft has recently demonstrated with its plan to sell its Office Copilot software at a roughly 2x price increase over the existing non-AI version.

Software companies may also benefit from lower operating expenses via improved employee productivity; one of the most obvious use cases for LLMs is in software development, where recent feedback suggests that AI-driven code augmentation could accelerate product development timelines by more than 20%.

Equity Position Update: Danaher (DHR)

Danaher is our longest held investment and remains a top five position. Danaher has underperformed the S&P 500 this year due to a slowdown in the bioprocessing industry and more cautious spending by biopharma customers. Bioprocessing is a key end-market that drives more than a quarter of Danaher’s profits. Bioprocessing products are the main inputs that biopharma companies use to manufacture biologic drugs, which are the fastest growing category of drugs, growing low-to-mid-teens and representing a sizeable portion of the clinical pipeline.

The bioprocessing industry experienced significant growth in 2021 and 2022, driven by Covid vaccines and a strong biotech funding environment. Several participants, including Danaher, lowered their 2023 growth outlook in large part due to customer inventory de-stocking and biotech funding weakness. We anticipate that this slowdown is temporary, and the bioprocessing industry will return to normalized growth of high-single digit to mid-teens in 2024 and beyond.

Q2 2023 hedge fund letters, conferences and more

Equity Position Update: Shell Plc

We initiated a position in Shell PLC (NYSE:SHEL) in the summer of 2021 and highlighted the company’s significant discount to intrinsic value as well as to US-listed peers after decades of poor performance. While shares have performed well since we initiated the investment, the company still trades at staggering discount to intrinsic value and represents a compelling investment at current levels.

We initially argued (and still believe) that the fastest path to improved performance and better valuation would be a separation of Shell’s business units to better attract shareholders and improve accountability, the latter of which was essential when the company was in the hands of executives who had demonstrated virtually no focus on shareholder value creation.

The most important change at Shell over the past two years has been the upgrade in the management team, with the appointments of Wael Sawan as CEO and Sinead Gorman as CFO. They have demonstrated an unwavering commitment to shareholder value, capital discipline, and improved returns. At their recent analyst day, Mr. Sawan stated “underpinning all that we do will be a ruthless focus on performance, discipline, and simplification.” It was the third time they used the term “ruthless” in their presentation, sending a strong message to shareholders.

Q2 2023 hedge fund letters, conferences and more

Corporate Credit

Third Point corporate credit returned 8.7% net on invested assets for the first half of the year, outperforming the JPM Global High Yield Index return of 5.3%. High yield spreads have traded in a tight range this year (435-560bps), but dispersion has been relatively broad, and we have identified improving situations despite the uncertain macro backdrop. Additionally, events such as the short lived “banking crisis” created attractive trading opportunities that the credit team capitalized on.

Structured Credit

The residential mortgage portfolio generated 0.1% net in Q2 and has returned 3.2% net year-to-date, driven by continued resilience in house prices and solid borrowers, who have locked in low rates and have 40-50% equity held in their homes. The structured credit portfolio as a whole generated 0.2% net in Q2, bringing year-to-date returns to 4.1% net. Over the past few quarters, we have added senior bonds in residential mortgages at 9-12% yields with total return upside into the mid-teens.

As rates have increased over the past 18 months, many investors have shifted their portfolios towards fixed income. Insurance companies and money managers are seeing material inflows as they look to capture the outsized yields in investment grade structured credit. On a national scale, US housing stock totals $43 trillion and there is currently $13 trillion of mortgage debt, which means there is $30 trillion of equity in the US housing market in the hands of homeowners.

This sizeable amount of capital provides stability to the US homeowner and consumer and is reflected in the continued strength we see in our monthly remits. In consumer ABS, we have added BBB rated bonds at 10% yield with a 2-year duration. As these bonds amortize, we believe they could be strong rating upgrade candidates with returns in the mid-teens as buyers look for single A rated profiles.

Q2 2023 hedge fund letters, conferences and more

Sincerely,

Daniel S. Loeb

CEO & CIO