Confidence levels among hedge fund managers for the next 12 months fall slightly amid continued macroeconomic and geopolitical concerns

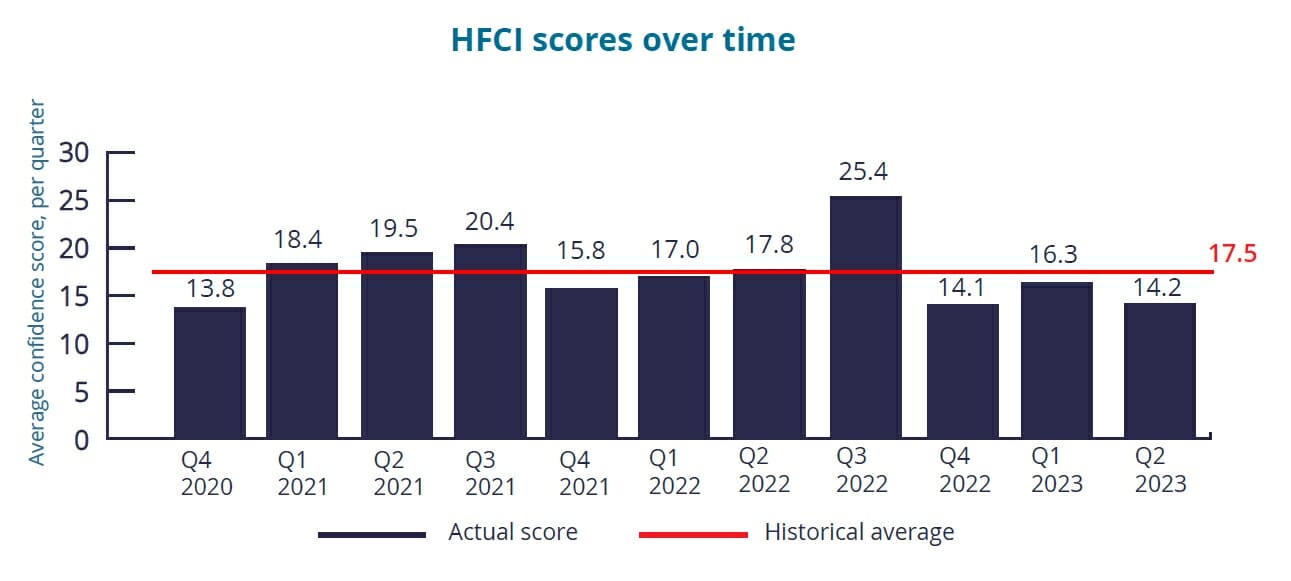

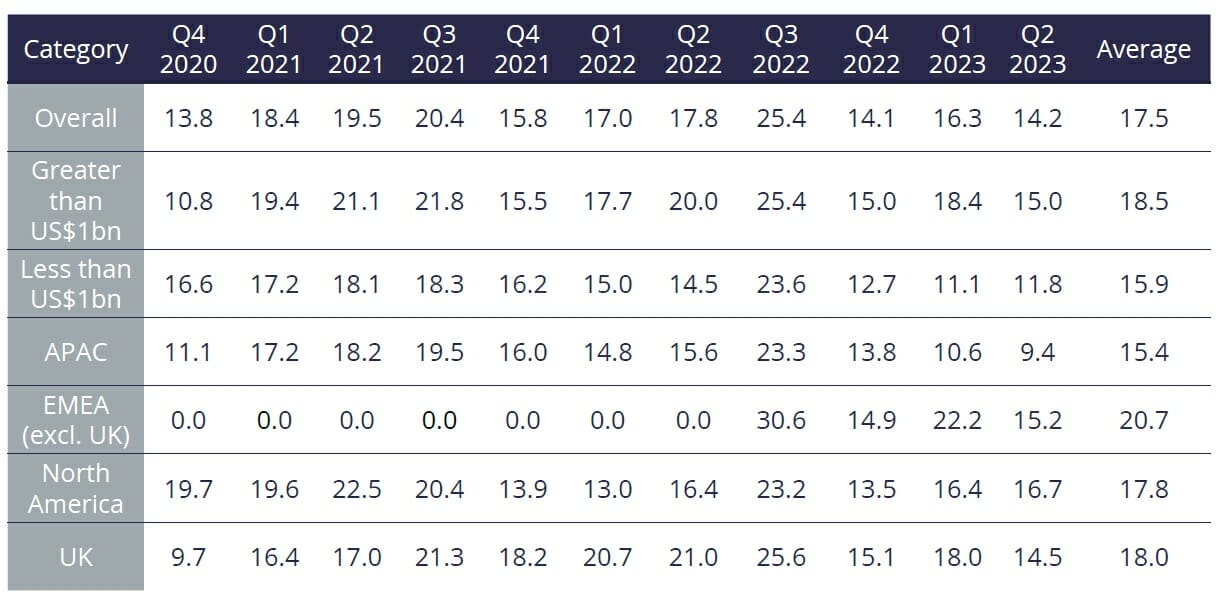

AIMA, in partnership with Simmons & Simmons and Seward and Kissel, are proud to present the 11th quarterly Hedge Fund Confidence Index (HFCI), which provides a snapshot of fund managers’ confidence in their economic prospects for the coming 12 months. A full time series of confidence levels since Q4 2020 can be found at the bottom of this report.

