Jensen Quality Growth Fund conference call video and slides for the third quarter ended September 30, 2018.

H/T Dataroma

Jensen Quality Growth Fund 3Q18 Conference Call Slide Deck

Jensen Quality Growth Process

Sell Discipline

Our sell discipline monitors the key tenets of our buy discipline: sustainable competitive advantages, growth, value creation and price.

We will sell a company if:

- Company fundamentals deteriorate below our minimum business standard of a 15% return on equity on an annual basis, indicating a possible loss of competitive advantage

- The market price of a business exceeds our estimate of full value

- It is displaced by a better investment that allows an upgrade to the portfolio’s quality, growth outlook and/or valuation metrics

Q3 hedge fund letters, conference, scoops etc

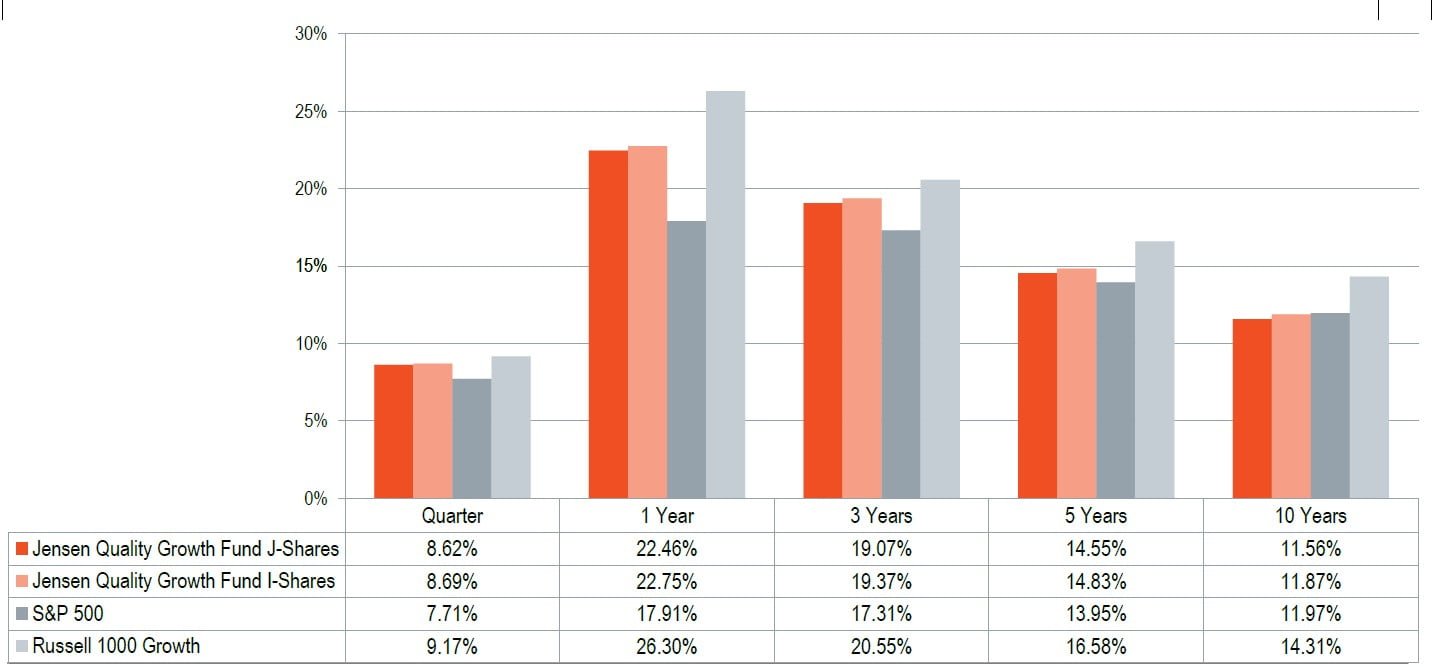

Investment Performance

average annual returns as of 9/30/18

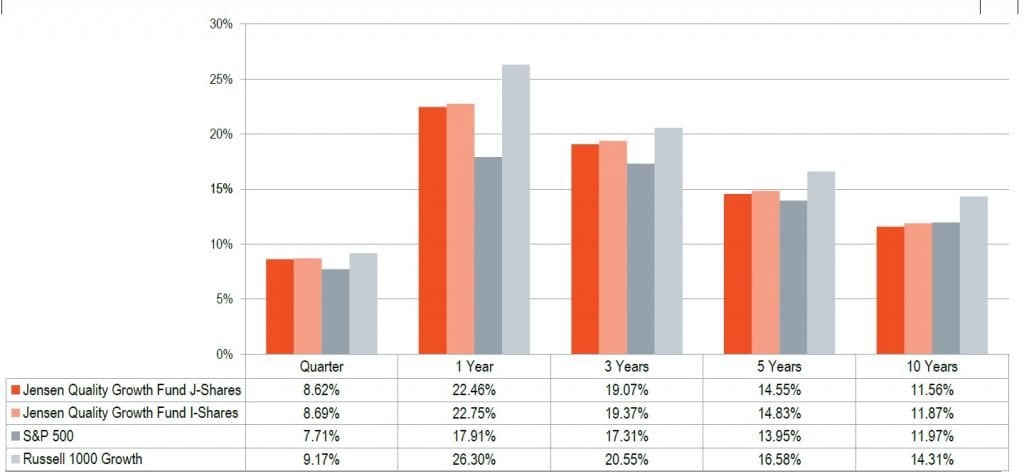

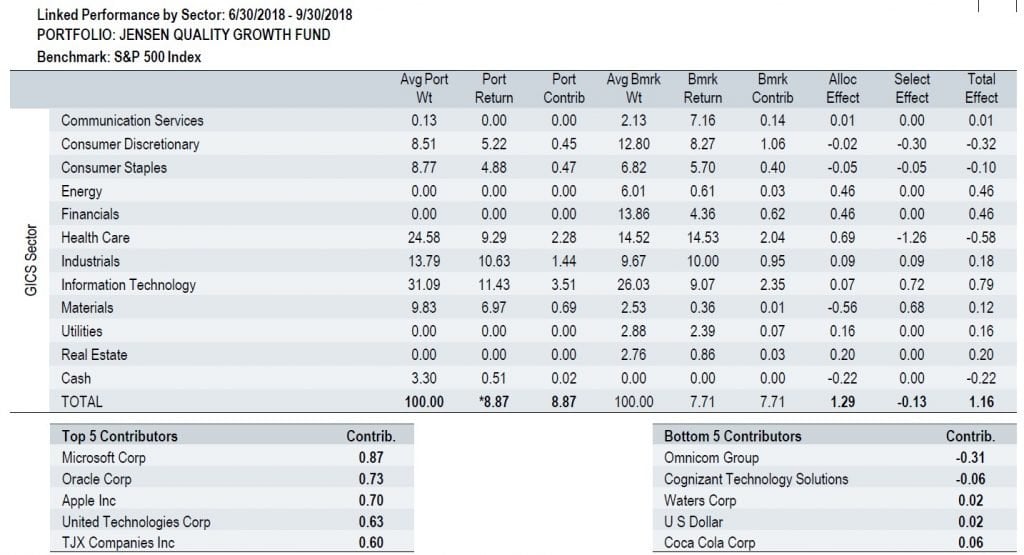

Performance Attribution

by sector in 3Q18

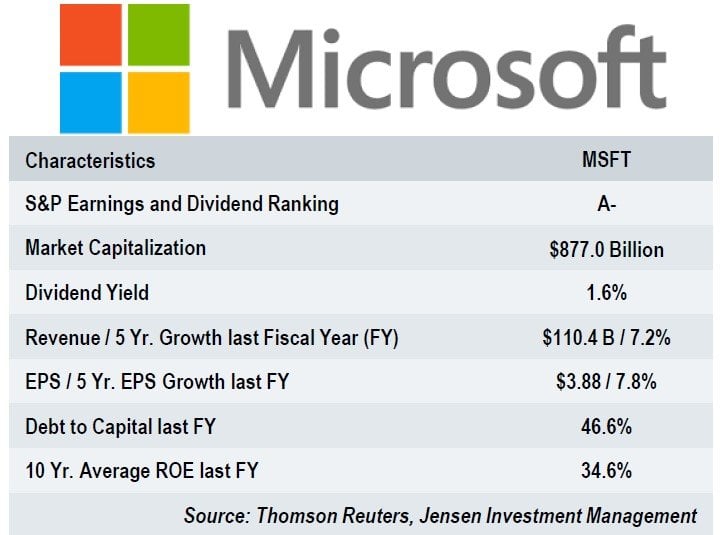

Microsoft Corp

Investment Thesis

- Strong competitive advantages

- Network effect

- Scale

- High switching costs

- Compelling growth prospects

- Dominates enterprise cloud market

- Strong senior leadership and board

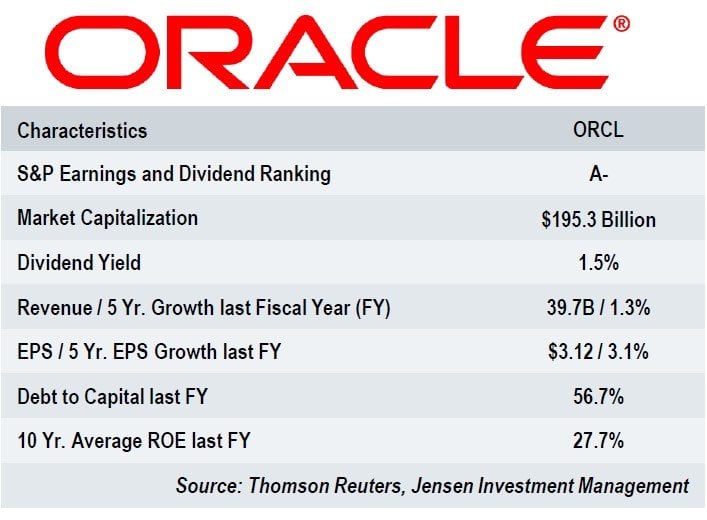

Oracle

Investment Thesis

- Solid competitive advantages

- Scale

- Technological leadership

- Broad product portfolio

- High switching costs

- Strong financials

- Growth ongoing despite slowdown in core markets

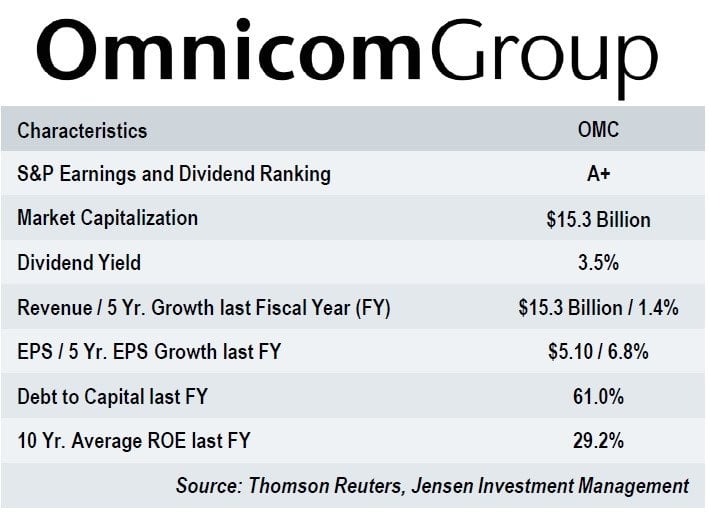

Omnicom Group

