Excerpted with permission of the publisher, from Lighthouse: Women Leading the Way in Finance by Maya Peterson. Used by arrangement with the Publisher. All rights reserved.

Q3 2020 hedge fund letters, conferences and more

Lighthouses in Perth's Words

“We launched the ETF on May 23. And in early June, democracy protests began in Hong Kong. Millions came out to stand up for freedom in their city. It’s been five months and they’re still fighting out on the streets. No matter what happens, what they are doing is historic. It was in Hong Kong that I first saw the impact freedom made, in my life, in society, and in economies and markets. And it’s the Hong Kong protesters that are now risking their lives and futures every day to stand up for freedom. They are my lighthouse, these freedom fighters and others fighting repressive regimes all over the world. I’m building this company, using the tools I have, indexing, to provide an alternative for investors who want to take a stand for freedom with their emerging market allocations.”

Early Years

Perth Tolle attended Trinity University in Texas with an unclear idea of what she wanted to study. She studied business because it was what came most naturally, but along the way, she took an interest in more creative fields. The summer before her senior year in college, she went to ArtCenter College of Design in Pasadena to study advertising and graphic design. “There I realized that while I enjoyed design, my talent level as a graphic designer was, let’s just say, not up to par with the other students. So, I came back to Trinity and finished my business degree with finance and marketing concentrations.” After graduating cum laude, she moved to Hong Kong for about one year, which is where her real interest in finance and freedom began: “I witnessed things that made me realize how different my life would have been had I not moved to the USA as a child.” What stood out to her about China was the lack of freedom in the markets: “It was clear that freedom made a difference in my life and it makes a difference in markets. I also saw the impact of the One Child policy on the culture of my generation, how it changed our mindset, changed the things we value, changed the demographic trends of the country, and realized that policies and governance make a huge impact on the future growth and sustainability of a market and society.”

Path to Success: Life + Liberty Indexes

After returning to the USA, Perth started working for Fidelity as a financial advisor in the Texas and California branches, and that is where she really learned about investing. As a financial advisor at Fidelity, she learned how to build a portfolio and understand investor behavior. She understood how emerging markets fit into a diversified portfolio, and she understood firsthand that aligning clients’ values with their investments was not always easy to do because money is personal and not always rational. But she also learned that investors can stick to their plans more easily if their investments align with their convictions. She was surrounded by bosses who pushed her to keep learning and colleagues who cared as much about their clients as the market.

After becoming a mom, Perth made the decision to leave Fidelity to stay home with her young daughter until she started school. At that point, Perth began working on her new venture, starting her own index, and later, an exchange traded fund (ETF) based on that index. Perth wanted to make it simple for investors to participate in emerging markets and also avoid the downsides of some of the negative policies and governance she found in China and other less free markets. Because this combination was not readily available to most investors, who simply bought a market-capitalization-weighted, emerging-markets fund, she started her own index company: Life + Liberty Indexes. If this sounds hard to do, it probably is for most people, but Perth found a way. “What I have learned and continue to learn through this is that when we are called to do something, we will be equipped to do it, even if we have legit excuses not to, such as “I’m a single mom.” Don’t give yourself any excuses; just do what you know you have a fire inside to do. And if it’s truly a calling, you will be equipped to do it. That doesn’t mean success is guaranteed, just that you decide the risk is worth it. I realized I would rather fail at this than not try it.”

