Cyxtera Technologies Inc (NASDAQ:CYXT) came public via a SPAC in the summer of 2021. The company is a sub-scale operator of poorly-positioned data centers leased from facility owners.

The leasing strategy, high-cost retail model, low space utilization, and excess leverage drive the bottom of the industry cash generation. Financial performance is unlikely to improve going forward.

Continued negative leasing dynamics and an ill-considered financial strategy exposing the company to cost inflation and rising rates will likely pressure margins further going forward.

Q2 2022 hedge fund letters, conferences and more

The company reported negative financial results for 2Q22 on August 11th. Financial underperformance left the company with only $40M in cash after burning $30M in the quarter.

Management lowered guidance for 2H22 modestly in expectation of cost increases.

In testimony to the precariously low cash balances, the company filed an S-3 shelf registration for $300M in new securities and the sale of 130M of shares owned by insiders and the SPAC’s PIPE investors. We believe that the offering will be the catalyst that begins to send the stock toward fair value of $2-3.

Key issues include:

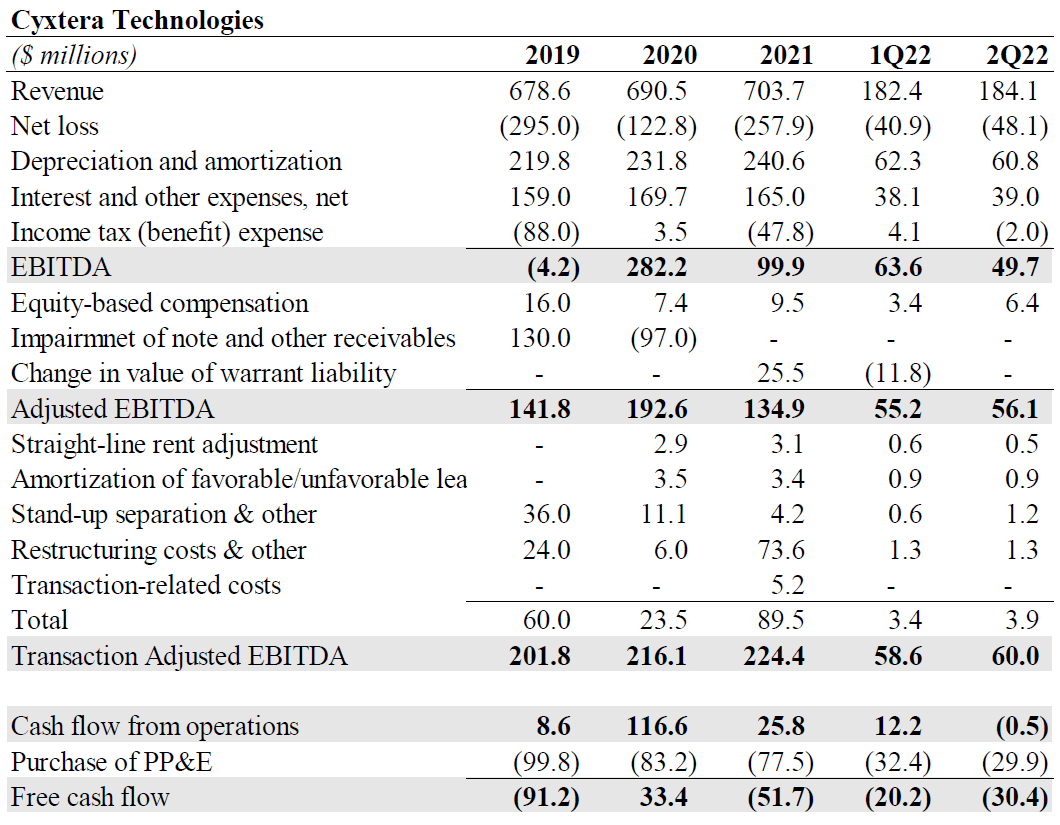

Cannot generate cash from operations/negative free cash flow - Low capacity utilization and poor service offering results in sub-par cash flow from operations; coupled with high CapEx requirements drives the company’s large cash burn. In 2021, the company generated only $25.8M in CFO and negative free cash flow of ($51.7M). Further low quality offerings will likely pressure utilization going forward.

Crippling levels of leverage – The company’s excessive debt load creates an interest expense that consumes an average of 80-85% of all cash generated by the business. Leverage makes CYXT’s financial model unsustainable. One of the company’s revolvers was not renewed, the other revolver is due in 11/23 and $868M of debt is due in 2024.

