Alpine Capital Research commentary for the second quarter ended June 2021, titled. “Inflation, Markets And Returns.”

Q2 2021 hedge fund letters, conferences and more

Market Update

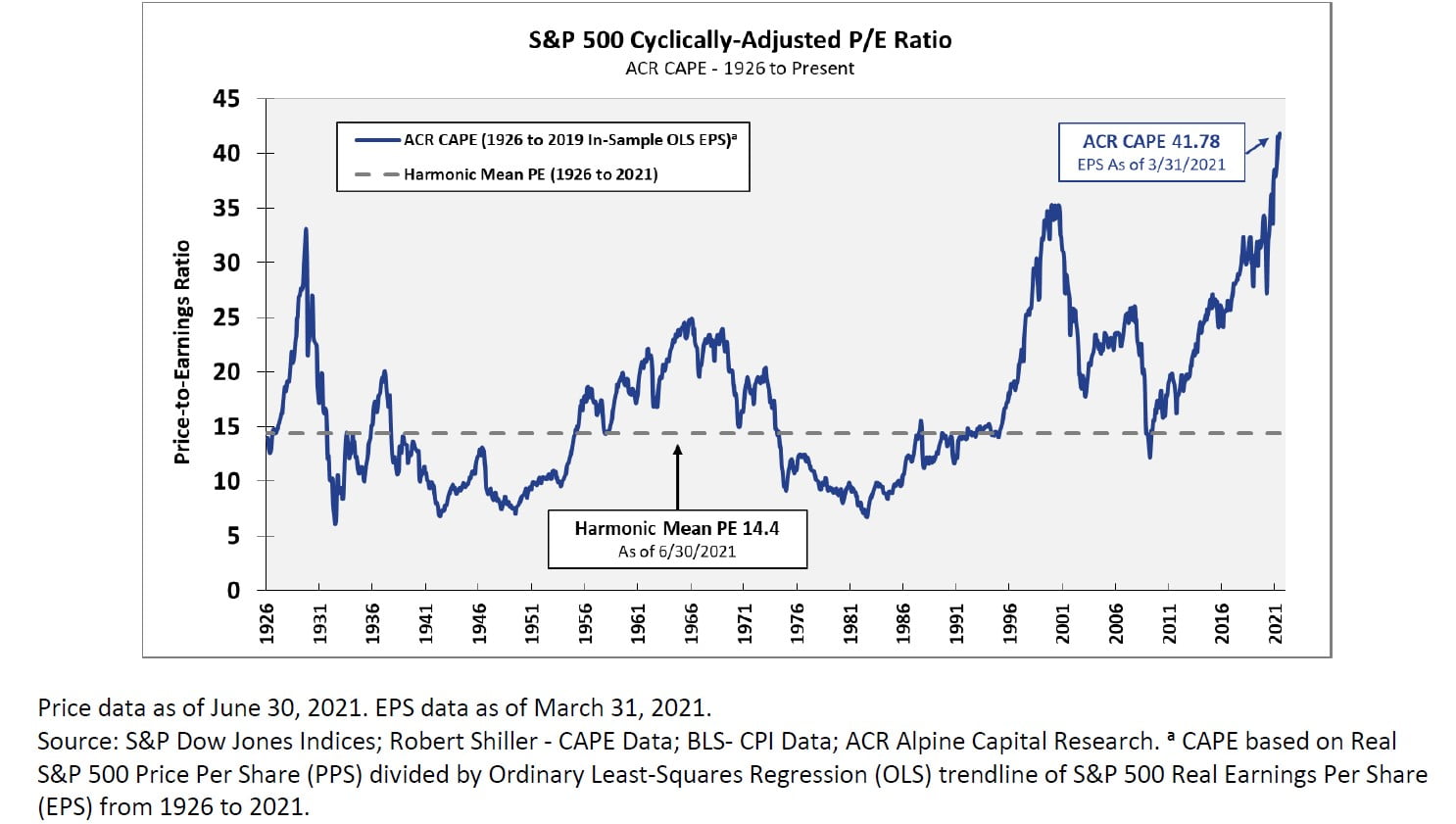

Financial market prices continued to rise in the second quarter with equity-market values hitting all-time highs compared to cyclically adjusted profits. The ACR investment team, while satisfied with our current holdings, are struggling to find new investments that meet our quality and return requirements. For more than 21 years we have exercised patience. We are not about to change stripes now.