Focusing On Emerging Markets With Life + Liberty Indexes

One of her “mom friends” came up with the ticker for her first index (FRDM) when she was in the grocery store and texted it to Perth. Another did her website and graphic design. Their mission is to “create strategies that empower investors who believe in freedom to invest in alignment with their values—direct investment allocations to markets that protect and promote human and economic freedoms and provide an alternative to market-capitalization-weighted country allocations in emerging market indexes.” Although Life + Liberty Indexes focuses on emerging markets, it does not include the classic BRICs. “We determine country inclusion and weight based on their freedom levels. We isolate the freedom factor on the country level, and we look at just their level of protection for human and economic freedom, and that alone determines if the country is included, and what its allocation is in the index.” However, if a country in the index experiences a rapid decline in freedom levels, as Turkey did in 2017, they can be kicked out of the index. The biggest challenge in the beginning of the project was that there was no comprehensive quantitative measure of human freedom. So, Perth’s company developed and provisionally patented a way to quantify freedom using ordinal scales. A couple years later, when she started scoring countries using this system, she found that the Fraser Institute, the Cato Institute, and the Friedrich Naumann Foundation had started to quantify human freedoms in much the same way she did. As a result, she decided to go with their data set for third-party objectivity. Her independence from these think tanks would assure her investors that she could not “game the system to arbitrarily include or exclude any country.”

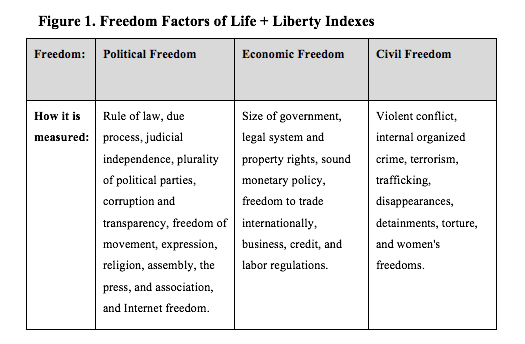

These data providers evaluate each country with seventy-nine objectives, quantified freedom variables, encompassing both personal and economic freedoms. 8 Her index fund works to put money into freer, developing countries. In order to build an index, Perth had to write the index methodology, find an index calculator, and publish the new index. She originally published her index in 2014, using freedom metrics combined with other factors such as valuations and yield. But when she presented her concept of focusing solely on freedom to advisors and portfolio managers, she got lots of feedback along the lines of “If they [investors] wanted to tilt to value, or dividends, they could do that on their own.” Sam Rines, a local advisor in Houston, told her, “Look, freedom is the real innovation here.” Perth decided to isolate the freedom factor in her index. Life + Liberty Indexes looks at three aspects of freedom: political, civil, and economic (see Fig. 1 below).

Launching Her ETF

Getting her fund to market was another odyssey. Perth negotiated a lot of deals that fell through, teaching her the importance of having patience and confidence in the concept. Eventually she found the perfect partner in Alpha Architect, a group of US Marines PhDs who are passionate about ETFs and freedom. Before she found Alpha Architect, she almost completed a deal with one of her top issuers, and although it was not the best deal from her perspective, she thought it would give the ETF the best chances of success. Once she agreed to it, the issuer began to hesitate: “I went to Inside ETFs, a big ETF conference in Florida, near Miami. Every year at this conference I give myself a few extra hours at the beach on the last day before heading home. So, on the last day, after I had lunch with Rob Arnott (indexing legend and my first seed investor and future partner in the firm), then sat outside at the bar for a while with Reggie Browne (ETF legend who ended up becoming my lead market maker), I headed toward the beach and checked my emails. There was an email from the CEO of this issuer, backing out of the deal. It was the worst end to any Inside ETFs ever. The next day it was fine, but it was super sad at the time. Still, by then I had gone through enough in this endeavor that I knew things happened for a reason, and I had no doubt that I should keep going. I do want to note that through the experience, all friendships survived and even grew. In the ETF industry, where everyone is an underdog, especially the indie issuers, everyone sticks together and that goes beyond these temporary things like job offers. We’ll all still be buddies long after this is all over. And I love that about this industry and the people in it.” Her current issuer is ideal for her project.

Philosophy

Perth’s work is a good example of value plus value. Her fund opens up new ways for individual US investors (large and small) who believe in the benefits of freedom to participate in fast-growing emerging markets around the world, and to do so while aligning their portfolios with their values.