Desperate for cash – Inadequate cash flow has driven the company to pursue a $10M sales leaseback transaction in 1H22 and receivables factoring in both 2021 and 2022. However, an estimated cash burn of $50M in 2H22, cash needs are far beyond the short-term fixes.

Insiders want out – The S-3 also includes 130M shares of recently unlocked shares owned by insiders, the SPAC sponsor, and PIPE investors. The float will increase roughly 4x from ~48M shares to 178M plus whatever is sold in the offering.

High comparative valuation – Despite being the weakest public data center operator, Cyxtera currently trades at an EV/Adjusted EBITDA of 30x compared to 25x for peers, which convert ~80% of EBITDA to cash flow compared to 4% for CYXT. A discounted multiple indicates the stock is worth $2-3 or 70-80% below current levels.

CYXT’s collection of poor, leased retail data center assets makes for a low margin business in the best case. Excess leverage makes the company’s model unsustainable.

I. An Unsustainable Business Model

We believe the company’s business model is fundamentally flawed. As a provider of retail colocation space, labor and engineering are significant costs.

Leasing the facilities fixes the costs and subjects the firm to potential rent increases, but persistently low utilization results in sub-par revenue and low margins.

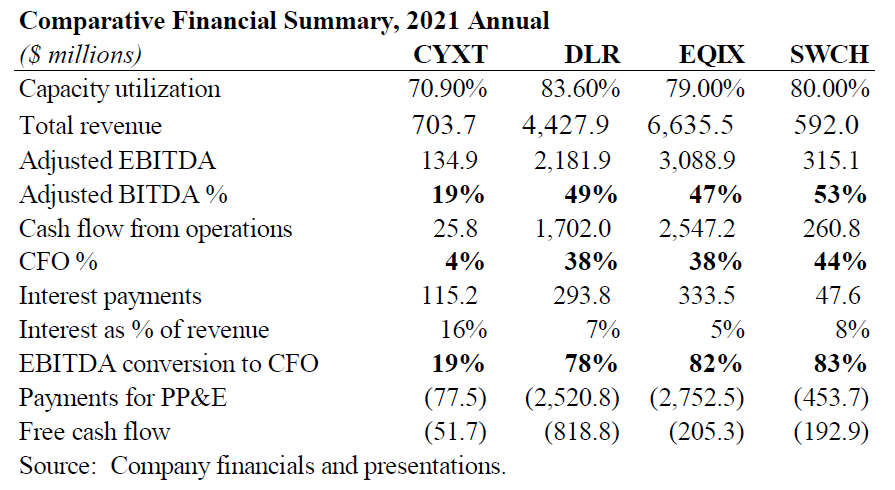

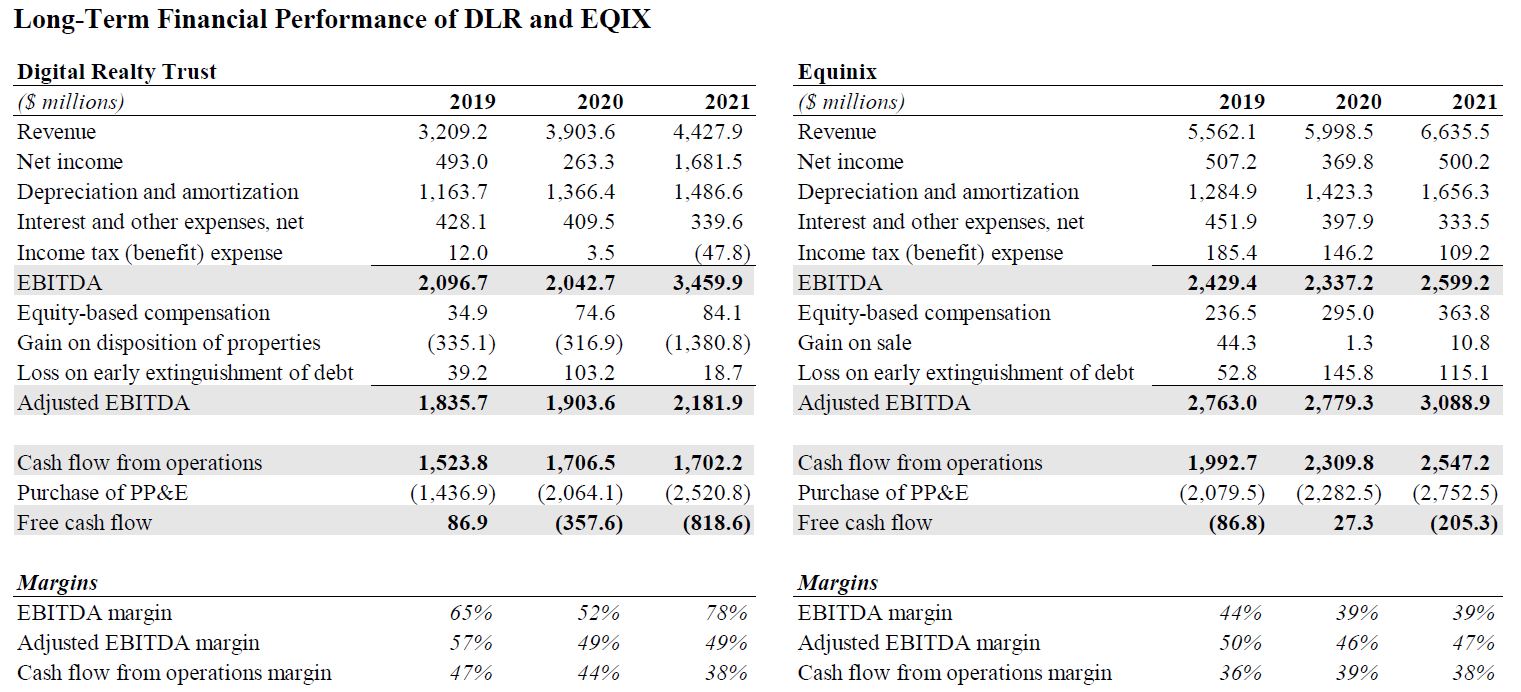

The company’s flawed business model results in very weak cash flow relative to the other players in the data storage space, as indicated in the table below.

Cyxtera is the weakest financial performer of the group. Low utilization leads to poor EBITDA. Cash flow from operations in 2021of $25.8M equates to only 4% of revenues, compared with ~40% for the peer group.

Weak cash generation is a long-standing problem. In the appendix we provide a long-term financial summary for CYXT as well as DLR and EQIX for comparative purposes.