The value-oriented equity portfolio resurgence during the fourth quarter of 2020 and first quarter of 2021 reversed in the second quarter (updated strategy returns can be found at https://www.acr-invest.com/strategies/eqr-advised-sma-composite). The tossing about of equity prices by speculators betting on the twists and turns in the virus, inflation, and interest rates continues. We ignore the noise of short-term fluctuations that are unlikely to have a meaningful impact on intrinsic value.

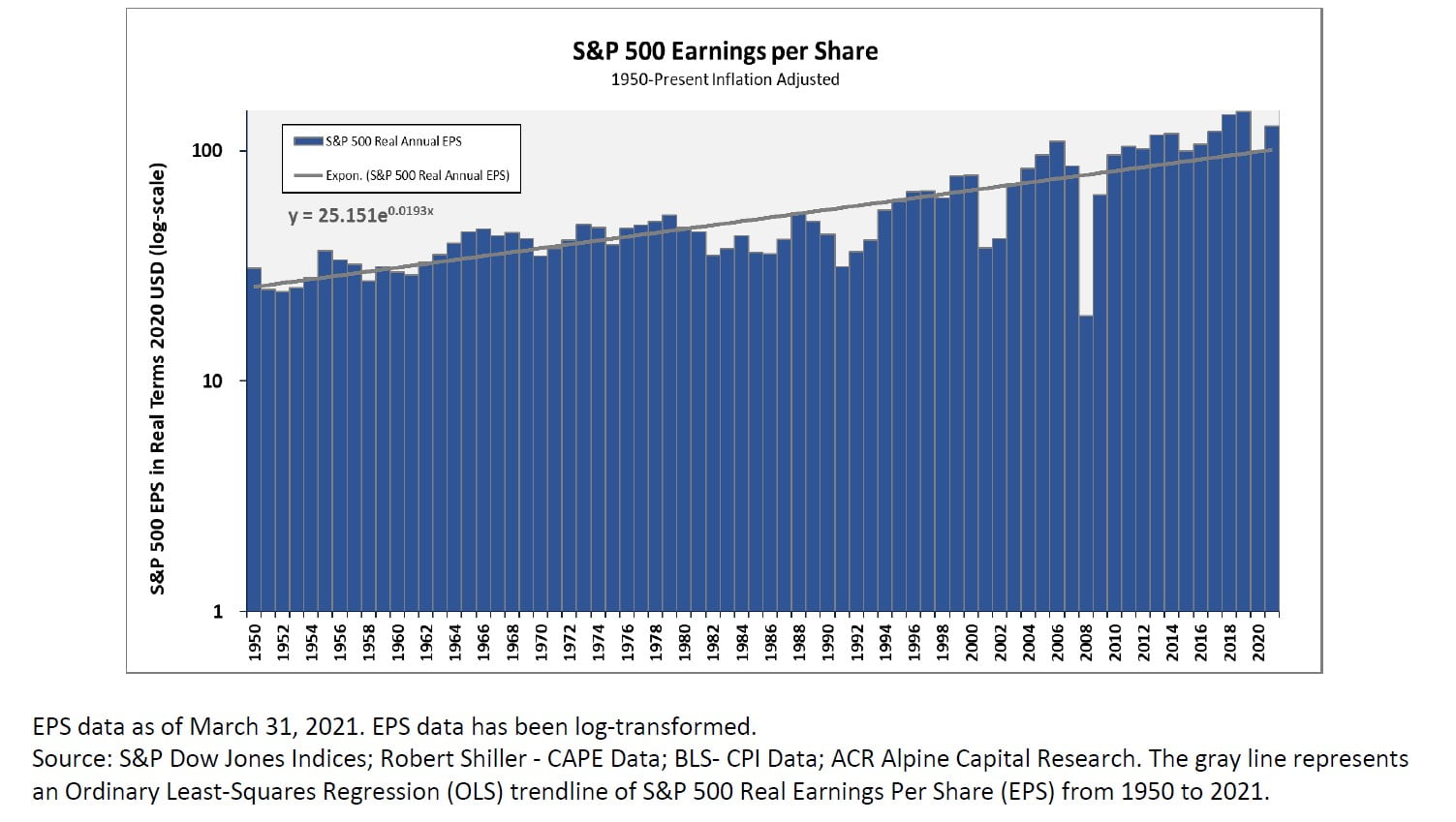

The signal is contained in the more essential economic drivers and remains the same: (i) corporate profits continue to accumulate along their long-term GDP-linked path, (ii) high prices on normalized profit levels imply lower equity-market returns, (iii) value-oriented portfolios like ours remain highly depressed in price compared to the overall market, (iv) we therefore remain confident of being able to deliver satisfactory returns regardless of high equity-market prices.

Quick Take on Inflation

ACR’s stated mission is to protect and maximize our investors’ purchasing power. “Purchasing power” was explicitly chosen to reference the protection of real value against inflation. Now that inflation has become the topic du jour among serious economists and pundits alike, it is a good time to summarize how we endeavor to achieve our inflation-protecting mission.

