Robert Kiyosaki’s Rich Dad Poor Dad defined assets as anything that puts money into your pocket and liabilities as anything that takes money away from your pocket.

Although that definition appears overly simplistic, the wisdom it communicates is rooted in simple math – which explains why the book has been extremely successful.

As an eCommerce merchant, one of the things that take money out of your pocket today is chargebacks.

Chargebacks are a growing sustainability risk for the entire eCommerce ecosystem.

Take a look at these numbers:

- Analysts estimate global chargeback cost for 2023 to reach $117.47 billion.

- The average industry cost per $90 chargeback will hit $191 this year.

- NRF found the total losses from friendly fraud over a year to be $25 billion, and friendly fraud accounts for about 75% of all transaction disputes.

By and large, chargeback costs are not limited to the loss of service or merchandise but can also include the loss of payment processing privileges.

This article seeks to guide the reader through chargeback mitigation best practices used by eCommerce veterans and dispute managers.

Understanding the chargeback concept and reasons why cardholders file disputes

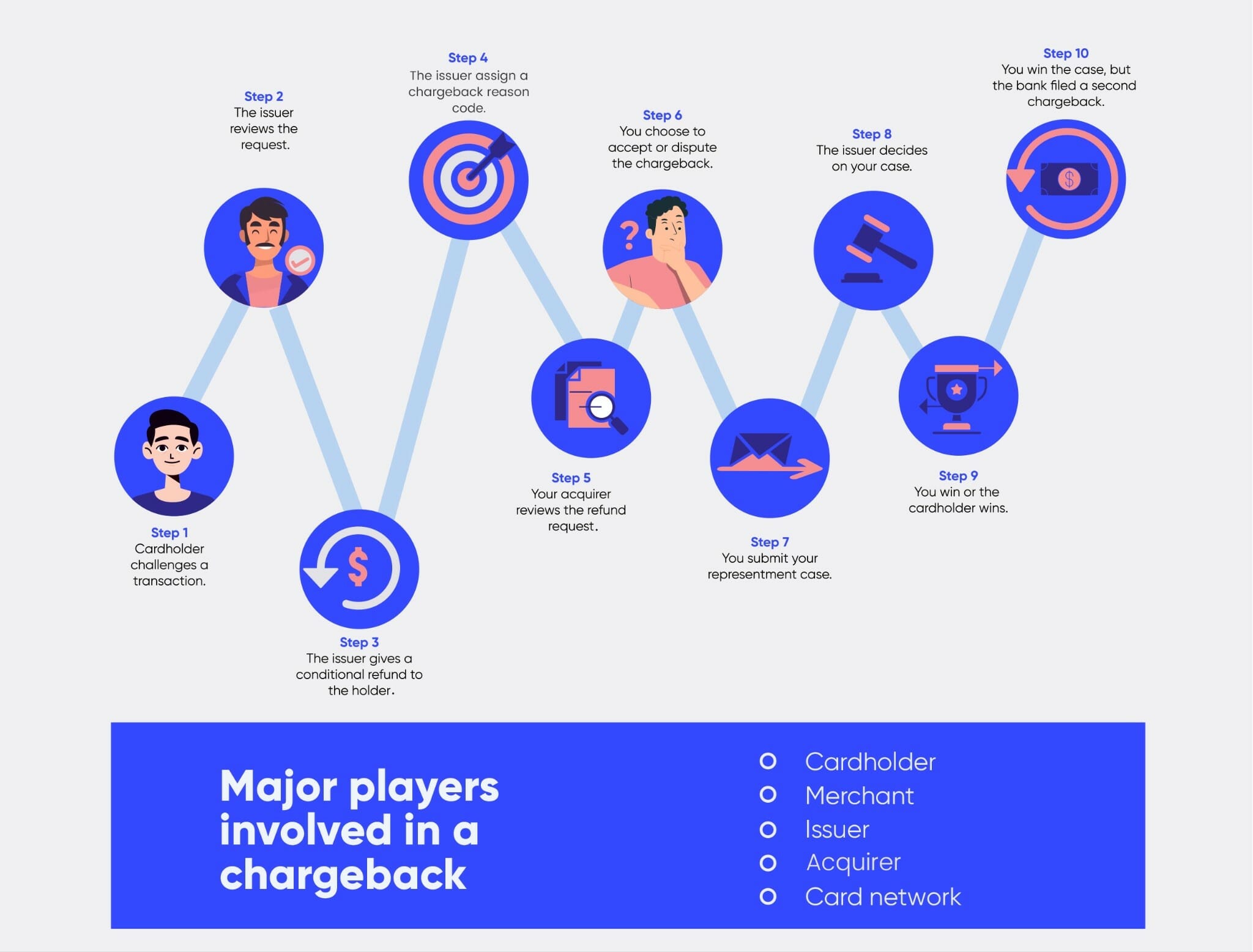

If you’re new to the concept, you might struggle understanding how banks can reverse transactions to pull money from your account and award it to the cardholder.

Well, the history of chargebacks dates back to the early ‘70s. Credit cards were fairly new during this period, and consumers hesitated to adopt them as a transaction instrument.

The reasons were two-pronged:

- They feared they could lose their cards, and unscrupulous individuals will use the cards to ramp up bills for them to pay.

- Folks wondered if merchants with questionable characters would not overbill and shortchange them.

These issues prompted consumer protection professionals to seek federal protection, resulting in the Fair Credit Billing Act (FCBA) 1974. That law gave birth to what we know as chargebacks today. It empowers financial institutions or card issuers to reverse a transaction when a cardholder has an issue they cannot resolve with the merchant.

Reasons for chargebacks explained

The FCBA act has evolved over the years. However, there are three major reasons cardholders file chargebacks, including unathorized transaction, merchant error, and friendly fraud. We’ll explain those further as follows:

- Unauthorized transactions. These are transactions made without the consent of the card owner. A scammer gained access to the card details, a family relative, spouse, or a minor made a transaction, and the card owner is unwilling to pay the bills.

- Merchant error. Avoidable merchant missteps like double billing, charging a canceled recurring billing, or poor order fulfillment practices can attract buyers’ wrath and incidental chargebacks.