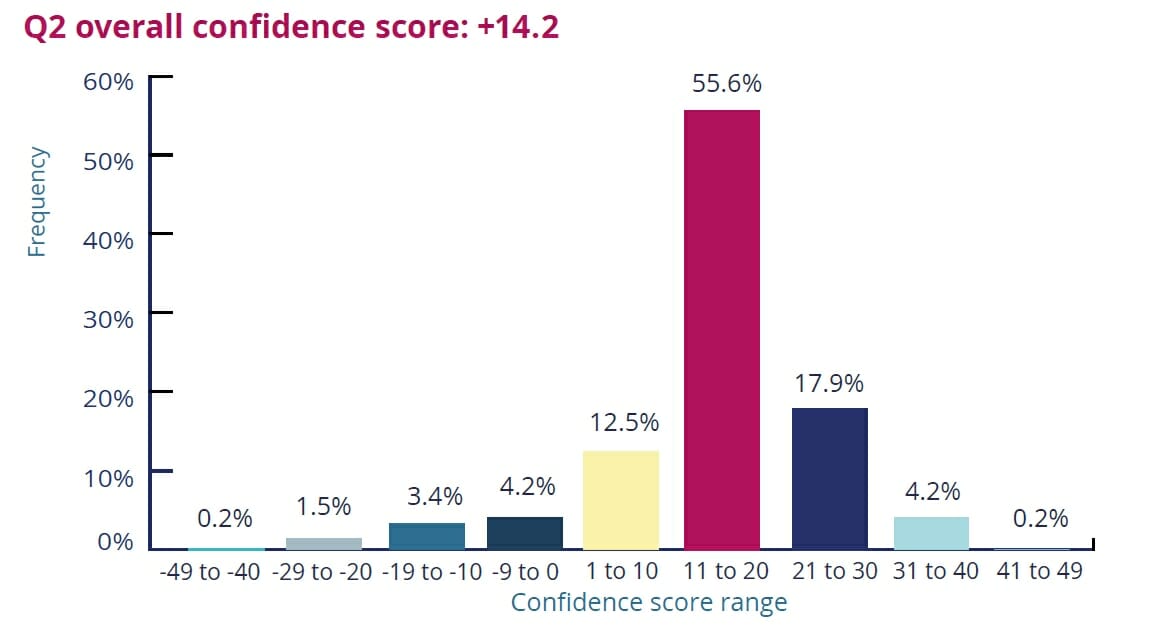

Selecting the appropriate level of confidence, respondents are asked to choose from a range of -50 to +50, where +50 indicates the highest possible level of economic confidence for the firm over the next 12 months. When measuring their level of economic confidence, hedge fund respondents are asked to consider the following factors: their firm’s ability to raise capital, their firm’s ability to generate revenue and manage costs, and the overall performance of their fund(s).

