The blockchain ecosystem is growing at a phenomenal rate. Bitcoin is now a legal tender in El-Salvador and Ethereum ETF got listed on Brazil’s Stock Exchange. Institutional investors are jumping in, and billions of VC money is now flowing into early stage crypto companies.

Q2 2021 hedge fund letters, conferences and more

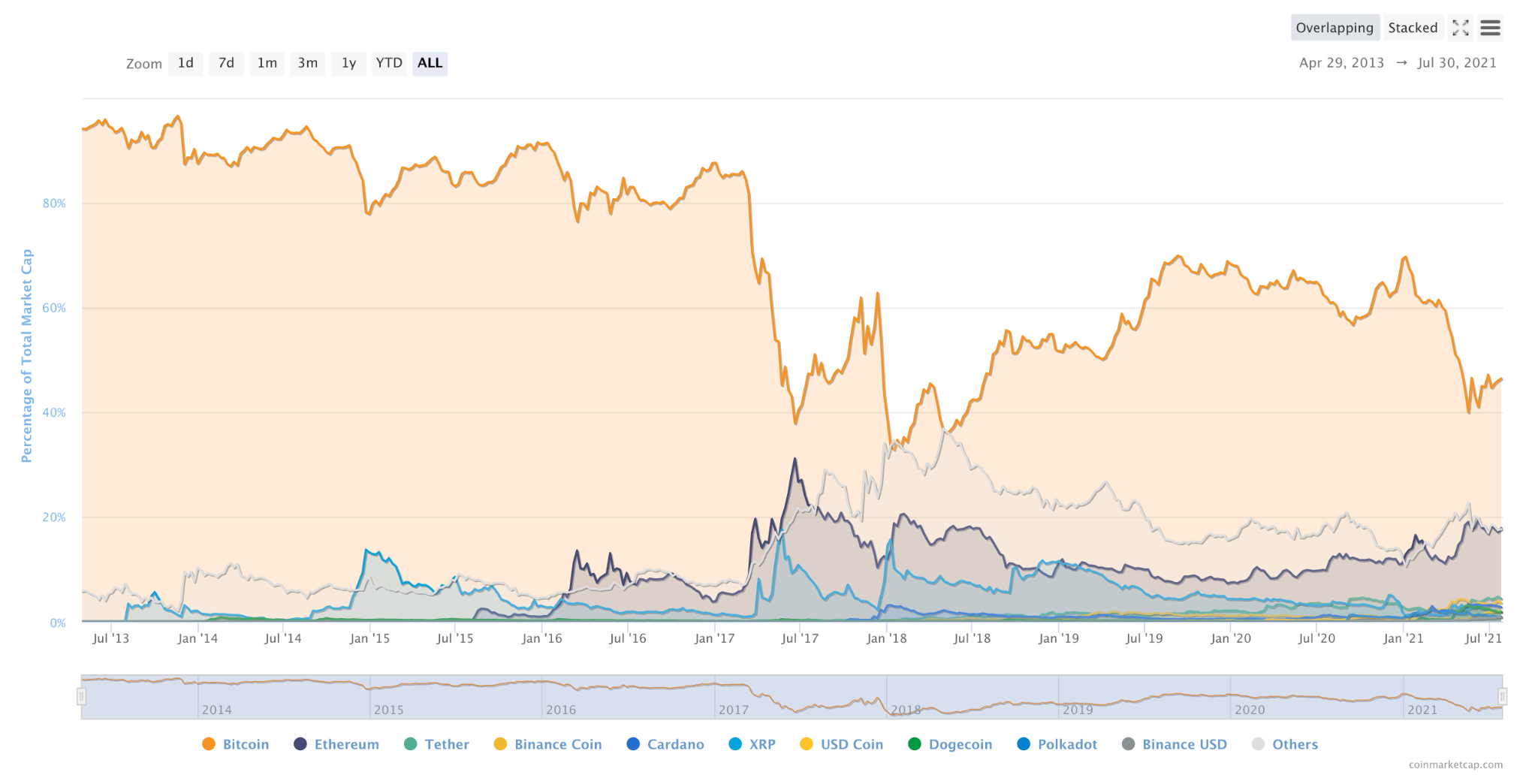

However, over 65% of the $1.54T cryptocurrency market is dominated by two big protocols - Bitcoin and Ethereum. These protocols have grown to monopolistic proportions because they work in silos and cannot communicate or transact with each other.