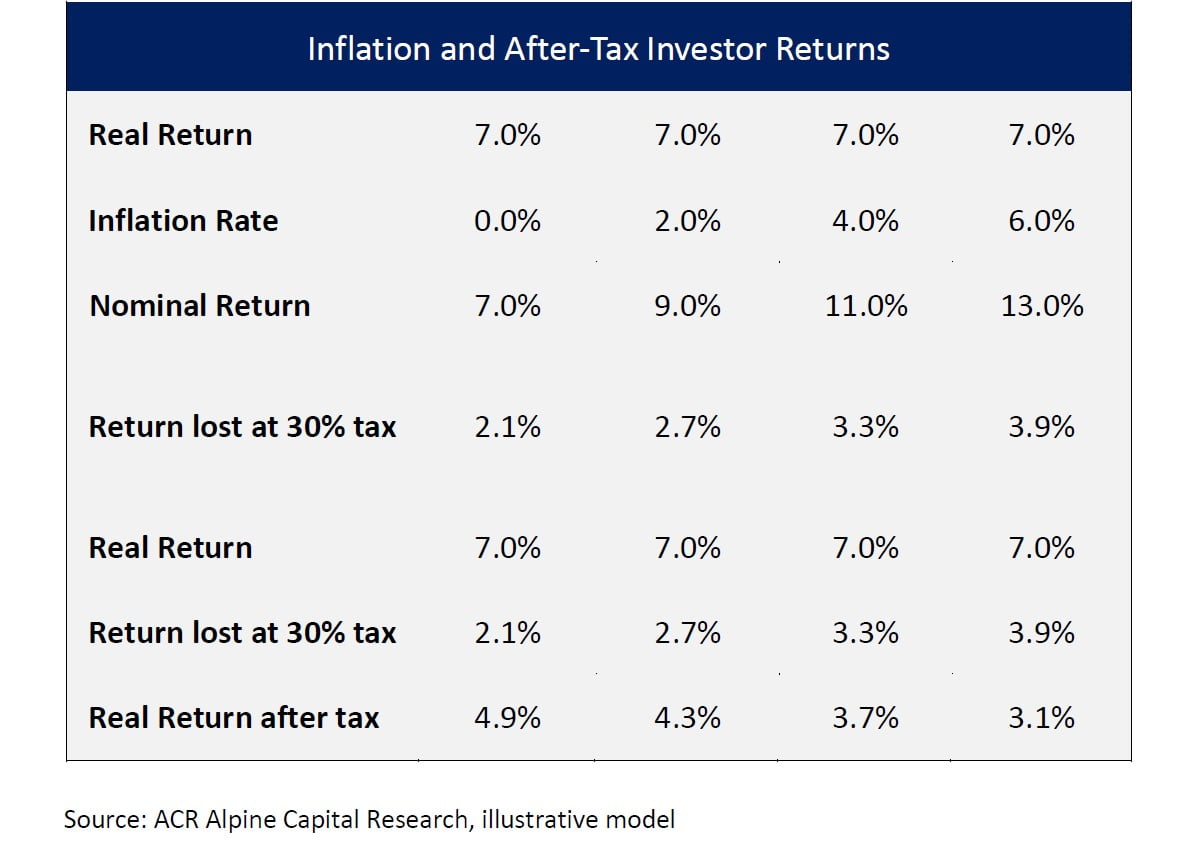

The short answer comes in two parts—at the company and taxable investor levels. At the company level, we are confident of being able to protect against inflation in the long run by owning businesses that can raise their prices with their costs. At the taxable investor level, inflation could cause some unavoidable after-tax real return erosion in taxable accounts, since returns are not indexed to inflation. The table of hypothetical returns that follows illustrates this effect:

Two observations. First, tax mitigation strategies can help. Deferring unrealized capital gains can materially reduce the annual tax on investment returns. Other more complex tax mitigation strategies, which are beyond the scope of this commentary, are also possible. Second, we believe it is unlikely that long-term inflation will permanently impair the taxable investor’s after-tax real return by more than 0.5-1%. The next section will address some of the complexities relating to inflation and equity returns, including the rationale for our second observation. Anyone wishing to avoid the deeper dive can skip to the final section, which contains a brief inflation outlook.

More on Equities and Inflation

In principle, equities are a hedge against inflation. To say that price increases are caused by companies raising prices is tautological. This is what happens. Yet, as with many issues in economics, the truth is more complex. We have found there to be a wide divergence of opinion on this topic among both academics and industry practitioners.

Research on equities and inflation has, in our view, been lost in the woods for decades. An article on the subject from a reputable financial journal summarizes the general consensus: “An extensive literature has documented the poor inflation-hedging properties of the overall stock market.”i The same paper goes on to describe how some individual equities may provide a hedge against inflation, as other papers have in more recent years.

Confusion, in our opinion, stems from three sources: (i) the periods studied, (ii) data frequency, (iii), the distinction between protection at the corporate-earnings and stock-return levels. The periods studied are generally too short and the frequency of stock return data too high. Recall that inflation protection is a function of companies raising their prices with costs. Importantly, this occurs at the corporate earnings level. While corporate earnings and stock returns are directly related, we also know that they have diverged wildly over the years. Variations in the cyclically adjusted price/earnings (P/E) ratios over the past 50 years have ranged from 7x to 42x. Additionally, there are many other factors impacting earnings and prices than just inflation. Therefore, only a study that covers very long periods over which price and earnings have time to converge would potentially be able to properly capture the relationship between equities and inflation.

