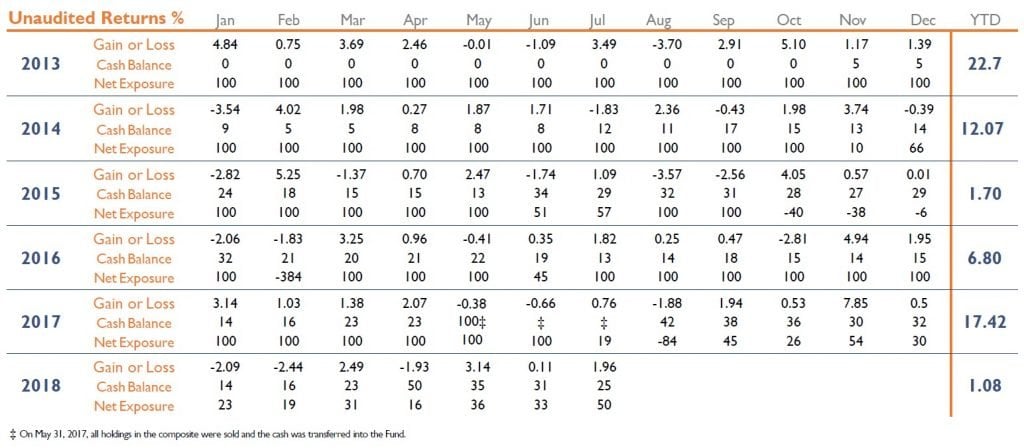

Global Return Asset Management factsheet for the month ended July 31, 2018.

Q2 hedge fund letters, conference, scoops etc

Investment Objective

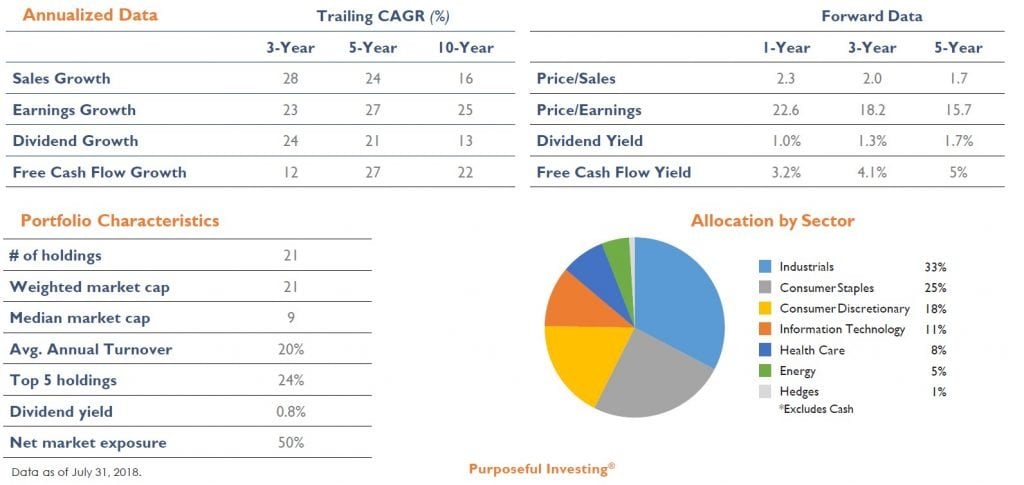

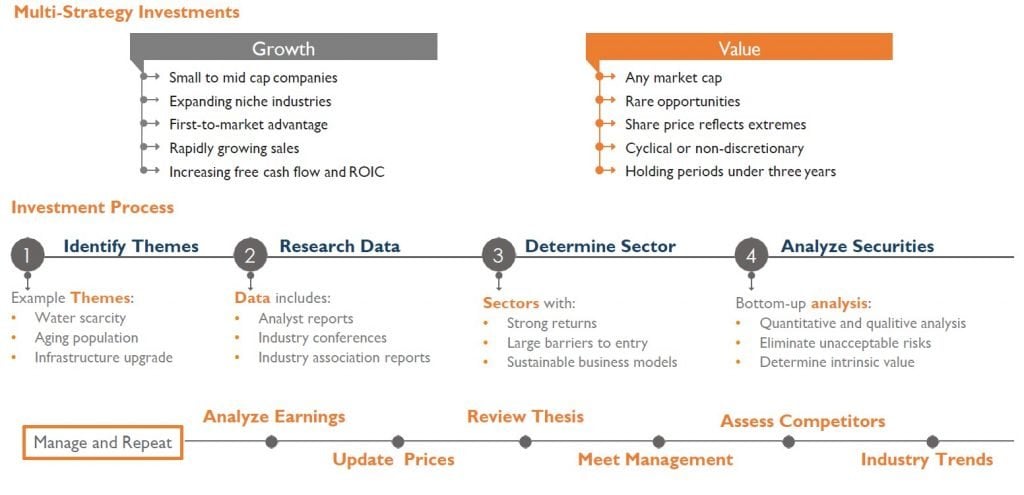

Seeks long-term capital appreciation and income using value investing strategies focused on risk management.