- Friendly fraud. This is a fancy pants’ name for intentional or unintentional abuse of the chargeback system. In this case, the customer might have buyer’s remorse, want to get a freebie, or don’t understand or want to follow your return policy.

With all that said, it’s equally vital to mention that the chargeback reason code (i.e., an alphanumeric code that banks send to highlight the reason for the dispute) does not always reflect the actual reason behind the chargeback.

Take an unauthorized transaction chargeback, for example. The customer might have forgotten they made the transaction. Or they may be looking for a way to escape the financial responsibility.

While such behavior might seem fun for the perpetrator, the impacts weigh heavily on the business.

Chargeback impact on businesses explained.

It would’ve been great to treat chargebacks as the cost of goods sold in your books. But it’s not true that chargebacks are a cost of doing business.

First, there’s the chargeback fees. Most banks place a chargeback fee of $15 to $100 on each dispute you receive. The exact chargeback amount depends on the acquirer you’re dealing with and your chargeback ratio, as “high risk” merchants pay much higher fees. Penalties can range from $5000 to $25,000.

Bearing that thought in mind, let’s take inventory of other ways chargebacks cost your business.

- Overhead expenses: Every eCommerce transaction involves multiple tasks like product pick-up, packaging, warehousing, and shipping. These tasks also come with fees. Unfortunately, if a scammer issues a false chargeback, it affects your revenue and your balance sheet due to the overhead costs associated with these tasks.

- Marketing and customer acquisition fees. You invest significant money in generating leads, acquiring the buyer, and closing the sale. This could involve hiring a full-time sales and marketing team or freelancers. Typically, you may spend between 30 to 40 percent of your sales budget on marketing. However, if the order gets charged back, all the resources spent convincing the buyer to purchase from you go to the wind.

- Order processing fees. When merchants process transactions, they pay a fee to the payment processor for order processing. Additionally, an interchange fee, typically between 1.5% to 4% of the transaction value, is paid to the issuing bank. If a chargeback occurs, the interchange fee becomes a loss.

- Inventory. On average, merchants lose around 20% of their revenue due to chargebacks caused by inventory management expenses.

Sometimes, a cardholder may ask the merchant for a refund and file a chargeback with their issuer – like requesting two Uber rides and jumping onto the first car to arrive.

