Forge First Asset Management commentary for the month ended February 2019, discussing the performance of their F Lead Series funds.

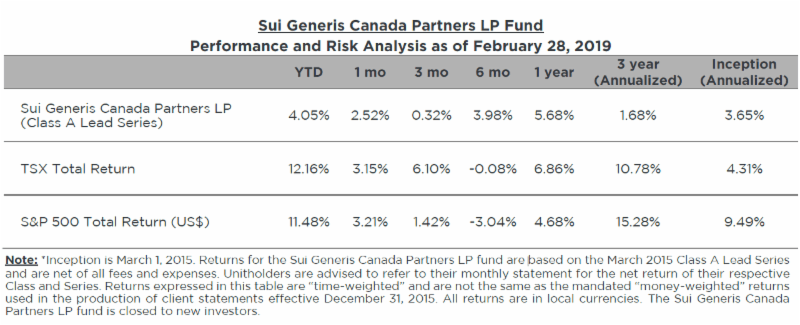

The Sui Generis Canada Partners LP fund was up 2.52% for the Class A Lead Series during February 2019, resulting in a year-to-date net return of 4.05% since inception (March 1, 2015) and cumulative net return of 15.41% (3.65% annualized).

Q4 hedge fund letters, conference, scoops etc

Forge First Asset Management February 2019 Commentary

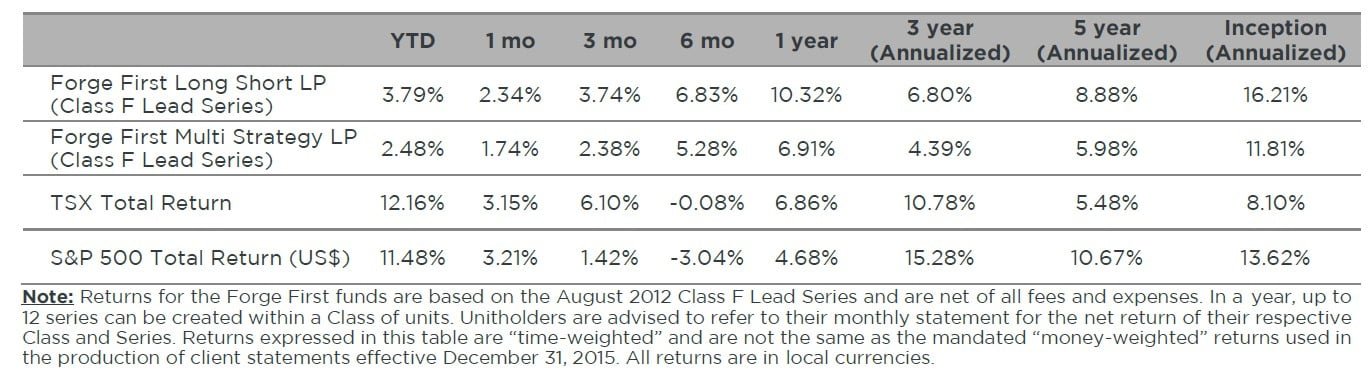

February marked another positive month for the funds at Forge First Asset Management with the Forge First Long Short LP CL F Lead Series (“FFLSLP”) returning +2.34% net of fees and the Forge First Multi-Strategy Fund CL F Lead Series (“FFMSLP”) clocking in at +1.74% net. Not unlike January, the positive contributions came from a variety of exposures that we believe speak to our ability to build a diversified portfolio but stay within our knowledge base. To wit, our top five positive stock contributions came from four disparate sectors; gold mining, technology, industrials and energy.

February also marked the closing of U.S. earnings season and the beginning of ours here in Canada. As we have asserted from time to time, we are generally excited for quarterly reports to come our way as that’s when the action happens. In making this statement we mean that we consider ourselves to be value investors, digging up names we believe have under-appreciated (or inflated) cash flow profiles; excavators of truth, as it were. So earnings reports are often an opportunity to make apparent to others what we believe we already know, ideally with stock reactions that support our theses and enhance the risk-adjusted net return profile of our portfolios. To this point, roughly 80% of all S&P 500 gains over the past five years have come during earnings season, hence earnings reports are both statistically and intellectually a great time to unearth value and get smarter on companies we follow.

While the report card in any given earnings season is never perfect, we once again feel good about how our names stacked up vs. the expectations of the investing world at large. Of note, and amongst our aforementioned top contributors for the month, both Air Canada (AC.CA) and Palo Alto Networks (PANW.US) reacted very well to strong earnings reports while the rest of our top five for the month was rounded out by Canadian Natural Resources (CNQ.CA), Tidewater Midstream (TWM.CA) and Atlantic Gold (AGB.CA), three long held names that had yet to report at month end.

To drive home the point of our returns being largely driven by our deep understanding of our portfolio companies’ long term earnings power (or lack thereof) our investors would be very pleased with the immediate stock reactions to the quarterly results from Criteo SA (CRTO.US), Sleep Country, a short (ZZZ.CA), goeasy (GSY.CA), Enerflex (EFX.CA), and Viper Energy Partners (VNOM.US). Trust us, we aren’t trying to brag by pointing out a bunch of earnings reports that went our way, believe us when we tell you we’re fully aware of how it feels when they go the other way. But we want to drive home the concept of thorough due diligence and the idea that we weren’t surprised by the reports issued by these companies. The reactions in these stocks would suggest that others were, furthering our belief that the level of time we spend on stock selection is an edge.

