As a result of the coronavirus restraining normal activities, including traditional Halloween events, such as trick or treating and costume parties, retailers are feeling the pinch of a scary Halloween season.

Q3 2020 hedge fund letters, conferences and more

In collaboration with StyleSage, Refinitiv reviews this year’s Halloween discounts and consumer purchasing behavior in the report: It’s a Mixed Trick or Treat Bag at Halloween for US Retailers

Mixed Trick or Treat Bag for US Retailers this Halloween

Jharonne Martis, Director of Consumer Research, Refinitiv comments:

“Compared to last year, there is more Halloween merchandise on sale this year. Although Halloween sales are expected to be lower compared to previous years, strength in other business segments will help offset weakness at stores like, Michaels Stores and Hershey’s. What’s more, the strong demand for home-related merchandise is helping Michaels Stores post a robust 50.3% earnings growth for the quarter. On the other hand, Party City might not fare as well.”

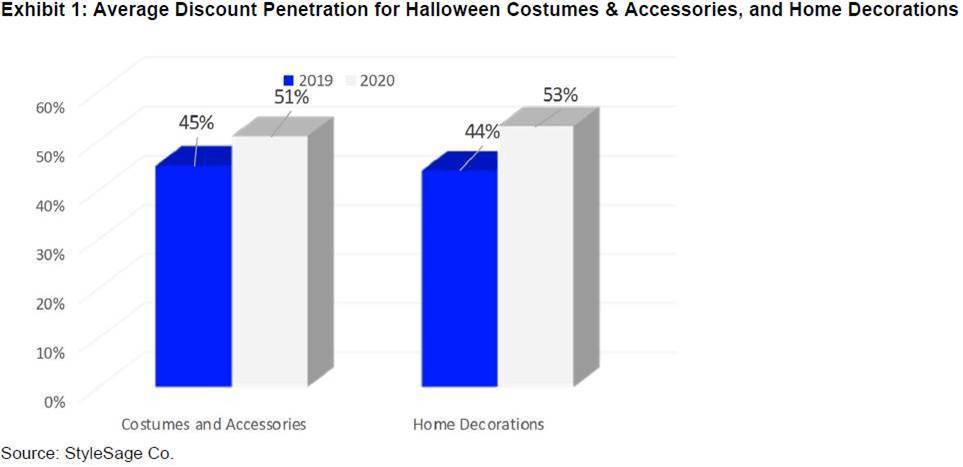

- Average discount penetration [penetration of Halloween-related merchandise on sale] up compared YoY

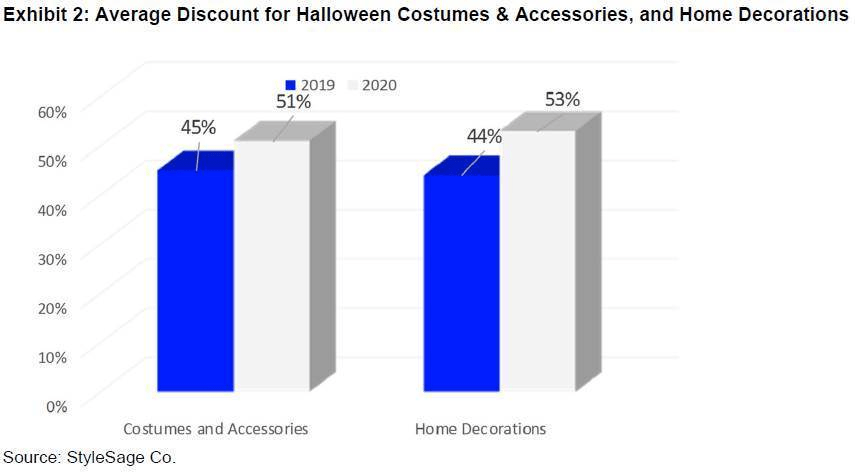

- However, average discount lower this year going into the holiday weekend as retailers try not to hurt margins

- Coincidentally, costumes and home décor are the top 2 items Americans intend to purchase for Halloween 2020

- National Retail Federation says total Halloween spending expected to be $8.0bn this year compared to $8.8bn in 2019

3 Companies Banking on Halloween: Michaels, Party City, Hershey

Michaels

- Recently announced its new transformation plan due to Covid, aimed at improving its omnichannel offering and store operations

- Analysts polled at Refinitiv - bullish on their Q3 performance (includes Halloween sales)

- StarMine Analysts Revision Model (ARM) - scored 96 out of 100 - suggests analysts likely to revise earnings estimates upward

- Benefitted from consumers ‘nesting theme’ in Q3 - expecting 50.53% growth in earnings and 13.9% growth in revenue

- StarMine Earnings Quality Score of 98 suggests earnings coming from sustainable sources

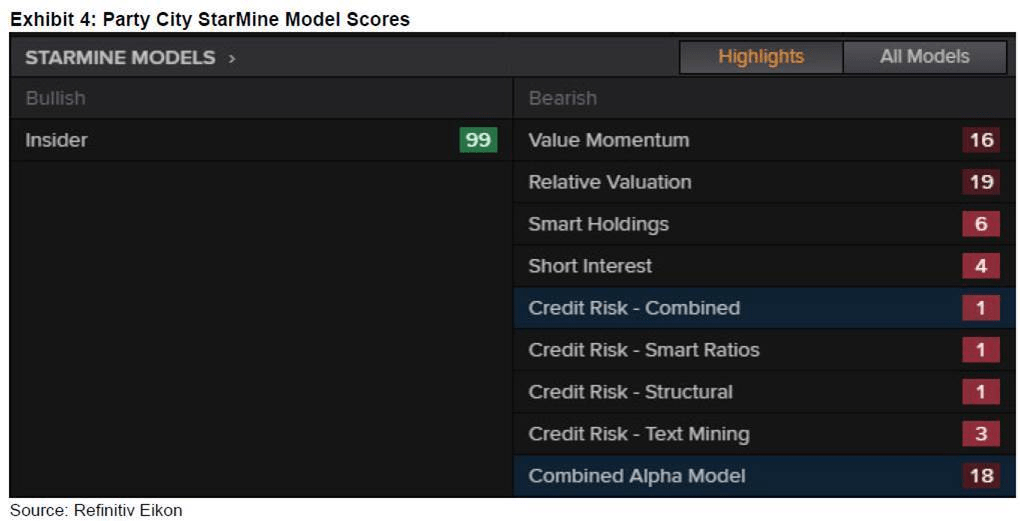

Party City

- Analysts polled by Refinitiv agree, Covid-19’s restrictions on gatherings are making Party City’s Halloween sales look spookier this year

- Credit Risk SmartRatios Model score is weak - 1 out of 100

Hershey Co

- Analysts polled by Refinitiv see upside on the company’s investment in its e-commerce presence and pricing

- Q4 earnings are expected to show a 7.8% growth

- StarMine Earnings Quality Score for Hershey is 84 - suggests cash flow and operating efficiency levels look healthy

- Credit Risk SmartRatio score suggests its leverage ratios could use some improving

- Credit Structural Model score of 84 - suggests the company is unlikely to default on its debt obligation over the next one-year period

Sources: Data/Charts - “Refinitiv”

Commentary - “Jharonne Martis, Director of Consumer Research, Refinitiv”