Investment Highlights

- Concentrated portfolio of S. listed stocks

- Long-term focus with low turnover

- Bottom-up fundamental analysis

- Short exposure when necessary

- Fully integrated ESG

Primarily invests in select high-quality companies that are market leaders with a history of increasing revenues and cash flow, have high returns on invested capital and durable competitive advantages. Short exposure with index options for risk management.

About Global Return Asset Management

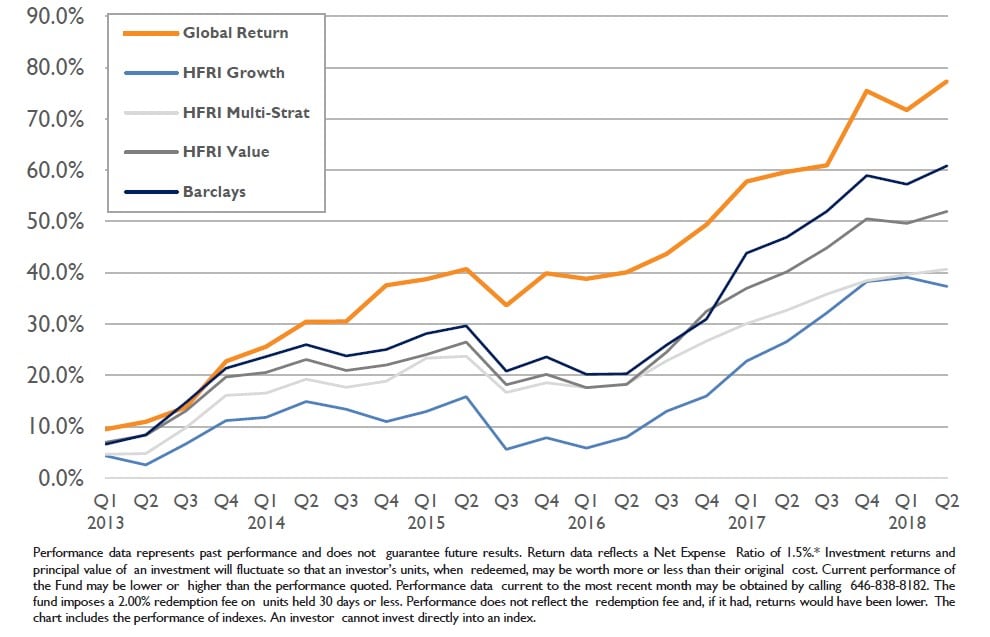

Founded in 2013, Global Return Asset Management is a leading fund manager focused on risk management and compounding its capital and the capital it manages. The combination of our advanced technology, fundamental analysis and risk management strategies have enabled us to consistently deliver risk-adjusted returns superior to our peer groups.

Below is a new section we’re calling...

Think Differently

The purpose of this section is to bring a different perspective to the everyday conversations happening around the investment industry. My goal is to offer you a different, and hopefully sometimes comical, perspective on investing. Here goes…

If High School Report Cards Were Like Corporate Earnings Announcements

GAAP Results: “Mom, Dad I got my final grade in Geometry. It’s a C minus.”

Adjusted GAAP Results: “Mom, Dad I got a B+ in Geometry if you stripout the one-time Midterm test.”

EBITDA Results: “If you addback the grades from quizzes I missed, I would have a B.”

Adjusted EBITDA Results: “If you addback the grades from quizzes I missed, remove the days I skipped class, and overlook the Midterm test, I got an A.”

Proforma EBITDA Guidance: “Everyone knows my Geometry teacher is impossible.”

Change in Revenue Recognition Policy: “There are only six weeks left in the semester and I have a C. So, I’m going to pull-forward the ‘A’ I know I’ll get next semester to ensure I have a B this semester.”

Of the parents reading this, who among you would accept these re-evaluated grades? Probably none! Yet, we investors readily accept them?

Joking aside, companies have many moving parts and precision is impossible; but common sense is not.

This week I read a mountain-high stack of earnings releases and 10-Q’s. And though some considerations are always necessary, I’m looking for companies that don’t require acrobatic financial analysis; just common sense.

Feel free to contact me if you have any questions about our risk management or how we invest.

Sincerely,

Elliot Trexler