Rising commodity prices and domestic attacks on remuneration could propel activism in Canada to record highs.

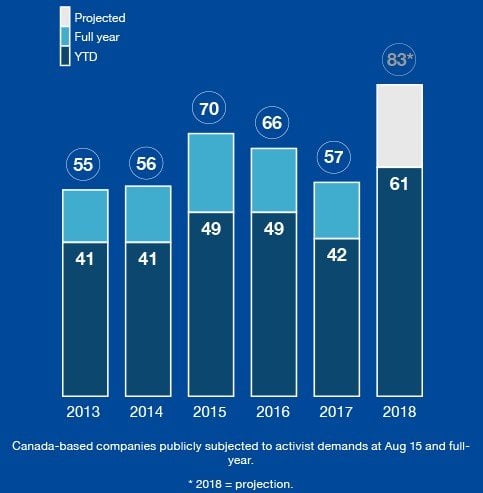

The number of companies publicly targeted in Canada in 2018 had reached 61 by mid-August according to an analysis for the September edition of Activist Insight Monthly, about a quarter higher than the 49 companies targeted by mid-August in 2015 and 2016.

Q2 hedge fund letters, conference, scoops etc

Booming Bay Street

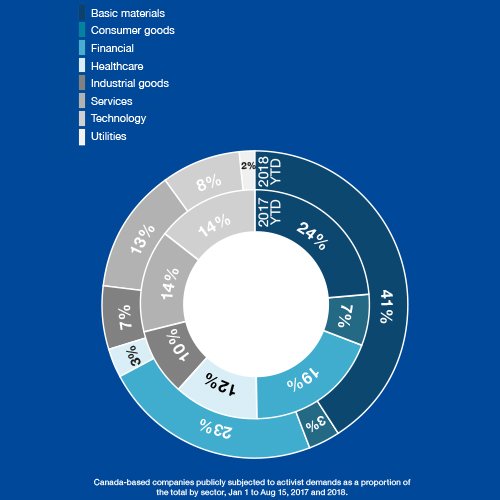

A more attractive commodity environment has meant a wave of interest from non-Canadian activists. So far this year, 21 companies publicly subjected to demands were targeted by non-Canadian activists.

Less lucrative settlements

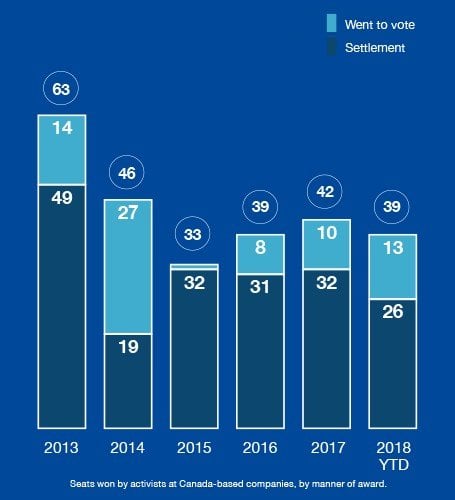

Activist Insight data show that the number of board seats won in proxy fights has fallen since the heady days of 2013-2014, while settlements have stabilized. That change has taken place even as demands for board change have increased.

Getting on board

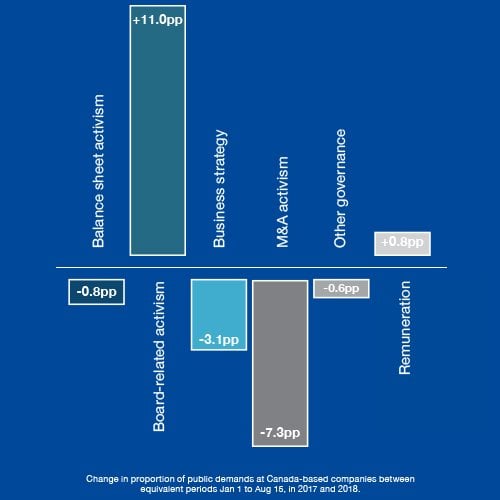

Activist Insight data show that while Canadian and U.S. activists place similar priority on board change, Canadian activists – particularly Quebecois members group Mouvement d’education et de defense des actionnaires (Médac) – are more likely to focus on compensation issues, and Americans to make M&A-related demands.

It’s all over, now