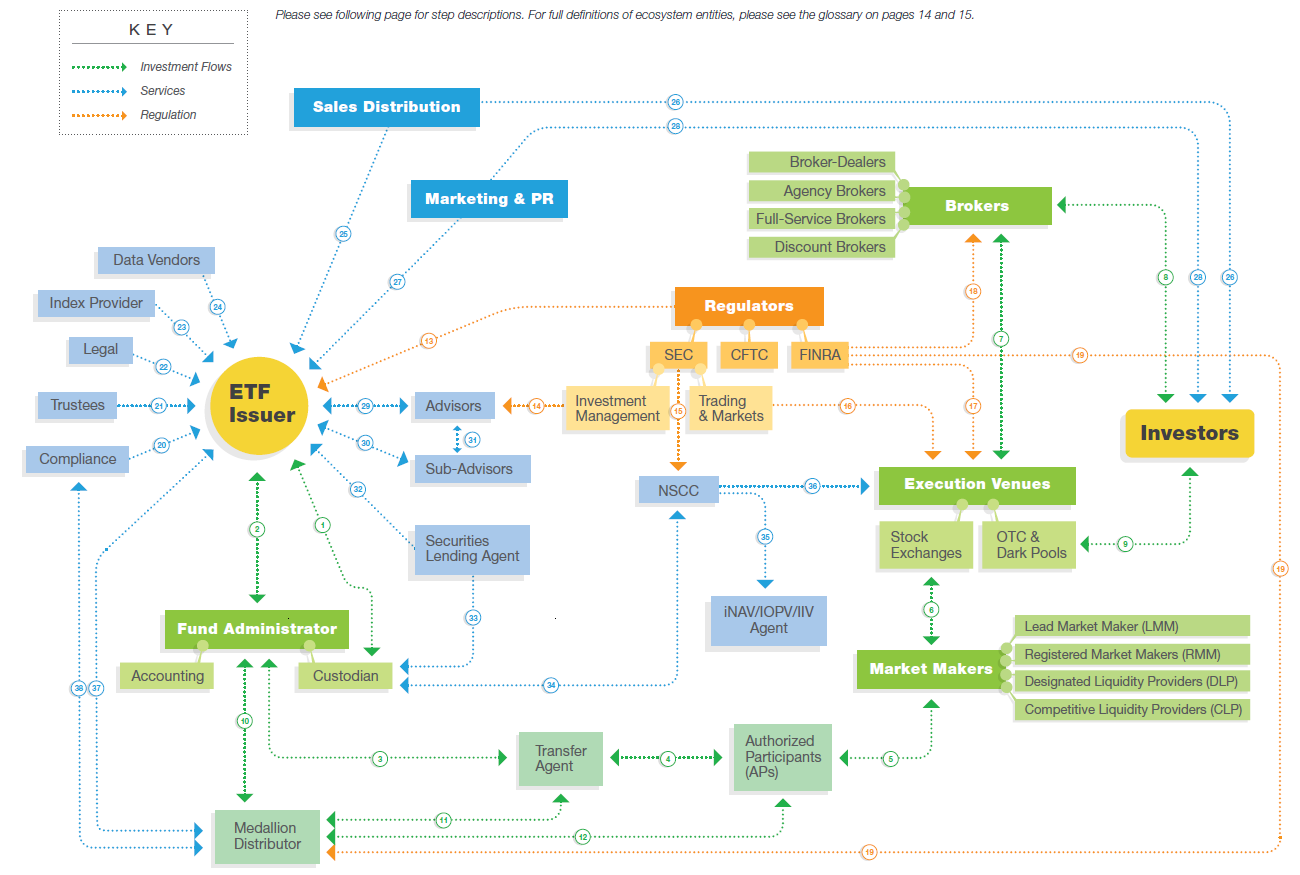

The exchange-traded fund (“ETF”) ecosystem consists of a web of interlocking entities and relationships that help ensure ETFs can be bought and sold smoothly throughout the day. A key feature of traditional ETFs has been their being transparent- the fact that they disclose their holdings each day – but with the introduction of new structures and models, this is beginning to change.

Q2 2020 hedge fund letters, conferences and more

As the ETF universe has continued to grow, new entrants to the space and new approaches to ETF structures have received SEC approval, including semi-transparent ETFs. These new ETFs selectively disclose portfolio holdings information to the public on a schedule similar to traditional actively-managed mutual funds while still striving to maintain market and net asset value parity. This is accomplished through the use of alternative methods of signaling the value of an ETF’s portfolio to the market.

The goal of this guide is to serve as a comprehensive companion to the expanded ETF ecosystem, encompassing both traditional passive ETFs as well as these new semi-transparent models that are beginning to see the light of day.

Part 1 - The Original Transparent ETF Ecosystem

The exchange-traded fund (“ETF”) ecosystem consists of a web of interlocking entities and relationships that help ensure ETFs can be bought and sold smoothly throughout the day. A key feature of traditional ETFs has been their transparency—the fact that they disclose their holdings each day—but with the introduction of new structures and models, this is beginning to change.

As the ETF universe has continued to grow, new entrants to the space and new approaches to ETF structures have received SEC approval, including semi-transparent ETFs. These new ETFs selectively disclose portfolio holdings information to the public on a schedule similar to traditional actively-managed mutual funds while still striving to maintain market and net asset value parity. This is accomplished through the use of alternative methods of signaling the value of an ETF’s portfolio to the market.