For CYXT, it shows that between 2019 and 2Q22, the company generated only a total of $162.7M in cash from operations and accumulated an aggregate negative free cash flow of ($160.1M).

Urgent cash needs have triggered management to pursue several short-term fixes.

In 1Q22, the company completed a sales leaseback that generated $10M. The company factors receivables for short-term financing. During 2021, factoring resulted in net proceeds of $99.5M net of fees.

Factoring reduces receivables and increases cash flow from operations. In 1H22, the company factored $11M of receivables.

The factoring likely creates a maximum 30-day financing, given the company’s monthly billing cycle. The discount paid implies a 1.8% cost, which is annualizes to ~24%.

In our view, 24% interest rate for such short-term financing is indicative of severe cash shortages.

The sub-par cash flow evident in 2021 is unlikely to change going forward. In 1H22, the company generated only $11.7M in cash flow from operations. Including $62M of CapEx, free cash flow was ($50.6M) for the period.

Management lowered guidance modestly for 2H22, reflecting higher expected costs. We estimate that the company will burn an additional $50M in the period taking full-year cash burn to ~($100M).

Management strategy may exacerbate the margin problem going forward. Unlike most peers, Cyxtera does not hedge the cost of power.

The company rents mostly on an ‘all in’ basis, including power. Although the company can pass along 90% of power cost increases, they absorb 10% and collect the remainder with a lag.

Additionally, all outstanding financial debt is floating rate, exposing the company to rising rates, which will eat-away at the already razor thin cash margin.

Cost inflation has already had an impact. For 1H22, the cost of utilities was up $11.5M, increasing cost of revenues 6% for the period.

Management expects power cost inflation to accelerate in 2H22. The company’s debt is LIBOR based, which has increased to 2.92% from 0.12% a year ago. The debt reset should raise the cost of interest making the cash flow margin yet smaller.