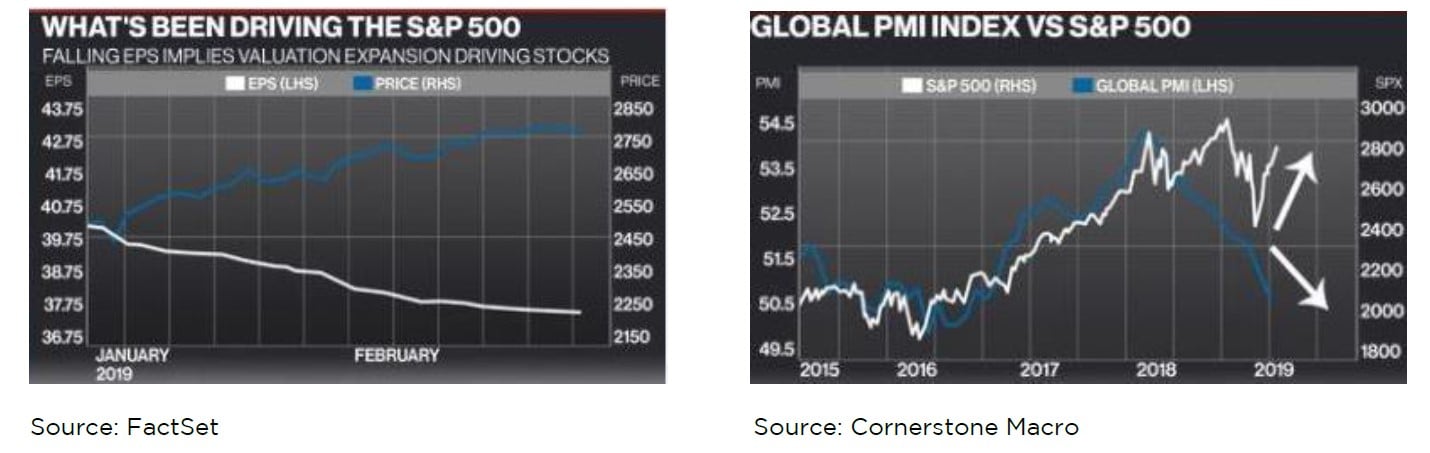

With respect to broader equity markets, they ended up looking like a toned down version of January, as all North American indices finished the month with solid gains though much less so relative to the gains of the previous month. Interestingly, the continued price appreciation of stocks has been the result of multiple expansion rather than growth in forward earnings expectations, or in other words stocks are getting more expensive. As the graph on the below left shows, there has been a pronounced divergence in the estimate for aggregate earnings per share (EPS) for the S&P 500 and the actually price level of that index. What’s more, the first quarter of 2019 marked the largest percentage decline in EPS estimates over the first two months of a quarter in three years, declining 8.4% through the end of February.

Continuing along this theme of divergence for a moment, we also find it curious that equities continue to rally in the face of still weakening leading economic indicators. Often we will see stocks move in unison with our preferred leading indicators, namely global PMIs. However, thus far in 2019 this has not been the case as PMIs are stuck at still-expansionary but slowing economic levels while stocks keep moving higher. The chart on the above right, from our friends at Cornerstone Macro, illustrates this point very well.

With nothing short of explicit rate cut talk (that we didn’t get) enabling us to view the Fed as possibly being construed as having become more dovish than they had already become by mid-February, presumably the recent move higher in stocks is being catalyzed by the hope for a positive outcome from Trump’s trade talks? However, it’s possible this development could be more accurately described as a mismatch in timing and little more. Stay with us.

Investors’ proclivity to price in future events and thus (in this case) bet on a successful conclusion to the US-China trade dust up clearly began in late December, when global PMIs & the S&P 500 began to diverge. However, purchasing managers the world over are not afforded the same luxury of simply being able to “sell” if they’re wrong the way equity investors are. We believe the result is that purchasing managers will need to see actual evidence of a trade deal before acting en masse to expand their businesses more aggressively. Hence, the result we’re seeing now is of subdued PMIs & rising stocks, as while equity managers are taking a leap of faith, purchasing managers won’t.

So there’s FOMO (fear of missing out) in stocks right now but this doesn’t appear to have leaked outside of the world of capital markets. The obvious conclusion to draw from this is that PMIs could play an aggressive game of catch up (to stocks) if Trump and his minions are to be believed and a deal is actually nigh, in this instance we may be inclined to fade the news. Inversely, if a deal is not consummated and both sides storm off, well we’ll let you use you your imagination as to what a game of upside-down catch up would look like for stocks.

While it is not our intention to leave you on a somewhat dour note, we would be remiss if we hadn’t pointed out that there are risks to this (as of yet) unsupported rally taking place in stocks. And of course, risk is why each of our funds always includes a diversified short book of individual stocks & ETFs.

That discipline explains a large part of why our funds did a great job of preserving capital during December (FFLSLP CL F Lead Series down 0.04% net, FFMSLP CL F Lead Series down 0.10% net) and Q4 of 2018 in general. Conversely, year to date each of our funds has generated solid returns.

Please visit our website for information on our funds. Should you have any questions, please contact us.

Thank you,

Daniel Lloyd

Portfolio Manager

Andrew McCreath

President and CEO

This article first appeared on ValueWalk Premium