A 2001 paper by James R. Lothian and Cornelia McCarthy called “Equity Returns and Inflation: The Puzzlingly Long Lags”ii stands the test of time for its analysis of long-term equity values and inflation. I came upon this paper studying the subject in the early 2000s. Its conclusions are as relevant today as ever. The paper abstract posits the case well:

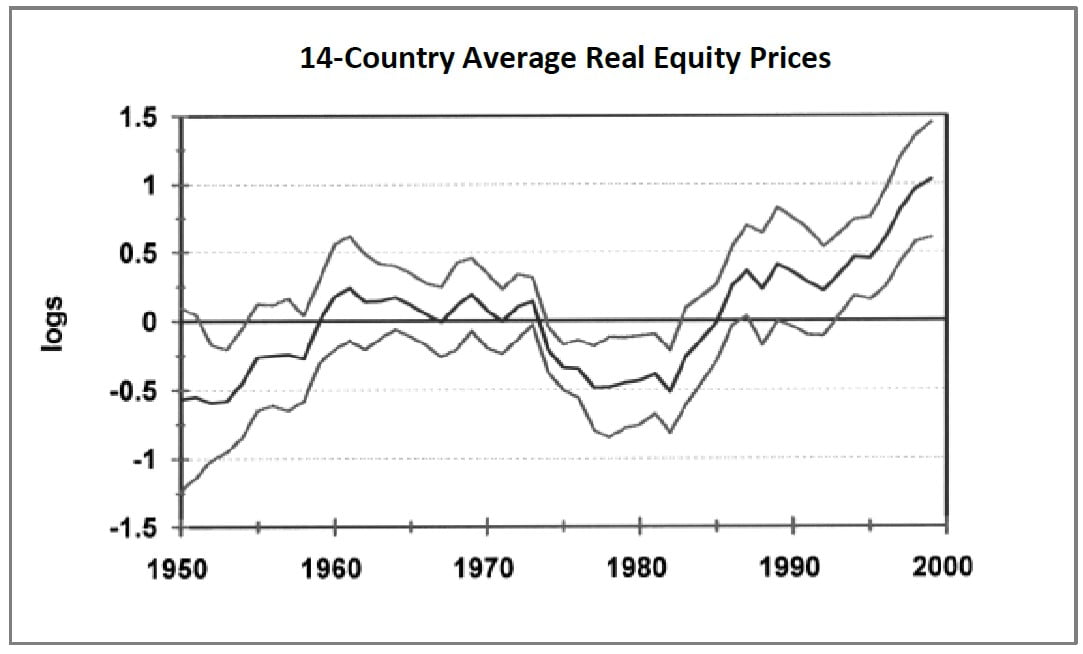

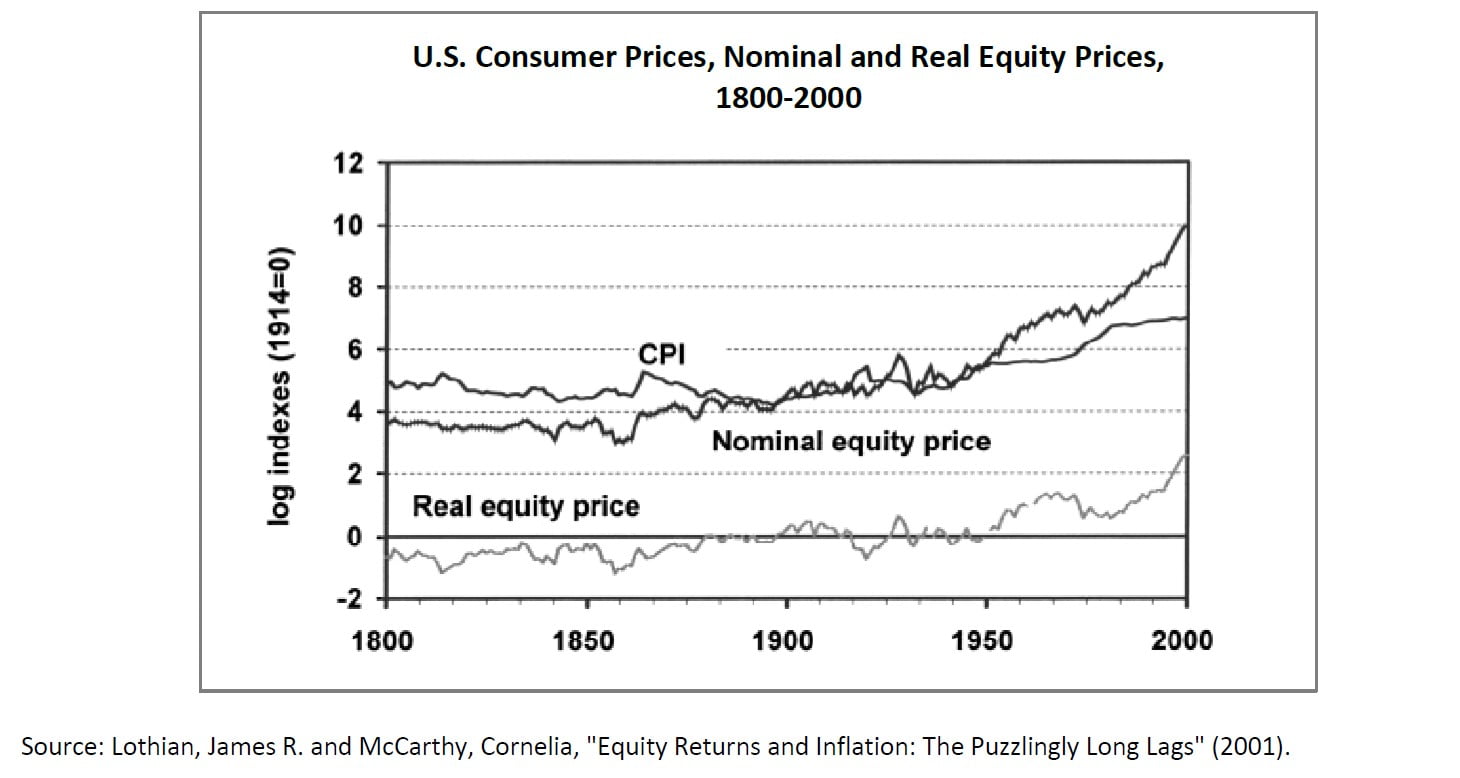

This paper examines data for stock prices and price levels of 14 developed countries during the post-WWII era and compares their behavior in that sample with behavior over the past two centuries in the UK and the US. Contrary to much of the literature of the past several decades, we find that nominal equity prices do, in fact, keep pace with movements in the overall price level. Our results suggest, however, that this is only the case over long periods. The puzzle therefore is not that equities fail the test as inflation hedges, as had been quite widely believed, but that they take so long to pass.

Two charts from the Lothian paper illustrate the point:

The first chart shows a 14-country average of real equity price increases with standard deviation bands over 50 years. The second chart shows the U.S. consumer price index and nominal and real equity prices over 200 years. Real equity prices clearly rise in the long run, thus showing that equities provide a hedge against inflation (the paper provides a great deal more statistical evidence). The result seems anticlimactic because it is so intuitively expected.