Q2 2023 Results

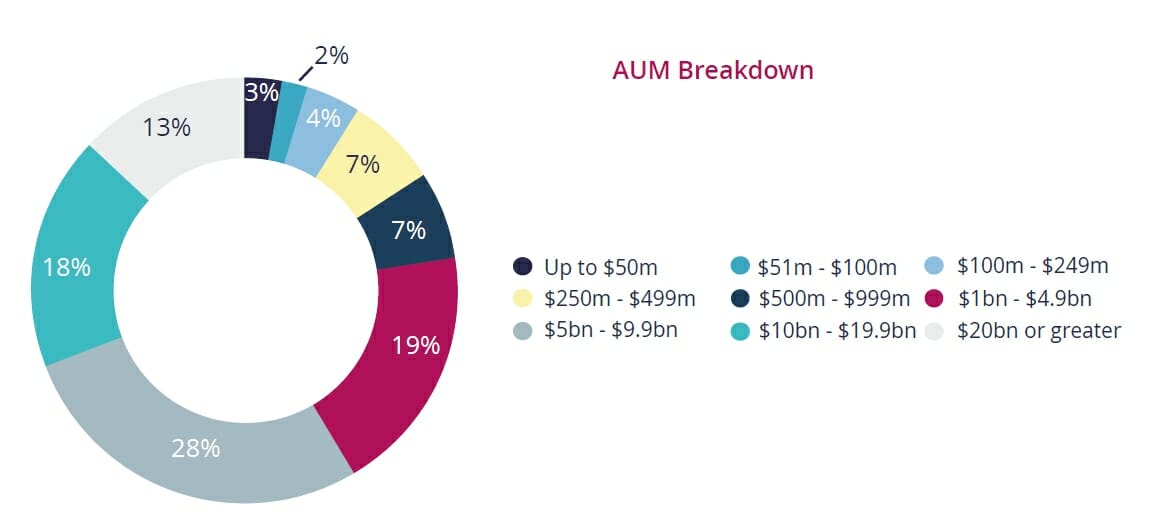

The latest HFCI is based on a sample of 408 hedge funds (accounting for approx. US$3.34 trillion in assets and the largest ever HFCI in terms of the absolute number of respondents and overall AUM) that participated in the industry poll taken throughout the week ending 23 June 2023.

The average measure of confidence (in the economic prospects of their business over the coming 12 months) is +14.2, down from +16.3 in Q1 dragging the HFCI further away from the historic average of +17.5 (see HFCI scores overtime, overleaf).

The downturn comes despite the slightly greater percentage of respondents representing those managing more than US$1 billion in assets (77% in Q2 versus 71% in Q1) and the average AUM of respondents also increasing to US$7.9 billion, up by almost US$1 billion from the prior quarter – both historic indicators of greater confidence.

Overall, how would you score your confidence in the economic prospects of your business over the next 12 months, compared to the previous 12 months, on a scale of +50 to -50? (Hedge fund managers).

