In this session, we put the last loose ends to rest. First, we completed the discussion of cross holdings and why they are so difficult to deal with in valuation. Second, well looked at complex businesses and how to incorporate our concerns into value. Then, we went back and looked at defining debt. While we used a narrow definition of debt, when computing cost of capital, we argued for using a broader definition of debt, when subtracting from firm value to get to equity value. Next, we talked about how best to deal with both currently outstanding employee options and potential options grants in the future. With the former, we argued for using an option pricing model to value the options and netting that value out of equity value, before dividing by the number of shares outstanding. With the latter, we suggested incorporating the expected cost into the operating expenses, thus lowering future earnings and cash flows. If you are still a little shaky on why stock-based compensation should not be added back as a non-cash expense, please read this post: Stock-based Employee Compensation: Value and Pricing Effects

Slides: http://www.stern.nyu.edu/

Q4 hedge fund letters, conference, scoops etc

Session 12: Loose Ends In Valuation

Transcript

So last session we were talking about loose ends right. The first loose end was cash. Somebody remind me again what to do with cash. Most of the time what do we do with cash. Don't mess with it just the whole day. And last session we talked about maybe maybe we shouldn't be doing that for some companies. We might discount the cash. Remind me why why did we discount cash advance of some companies. Because we don't trust the guys holding our cash. And in some companies we might attach a premium to the cash. You remember why we attach a premium to the cash. They're growing and they face a capital constrained and for them cash becomes strategic weapon that they can use to survive and grow.

Now let's move onto the second loose end.