This lack of interoperability coupled with the vertical growth sparked scalability issues due to high network utilization. We do have Layer-2 networks on Ethereum that solve Ethereum’s scalability issues to some extent, but they suffer from the same inherent problem; lack of cross-layer interoperability.

We are left with siloed blockchain protocols and siloed Layer-2 networks. This isolated infrastructure severely limits the possibilities of application developers to build applications that can benefit from the properties of these protocols. E.g., a DeFi app on Layer-2 Ethereum Network performing cross-layer asset swap with an application deployed on another Layer-2 network.

Composability is Innovation

What we really need is a composable infrastructure that combines the siloed Layer-1 chains and Layer-2 protocols. Crypto networks are analogous to cities, as they benefit from the bottom-up growth on top of shared infrastructure. In a highly composable environment, developers can build applications on top of existing resources such as shared code, data, user-base, or security.

If there is anything that has changed the face of the internet, it is the composability in the ecosystem, as you can use APIs, shared code-base and data, interact with other applications, and more.

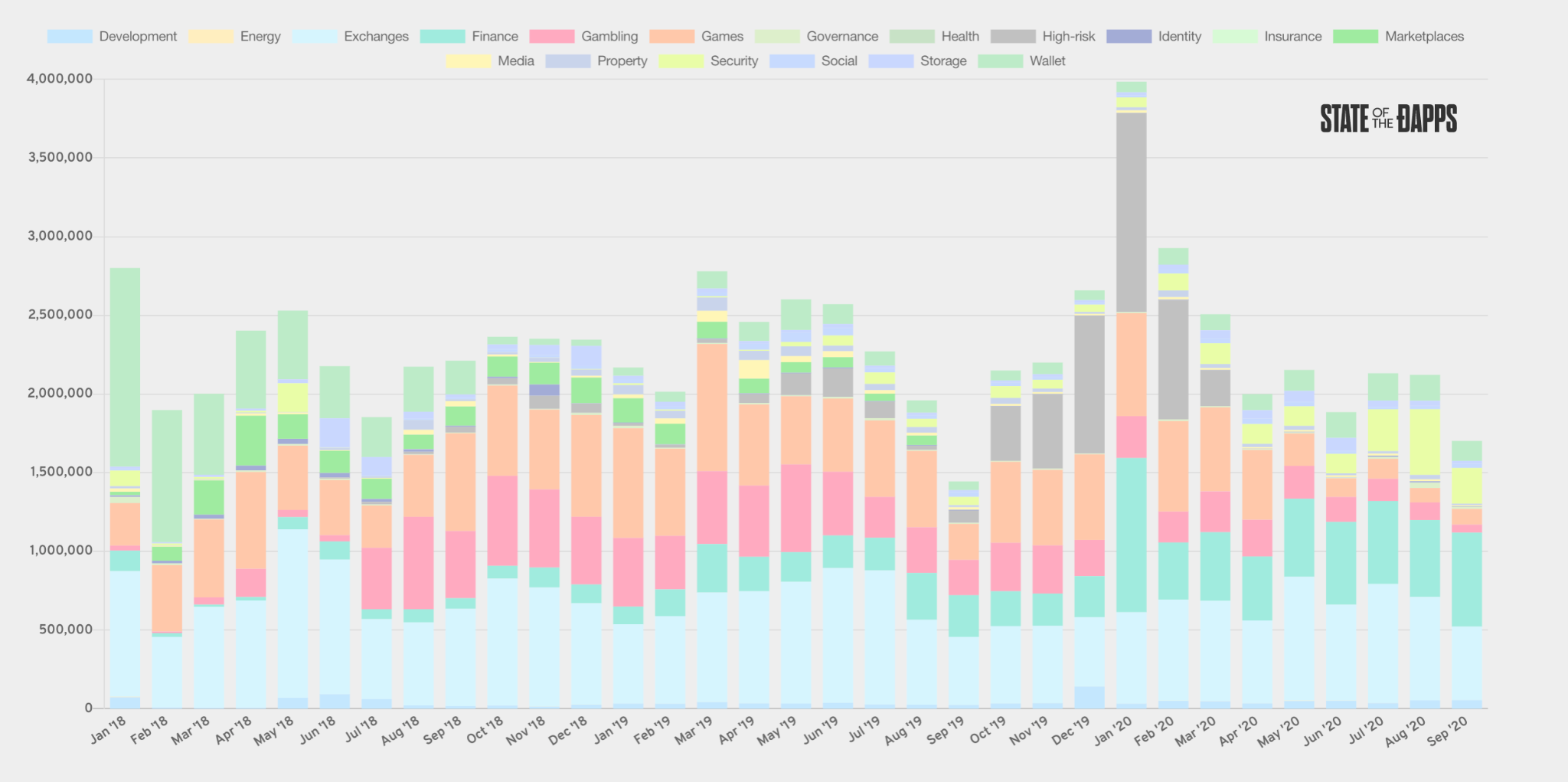

We don’t see this level of composability in the blockchain ecosystem, and the developers are confined to the limitations of the underlying platform they are building upon. Still, the DApp ecosystem is rising and together with composability within the DApp ecosystem, there can be an exponential growth.

However, different protocols are trying to build interoperability solutions to make the blockchain ecosystem more composable. From a technical standpoint, these interoperability-focused protocols are using one of the following approaches:

Centralized or multisig: If something happens on Chain A, an event is carried out on Chain B by either a centralized party or a group of individuals in a multisig scheme.

Relays or Sidechains: Chain A can read events or subscribe to state updates of Chain B through relays.

Hash-locking: Triggering same events on Chain A and Chain B using common hashes.