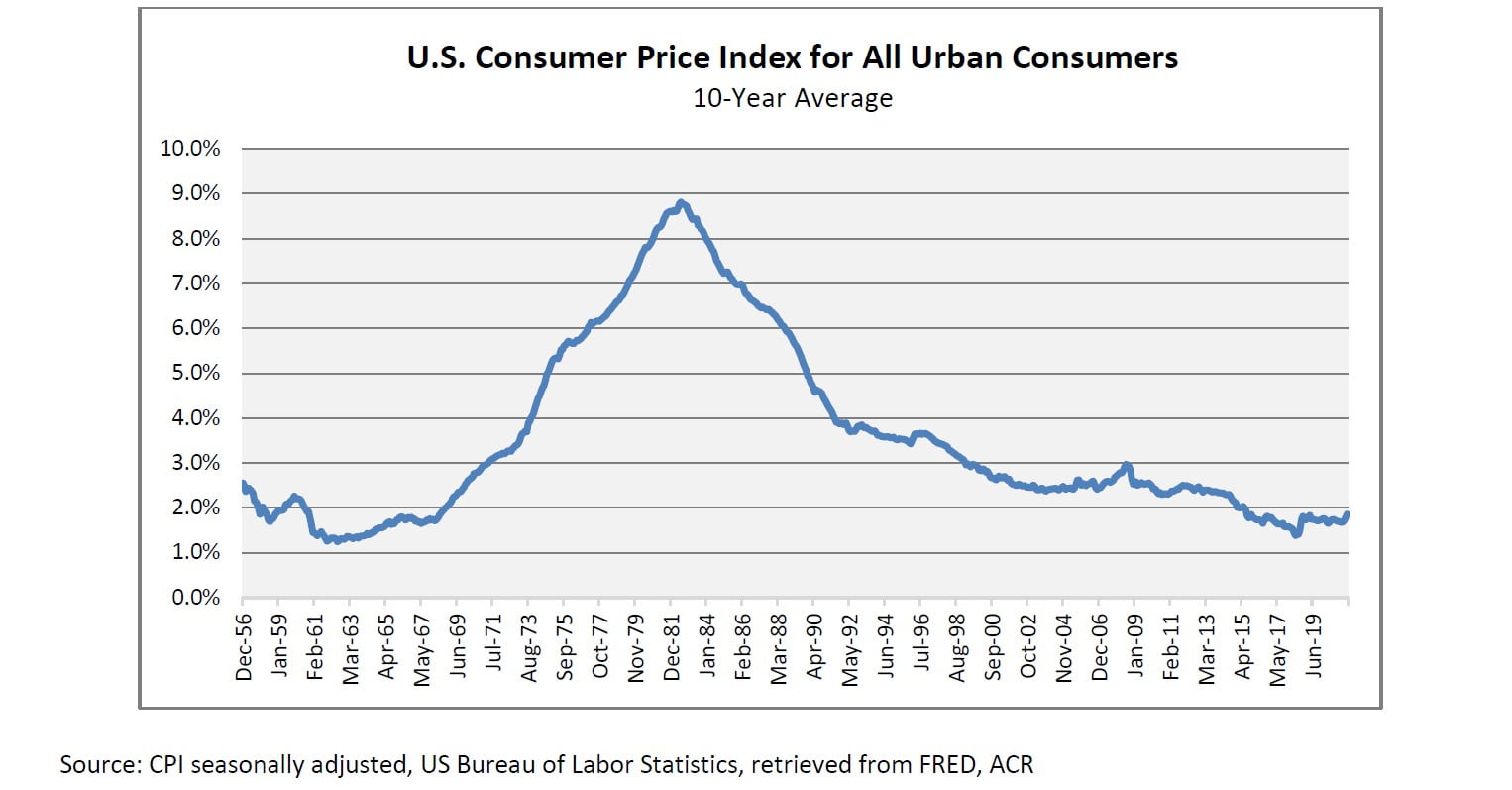

Embedded in the long-run data is a distinct period of declining real U.S. equity prices from the early 1960s to early 1980s. Interestingly, this period coincides with the only significant period of sustained inflation in the U.S. over the entire data set. The chart below shows this period as measured by the 10-year average consumer price index. Despite the large amount of high-frequency data employed in much of the research on equities and inflation, this period represents the one-and-only data point we have for a sustained higher inflation!

Many erroneously concluded from this single data point that equities were not a hedge against inflation. As Lothian observes, equity prices are a hedge against inflation in the long run since there is a period of much higher real equity price increases that eventually overcome the period of real equity price declines. But why the long lag? Several explanations come to mind.

The first is the market got it wrong from the mid-70s to early 80s and this was a wonderful time to invest in equities. Indeed, this is the case in retrospect. At the time, cash was clearly king as short-term rates climbed to highs in the double-digits. Investors were understandably lured by historically rich “risk-free” yields without properly appraising the prospects for stocks. This leads us to a second critical distinction. Company-level earnings kept pace with inflation over this period as theory suggests, while the declining real price resulted in P/E ratios plummeting into the single digits.

