Whitney Tilson’s email to investors discussing Berkshire Hathaway Inc. (NYSE:BRK.A) (NYSE:BRK.B)’s third-quarter earnings report; updated estimate of Berkshire’s intrinsic value.

Q3 2021 hedge fund letters, conferences and more

Berkshire Hathaway's Third-Quarter Earnings Report

1) Berkshire Hathaway (BRK-B), which I continue to believe is the No. 1 retirement stock in America, is up 25% this year, exactly in line with the S&P 500 Index.

The company reported its third-quarter earnings on Saturday. (Here are links to the press release and 10-Q.) As I do every quarter, I asked my longtime friend and former partner Glenn Tongue, who is the axe on the company, to share his analysis of it. Here's what he sent me:

I hate to sound like a broken record, but Berkshire's third quarter can be simply summarized in four words: "more of the same."

In the third quarter, Berkshire Hathaway's earnings continued to rebound from the COVID-impacted quarter a year earlier, again led by the most economically sensitive business units: manufacturing, service, and retailing.

As you can see in this table from the 10-Q, pretax earnings rose 4%, led by noninsurance earnings jumping 15%, partially offset by a 66% decline in insurance earnings (due to a number of "significant catastrophe events" and more auto claims at GEICO as drivers returned to the roads):

Operating cash flow was a staggering $31.6 billion in the first three quarters of the year, up from $29.2 billion year over year.

As always, we like to look at how CEO Warren Buffett and vice chairman Charlie Munger allocate capital. Their choices are capital expenditures, acquisitions, purchases of publicly traded stocks, and repurchasing their own shares. (They could also begin paying dividends but have chosen not to do so.)

The first priority has always been to reinvest in the fabulous businesses they own and love via capital expenditures, where they spent $9.2 billion in the first three quarters of the year, down slightly from $9.5 billion last year.

They are also always on the hunt for attractively priced, large, high-quality businesses to purchase outright, but they haven't been able to find any so far this year, due to high valuations and competition from special purpose acquisition companies ("SPACs") and private equity firms, which are flush with cash.

They are also open to buying partial ownership stakes in such businesses via open market stock purchases – for example, Buffett's $31.1 billion investment in Apple (AAPL) is currently worth $137.3 billion, even after he's trimmed the position somewhat. But here too, Buffett has found nothing cheap enough to buy recently. In fact, in the first three quarters of this year, Berkshire has been a net seller of stocks to the tune of $7 billion.

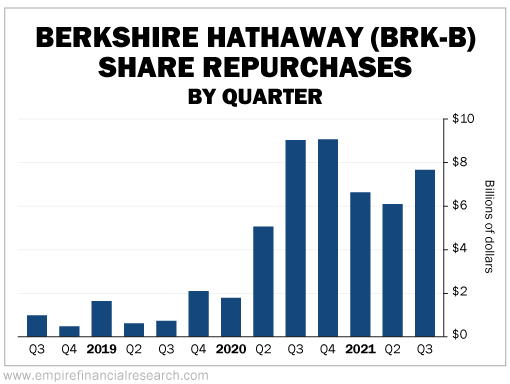

This leaves share repurchases, which I am pleased to see that Berkshire is doing in size, as you can see in this chart:

In total, Berkshire repurchased $20.2 billion of its stock in the first three quarters of this year, equal to 90% of its free cash flow. That's up from $15.7 billion during the same period in 2020, reducing the share count by 5.3% year over year.

The inter-quarter repurchases patterns can give insight [into] their valuation thresholds. In the second quarter, the buyback threshold seemed to be around $290 per B-share, as repurchasing activity materially slowed above that level in May. But in the third quarter, repurchase was consistent each month. We expect to see more of the same in the fourth quarter.

Thank you, Glenn!

Updated Estimate Of Berkshire's Intrinsic Value

2) Regarding Berkshire's intrinsic value, I've used a consistent and simple methodology – one that I think Buffett himself uses – to value Berkshire for more than two decades. Take cash and investments (valued at market) and add the value of the wholly-owned operating businesses, calculated by applying a conservative multiple (I use 11 times) to the pretax earnings of those businesses.

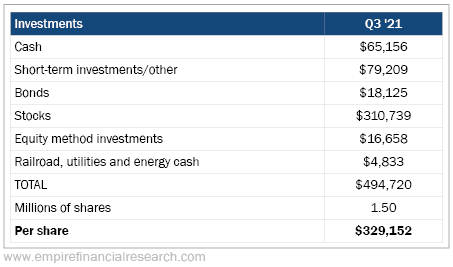

This table shows how I calculate Berkshire's investments per share as of the end of the third quarter:

Adjusting the stock portfolio upward by the 9.2% increase in the S&P 500 Index since the quarter ended on September 30 yields investments per share of $348,000 currently.

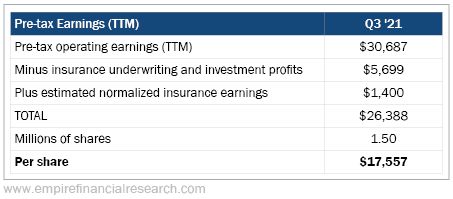

To value the wholly-owned businesses, here are the figures I use to calculate their earnings:

Note that I subtract all of the underwriting and investment profits from Berkshire's massive insurance operations but add back a rough estimate of the average insurance underwriting profits over the past decade ($1.4 billion annually).

This results in $17,557 in adjusted pretax earnings per share over the past 12 months, to which I apply a multiple of 11 times to arrive at a value for the operating businesses of $193,000 per share.

Now add the $348,000 in cash and investments per share to arrive at a total intrinsic value of $541,000 per A-share (or $361 per B-share).

With the A-shares closing Friday at $434,000, that means the stock is trading 20% less than my estimate of its intrinsic value.

The company is incredibly safe and growing at a healthy rate. The stock, conservatively valued, is trading 20% below its intrinsic value – so cheap, in fact, that two of the greatest investors of all time are buying it in size. What's not to like?

Best regards,

Whitney

P.S. I welcome your feedback at [email protected].