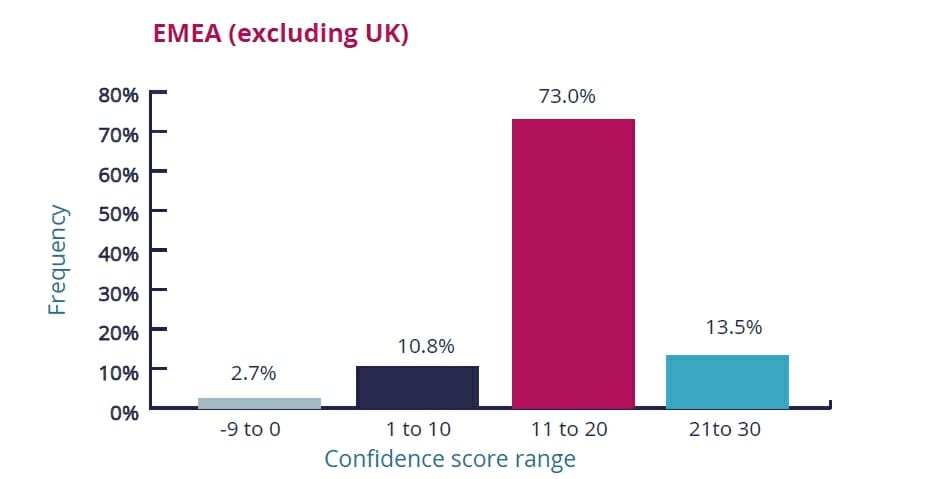

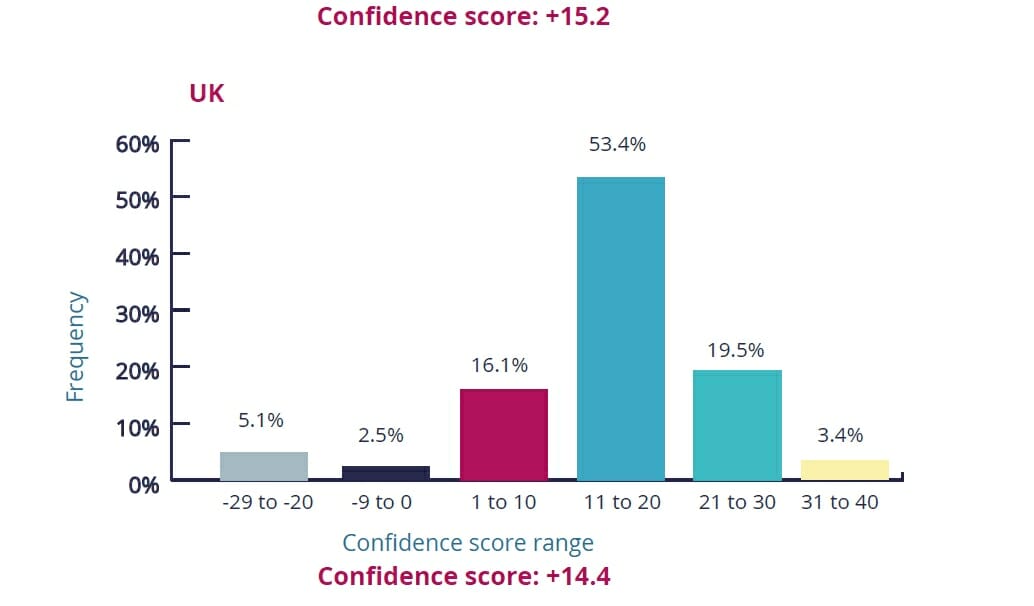

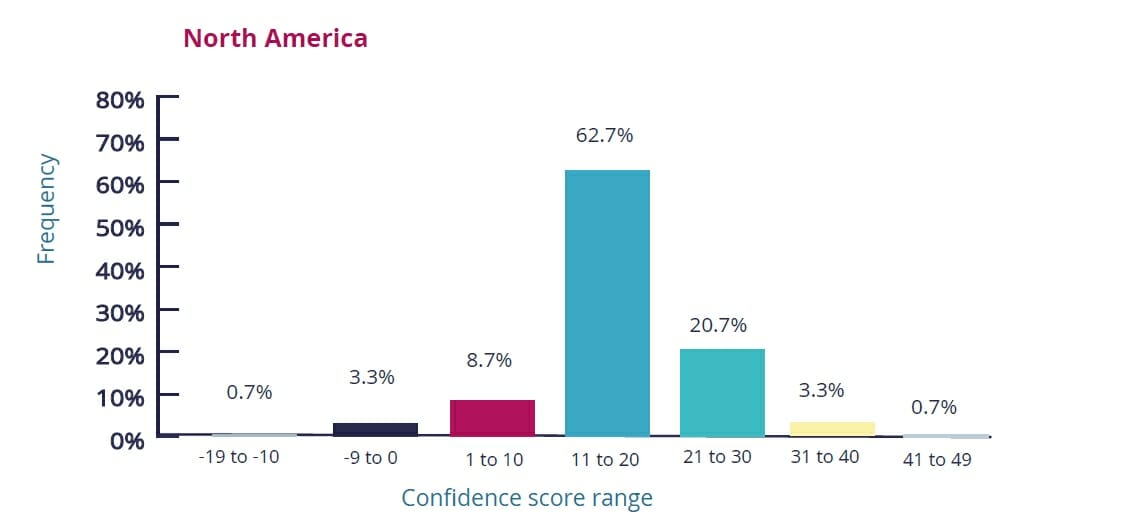

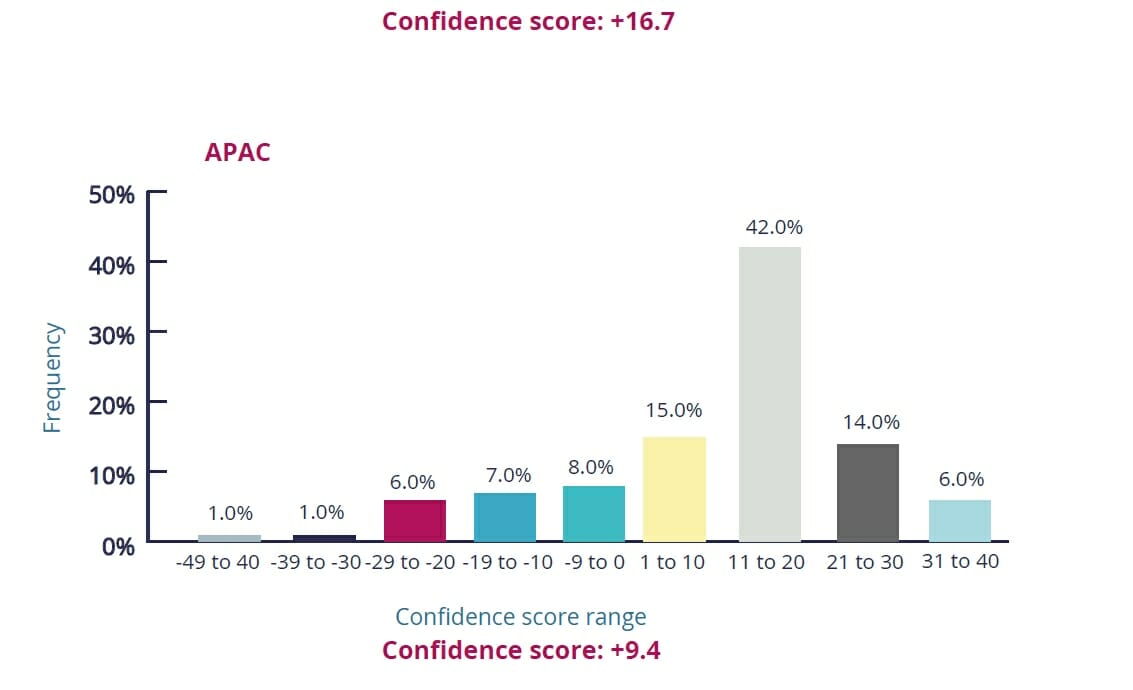

Breakdown By Hedge Fund Location

Regionally, North America reclaimed the title of the most confident region, having trailed the UK for seven consecutive quarters. The reshuffle reflects resilience among North American fund managers that maintained a flat average confidence score of +16.7, while the UK slipped from +18 to +14.5.

For North America, the score in part reflects the fact it had the highest average AUM of any region (US$9.21 billion), compared to US$7.2 billion in the UK and US$5.88 billion in APAC. Notably, the strategy split for all three regions was largely the same and so should not be a contributing factor to one region’s score over another, unlike previous editions of the HFCI.

Asia Pacific meanwhile fell back to single digits (+9.4) – the region’s lowest score on record and its third consecutive drop in average confidence. However, the overall regional confidence score belies a wide discrepancy between the score of the regional financial hubs. Japan and Singapore reported scores of +18 and +16, respectively, while Hong Kong only achieved a modest score of +4. In fact, almost half of the Hong Kong-based hedge funds reported a score of 0 or negative confidence.

Over two-thirds of Hong Kong respondents represent strategies that would be particularly exposed to public markets and central bank policy. The city’s average confidence score has trailed Singapore for at least the past 6 quarters, which partly reflects the city’s delayed emergence from the COVID-19 lockdown and the knock-on effect this had on all aspects of businesses, some of which were lured away to other markets – most notably Singapore.

Moreover, the belated removal of pandemic-related challenges only returns focus to other areas of friction, primarily geopolitical challenges, that are giving international investors pause for thought about Hong Kong’s long-term viability, especially given the rise of other markets that appear much more open to foreign investment, such as Dubai.

With all that said, some Hong Kong commentators we spoke to suggest there are reasons for optimism as the return to social and business norms in Hong Kong is nearly complete with international travel now possible without quarantine, which will pave the way for an uptick in overall confidence by the end of the year.

There is more good news elsewhere in APAC. Alongside, Singapore’s continued bullishness Japanese hedge funds continue to report high levels of confidence, no doubt helped by a very strong performance from the local stock markets (Nikkei up 30% YTD) as well as the fundamental economic conditions in the country being better than the US, Europe and China.

