For every hour the market was open in 2017 there was a net inflow of $29,539,973 into the three largest S&P 500 index ETF’s available to investors. Collectively, iShares, Vanguard and State Street saw $55,609,000,000 in net inflows for the calendar year. Through December 11th of 2018 they’ve racked up another $9,116,000,0001. The move to passive, market cap weighted, indexed style investments has been a trend that’s shown little sign of slowing for over a decade now. With so much data pointing to the growth in popularity, and effectiveness, of pure beta portfolio exposures, the conventional wisdom seems to have found firm footing in the camp of beating the market is not worth the time or effort. We’ll take the other side of that argument.

Persistance Of Mr. Market

Think about it, who are some of the most notable investors of all time? Chances are the name in your head didn’t earn their clout in the last ten years. Statistically speaking, it’s become noticeably more difficult to beat the S&P 500 (assuming that was your objective) over the last 30ish years. Since 1981, the S&P 500’s rolling 5 year median rank within the Morningstar Large Cap Blend Universe has been in the top 38%. As time has gone on, and the number of mutual funds and ETF’s within the group have swelled to 1,233, the rank of the index has climbed. Since 2002 the index has ranked in the top 20% on a rolling 5 year basis. Since the recovery in the economy and market in 2009, the index has consistently been ranked in the top 8% of the Morningstar group2. With such a small portion of professional money managers succeeding in outpacing the market, what’s it take?

Q3 hedge fund letters, conference, scoops etc

Comfortable Being Uncomfortable

Fifteen years ago Roger Clemens, 7 time cy young award winner, shared with us in conversation what he attributed much of his success to. “I learned how to become comfortable being uncomfortable.” As one of the most dominant pitchers in baseball history, it seems unimaginable that’s all it took. But Clemens, like all other professional athletes, overcame seemingly unsurmountable odds to reach his objectives. For amateur athletes, they’ve constantly been reminded how unlikely it is they’ll experience ultimate success. An American high school baseball player has a 0.5% chance of eventually becoming a professional affiliated baseball player one day3. Clearly he didn’t mean just physically uncomfortable on the pitcher’s mound, he also meant mentally. Trusting his process in preparation and competition allowed for him to block out the noise and continue forward.

Athletics and investing are much the same. With the industry supplying no shortage of evidence that investors can’t top the market, it might be easy to simply try to be contrarian in your thinking. But that’s a slippery slope. Being different in your thought process or approach for the sake of being different isn’t a guaranteed recipe for success. “The goal is not to be a contrarian…The goal is to be research-driven and be comfortable being a contrarian.” This was Michael Hasenstab in 2016 speaking to Bloomberg. Michael has been the portfolio manager for the Templeton Global Bond Fund since 2001. One of the largest, most successful global bond funds in the industry, Hasenstab has stood out as one of the most successful and decorated fund managers in recent years. His mindset echoes that of Clemens’, and we think carries the same message: think for yourself, and trust the process. Hasenstab and Clemens both illustrate the concept of in order to be alone in your success, you must be comfortable being alone in your beliefs. Whether it’s your end game, pitch selection or a trade.

Where Do We Start

We don’t see SPIVA reports and think to ourselves it’s useless trying to beat the S&P 500. We see these statistics as confirmation as to just how difficult it is to succeed in this imitative. For instance, we’ve only made reference to the unlikelihood of ranking above the index in a given rolling 60 month window. Remaining a top quartile performer in each of the 5 years ending September 2018 was only accomplished by 2 of the 220 funds that began the period in the top 25% of peers. How do we think it gets done?

Conviction, homework and gamesmanship. Three components we think are important to any investment strategy with the objective of topping the S&P 500.

We’ve curated a set of quantitative and qualitative rules for which we narrow down the investible universe to companies that possess the factors we believe are necessary to be a top performer vs their peers. From there we place an emphasis on identifying companies for which we believe can not only defend their place in their industry today, but are gearing up to secure new market share within their operating segments. This is done through rigorous research of company fundamentals and strategic initiatives laid out by management teams moving forward. Once we’ve have a shortlist of names, we tip our cap to the competition we’ve involved ourselves in. We’re investing in the same space and building positions in some of the most widely covered and held names within the industry, how do we give ourselves a chance for outsized returns? Deviate from the norm. In an investment world flooded with index funds, and actively managed mutual funds who really are closet indexers, we think position sizing plays a key role.

