First comes love. Then comes marriage. Then comes a joint bank account with your spouses or partner?

Many couples choose to merge their finances, so MagnifyMoney commissioned a survey of over 1,000 Americans regarding their feelings about doing so with a spouse or partner. About half of those surveyed are married or living with a partner.

The survey revealed that some feel regret or tension over combining their finances. Before couples run along and open a joint bank account, keep reading for more findings. These are helpful discoveries when you consider that MagnifyMoney in 2017 found that 21% cited money as the cause of their divorce.

Q3 2019 hedge fund letters, conferences and more

Key findings on Spouse, Partner sharing

- 1 in 5 regret combining finances with their spouse or partner, and those who earn more than their partner are more likely to regret it. Breaking that down, 29% of higher earners feel regret, compared with 16% who earn less and 11% who make about the same amount as their partner.

- Members of Generation X (ages 39 to 54) are more likely to wish they had not combined financial accounts. 27% of that age group reported regretting doing so, versus 22% of millennials (ages 23 to 38) and 12% of baby boomers (ages 55 to 73).

- Women are almost twice as likely to say they’re not satisfied with the way finances are managed in their relationship. Across both genders, less than two-thirds are completely satisfied with the handling of money in their relationship.

- Nearly 4 in 10 are concerned their spouse or partner spends too much. The higher earner in the relationship is typically more concerned about their partner’s spending levels than those who either earn less or earn about the same.

- 58% percent of men said they outearn their spouse or partner, while just 23% of women said the same.

- Unmarried couples living together are more likely to have argued about money within the past month than married couples, despite being less likely to have shared financial accounts. This could have something to do with the fact that 44% of unmarried individuals living with their partner are concerned that the partner spends too much, compared with 34% of married couples who said the same.

- Millennials argue about money more often than other generations. About 40% said they had a money-related argument with their spouse or partner within the past month, versus 31% of Gen Xers and 22% of baby boomers.

- 78% of Americans check with their partner or spouse before making a purchase over $500. 60% would be angry if their partner or spouse spent that amount without telling them first. Women are more likely than men to be angry about this occurrence.

Who is merging their finances with their Spouse or Partner?

Joint bank accounts are not reserved solely for married couples. Those living with a partner can join their finances as well.

In fact, 43% of unmarried couples who live together have entirely joint bank accounts or at least have some of their money in a joint bank account with their partner. There is no guarantee married couples will merge their bank accounts either, as 16% keep separate bank accounts.

Even married couples who share bank accounts don’t necessarily combine all their finances. While 65% of married couples merged their financial accounts, 19% reported keeping some of their finances separate.

Couples are more likely to merge their finances on their own timeline. In fact, 69% of married couples opened their joint account after the wedding, while 16% did so after getting engaged. Even without marriage plans on the horizon, 13% chose to merge their finances after moving in together.

But not everyone is ready to jump on the shared finances bandwagon. Of those with separate accounts, 73% said they never plan on joining their finances. Meanwhile, 21% plan to combine their finances after marriage, with just 4% waiting for an engagement and 3% waiting until they have a child to do so.

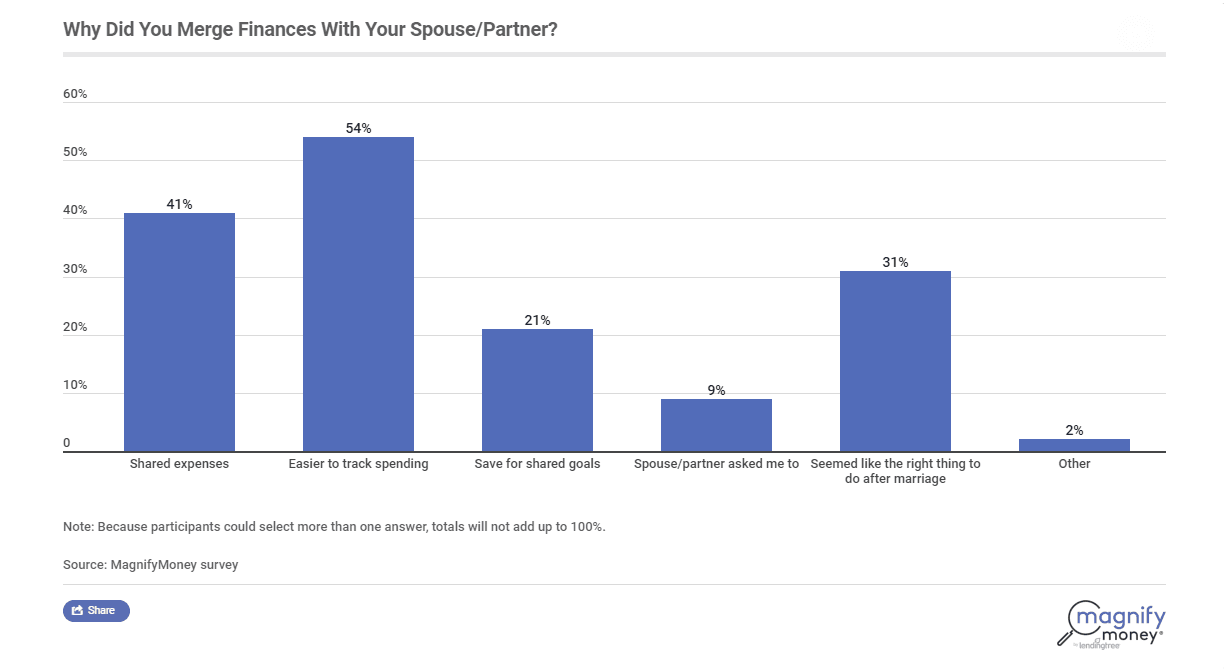

Why couples merge their finances with their spouse or partner

As with other areas of life, couples can have varying opinions regarding how they should best manage their finances.

Whether couples are joining their finances, many still plan together financially. In fact, 30% of couples reported sharing responsibility for managing the household finances.

Spending causes problems

You might want to check with your beloved before you make a pricey purchase. Of those surveyed, 60% reported they would be angry if their partner or spouse spent $500 without telling them first. Women were even more likely to express anger if they weren’t informed of such a purchase.

Not being on the same page about what constitutes as overspending could lead to anger and resentment, which are feelings most couples would like to avoid. The amount that members of a couple are content with spending can vary.

Considering the fact that 36% of people feel their spouse or partner spends too much money, it’s wise to get on the same page and determine an appropriate budget.

How couples feel about merging their finances

For many couples, combining finances feels like a no-brainer. It’s just the next step after the honeymoon. But some couples may find that this seemingly obvious financial step doesn’t work for them.

In fact, 20% of couples reported regretting merging their finances with a spouse or partner. Those who earn more than their romantic partner feel more regret after merging finances. Almost 29% of respondents who earn more than their partner regret doing so. The higher-earning partners were also about twice as likely to report arguing with their partner about money at least once a week.

This is a reminder why it’s important to speak with your partner about important financial issues before you merge your lives together. Planning how you’ll work together to pay off debt, create an emergency fund, buy a home and manage your living expenses is an important part of keeping your relationship financially and emotionally healthy.

Methodology

MagnifyMoney by LendingTree commissioned Qualtrics to conduct an online survey of 1,070 Americans, 573 of whom are either married or living with their partner. The survey was fielded July 26-30, with the sample base proportioned to represent the general population.

Advertiser Disclosure: The products that appear on this site may be from companies from which MagnifyMoney receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). MagnifyMoney does not include all financial institutions or all products offered available in the marketplace.