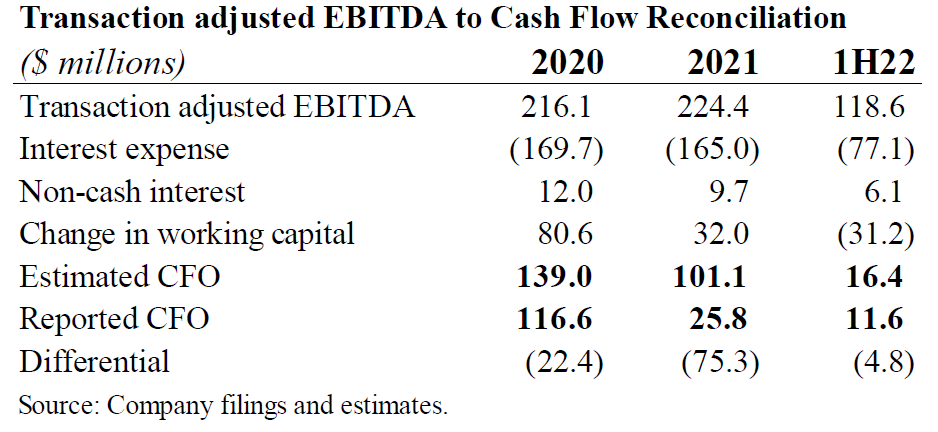

Management reports Transaction adjusted EBITDA on a quarterly basis. We believe it inflates the perception of cash flow by excluding cash expenses.

In the table below, we attempt to reconcile management’s EBITDA with cash flow from operations to illuminate the problem.

In each period there is a material differential between our estimated CFO and reported CFO. The largest gap was $75M in 2021.

The company added-back $74M in restructuring charges to EBITDA in the year. The restructuring charges resulted from an office closure in Texas and closure of the underperforming Moses Lake data center.

Both events required lease termination payments. The EBITDA-cash flow differential suggests they were cash expenses.

Changes in working capital are managed aggressively to boost cash flow. In 2020 as the company prepared to go public, accounts receivable and prepaid expenses added an $57M.

The $81M and $32M added by working capital in 2020 and 2021, respectively, include the impact of other liabilities of $22M and $61M for each year. Other liabilities is the big swing account impacting cash flow.

We believe the category is driven by deferred revenue, or client pre-payments. Deferred rent, which results from the difference between the straight-line rent expense and cash payment may also have an impact.

The company does not provide enough granularity to know fully what drives the accounts critical contributions to cash flow. Without this swing account cash flow from operations would be worse.

Cash flow from operations adjusted for the impact of other liabilities was $94M in 2020 and ($35M) in 2021. In 1H22, other liabilities had a relatively minor impact of ($3.8M).

Excluding it, adjusted CFO is $15.4M. Although not negative, the number highlights the lack of profitability in the model with a very slim 4.2% cash flow margin.

II. Persistently Low Capacity Utilization

Since purchasing the business in 2017, CYXT has not been able to consistently increase utilization. Between 4Q19, the first period for which we have data, and 1Q22, total occupancy only increased to 70% from 67%.

Occupancy as of 2Q22 was 73.33%. We consider the unusually high net-add during the quarter an anomaly driven primarily by a significant sale in a large market.

Going forward, we believe the leasing dynamics will be negative, pressuring occupancy. Four factors drive the negative dynamics.

Built-in occupancy headwinds - Lumen /NYSE: LUMN/, formerly CenturyLink from which CYXT was spun off, was 10% of revenues in 2021. Lumen’s contract ends in April 2025 and has staggered disconnects until then creating leasing headwinds.

We believe the company offers a low-quality service. This is evidenced by the fact that the company has not been successful leasing space in high-demand markets with low vacancy. As an example, in 1Q20, CYXT opened in Amsterdam with 12,338 square feet.

After renting only 1,029 square feet as of 4Q21, the company increased space to 23,655 square feet. Amsterdam is one of the world’s 10 largest data center markets with total vacancy less than 10%, yet CYXT has only rented 1,169 square feet in 2 ½ years for a 95% vacancy rate.

Cyxtera’s inability to rent space in a high demand market suggests the product does not meet customer standards. Current and former employees writing on Glassdoor support the low-quality thesis with posts stating that CYXT’s maintenance and customer service has eroded substantially since the company was purchased by the private equity owners.

Increasing competition in key markets. 51% of CYXT’s rented space is in in five markets that have significant amounts of data center space under construction. In 3 of 5 markets, the company has had very limited success growing occupancy between 4Q19 and 2Q22 despite high demand and low vacancy.

We believe that as new space comes online in these highly competitive markets, the company will be vulnerable to customer losses.

The struggle in lackluster markets will intensify – Top-10 markets accounted for 98% of all rental space gains between 4Q19 and 2Q22. CYXT’s remaining 14 markets contributed only 2%. 7 of the 14 markets have lower occupancy now than in 4Q19.

This excludes the two most underperforming markets that were shuttered, and are not included in the 14. 3 of the 7 with occupancy increases over the period are near capacity, severely limiting further upside in the markets.

