Whitney Tilson’s email to investors discussing the analysis of Berkshire Hathaway Inc. (NYSE:BRK.B)’s Q2 earnings and tips on becoming more productive.

1) Glenn Tongue, my former partner at T2 Partners and Kase Learning, shares my passion for Berkshire Hathaway. Here are his thoughts on the company’s second-quarter earnings report…

Q2 hedge fund letters, conference, scoops etc

Berkshire Hathaway reported strong second-quarter earnings last Saturday that reinforced what an earnings machine the company is, with perhaps the country's most resilient balance sheet coupled with truly massive liquidity.

The bottom-line results can be misleading due to a change in generally accepted accounting principles ("GAAP"), which now require unrealized gains/losses of the equity portfolio to be reflected in the income statement. So while quarterly GAAP earnings grew to $5.74 per B share, up from $4.87 a year ago, this is meaningless.

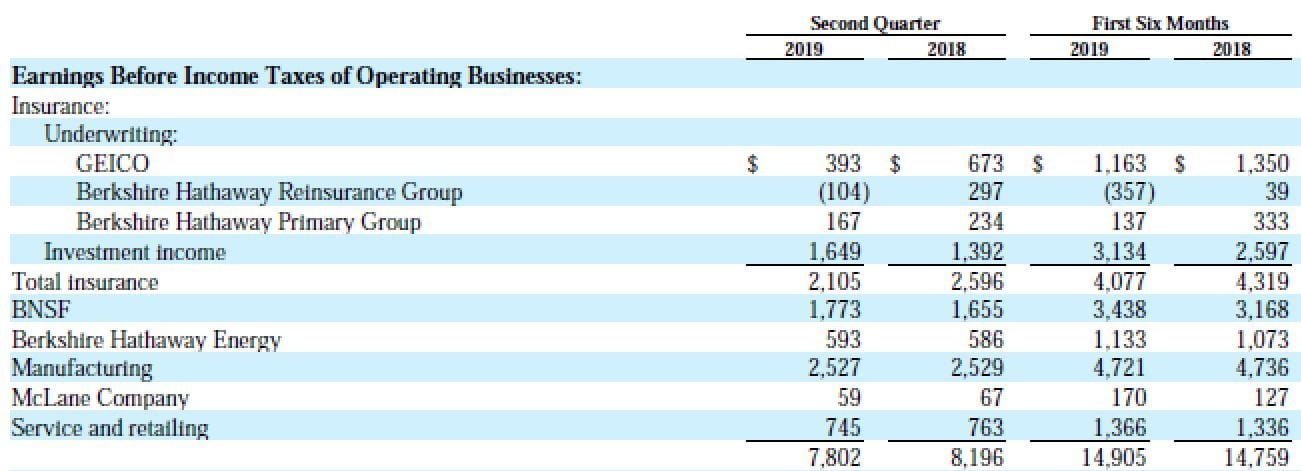

The more important analysis looks at the performance of the operating businesses, which is disclosed on page 26 of the 10-Q (followed by 16 pages of "Management's Discussion and Analysis")...

Though insurance underwriting income (pretax) declined to $456 million from $1.2 billion, this simply reflects the inherent lumpiness of insurance earnings, especially reinsurance. GEICO was impacted by an increase in loss severity, a dynamic that should normalize.

Investment income was strong, growing 18% from $1.39 billion to 1.65 billion. Given Berkshire's enormous investment portfolio, this bodes well for Berkshire's future.

The noninsurance businesses (BNSF, BH Energy, Manufacturing, McLane, and Service/Retailing) were all basically flat, with pretax profit collectively rising 2%.

In summary, Berkshire's operating businesses continued to generate gobs of cash.

Turning to the balance sheet, it continues to be rock solid, with cash and short term investments growing to $119 billion. Insurance float rose to $125 billion, up $2 billion from the start of the year.

Lastly, the cash flow statement revealed that operating cash flow rose from $8.5 to $9.2 billion year over year, while cap ex fell slightly from $3.7 to $3.6 billion. As a result, free cash flow rose 17% from $4.8 to $5.6 billion.

Most of this just piled up, as Buffett and his investment team only bought $2.8 billion of stocks (down from $20.8 billion in Q2 '18) and sold $4.5 billion (down from $9.0 billion a year ago). In addition, he only spent $318 million making acquisitions and another $548 million repurchasing stock.

While the tepid share repurchases are a little disappointing, you can be sure that when Warren Buffett buys in even a single share of his stock, he's confident that he's getting a good value.

Today, Berkshire's share price is a bit below where Buffett was buying it last quarter. If it was good enough for him then, it's good enough for us now...

2) If you're looking to become more productive (who isn't?), here are a few tips:

- Minimize mindless time sucks like binge-watching Netflix or video games like Fortnite. With so much great, inexpensive, highly addictive entertainment available any time, it's incredibly easy to get sucked down rabbit holes and waste an ungodly amount of time. I'm not saying don't play any games or give up TV altogether – I confess that I've never missed an episode, spanning nearly 20 years, of reality shows Survivor and Amazing Race (and hope to be on both shows someday) – but there's a huge difference between a few hours a week and 20!

- A bike is an incredibly efficient way to get around many cities – and riding one is good exercise – but be careful! I ride my bike almost every day in Manhattan and have gotten doored (fortunately I was able to walk away), had many close calls, and know many people who have really gotten hurt in falls.

- I read pretty much nonstop. But sometimes I can't read, usually when biking, jogging, working out, or driving. During these times, I used to listen to music, but now I listen to an Audible book, a podcast, or YouTube. No matter what I listen to, I crank the speed up to at least 2x (the max on YouTube) or, ideally, 2.75x (Audible or podcasts). (It takes some getting used to – I recommend starting at 1.25x, then move to 1.5x, etc.)

The combination of listening to educational, enriching content rather than music – plus training myself to listen at high speed – has been TRANSFORMATIVE. I used to be lucky to read one book a month, but now I'm getting through one a week, and I've discovered some great podcasts as well.

Best regards,

Whitney