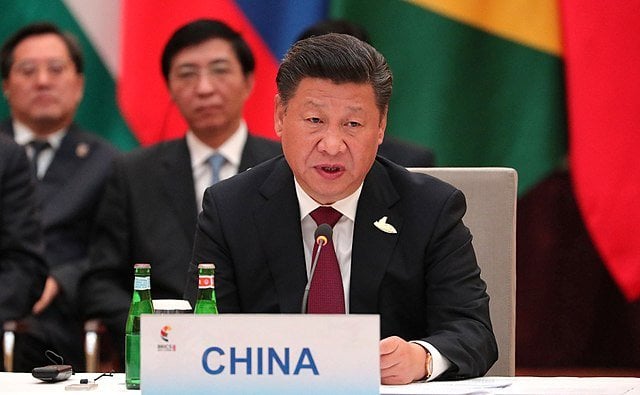

Whitney Tilson’s email to investors discussing his friend’s comment discussing the NY Times article titled, “China’s Economy Slows Sharply, In Challenge For Xi Jinping.”

A friend who’s lived and invested in China for many years sent me these interesting comments in response to this article I sent around China’s Economy Slows Sharply, in Challenge for Xi Jinping:

Q3 hedge fund letters, conference, scoops etc

Yes – things here are challenging – though more it seems from a general sentiment perspective than the day-to-day actual financial results folks are experiencing. That being said, poor sentiment and future outlook could over time become self-fulfilling – especially if the current trade/nationalistic rhetoric/actions continue to deteriorate.

In the manufacturing-related businesses that we are close to (like those discussed in the article), we have actually seen strong results to date with much of their 2018 businesses being dramatically front-loaded in anticipation of a worsening trade situation. Essentially they have completed their year’s work early, and in most cases with significant gains over last year in terms of total expected 2018 revenues and profitability. While 2018 looks quite good, there is a great deal of concern for 2019, and many of these companies have been focused on developing/implementing alternative plans for the coming year to manage their business either through diverting production to factories outside China or markets other than the United States.

For more domestically focused businesses, we have seen mixed results. Definitely a slowdown in large scale discretionary purchases like autos or homes, though day-to-day consumption continues to expand significantly. [A leading domestic sportswear brand] for example, has experienced substantial (mid/high teen) growth this year at retail (including through 3Q) with significantly higher growth in terms of online revenues. Overall there continues to be quite robust consumption growth and a relatively positive outlook going forward. That being said, the capital markets have been off dramatically since the mid-January 2018 highs, and this has taken its toll on overall domestic sentiment.

Important to keep in mind that 2017 was a big year for China, with the equivalent of nearly $1.2 trillion in additional GDP, the highest level of absolute economic growth ever experienced to date in China, equivalent to the size of the entire Mexican economy. The China-related capital markets had a banner year in 2017 as well. In early 2018, the Chinese government felt things were getting overheated and started their deleveraging campaign to calm things down. The resulting capital markets decline and RMB depreciation were well on their way when the trade war/United States-China relations challenges started gathering momentum in the summer.

While I’m generally optimistic over the medium-/long-term for continued economic growth here in China, I am quite concerned that the rhetoric on both sides of the trade dispute and more generally overall United States-China relations is misguided and getting out of control. This is not in either country’s interest and most unfortunate given all of the areas that the two countries need and should be working more closely together (trade, energy, environment, public health, regional security).

We certainly live in interesting times…