This leaves a mere 3 out of 14 markets with a clear path to stronger occupancy. The overall dynamics in markets outside the top-10 indicate pressure on occupancy will increase going forward.

Granular analysis of occupancy trends suggests that CYXT’s protracted efforts to reposition company assets and build occupancy are far from over. We believe a mix of low quality product, increasing competition in strong markets and presence in many lackluster markets means the balance of pressure on occupancy is to the downside.

III. Over-levered and Needs to Raise Capital

CYXT has a total of $2B in debt, consisting of $1.1B in capital leases and $888M of financial debt. The company had a $20M revolving credit line due May 2022 that was not renewed.

To repay the facility, the company drew down $20M from a new revolving line due November 2023.

$868M in first lien facilities that mature in 2024. All facilities are LIBOR plus a margin of 3-4%. As of 2Q22, the rate on $775M was 4% and $95M 5%.

The 3-month LIBOR has increased to 2.9% from 0.12% a year ago. We estimate the interest expense on the credit facilities can increase by $16.5M to ~$53M upon reset.

Put in context, a $16.5M increase in interest expense amounts to 64% of all cash flow from operations generated in 2021.

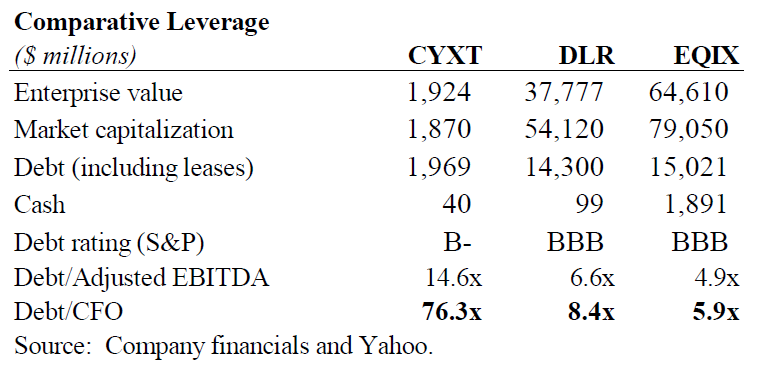

CYXT is the most highly-levered company in the group as shown in the table below.

Debt to 2021 Adjusted EBTIDA of 14.6x compares to 5-7x for the peers. Debt to cash flow from operations of 76x leads to an unsustainably high interest rate expense.

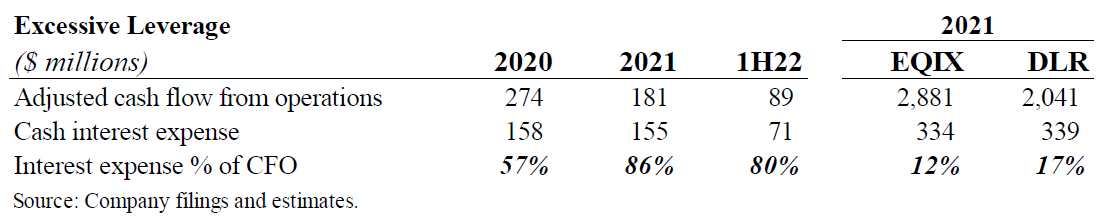

In the table below we adjust CFO by adding-back the cash interest expense. We then show the cost of interest as a percentage of adjusted cash flow. We provide the statistic for EQIX and DLR for comparative purposes.

In 2020, GAAP cash flow from operations was unusually high as the company squeezed all it could from working capital to dress for a transaction. In 2021 and 1H22, 80-86% of cash flow went to cash interest payments.

S&P stated that it could lower the rating should the company’s path to delever become less credible. Consequently, we believe it is likely that the uses some cash from the pending equity offering to repay debt. We believe the long-standing failure to improve financial performance coupled with higher rates would make refinancing the entire balance difficult and very expensive.

We believe the cash shortages and current price above the $10 SPAC IPO will drive the company to raise as much cash as possible with the current shelf-registration.

IV. Terremark: It has Happened Before – Insider Ownership and Lock-up Expiration

The private equity consortium of Medina Ventures and BG Partners purchased the Cyxtera data center assets from CentryLink in 2017. Chairman of the Board, Manuel Medina had previous experience in the data center space.

Mr. Medina was the CEO of Terremark Worldwide. Terremark’s stock was flat over the 5-year period from 2005 to 2010, reflecting the company’s poor financial performance.

