No ordinary business can increase its dividend payments for 25+ consecutive years.

It takes a high quality company with a shareholder friendly management to accomplish this feat. But a long dividend streak alone doesn’t indicate a good investment moving forward….

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

In fact, we are projecting the 3 companies below to actually deliver negative returns over the next 5 years - even though they've been increasing their dividends for 25+ consecutive years.

That's because each is significantly overvalued. These companies' growth and dividend prospects just do not make up for their poor valuations.

Key Metrics

Overview & Current Events

Cintas Corporation is the U.S. industry leader in uniform design, manufacturing, & rental. The company also offers first aid supplies, safety services, and other business-related services. Cintas was founded in 1968 and has grown to a market capitalization of $18 billion and annual revenues of more than $5 billion. Cintas’ CEO is Scott Farmer, the son of its founder Richard Farmer. Scott Farmer owns more than 14% of Cintas’ stock, which shows that the company’s upper management is incentivized to act in the best interests of its shareholders. Cintas qualifies to be a member of the Dividend Aristocrats Index with 35 years of consecutive dividend increases.

In late March, Cintas reported (3/22/18) financial results for the third quarter of fiscal 2018, which ended February 28, 2018. Revenue grew 26.6%, primarily due to the acquisition of G&K Services, Inc., which closed in March of 2017. With that said, organic revenue growth of 7.8% was still quite strong. The company’s Uniform Rental and Facility Services generated 6.5% revenue growth while its smaller First Aid and Safety Services segment generated 10.0% revenue growth. Excluding the costs associated with the G&K transaction, tax reform tailwinds, and a one-time cash payment to employees as a result of tax reform, Cintas’ adjusted earnings-per-share increased by 22.3% in the third quarter. All said, the company’s third quarter financial performance was excellent, and we expect continued strong performance moving forward.

Growth on a Per-Share Basis

Cintas has compounded its earnings-per-share at a rate of 7.6% since 2008. Over full economic cycles, we believe the company is capable of delivering continued earnings growth in the range of 8% per year. In fiscal 2018, Cintas is expecting to report earnings-per-share in the range of $5.80 to $5.85. Applying an 8% growth rate to the midpoint of this earnings guidance gives a 2023 earnings-per-share estimate of $8.57.

In the near-term, Cintas’ growth will be driven by the aforementioned acquisition of G&K Services, which closed in March of 2017. The transaction is anticipated to be accretive to Cintas’ earnings in the second full year after closing (which is fiscal 2019) and is expected to generate between $130 million and $140 million of annual cost synergies. Importantly, the acquisition was non-dilutive to continuing Cintas shareholders. The acquisition was funded using a combination of existing cash, assumption of existing G&K Services debt, and new debt. The integration is still underway and we believe that exciting opportunities likely exist for the two companies to merge into one cohesive business unit.

