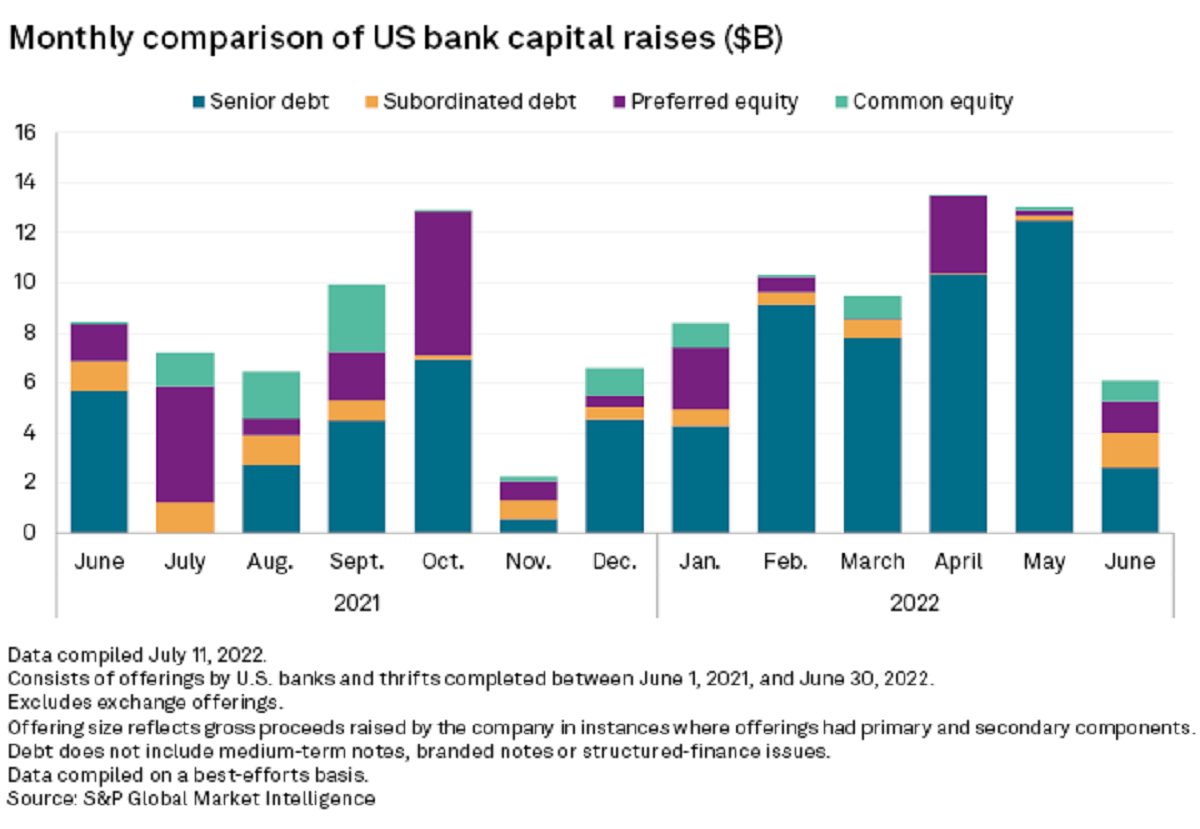

The overall total value of capital markets issuance from U.S. banks plummeted in June despite month-over-month increases from subordinated debt offerings along with preferred and common equity.

Capital raised by U.S. banks in June fell to $6.08 billion, a 53.2% decline month over month and 27.9% decline year over year, according to a new data analysis from S&P Global Market Intelligence. The drop was driven by a reduction in the value of senior debt issuance, which fell 79.1% month over month and 53.8% year over year to $2.62 billion, and was the lowest total in a calendar month since November 2021.

Q2 2022 hedge fund letters, conferences and more

Key highlights from the analysis include:

- June marked the seventh straight month in which senior debt generated the highest total value, and it was followed by subordinated debt offerings at $1.38 billion, marking the first month since August 2021 that the total cleared the $1 billion threshold.

- Preferred equity and common equity capital raises saw drastic month-over-month increases in June. Preferred equity jumped to $1.26 billion in June from $212.1 million in May, while common equity increased month over month to $818.9 million from $115.66 million.

- Preferred equity declined on a year-over-year basis, falling from $1.49 billion in June 2021. Common equity did increase on a year-over-year basis, from $75.77 million in June 2021.

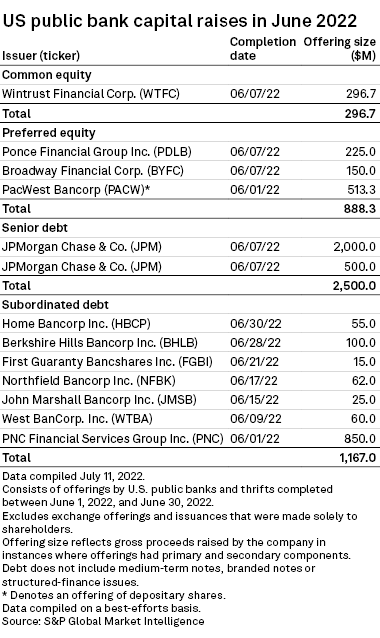

- Largest issuers among U.S. public banks: JPMorgan Chase & Co (NYSE:JPM) raised the most in June owing to two senior debt offerings on June 7 totaling $2.5 billion. PNC Financial Services Group Inc (NYSE:PNC) raised the second most among public banks with its $850 million subordinated debt offering.