In 2010, Terremark generated only $23M in CFO on $292M in revenues; and a negative free cash flow of $95M after $119M of CapEx.

Despite poor performance, Mr. Medina engineered an exit by selling the company to Verizon in 2011. Verizon purchased other data centers after Terremark, but the company’s “everything as a service” business model was never profitable, and the company sold all data center operations in 2016.

Cyxtera is similar situation to Terremark. It is a sub-scale provider in an industry of giants, operating financially underperforming set of assets without much hope of improvement and likely to decay further over the next several quarters.

Insiders, including the PE majority owners and the SPAC sponsors own a total of 61% or ~110M of 178M shares. Both the PE owners and SPAC sponsors were subject to a one-year lock-up - less if trading criteria were met.

We believe the trading requirements releasing the lock-up were satisfied in April 2022.

The formal -year lock-up period ended on July 29, 2022. On the same day, an investment fund holding stock for the private equity owners filed a 13-D/A stating that it made a distribution of common stock to the LPs.

The distribution is flowing through to Form-4s filed by the individual LPs. On Friday, August 12, the company filed an S-3 prospectus with the SEC. It is a shelf-registration for up to $300M in securities as well as the sale of 130M shares from insiders and PIPE investors.

Poor business performance, immediate cash needs, and insider sales will likely weigh on the offering price. Further, we think the company will be unlikely to satisfy capital raising needs and insider appetite to sell with one deal.

V. The Comparative Valuation is High – a White Knight Unlikely

In April 2022, less than 1-year after going public via the SPAC, management announced that they had hired bankers to explore strategic options. We think a buyer at the current valuation is unlikely to emerge – the equity is significantly overvalued at the current stock price of $10.50.

We look at value using cash flow and an EBITDA metric. We constructed an adjusted EBITDA metric that is comparable across the publicly traded data centers.

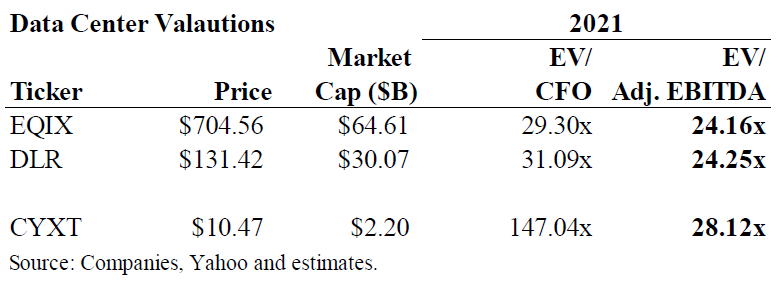

The results are shown in the table below.

We adjust Cyxtera’s EBTIDA for stock-based compensation and changes in the warrant liability, and include restructuring charges eliminated by management. EQIX and DLR are adjusted for stock-based compensation, gains on sale, and losses on extinguishment of debt.

Using our EBITDA metric, peers trade at ~24x 2021 numbers while CYXT trades at an elevated multiple of 30x. However, substituting cash flow for EBITDA shows peer valuations to be constant and CYXT to be vastly overvalued on a relative basis with an EV/CFO multiple of 156x vs 30x for the group.

The cash flow dynamics of interest payments absorbing ~85% of cash flow suggests that the equity is worth little, if anything. CYXT should trade at a significantly discounted adjusted EBITDA multiple to reflect the fact.

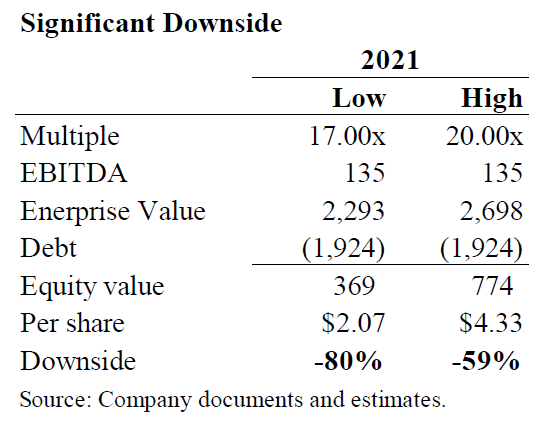

Using a 17-20x 2021 adjusted EBITDA we obtain a value of $2-4.50 per share, as shown below. The multiples imply 60-80% downside in the stock.

Glassdoor: Cyxtera Data centers Employee Review

Senior Systems Engineer in Los Angeles, CA- Oct 14, 2020

Pros

Stable job, short commute, long history

Cons

declining salaries, declining services, negative reorganizations