Asset swaps (lock and mint/liquidity pools): Swapping Chain A assets with Chain B assets using the lock and mint approach (assets locked on one chain, minted an equivalent representation on the second chain). The second approach is liquidity pools and Automated Market Making (AMM), where liquidity providers add native tokens to a pool of funds, and the protocol allows asset swaps through the pool.

Celer network has recently launched a cBridge that allows low-cost, instant, and ANY-to-ANY within Ethereum’s main chain and across Ethereum’s layer-2 networks. cBridge will also integrate with other Layer-1 chains and their Layer-2 networks as part of their development roadmap.

cBridge uses Celer network’s state channel core, and also supports Non-EVM chains such as Polkadot with Celer substrate module. To transfer assets between Ethereum Layer-2 and other Layer-1 chains like Polkadot, it uses multi-hop value routing, e.g., If a user wants to transfer assets from arbitrum, and Ethereum Layer-2 network, to Polkadot, multiple cBridges are used that relay liquidity from Arbitrum to Optimism Rollup, then Ethereum’s main chain, and then to Polkadot using several hops across Celer State Channel Network.

Another prominent cross-layer interoperability platform is Composable Finance that allows seamless transfer of assets between Ethereum Layer-2 networks using Layer-1 liquidity vaults. The Layer-1 vault is a network of liquidity providers to facilitate instant cross-asset swaps without the long lock-up periods.

A lot of the projects are using bridges to achieve cross-chain interoperability. Polkadot and Cardano use a similar model, called Hub & Spoke Architecture where the main chain (hub) is connected to external chains via bridges that relay information and lock/mint assets.

With all these different approaches towards enabling cross-chain and cross-layer interoperability, which one is the best? Well, it’s all about who gets the market first and who delivers the best developer experience.

Closing Thoughts

Cross-chain and cross-layer interoperability is the undoubtedly the next next big step towards the interconnected decentralized economy, where developers can build applications that are not confined to just one chain, but have access to a complete blockchain ecosystem where they can interact with DeFi protocols, Layer-1 and Layer-2 networks to deliver a seamless user experience.