American consumer confidence is down more than 4 points since last month, which appears to be attributed to increasing Covid-19 cases, hospitalizations, deaths and new business shutdowns. It’s now at its lowest level since August.

Q3 2020 hedge fund letters, conferences and more

“The Refinitiv U.S. Retail and Restaurant Q3 blended earnings index is showing -6.6% estimate. As another wave of Covid-19 looms in the United States, the index is expected to drop to -22.3% for Q4. Still, the strongest sectors include leisure and household products. This suggests that consumers continue to seek to improve their 'stay-at-home' experience this holiday season,” says, Jharonne Martis, Director of Consumer Research, Refinitiv

American Consumer Confidence For December 2020 Drops

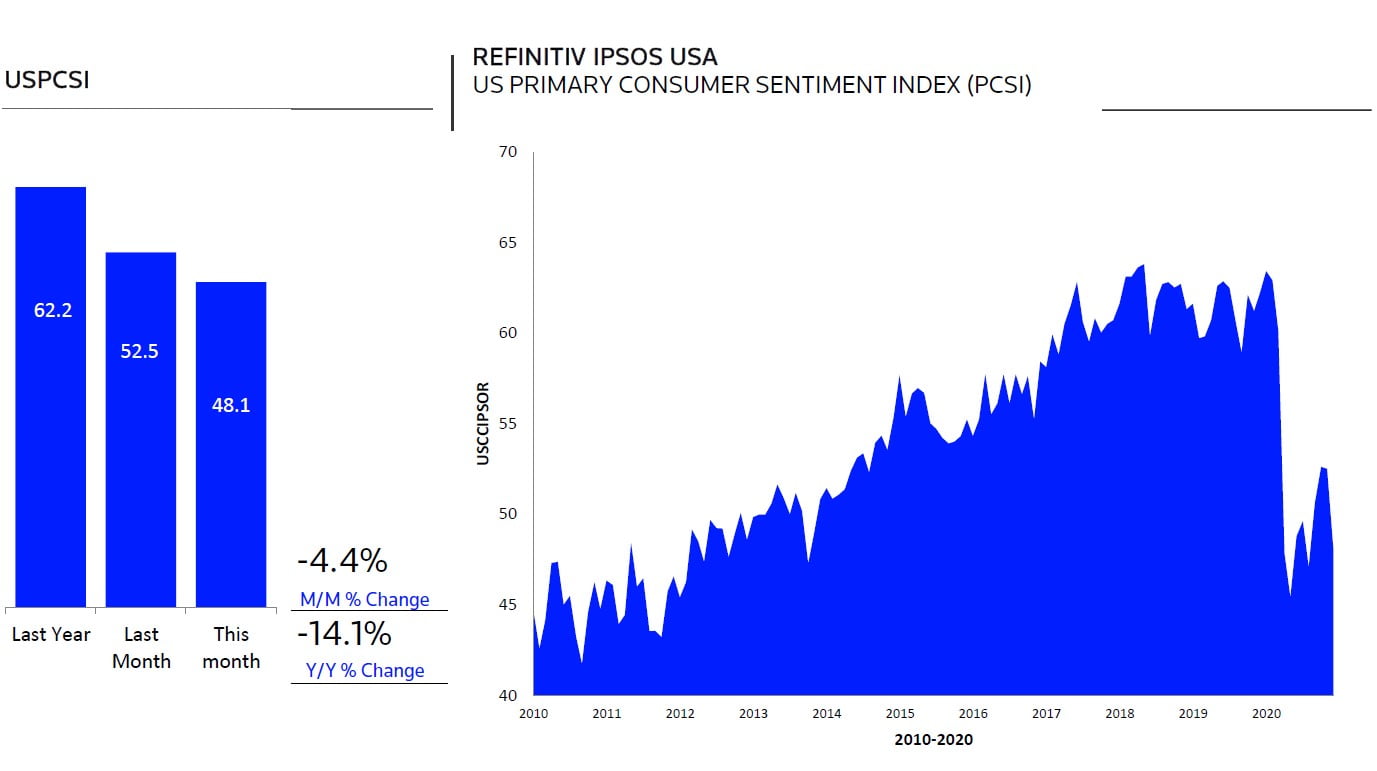

WASHINGTON, DC ‐ At 48.1, American consumer confidence for December 2020 has dropped more than four points (‐4.4) since last month, according to the Refinitiv/Ipsos Primary Consumer Sentiment Index.