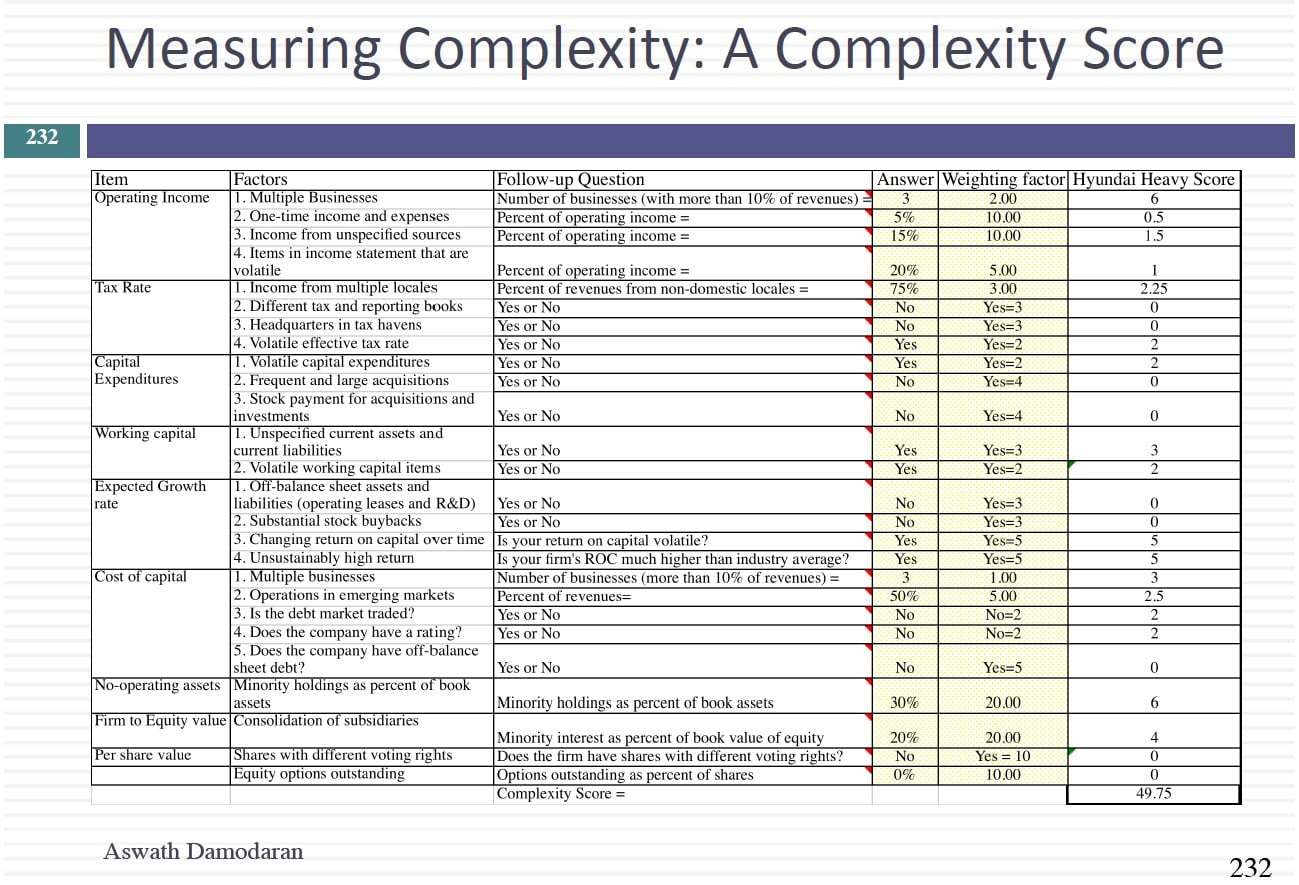

This is what I call the black hole evaluation. This next section. This is where it gets really difficult to keep your good senses. That's when companies have cross holdings and I tell you the first problem with cross holdings before we do that through the start of the crisis right because some of the issues we're going to deal with in loose ends are going to be the ones I gave you two firms that look exactly the same in terms of financials same cash flow same growth rate same return on capital but with a different company is in a single business that has very clear financials. Company B is in multiple businesses is complex. So Company A simple company B is complex. All the numbers look exactly the same. Which of these two companies have either would you value more would you value company because it's simpler to value. Company B because it's more diversified. Or neither they have the same numbers and therefore should have the same value. Just give me a guidance thing now we'll come back and examine what the ads are. What do you think company A B?

Okay. So you would actually value the more complex company more than the simple company.

Okay. Anybody.

You'd value a simpler company more than the complex company. This is good because one of you has to be right. You know. Or is it the third answer.

You open up my textbook and start plugging in numbers and equations. What are you going to find. They both have the same value they. So in fact I for all three are possible. It could be that simpler companies are more valuable. Why. Because there are fewer surprises waiting for you. You're seeing complex companies are better because they've spread their risk more. And the third is the numbers are the numbers. Who cares. The market adapts to a discount to complex companies or simple complex companies will act as if markets don't always do the sensible thing over an intrinsic value standpoint. That's one of the things we're going exam.

Yup.

Let's not even talk about pricing from a value perspective because pricing who knows what the game is played. Right from a value perspective. I want I want to come back and examine. Should we bring complexity to that. Here's the second question. You've just computed a firm valuation discounting free cash flow from the cost of capital. You come up with the value for the operating assets of 100 million this company as debt outstanding of 100 million in face value terms. But the market value of the debt is only 80 million. To get the value of equity usually take the value of the firm subtract our debt right. So in this case I've given you two values book value of market value in an intrinsic valuation which numbers should be subtracting of the book value in which case I get zero.

The market value in which case I get 200 million or 20 million I'm sorry cash 200 million. So I've just kind of guessed knows that the cost of capital have come up but the value of the firm.

Question is what debt should I subtract out book value or market value? That sounds like the right answer. In fact an intrinsic valuation when we ask you to subtract the market value and that is actually the right thing to do. But in this case you've got to be a little queasy about what you've just done. Think of what. Why is the market value of debt lower than the book any of that. What has to be true about this company. When does the market value drop dramatically below the book value? In some kind of distress. You know what you should be worrying about what do you do in the first step you took precast for the fool for how long. For ever. Right. You assumed the going concern to value the firm you're now subtracting out the market value of debt. But the market value of that that's a message what's the message your company might not make it as a going concern. Again if you open up a book and say subtract out the market value but I want you to think about the implicit assumptions you're making when you do it and maybe today we talk about things you can do that for some are in the middle right because it's either zero or not 20. I think the boat. Wrong numbers. But you ask where does it fall between zero and 20. So Narcopolis zero to 200 should be 200 to be 20. Last question. That's how you value the equity in a company you've come up with a billion dollars in equity discounted free cash or equity at the cost of equity. So you don't already get a value of equity there 100 million shares.