Fundamental value investors who pay attention to earnings rather than stock prices would have been happily loading up on stocks, and in the subsequent two decades, would have been amply rewarded. It should also be noted that the erosion of investor after-tax returns in the short term is offset by the higher real return on equities at single-digit P/Es.

Interestingly, we may be at the opposite end of this spectrum today. Inflation and interest rates have been declining and P/E ratios rising now for more than 40 years. Cash, far from being king, is a four-letter word. Yet, just as in the early 1980s, investors had it wrong; perhaps history will prove the present day’s conventional wisdom about cash being trash is also wrong. We are not suggesting a sustained increase in prices and return to ‘70s and ‘80s style inflation. We do believe it is possible that the most recent era of negative real rates may not last forever, just as the high inflation and interest rates of the ‘70s and ‘80s eventually passed into the rearview mirror of economic history. A return to average historical real yields would still be significant for the financial markets.

The last item of importance is the one on which we spend the most time. To be successful at protecting against inflation, we must still own the “right” equities—those that can raise their prices with their costs. Not every company we own will be able to do so. Several could fail in this respect (while others could exceed expectations), which is why we manage diversified portfolios. The dynamic between cost pressures and product price increases is also likely to be lumpy. Costs may rise quicker for a quarter or two or even longer before product price increases can be established. The monitoring of company cost structure and pricing power and the competitive dynamics that drive margins are central to our analysis. The weak link in the supply chain is most likely to feel the most pressure. We tend to avoid such companies due to our insistence on quality. Investing in companies with sound competitive positions is a key element for investment success, as well as for warding off the deleterious effects of inflation.

Inflation Outlook

Investors looking for a specific inflation forecast from the ACR investment team or our macroeconomic advisor will be disappointed. While we have well-considered views on the subject, inflation, in our opinion, cannot be reliably forecasted with any degree of precision. Yet we do have a few thoughts about how we see various potential forward-going inflation-rate scenarios impacting our portfolios and decision-making.

First, there is a possibility that inflation will surprise to the upside in the short run and the U.S. Federal Reserve will have to raise rates quicker than expected. Should this occur, there is a good chance our holdings would temporarily decline in price. However, we do not believe the earning power or intrinsic value of our companies would be significantly diminished. Temporary higher inflation and rates and a subsequent recession are hardly worthy of panic, given our positioning. Rather, we would welcome the opportunity to invest our cash reserves at better prices.

There is also a strong possibility that the bottlenecks caused by the unusual economic whipsaw from pandemic recession to stimulus-driven recovery will be resolved in a matter of months, and as the stimulus fades, both demand and price pressures will recede. A “soft landing” would be neutral for our portfolios in the sense that market dislocation would be unlikely, and we would have fewer opportunities, but our current holdings would be positively impacted.

The economy could also get worse. The Delta variant may cause the recovery to falter in the U.S. and globally, and there is always the chance of a breakthrough variant that is resistant to current vaccines. Our base case nevertheless remains continued solid recovery. Presently, we do not believe the Delta variant will cause a serious enough healthcare setback to knock the recovery off track, and we believe the chance of a vaccine-resistant variant remains relatively low. Most importantly, the quality of our holdings will always remain a mitigant against more turbulent times.

Lastly, an unexpected bout of longer-lasting inflation could take hold due to the self-fulfilling prophecy of higher wage and price expectations, or because of other more complex and unpredictable factors, such as slowing global labor supply from China. The dynamics of global inflation are complex to say the least. Yet just because such a scenario can be imagined and supported with a plausible rationale does not mean it is inevitable nor even likely. Investors may wish to purchase protection from such an event. At ACR, we remain comfortable with the natural long-run inflation protection we enjoy from owning companies that can raise their prices with costs.

Nick Tompras

July 2021