S&P Global Market Intelligence projects a dramatic slowdown in key measures of volume of insurance carrier firms and broker/agency deals through the balance of 2020. Prospective acquirers are aggressively managing liquidity and will subject potential targets’ balance sheets to intense scrutiny. Previously routine deal-making functions face logistical challenges as well due to broad stay-at-home restrictions across geographies.

Q1 2020 hedge fund letters, conferences and more

Top-line highlights from the analysis included below:

Insurance Carrier M&A Deal Value To Decline

- S&P Global Market Intelligence expect aggregate deal value for M&A deals involving insurance carriers to decline by approximately 59% or more on a year-over-year basis in 2020 to the lowest inflation-adjusted level since 2004. Managed care deals are excluded and limited to transactions with US or Bermuda-headquartered buyers and/or targets.

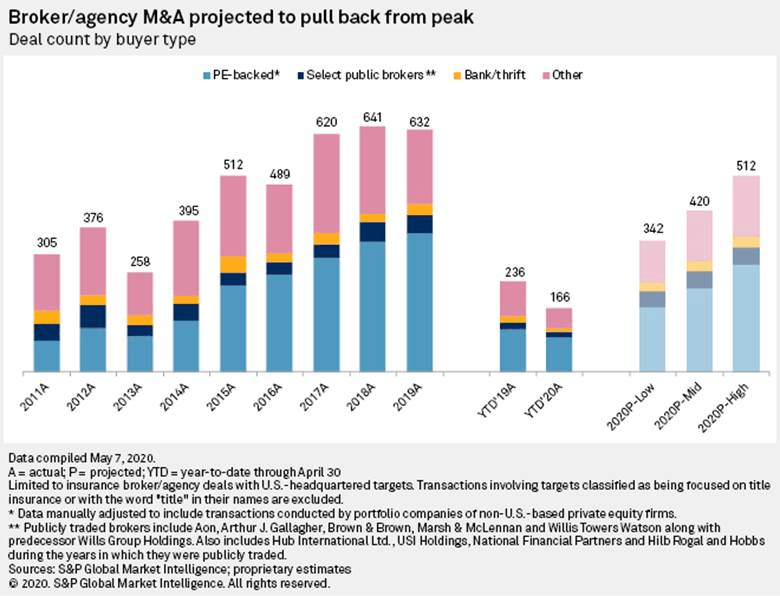

- Among US insurance brokers and agencies, which has represented one of the most active and consistent areas of consolidation within the financial sector, we project the number of deals to fall from last year’s near-record high by between 19% and 46%, depending upon the pace of the economic recovery.

- Primary impediments to deal-making include the following:

- A desire by potential buyers to preserve capital and liquidity, low relative valuations for many publicly traded companies,

- A reluctance to sell at what might be considered the bottom of the market, significant concerns about assets (particularly the quality and credit risk in investment portfolios) and liabilities (especially the potential direct and indirect impact of COVID-19 on claims volume),

- And a lack of clarity about the near- and intermediate term outlook for growth and profitability.

- Logistical challenges make transacting difficult, including an inability in many cases to conduct on-site due diligence.

- S&P Global Market Intelligence expect an eventual pick-up in activity as some potential sellers will face increasing pressure to sell due to either their financial condition, business outlook, or desires to divest low-returning blocks of business in an ultra-low interest rate environment. We do not envision this pick-up happening until 2021, however.