Investment Thesis

- Strong competitive advantages

- ‘One-stop-shop’ due to wide breadth of offerings

- Strong creative reputation

- Global infrastructure

- Revenue diversification across geographies and customers

- Holding company structure allows for nimble strategic execution

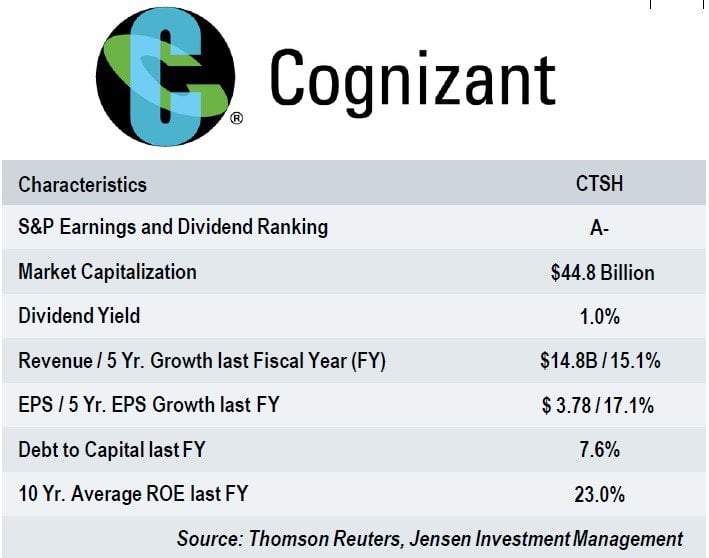

Cognizant Technology Systems

Investment Thesis

- Global delivery model

- Vertical integration

- Processes built from the ground up advantageous over traditional IT services providers

- Strong revenue, earnings and cash flow growth

- Ongoing expansion of service offerings and solutions

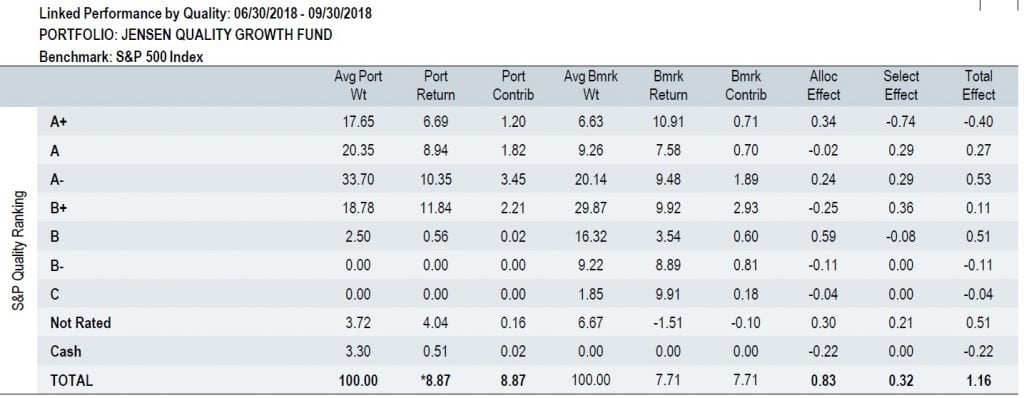

Performance Attribution

by quality in 3Q18

Outlook

- Expectations heading into 4Q 2018 and beyond

- Economic and Market Dynamics

- Opportunities and Risks