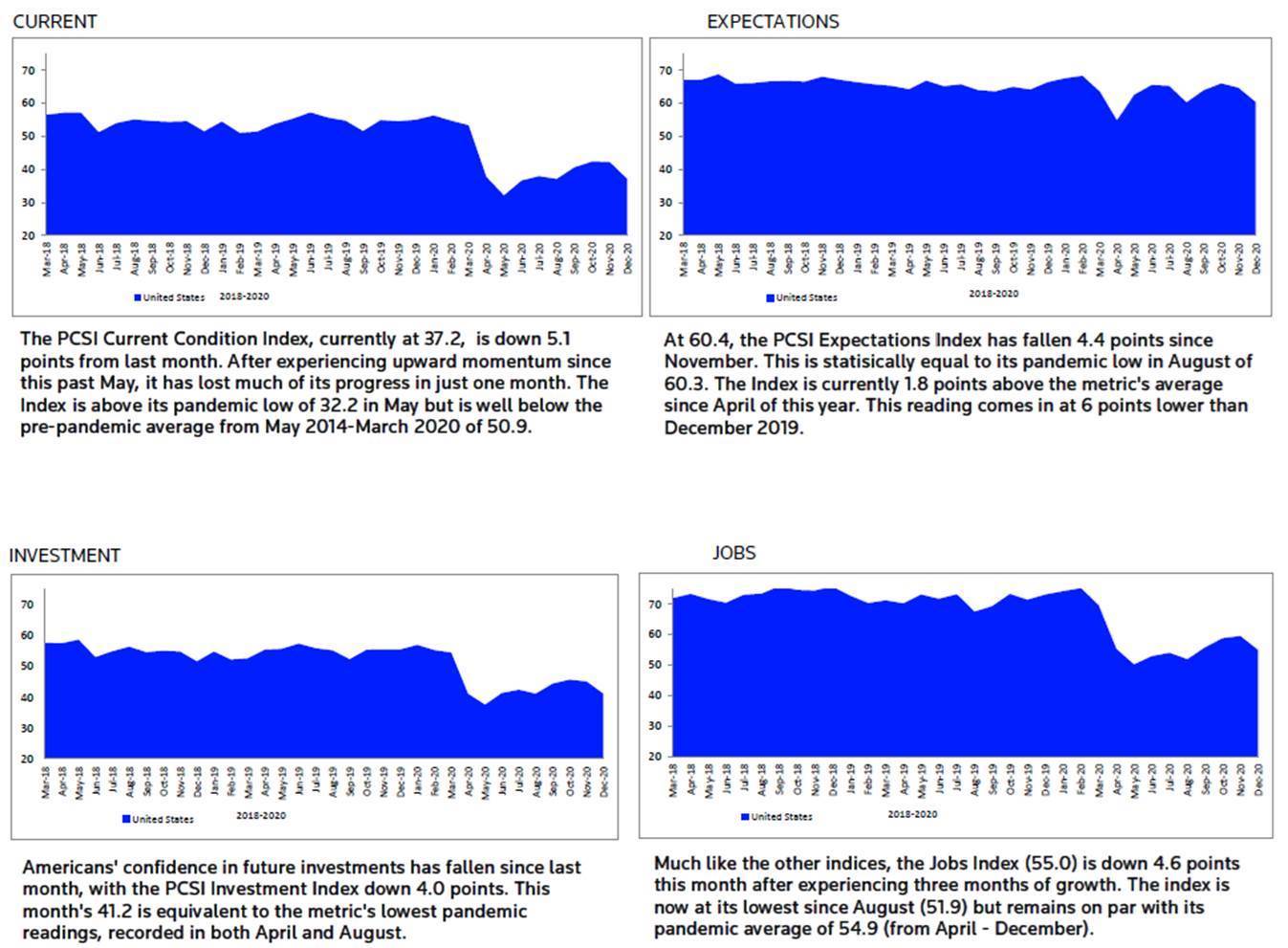

After experiencing consistent growth since August, American consumer confidence has fallen from 52.5 in November to 48.1 now. This decline can be seen across all indices, with the Current, Expectations, Investment, and Jobs sub‐indices down at least 4 points compared to last month.

The Current, Expectations, and Investment indices (currently at 37.2, 60.4, and 41.2 respectively) are in line with sentiments as of August this year. This is a stark contrast to highs seen across the three in October (42.4, 66.1, 45.8). The Jobs Index is the only subindex at a higher level than August of this year (55.0 now vs 51.9 in August).

Nonetheless, year‐on‐year change reveals that all indices are suffering amidst the COVID‐19

pandemic, especially the Jobs index (‐18.2 points). The Current (‐17.9) and Investment (‐14.4) indices are down around 15 points. In contrast, the Expectations index is down only 6 points, potentially pointing to positive future outlooks.

COVID‐19 Cases Are Climbing

"COVID‐19 cases, hospitalizations, and deaths, are climbing across the country. This, paired with new business shutdowns, appears to be greatly affecting American consumer confidence, which is down more than four points since last month. It is now at its lowest level since August after remaining virtually unaffected by the volatile election month,” Chris Jackson of Ipsos notes. “The upward trend experienced prior to election has reversed drastically this month. This has completely undone any improvement seen over the last three months.”

Jharonne Martis, Director of Consumer Research at Refinitiv, said, “The Refinitiv U.S. Retail and Restaurant Q3 blended earnings index is showing a ‐6.6% estimate. As another wave of COVID‐19 looms in the United States, the index is expected to drop to ‐22.3% for Q4. Still, the strongest sectors include leisure and household products. This suggests that consumers continue to seek to improve their “stay‐at‐home” experience this holiday season."