Every so often the internet throws up an undiscovered gem from the world of value investing. The latest offering is a selection of articles written by Benjamin Graham in 1922 for the Magazine of Wall Street.

If you’re looking for value stocks, and exclusive access to value-focused hedge fund managers, check out ValueWalk’s exclusive value newsletter, Hidden Value Stocks.

These articles cover several topics including analysis by Benjamin Graham on several securities, giving us a fascinating insight into the way the Godfather of value investing analyzed securities and how he looked for value.

Q2 hedge fund letters, conference, scoops etc

I've already covered one of these articles which looked at a so-called, "Neglected Chain Store Issue." In this piece, I'm going to cover another of Graham's Magazine of Wall Street articles, which focuses on the railroad industry.

Speculative opportunities in railroad stocks

The article begins with Benjamin Graham laying out the purpose of the article, which is "to discuss a number of railroad issues which have good speculative possibilities." He goes on to say:

"Our attention must, therefore, be confined to the low-priced issues, because -as is well known—they are subject to much wider fluctuations proportionately than the standard shares. To use a ready example, it would be by no means impossible for M. K. & T. new common to advance from 8 to 16 in a good rail market; but a corresponding doubling in the price of Union Pacific (from 120 to 240) is practically out of the question."

The rest of the article is devoted to the analysis of several railroad stocks (6 to be exact). The issues Graham highlights all have problems, primarily, high operating costs.

What's more, following on from government controls placed on the industry during WWI, it is difficult he notes, to try and estimate future performance. With this being the case, the bulk of the article is devoted to answering two key questions for each company:

"In connection with the issues treated, we must inquire, first, “What are the factors which will contribute most directly to an increase in value?," and second, "What are the prospects of these factors being realized in the near future?"

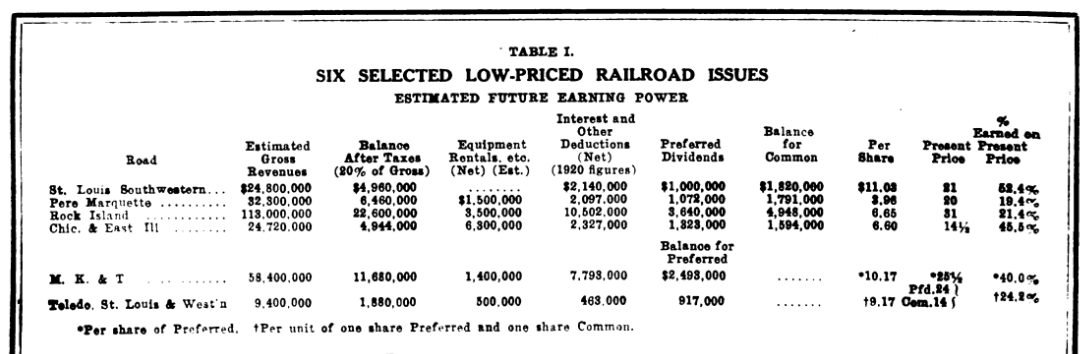

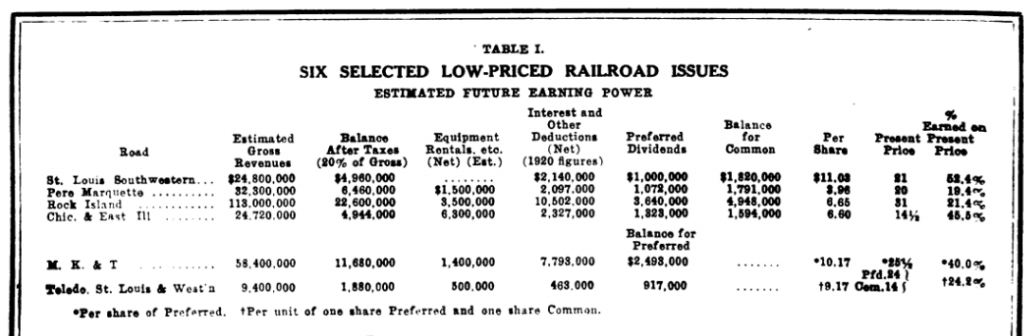

Graham selects six railroad companies for further analysis: St. Louis Southwestern; Missouri, Kansas & Texas; Toledo, St. Louis & Western; Pere Marquette; Rock Island and; Chicago & Eastern Illinois. As the table below shows, all six were trading at highly attractive valuations at the time.

Graham then goes through each company. He gives a short rundown of the problems affecting each business, and what it is expected to do for the next year. Here's St. Louis Southwestern's breakdown for example:

"St. Louis SOUTHWESTERN.—This common stock makes by far the best statistical exhibit in the entire railroad list. Its actual earnings for the past year were no less than $9.50 per share, or about 45% of the present price. The estimated future earnings are even larger, and, if realized, would exceed 50% of the current quotation of 21."

With Missouri, Kansas & Texas, Graham though the preferred stock might be a better investment for several reasons:

"Under ordinary circumstances, a railroad common stock selling at 8 would seem to have better speculative possibilities than a preferred issue at 25%. But M. K. & T. new preferred has three special points in its favor. The first is its 7% rate as against 4% to 6% for most other railroad preferred stocks. This no doubt gives the preferred shares a claim on all the earnings that will be distributable for many years. Secondly, this issue will ultimately be cumulative, a feature which will greatly strengthen its position. And finally, there will be only one-third as many preferred as common shares, so that the entire senior issue is now selling in the market for no more than the entire junior issue."

With regards to Rock Island, it seems that the market was discounting the firm's earnings potential:

"The chairman of the Board recently announced that Rock Island closed 1921 with about $3 per share earned on the common. The figures for the twelve months ended November 30 show only $2.25 earned on the junior shares. These are based on the I. C. C. reports for gross and net, using the 1920 items of interest and other charges and credits. It should be pointed out in connection with all these figures that the totals of the monthly statements are often subject to rather substantial adjustments in the complete annual reports."

And finally, Chicago & Eastern Illinois. Here, Graham gives a complete breakdown of the company's earnings potential based on its asset base. The Godfather of value investing recommends ignoring the firm's poor performance for 1921, and instead concentrating on its future potential:

"This is the youngest full-fledged member of the Reorganization Lodge, its final degree having just been awarded. The engineers who examined the property for the bankers estimated the normal future balance available for interest charges at $5,300,000. This corresponds closely with the figure arrived at in Table I. On this basis the road should earn $6.60 per share of common stock, or 45% of its current price. The actual results in 1921, however, were very disappointing, as only a nominal balance was shown over interest charges. This unexpectedly poor exhibit was caused in good measure by the abnormally heavy maintenance outlay, which consumed no less than 457% of gross. There was also a peculiar shrinkage in the credit for equipment and joint facilities rentals. In 1920 the company had realized about $1,667,000 net from these sources, but last year this extra income well-nigh disappeared. Considering the low price of C. & E. I. common, the speculator may well afford to ignore the mediocre performance of last year, and place his reliance on lower operating costs in the future."

This originally appeared at ValueWalkPremium.com