Fintel reports that Baillie Gifford & has filed a 13G/A form with the SEC disclosing ownership of 3.25MM shares of Duolingo, Inc. Class A (NASDAQ:DUOL). This represents 10.4% of the company.

In their previous filing dated October 6, 2022 they reported 3.07MM shares and 10.03% of the company, an increase in shares of 5.97% and an increase in total ownership of 0.37% (calculated as current – previous percent ownership).

Q4 2022 hedge fund letters, conferences and more

Analyst Price Forecast For Duolingo Suggests 18.14% Upside

As of January 30, 2023, the average one-year price target for Duolingo, Inc. is $109.90. The forecasts range from a low of $83.83 to a high of $141.75. The average price target represents an increase of 18.14% from its latest reported closing price of $93.03.

The projected annual revenue for Duolingo, Inc. is $473MM, an increase of 39.70%. The projected annual EPS is $-1.53.

Fund Sentiment

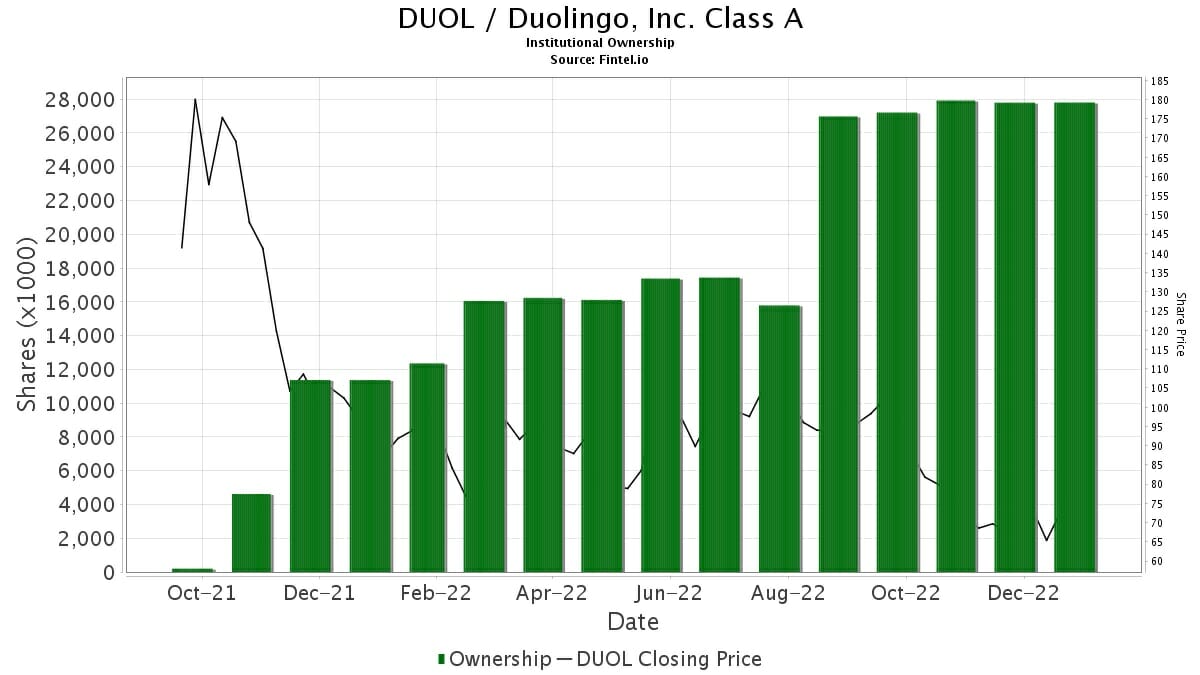

There are 358 funds or institutions reporting positions in Duolingo, Inc.. This is an increase of 50 owner(s) or 16.23%.

Average portfolio weight of all funds dedicated to US:DUOL is 0.4390%, a decrease of 24.1465%. Total shares owned by institutions increased in the last three months by 1.06% to 27,983K shares.

Durable Capital Partners holds 3,776,894 shares representing 9.40% ownership of the company. No change in the last quarter.

General Atlantic holds 1,479,294 shares representing 3.68% ownership of the company. In it's prior filing, the firm reported owning 1,599,286 shares, representing a decrease of 8.11%. The firm decreased its portfolio allocation in DUOL by 9.25% over the last quarter.

NewView Capital Partners I holds 1,139,835 shares representing 2.84% ownership of the company. In it's prior filing, the firm reported owning 3,239,835 shares, representing a decrease of 184.24%. The firm decreased its portfolio allocation in DUOL by 37.11% over the last quarter.

Foxhaven Asset Management holds 1,118,529 shares representing 2.78% ownership of the company. In it's prior filing, the firm reported owning 1,119,197 shares, representing a decrease of 0.06%. The firm increased its portfolio allocation in DUOL by 7.04% over the last quarter.

T. Rowe Price Investment Management holds 1,088,859 shares representing 2.71% ownership of the company.

Duolingo Background Information

(This description is provided by the company.)

Duolingo is an American educational technology company which produces apps for language-learning and provides language certification. On its main app, users can practice vocabulary, grammar, pronunciation and listening skills using spaced repetition.

Article by Fintel