That creates a situation known as a double refund chargeback, which causes the merchant to suffer two losses: the cost of the chargeback (including fees) and the cost of the refund. Studies indicate merchants lose at least $3 for every $1 charged back.

Chargeback Mitigation Best Practices

Considering the quantum of resources businesses lose to chargebacks, plugging this revenue leakage should be a priority for every executive.

After all, you’re not in business to write off losses, are you?

Here are the best practices to help you stop chargeback disputes from taking your business under:

1. It starts with your product descriptions

Research shows that poorly crafted product descriptions can be a source of dispute, as they create expectation gaps. Hence, make sure your product description isn’t letting you down.

Some checklists to consider for a great product description includes:

- The target audience and what they are looking for in the product

- Headline of your product description, with detailed and accurate product information

- High-quality images from multiple sides to highlight product features

- Product specifications, features, and any limitations

These are crucial because they help you set the right expectations, minimize misunderstandings, and reduce chargeback occurrences due to customer dissatisfaction or product misalignment.

2. Make it easy for customers to talk to you before talking to their bank

Investing in customer service brings you closer to your customers, making it easy for them to talk to you before seeking remediation from their bank.

Some customer service checklist to consider includes:

- Multiple and clear communication channels (phone, email, live chat, social media)

- Prompt response to customer inquiries and concerns

- Automated post-purchase emails to add a human touch to sales and possibly upsell

- Effective dispute resolution mechanisms that create a win-win experience

While these tips will help you stem disputes from actual customers, they might not make much difference when dealing with scammers looking to steal from you in the guise of a transaction dispute.

That brings us to the third best practice:

3. Limit the chances of fraud with digital security

History shows that online scams rise when markets shift and the economy contracts, such as we see happening today. For example, estimates from different sources show a growing fraud pattern since 2020. Statista says eCommerce losses to online payment fraud could reach 48 billion U.S. dollars this year, 2023, up from 41 billion U.S. dollars in 2022.

Protect your online store from scammers. Here are some non-exhaustive measures to consider:

- The payment processor that understands eCommerce

- Your website must have fraud anti-fraud tools like Geolocation, Proxy Piercing, Device Fingerprinting, Address Verification, Velocity Checks, Fraud Scoring, and 3D Secure

- Compliance with Payment Card Industry Data Security Standards (PCI DSS)

Using proactive fraud prevention measures ensures you don’t open a backdoor for scammers to punish you by stealing your customers’ data.

4. Ensure your refund and return policies aren’t shooting you in the foot

For some vendors, these tools might seem like after-thoughts, something you can quickly tack somewhere to secure a sale. Yet, an excellent return and refund policy is crucial to safeguarding your revenue.

Some questions to answer in crafting effective return and refund policies include:

- What constitutes sales-final, and when can customers seek a refund?

- Do customers understand your refund and return policy?

- Can buyers quickly access your policy when needed?

- Is there an online portal, or do customers have to call or email to initiate a return?

- Are any fees associated with the return process, such as restocking or shipping costs?

- Will your team be responsive and helpful if customers have questions or concerns about a return?

- Does your team offer additional resources, such as online chat or a customer service hotline, to make the return process as smooth as possible?

Analysts say 40% of consumers prefer to find information on their own. So your policies will be their first contact in addressing order issues. More so, over 60% of customers review the return policy before purchasing. While you want these documents to be flexible, you don’t want them to become counter-productive.

5. Play by industry best practices for order fulfillment and shipping

The first step on this wise is to make your billing descriptors easy to grasp. Research shows that some chargebacks can be avoided with an excellent billing descriptor displaying your business name, website, and contact information.

If buyers don’t recognize your billing information, they might be inclined to file a chargeback.

Additionally, you must always ship orders with tracking to ensure your customers can readily see the status of their orders at any time. But that won’t be possible if your inventory management systems are sub-optimal.

If you offer backordering, avoid delays that could result in buyer’s remorse.

6. Pre-empt losses with chargeback automation

As you know, about 70% of all chargebacks are meritless. One research found that 81% of cardholders have filed at least one chargeback because it was convenient. So no matter what defense mechanism you put in place, you will not fully be safe. That’s where automated chargeback systems like Chargeflow.io comes in.

Additional benefits of automated chargeback recovery are that you can track orders that could result in disputes, monitor transactions for signs of fraud or suspicious activity, and resolve disputes profitably.