We continue with our summary of The Intelligent Investor – best investing book. Chapter 13 – comparative analysis of 4 stocks.

Q2 hedge fund letters, conference, scoops etc

The Intelligent Investor - Stock Comparative Analysis

Transcript

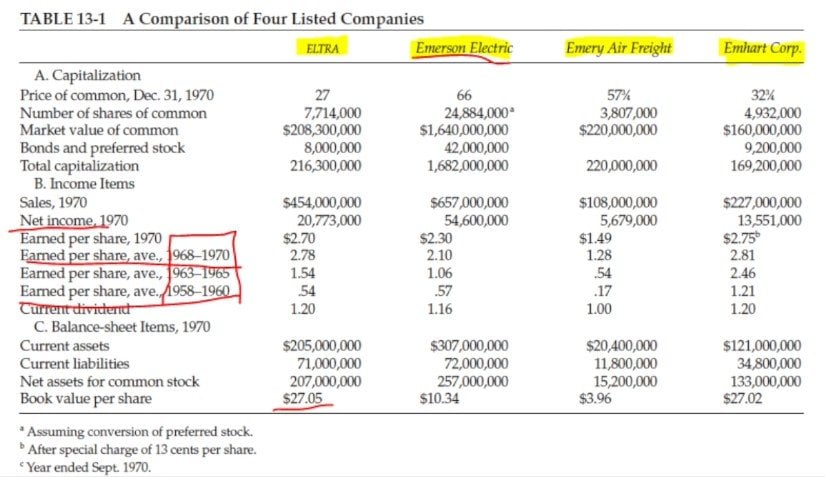

Good for investors. Chapter 13 a comparison of four stocks. At first I thought it will not be that interesting to discuss for stocks from the 1970s. But there is so much to learn so that this might be one of the most interesting chapters we summarize of The Intelligent Investor from Benjamin Graham. So he compares four stocks L Eldorado only alive Emerson other actor Eric Imrie air fright and Amhara corporation and what we see here on the left column is what key focuses on net income yes but earnings per share. And then the average earnings per share over the last 12 years plus the dividend plus the balance sheet. How much debt each company has and of course the book value. What you are paying for in comparison to what you own. A more detailed comparison shows that two companies of the four picked by Gramp have price earnings ratio of 10 11 12 and two companies have price earnings ratio above 40. The price to book value is also hugely different. The second row price to book value one for Elektra one point twenty two for hard but six point forty seven and fourteen point forty for the other two. But earnings have been slower growth over the last 10 years for two companies with those with lower earnings but still there has been growth and there has been huge growth for other companies but not that much for a company expensive at that point like Emerson Electric. This is not including inflation. You can see that Emerson Electric stocks went nowhere from 1972 ninth and set 80 so ten years it went really nowhere.

It was down 50 percent because it had a very expensive start. So when we invest in the long term we have to look also at the short term and not overpay for that long term in the long term. Emerson Electric stock exploded lately and we can see it now at 70 dollars which means 70 times what it was in 1980 not counting in the dividends. And this is the main message I think of this chapter. Look at the prices from 1960 free till 1968. Of all the four stocks three quarters to 50 was the high. So huge appreciation one to sixty six times higher 1 8 to 66 so what 500 times higher from low to high over 42 years. And also free and 5 eights to 58. So huge differences over a time span of 40 years. So we have to think OK not overpay in the short term but be confident about our stocks in the very very long term. But to the stocks Emmery that was a little bit expensive than 1000 invested in 1970 two would be still.