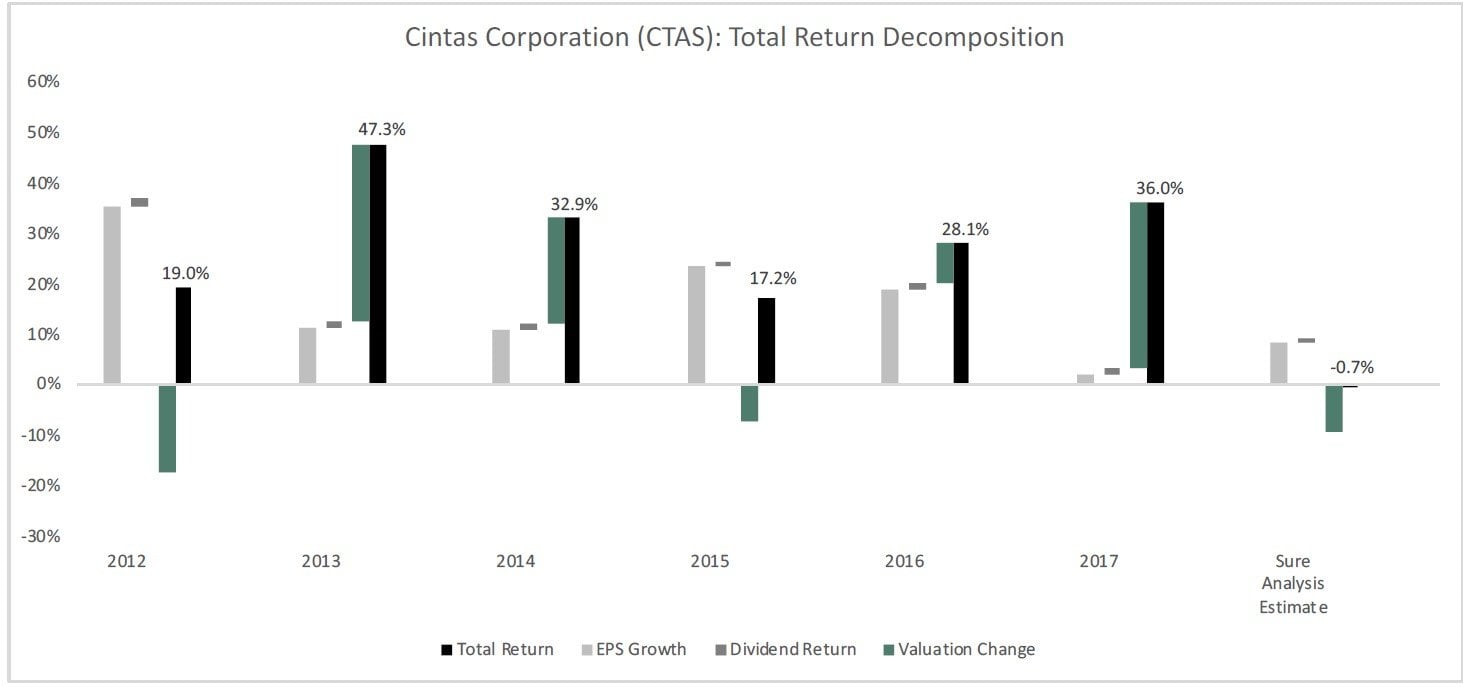

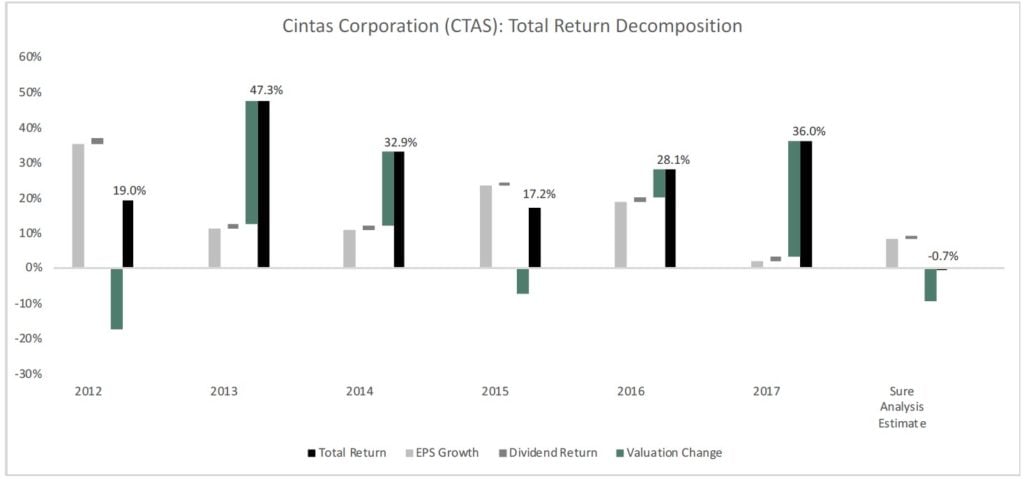

Valuation Analysis

Cintas’ valuation has varied from ~14 to ~27 over the last decade. We believe that excluding 2017’s figure makes sense due to the irrationally high valuation assigned to the company at that data point. Ex-2017, Cintas has traded at an average price-to-earnings ratio of 17.5 over the last decade. We believe that this represents a fair price to pay for a company of Cintas’ caliber. If the company’s valuation reverts to 17.5 times earnings over the next decade, this will introduce a significant 9.7% per year headwind to the company’s annualized returns during this time period.

Safety, Quality, Competitive Advantage, & Recession Resiliency

Although Cintas Corporation scores well on a number of our quality metrics, the company’s debt as a proportion of its total assets has ballooned following the G&K Services acquisition. Accordingly, we expect the company to focus on debt repayment over the next several years. Conservative investors should also note that Cintas’ gross profits as a percent of total assets are quite high, and the company’s below-average payout ratio leaves room for continued dividend growth in the event that earnings growth slows.

Qualitatively, Cintas’ most compelling competitive advantage is its industry-leading size and scale. The company operates approximately 9,000 local delivery routes, 377 operational facilities, and 8 distribution centers. This allows Cintas to serve large multinational companies in a way that its smaller peers cannot.

Final Thoughts & Recommendation

Cintas’ multi-decade streak of consecutive dividend increases combined with its impressive quality metrics make this company appealing for risk-average investors with a long time horizon.

While the company may be attractive, we have no doubt that the stock is not. Cintas’ common stock is grossly overvalued right now. Accordingly, we are placing a strong sell recommendation on this security, and recommending that investors look elsewhere for more appealing investment opportunities (which, admittedly, is a low comparison to match).

Article by Nick McCullum, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.