The goal of this guide is to serve as a comprehensive companion to the expanded ETF ecosystem, encompassing both traditional passive ETFs, as well as these new semi-transparent models that are beginning to see the light of day.

The Original Transparent ETF Ecosystem

Part 2: The Semi-transparent ETF Ecosystem

Since actively managed ETFs seek to generate alpha—outperform a benchmark—through security selection and innovative weighting schemes, many money managers have been reluctant to adopt the traditional ETF structure because it demands a transparency that could expose proprietary security selection and weighting methodologies to the public. Moreover, since large ETFs’ holdings are disclosed each trading day, and their rebalances occur on a regular basis, transparent ETFs open themselves up to “front running” whereby traders bid up the price of an ETF’s underlying holdings with the foreknowledge that the ETF itself will need to purchase those shares for a rebalance.

For asset managers who wish to harness the advantages of the ETF structure—including its tax efficiency and intraday tradability—but want to avoid some of its pitfalls, semi-transparent ETFs may offer a solution. With a few minor exceptions, semi-transparent ETFs utilize all of the same structures and relationships as fully transparent ETFs. They are mostly distinguished from fully transparent ETFs by the methods utilized to signal the value of the ETF’s underlying portfolio.

Blue Tractor: Shielded Alpha

Blue Tractor’s model seeks to protect the fund manager’s alpha by hiding the exact weightings of a fund’s holdings. The model discloses 100% of the ETF basket’s holdings with a 90% asset value overlap. What this means in practice is that the disclosed individual holdings’ weightings will vary slightly from the actual weightings. For example, Company X may be disclosed as a 1.8% weighting, when in reality it is a 2.2% weighting.

Eaton Vance: ClearHedge

Instead of disclosing the actual underlying holdings of the ETF, Eaton Vance’s ClearHedge model discloses liquid interests designed to have a high degree of correlation to the fund itself. The ClearHedge model also adds another entity, a Swap Administration Agent, to the ETF ecosystem. The Swap Administration Agent interacts with both the ETF issuer and market makers, issuing swaps every second of the trading day which can be used to swap the performance of the actual underlying securities. The updated illustration and key on the following two pages show where this new entity fits into the existing ecosystem.

Fidelity: Tracking Basket

Fidelity’s Tracking Basket model does not disclose the actual underlying holdings of the ETF. Instead, it discloses a “tracking basket” which is designed to closely track the daily performance of the ETF, without revealing its actual underlying holdings. The tracking basket consists of select recently disclosed portfolio holdings and ETFs that convey information about the types of financial instruments utilized by the fund that are not fully represented by Strategy Components. Each business day, the model also publishes a Tracking Basket Weight Overlap which helps investors understand how similar the tracking basket’s holdings are, in percentage terms, to the actual portfolio.

New York Stock Exchange/Natixis: Proxy Portfolio

The NYSE / Natixis model also does not disclose the true underlying holdings of the ETF. Instead, it discloses a Proxy Portfolio which is intended to reflect the risk characteristics and economic exposures of the Actual Portfolio on any given trading day and is also intended to perform in a manner substantially identical to the Actual Portfolio. The Proxy Portfolio is generated by performing a factor analysis on the actual portfolio, which is shielded from public view. The factor analysis utilizes three sets of factors or analytical metrics: marketbased factors, fundamental factors, and industry/sector factors.

Precidian: ActiveShares

Similar to mutual funds, ActiveShares are required to reveal their holdings on a quarterly basis at a minimum, however managers may choose to reveal holdings more frequently. Precidian’s ActiveShares model adds a new entity to the ETF Ecosystem: the Authorized Participant Representative (APR). Since the ETF’s underlying holdings are not disclosed throughout the day, the APR acts as a Trusted Agent, interfacing directly with the ETF issuer and Authorized Participants on the Primary Market. Additionally, ActiveShares publish Verified Intraday Indicative Values (VIIV) every second. The updated illustration and key on the following two pages show where this new entity fits into the existing ecosystem.

T. Rowe Price: Proxy Portfolio

T. Rowe Price’s model does not disclose the underlying holdings of the ETF. Instead, the fund discloses a Proxy Portfolio to the public. Designed to be highly correlated to the true underlying portfolio of the ETF itself, the Proxy Portfolio derives its holdings through fundamental and statistical relationships and is intended to have a substantial overlap between its holdings and the actual portfolio.

Conclusion

As they explore their options, asset managers should keep in mind that these models are novel products that will require firms to meet new compliance obligations that stem from their exemptive orders. If the market loses confidence in the different hedging mechanisms that each model utilizes, the models will fail.

Firms interested in utilizing such models need to be sure they have the ability to produce the necessary data and get it to market. Firms will also be required to keep a close eye on how their products are trading, both to ensure that they are putting enough information into the market and that they are meeting reporting obligations under their exemptive applications which require reporting certain events up to a fund board on short notice – something you don’t see with traditional transparent ETFs.

Innovative new models for semi-transparent ETFs have arisen as the ETF ecosystem continues to evolve and mature. This guide has sought to clarify what separates each of the new semi-transparent ETF models apart from one another, and to help identify potential opportunities in the space. Although the ETF industry is no longer in its infancy, the advent of semi-transparent ETFs shows that there is still plenty of room for innovation in the space.

Article by Arro Financial Communications in collaboration with Foreside.