The Middle East meanwhile dipped from +22.6 to +16.5, albeit from a significantly smaller pool of respondents than other regions and with a much larger average AUM (US$11.22 billion). The latest HFCI brings the rolling average down to +17.5 from +17.9.

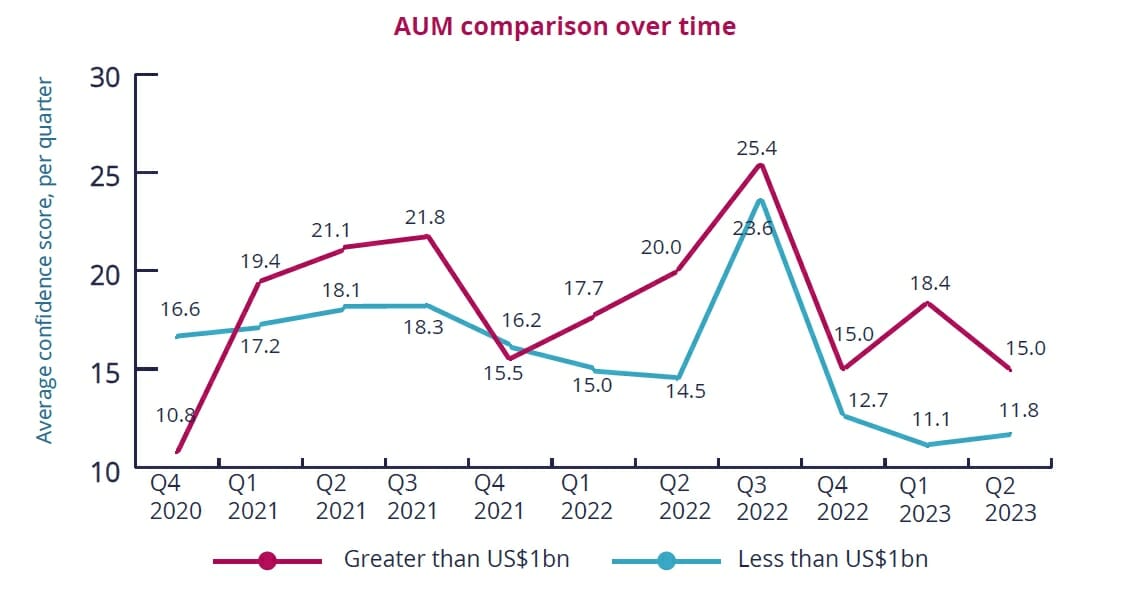

Breakdown By Hedge Fund AUM

When comparing the divide in the confidence scores of respondents globally managing more than or less than US$1 billion, smaller fund managers not only showed resilience but reported a modest uptick in average confidence, whereas their larger peers dropped by four points (see chart below).

Although larger managers remain more confident, on average, the gap between large and small was reduced to only 3 points, in line with the historical average for size-based confidence difference.

The most interesting group from this quarter’s HFCI is North American fund managers with less than US$1 billion in assets, whose optimism overwhelmingly supported the overall group’s score resilience, and North America’s return to the top spot (see regional analysis). They reported being as confident as larger UK fund managers and more confident than larger fund managers in APAC.

