In his Daily Market Notes report to investors, while commenting on Tesla Inc (NASDAQ:TSLA)’s GAAP income, Louis Navellier wrote:

Q2 2021 hedge fund letters, conferences and more

The Consumer Confidence Index Rises

On Tuesday, the Conference Board announced that its consumer confidence index rose to 129.1 in July, up from 128.9 in June, thereby reaching the index’s highest level since February 2020. This was a big surprise, since economists expected consumer confidence to drop to 123.9 in June after the University of Michigan’s preliminary consumer sentiment index declined. Also, the present situations component rose to 160.3 in July, up from 159.6 in June, while the expectations component was virtually unchanged. Overall, July’s strong consumer confidence index bodes well for continued strong consumer spending.

The preliminary estimate for second-quarter GDP from the Commerce Department’s U.S. Bureau of Economic Analysis came in at a slower annual rate of 6.5%, which was substantially below economists’ consensus estimate of 8.4%. The good news is that personal consumption rose at an 11.8% annual pace, significantly higher than economists’ consensus expectation. There will be multiple revisions to this GDP estimate, but there is no doubt that the weaker-than-expected preliminary report will provide the Fed with more time to sustain their accommodative policy of low interest rates and aggressive quantitative easing.

A Significant Milestone For Tesla

A major flagship stock, Tesla, reported that its second-quarter regulatory tax credits declined 31.7% from $518 million to $354 million, but the company nevertheless posted record GAAP income of $1.14 billion. This was a significant milestone for Tesla, since in past quarters virtually all of its net earnings were attributable to these regulatory tax credits. This also means that Tesla is finally making money from its electric vehicles (EVs) after reporting an impressive 98% surge in sales vs. the same quarter a year ago.

There is no doubt that Tesla is facing formidable competition via Mercedes and VW Group, but right now it has a competitive edge with its cheaper lithium iron-phosphate batteries that allows Tesla to price its Chinese-made Model 3 & Y models very competitively; so even though VW Group is selling more EVs in Europe this year, Tesla is putting up a good fight and beating VW Group in China and the U.S.

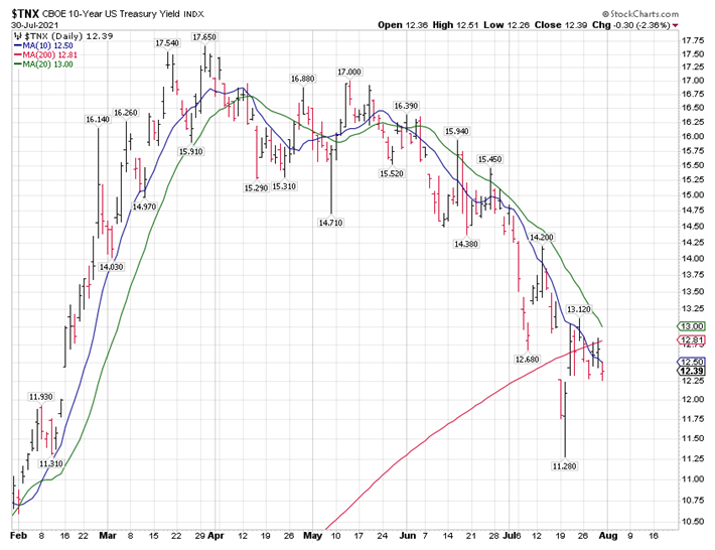

Treasury Note Yields Are Headed Even Lower

It is surreal that we traded under 1.2% on the 10-year Treasury note yield a couple of weeks ago, and it is even more surreal that after a weak rebound, Treasury note yields are again headed even lower. It has to be noted that all this bond trading is happening under a rising 200-day moving average for the 10-year yield.

A rising 200-day moving average should be providing support for Treasury yields in a normal economic scenario. In this case, it is doing the opposite; it is providing resistance as this bond trading happens under the 200-day moving average. The bond market looks like it is afraid of the delta mutation of the novel coronavirus, and it also is probably benefiting from Japanese and European QE money, which can find no yields in their home bond markets to chase, so they are looking at positive yields in the U.S. bond market.

If we start to trade under 1.20% this week, I think all kinds of value indexes and sectors will get hit as stock market participants at this stage in the recovery would like to see an uptick in Treasury yields so that they can feel reassured that the deflationary impact of the pandemic might be avoided.

It is entirely possible that we are headed to 1% on the 10-year Treasury as this delta variant is likely to postpone the normalization and reopening of the global economy. I do not believe that the current delta variant threat will ultimately derail it, vaccination rates are increasing.