Acknowledging the need for conviction within an investment thesis, as few as 8 names can be found within our single equity portfolio at any time. We think the true value in concentration is being able to maximize your upside potential through position sizing. Diversifying away just enough of the idiosyncratic risk within the portfolio is what we aim to do. This type of conviction and concentration is seldom found in the market today. How’s our thesis played out?

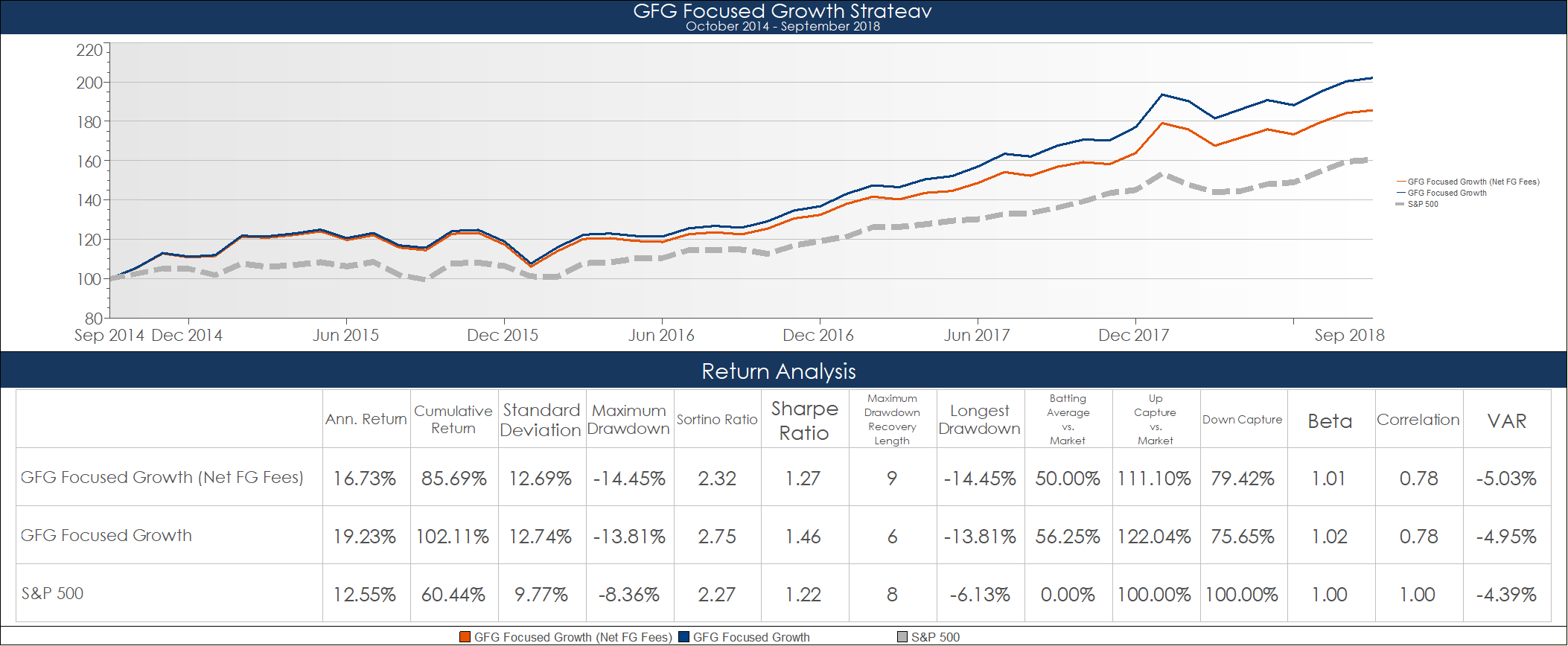

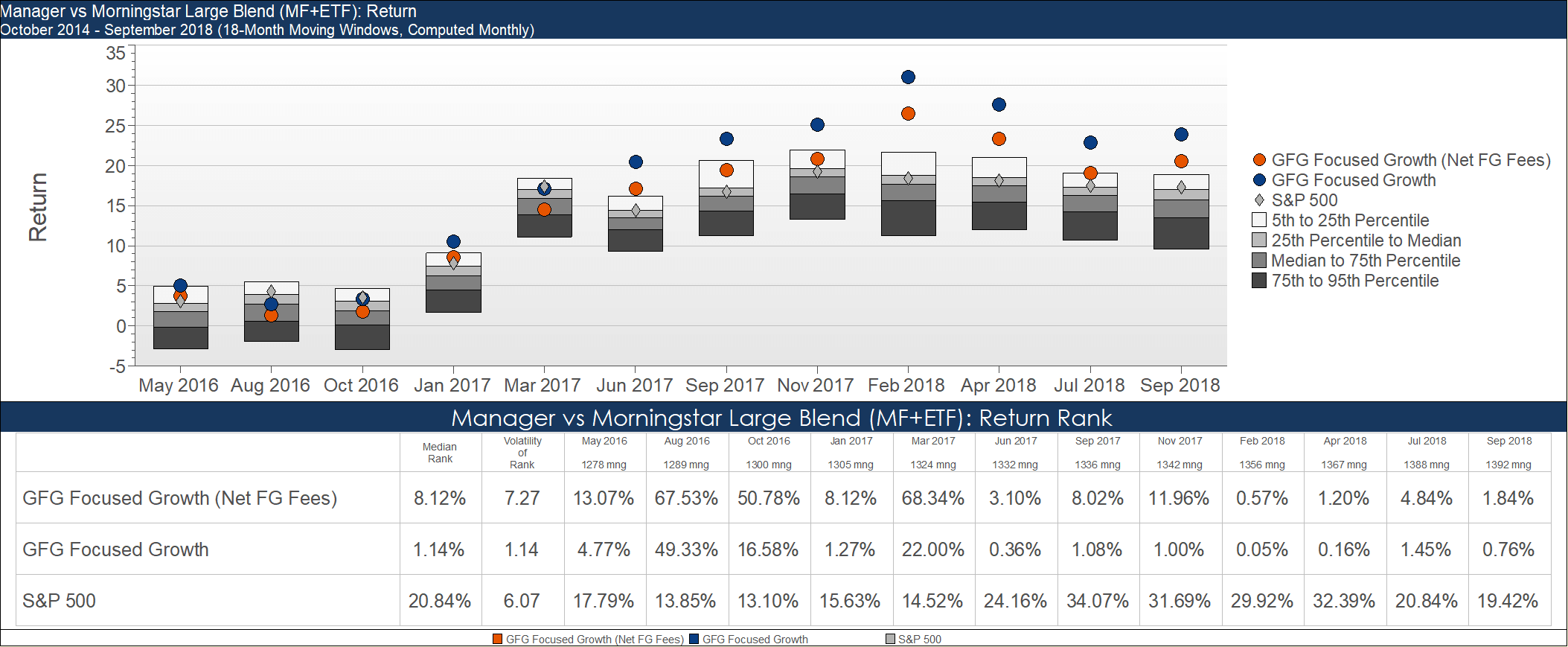

In the first four years since inception (October 1, 2014) the model GFG Focused Growth Strategy has returned more than 100% vs 59.53% of the S&P 500 on a total return basis. Absolute return in one thing, on a risk adjusted basis the Focused Growth Strategy has generated a Sharpe Ratio of 1.46, a Sortino Ratio of 2.75 and a VaR of -4.96%. This is relative to the S&P 500 which has carried a slash line of 1.22/2.28/-4.45% respectively4.

Within the Morningstar Large Cap Blend universe the strategy has also maintained a top 1% and top 8% ranking on a gross and net of fee basis respectively.

In the time we’ve executed this strategy the three giant S&P 500 index ETFs have seen net inflows of $141B5. Even in the face of glaring doubt, we’re comfortable in our own thought.