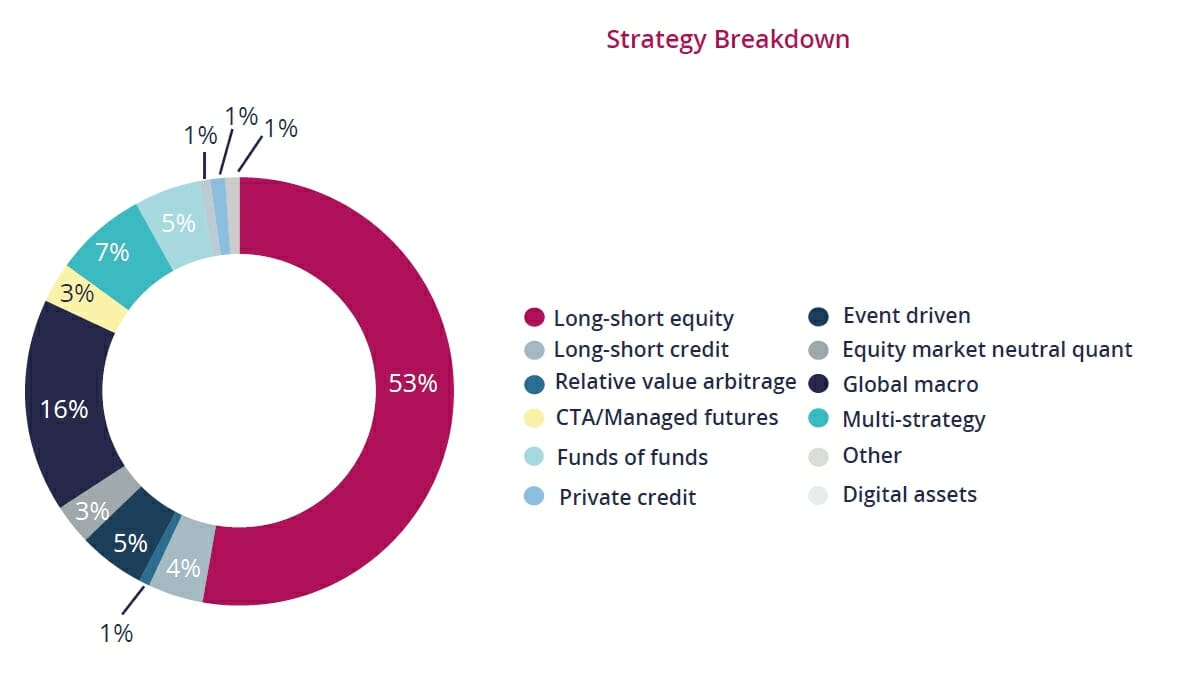

These scores may be driven by smaller managers’ ability to react to fast-changing market conditions, unencumbered by having to deploy large reserves of capital at a time of sparse opportunities across public markets. This advantage may also explain why highly-flexible multi-strategy and global macro strategies for funds were the only strategy groups to report an uptick in confidence compared to Q1. However, as a reminder, the HFCI is more than an indicator of predicted performance as respondents should consider their ability to raise capital and manage costs.

Commentary: Central Bank Policy And Geopolitics Driving Confidence Scores Against The Backdrop Of A Long-Term Inflationary Environment And Rising Costs Of Doing Businesss

Although 90% of respondents remain confident in their economic prospects, the Q2 HFCI reported a more bearish tone across all regions – except for North America – and most strategies reported a lower average score than Q1.

The macroeconomic uncertainty that dominated the narrative in Q1 continues. Stubbornly high inflation levels (especially in the UK) and noises from central banks that they may hike rates further are adding to the melee of factors impacting confidence levels among hedge funds.

Added to this, the relentless onslaught of regulatory change, particularly in the US, shows no signs of abating with scant detail on what the final version (of what could end up being the most serious overhaul of existing market practices for the private funds industry) looks like. Although there are pockets of confidence, overall sentiment is likely to remain dampened while these factors, among others, persist.

To further explain confidence scores from a geography perspective (see previous section), we can look through the lens of fund strategy. Just over half of this HFCI’s respondent pool was made of longshort equity fund managers, with a further 16% of global macro fund managers, both of whom have endured a difficult period over the past quarter making it sensitive to global interest rate cycles as a driver of confidence in economic performance.

Despite the gloomy environment, hedge funds may have some reason for cautious optimism. With signs pointing to a more divergent monetary policy from central banks globally in the second half of the year, this could present more trading opportunities for hedge funds with the resultant next HFCI potentially revealing a more positive pattern for the industry than that reported in the first half of this year.

Breakdown Of Respondents

Estimated assets under management for hedge fund respondents: US$3.34 trillion

Hedge Fund Confidence Index Over Time

Tom Kehoe, Global Head of Research and Communications at AIMA, said: “In the face of prevailing macroeconomic and geopolitical concerns, we acknowledge the lower levels of economic confidence reported by hedge funds. News that central bank monetary policy is likely to diverge from the second half of this year should present more trading opportunities for hedge funds and the resultant next HFCI being more positive to the pattern set in the first half of this year.”

Dev Saksena, Partner at Simmons & Simmons, said: “Despite a small drop in confidence among UK managers possibly due to a more challenging trading environment, we are still seeing a consistently resilient UK market. We have seen an increase in capital raising opportunities for UK managers from both the Middle East and other institutional investors. and positive performance results have also contributed to ensuring the overall trend over the last eight quarters remains positive in the UK.”